Tinubu’s 5% Fossil Fuel Surcharge, Shaped by Western Green Energy Agenda, Leaves Nigerians Facing Rising Costs and Limited Alternatives

Nigeria’s impending 5 per cent fossil fuel surcharge, set to commence in January 2026, is presented by the Federal Government as a strategic move towards cleaner energy. But there have been questions about its origins, fairness, and broader implications for ordinary Nigerians. The policy aligns more closely with foreign policies than with Nigeria’s realities, which could increase domestic hardship.

The Nigerian government says the new tax is part of its commitment to reduce carbon emissions from economic growth, fulfil its Nationally Determined Contributions (NDCs), and mobilise finance for sustainable development. The surcharge is similar to the “carbon tax,” designed to discourage fossil fuel use and generate revenue for clean energy projects. The policy follows examples like Sweden’s carbon tax in the 1990s. It reflects Nigeria’s promises under the Paris Agreement, including reducing greenhouse gas emissions by up to 47 per cent with international support by 2030 and achieving net-zero by 2060.

However, this policy is driven by international influence. Organisations like the UNDP and institutions such as the World Bank have pushed for green energy adoption. While Nigeria contributes less than 1 per cent of global emissions and has per capita emissions well below the world average, it faces pressure to adopt policies modelled on Western economies, where infrastructure and alternatives are already well established. This climate rule was imposed at Western request, without considering Nigeria’s energy challenges or economic instability.

This surcharge could increase hardship for millions of households and small businesses that rely on petrol-powered generators due to low power supply. The 5 per cent tax disproportionately burdens low-income earners, farmers, youth, and informal workers who already spend a significant amount of their income on fuel. With public transport and goods distribution tied to petrol prices, higher pump costs will ripple across the economy, pushing up food prices and worsening inflation. Nigerians, still dealing with the effects of subsidy removals and rising electricity tariffs, are being asked to shoulder yet another financial strain.

The government insists that alternatives exist, pointing to compressed natural gas (CNG) as a cleaner option. However, CNG adoption remains slow, and the FG recently increased the price from ₦230 to ₦450/SCM, stating the removal of subsidy as the reason. Similarly, a ban on solar panel imports has been criticised by PwC as premature, given Nigeria’s limited manufacturing capacity. With solar becoming less accessible and CNG increasingly unaffordable, citizens are trapped as petrol is more expensive, and alternatives remain out of reach.

There is also an absence of a transparent revenue framework by the Nigerian government. The government claims that surcharge proceeds will support the Climate Change Act 2021 and fund adaptation projects. The policy is more revenue-driven than environmentally motivated, recalling past experiences such as the Petroleum Trust Fund, where resources failed to reach citizens.

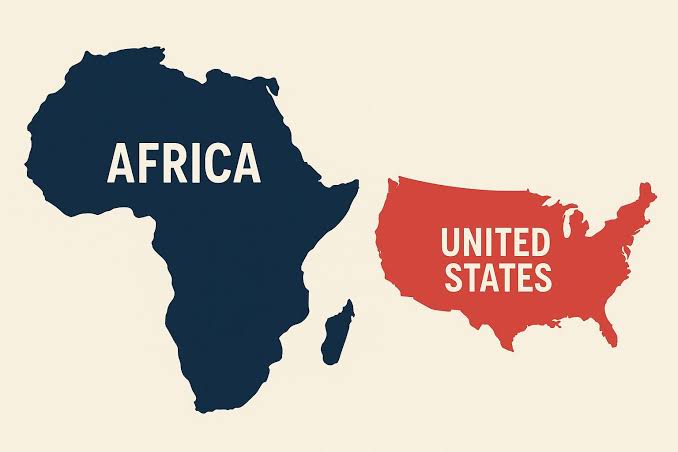

In 2022, Africa as a whole contributed just 3.9 per cent of global fossil fuel emissions, yet it bears the brunt of strict climate policies influenced by wealthier nations. The global economy cannot abruptly quit fossil fuels, and forcing developing countries to transition is punishing people with low incomes while letting historical polluters dictate the pace. The policy is inequitable and untimely. ActionAid Nigeria has urged the government to suspend the surcharge until viable alternatives are affordable and accessible, warning that the flat-rate tax risks inflaming public discontent.

The Nigerian government’s implementation of the 5 per cent fossil fuel surcharge is a poorly timed, Western-influenced policy that burdens citizens already struggling with inflation and unreliable energy supply. The policy is not a tool for climate progress but another example of Western-driven agendas being implemented at the expense of ordinary Nigerians.

Read More:

- Niger Launches New National Airline

- Africa’s Stolen Wealth: The West’s Two-Faced War On Corruption, Condemning In Public, Laundering the Continent’s Future In Practice

About The Author

Mayowa Durosinmi

author

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

%s Comment

Leave a Reply Cancel reply

Related Articles

Malian Prime Minister Presents 2025 Government Report, Pledges Stability and Reform

Mali’s Prime Minister, Major General Abdoulaye Maïga, has presented the government’s 2025...

ByWest Africa WeeklyMarch 2, 2026AES Ministers Conclude Roadmap Talks in Ouagadougou, Strengthen Security Coordination

Ministers of the Confederation of Sahel States have concluded high level discussions...

ByWest Africa WeeklyMarch 2, 2026Investigation Links Western Funding Networks and NGOs to African Conflict, Terror Financing, and Organised Crime

A transcontinental investigation has exposed an alleged web of Western-funded organisations and...

ByWest Africa WeeklyMarch 2, 2026Tinubu Approves Additional Endless Federal Road Projects While Old Projects Crawl at Snail’s Pace

President Bola Tinubu has approved a fresh round of federal road projects,...

ByWest Africa WeeklyMarch 2, 2026

And now there is going to be a 5% tax on fuel purchase above N10,000 beginning January 1st, 2026.