West Africa Weekly Aviation Special [Part 2]

The Audacity Of Fraud: The Incredible Story Of Nigeria Air

“For the services Fairfax has provided and will continue to provide, Fairfax will have one seat on the Board of Nigeria Air for 5 years and any further extension will be subject to approval by Nigeria Air’s Board.”

While the unreported runway incident in Part 1 was amputating a passenger aircraft’s front wheel at Akanu Ibiam International Airport, Enugu on Friday May 26, 2023, a different kind of farce was taking place about 433 KM northwest of Enugu at the Nnamdi Azikiwe International Airport in Abuja. There, aviation stakeholders and members of the outgoing Muhammadu Buhari administration were gathered to witness the arrival of a Boeing 737-860.

5 years of big talk by outgoing Minister of Aviation Hadi Sirika had yielded little more than a logo that was unveiled at the 2018 Farnborough Air Show, and a branded face cap that was immortalised in Twitter infamy when it was worn by a presidential lickspittle. Finally, this was Sirika’s moment of glory on his last working day as Aviation Minister; the day that the phrase “Nigeria Air” would stop being an internet meme.

For additional context, the dream of a Nigerian national carrier is one that is powerful and intoxicating enough to have persisted despite the demise of Nigeria Airways, Virgin Nigeria, Air Nigeria, Nigerian Eagle Airlines and Nigeria One between 2003 and 2013. 5 years after this stubborn dream resurfaced in 2018, it was time to party in Abuja.

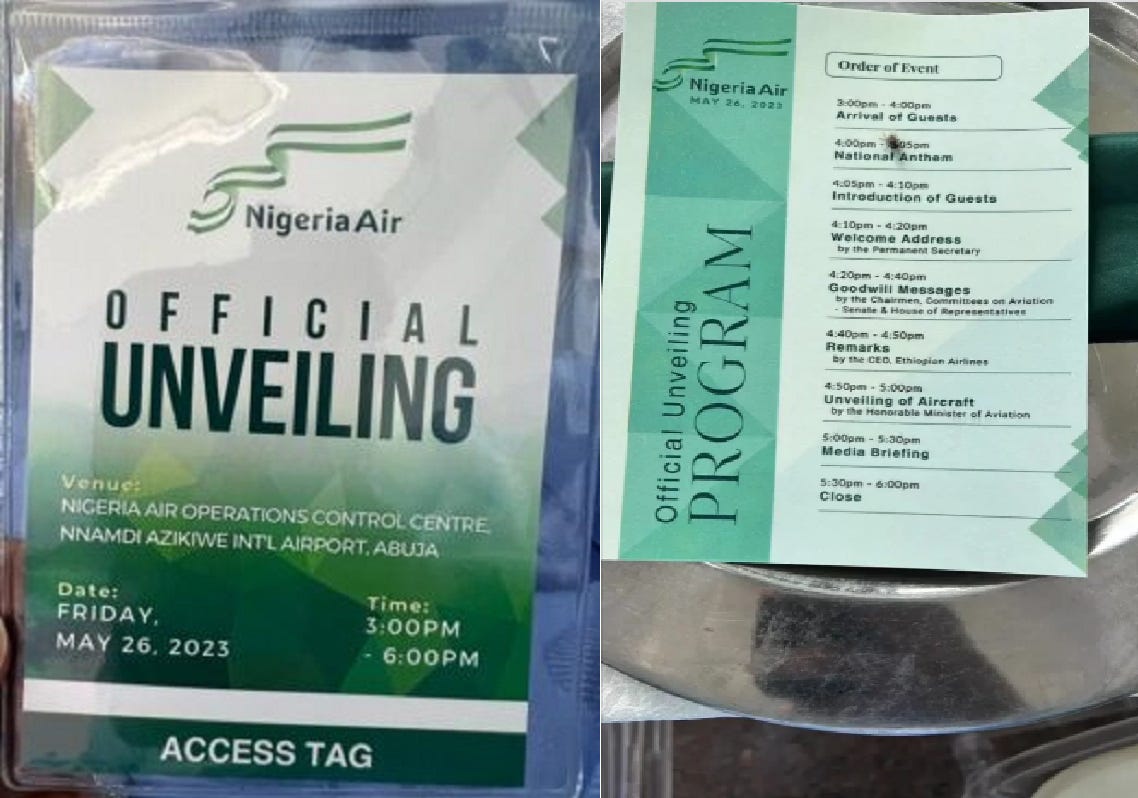

It wasn’t a lowkey welcome event either. The Ministry of Aviation pulled out all the stops. Official invitation letters? Check. Event access tags? Check. An event program complete with a rendition of the national anthem? Check.

There was even a water cannon salute to welcome the aircraft. For reference, such salutes in this context are given when an airline is landing at an airport for the first time. This is an important point that we will come back to later.

Sirika was in a celebratory mood as he posted the video of the Nigeria Air plane on his Twitter handle, repeatedly thanking cosmic deities for making such a day come to pass. To all intents and purposes, Nigeria’s latest attempt at launching a national carrier to compete continentally with the likes of Kenya Airways, Ethiopian Airlines and South African Airways had finally, belatedly sparked into life following “a very long, tedious, daunting and difficult path.”

Or so he would have had everyone believe anyway.

In reality, none of what actually happened remotely resembled the way it was presented. Yes, a Boeing 737-860 emblazoned in Nigeria Air livery did arrive in Abuja, and everyone at this event got to stand around and take pictures with it. Yes, there was a water cannon salute and the guests at the event bellowed out the national anthem to their heart’s content, even as speculation began circulating about Nigeria Air ticket prices and destinations. All of that happened.

But what also happened was that as soon as the event ended and everyone went home, the aircraft quietly disappeared from Abuja and reappeared the following day at Bole International Airport, Addis Ababa.

The next time someone took a photograph of the aircraft was on May 31, 5 days after its “Official Unveiling” in Abuja. By this time, its “Nigeria Air” branding was nowhere to be seen, and it was flying for Ethiopian Airlines – more on them later – from Addis Ababa to Mogadishu. Here is how it looked:

The entire “Official Unveiling” of Nigeria Air turned out to be weapons-grade Fugazi.

The first clue came from the fact that the aircraft itself had a tail identifier ET-APL. ‘ET’ is the country code unique to Ethiopia under Annex 7 of the ICAO Code. In Nigeria, the country code is ‘5N’. To cut a long story short, it would be in gross violation of ICAO and NCAA regulations for any Nigerian airline, let alone a Nigerian national carrier to operate an aircraft that is not registered in Nigeria. This was clearly not a Nigerian aircraft, let alone one belonging to “Nigeria Air”.

When this was pointed out, a number of pro-government voices predictably jumped to the defense of Hadi Sirika, making noises about ownership stakes, aircraft leasing arrangements and majority shareholders.

But not even they could muster a defense when on Tuesday May 30, Nigeria Air Managing Director Dapo Olumide confirmed to a House of Representatives committee on aviation that his (now-ex) boss had chartered a 737 from Ethiopian Airlines and branded it for the purpose of a “static display” 3 days to the end of his tenure as Minister of Aviation. Sirika himself attempted some damage control with a TV appearance on June 11 where he claimed among other things, that the aviation ministry did not organise the event and that “investors” did so for marketing purposes.

Essentially, even though the aviation ministry printed and sent out official invitations and event programs; even though he put out a triumphant message hailing the arriving Boeing 737 as “the end of a very long, tedious, daunting and difficult path;” even though he had spent weeks beforehand insisting that “Nigeria Air” would have its inaugural flight before May 29, thus creating the impression that a 1-day branded charter flight was in fact the inaugural “Nigeria Air” flight – none of this was Hadi Sirika’s fault. It was just “the investors” (more on them later too).

We must at this point segue into a brief examination of Hadi Abubakar Sirika, in order to understand why he would even attempt such Nwude-level public fraud. Who exactly is the man who was Nigeria’s Minister of Aviation until 3 weeks ago? What is his background and how did he get that job? Short answer – nobody really knows. The only source of any sort of historical information on him appears to be a poorly-written Wikipedia article which the – typically incurious – Nigerian media establishment has quoted verbatim and recycled for years.

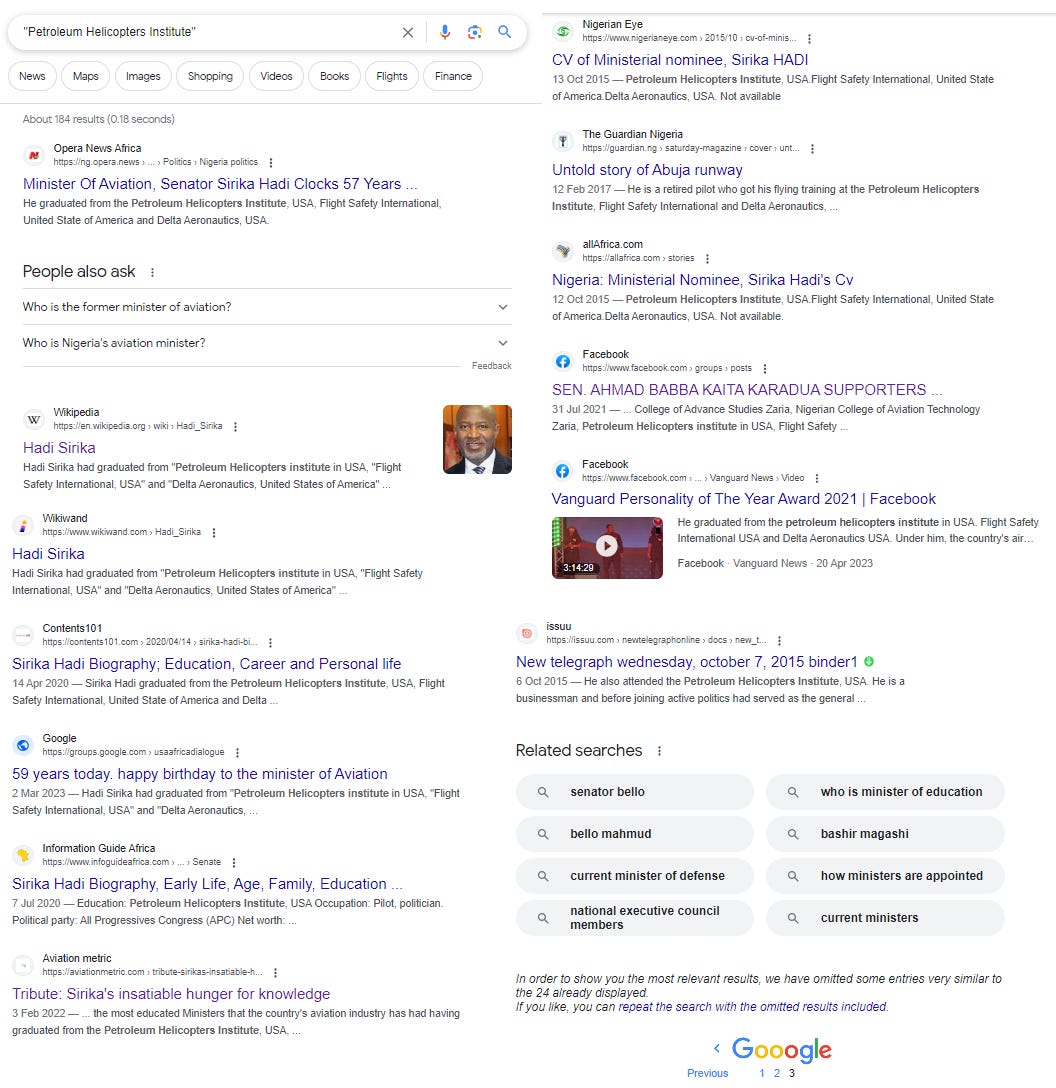

It is repeatedly claimed that Sirika was once a pilot, having attended the National College of Aviation Technology (NCAT) in Zaria, Kaduna, before studying at the “Petroleum Helicopters Institute”, Flight Safety International, and Delta Aeronautics, all in the USA. A quick refined search on Google shows that the “Petroleum Helicopters Institute” is mentioned only in articles about Hadi Sirika. Nowhere else on the entire internet does this “Petroleum Helicopters Institute” get a single mention.

The “Petroleum Helicopters Institute” does not appear to exist.

Even more curiously, Hadi Sirika has never provided any evidence that he was ever in fact, a pilot of any note. For an African helicopter pilot in the oil and gas industry, there is really only 1 place to be in the world – Nigeria’s offshore/Niger Delta region. Where did Hadi Sirika earn his stripes as a rotary wing pilot after allegedly graduating from 4 different flight training schools in Nigeria and the USA? Was it Aero Contractors? Bristow? Caverton? None of the above?

All that is really known about him in fact, is that in 2003 – at the ripe old age of 39 – he supposedly retired from his aviation career whose existence has never been proven, and went into politics, winning the House of Representatives election for Katsina North. In 2007, he contested in the Katsina North senatorial election and won, remaining in office until 2011. In 2015, armed with the formidable qualification of being a son of the president’s older sister and a graduate of 4 aviation schools – one of which appears to be fictitious – he was appointed Minister of Aviation by the famously meritocratic and not-at-all nepotistic President Muhammadu Buhari.

Now that we have established that the Minister of Aviation behind Nigeria Air is a career Fugazi who has failed his way up for the past 20 years, we can rejoin the main story. And this is where it gets interesting.

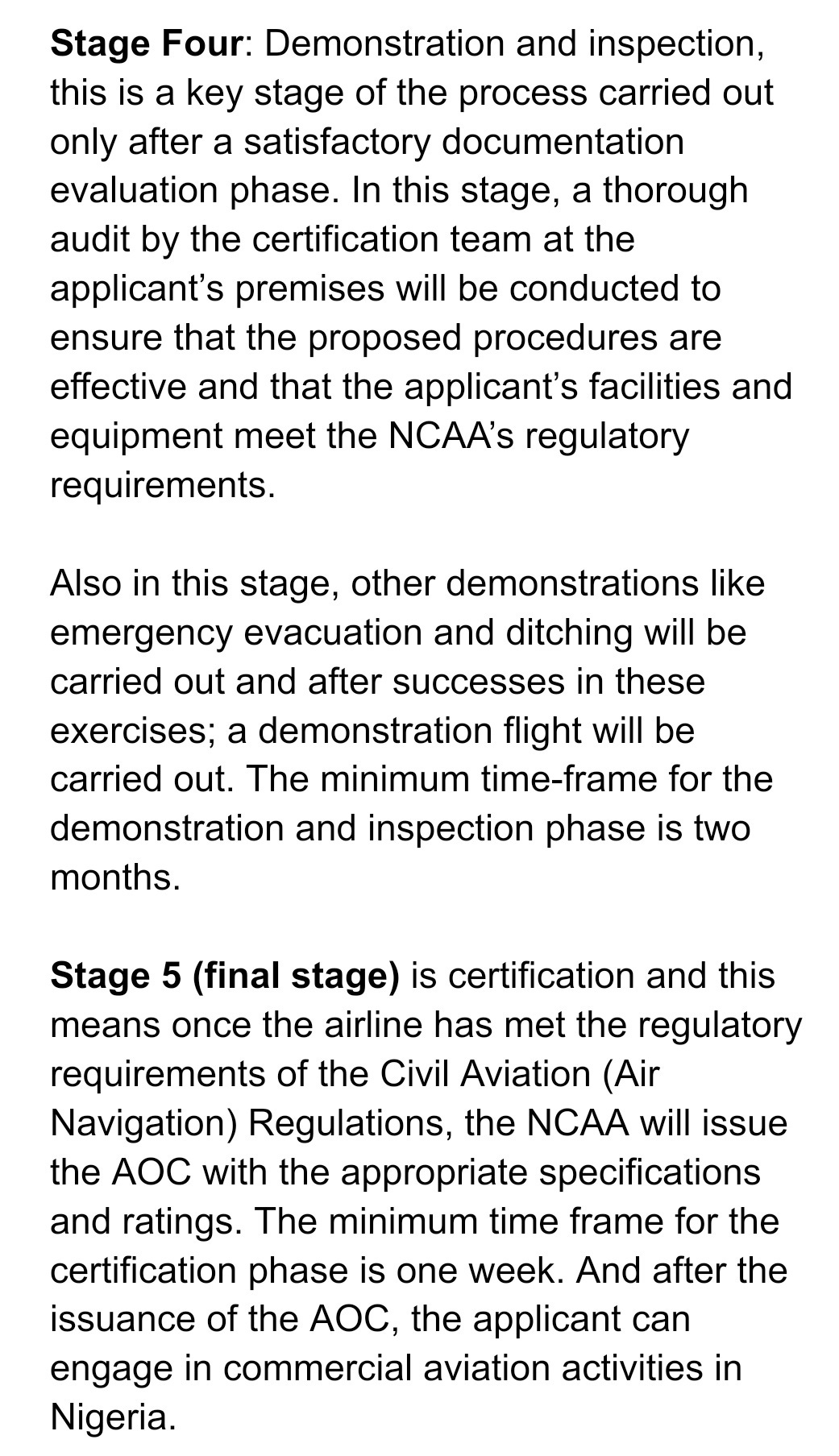

Sirika claimed during his TV appearance that Nigeria Air had moved beyond the first of 5 stages involved in obtaining an Air Operator Certificate. This directly contradicted Captain Dapo Olumide’s testimony before the House aviation committee (a testimony made under oath). Why this is important is that apart from Sirika telling yet another lie, if you think of an Air Operator certificate as a medical licence, then referring to a Stage 1 applicant as an “airline” that will “soon have its inaugural flight” would be just like referring to a 100-level fresher as a “doctor.” Here’s an explainer of the 5 stages of getting an AOC.

Now here is a letter I recently got my hands on, which shows exactly who has been telling porkies between Senator Sirika the Fugazi pilot and Captain Olumide, former MD of Aero Contractors and Virgin Nigeria.

Don’t worry, it gets worse. It always gets worse.

Shortly after the charter flight stunt became a national scandal, raising chuckles in Kenya and receiving coverage in Le Monde, Sirika and Nigeria Air began receiving public shows of support from an unlikely source – an Ethiopian one.

A respected figure in investment, advisory and consulting spaces, Fairfax Africa Fund Chairman Zemedeneh Negatu was the last person one would expect to stake their reputation for the sake of a Nigerian scam. Yet that is exactly what began happening as he insisted that – somehow – despite being on Stage 1 of the AOC process which takes a year at the very minimum, Nigeria Air would become a reality by the end of 2023.

Meanwhile, it was also pointed out that this “airline” did not even have a website and had not recruited any staff. Shortly after this was pointed out, a hurriedly-designed Nigeria Air website clearly built off a cheap WordPress template – with the placeholder “lorem ipsum” text still there – was unveiled to the public

A “WhoIs” query revealed something even more farcical about this entire operation. Apparently it had not occurred to Hadi Sirika and his co-conspirators that an airline tends to need a little thing called a flight booking website. It was not until May 26 – the date of the “Official Unveiling” that someone realised that the “airline” without an AOC that they wanted to unveil using a vinyl-wrapped, foreign-registered charter flight, might just so happen to need a website. Take note of the registration date and the name of the website owner.

Unsurprisingly, having been caught with his pants firmly around his ankles after the wordpress template site became the butt of jokes on Nigerian social media spaces, this is what the founder of Folio Media Group had to say about Nigeria Air.

In fact when one steps back to scrutinise Nigeria Air as a Hadi Sirika project, it quickly becomes clear that the whole thing was one giant – pardon me for using this term again – Fugazi. There really was no plan. Today the prospective technical partner would be Emirates. Tomorrow it would be Ethiopian Airlines. The day after, Qatar Airways. This was clearly a man who was entirely out of his depth and promoted vastly beyond his capacity, having known nothing but reward for failure all his life .

So now comes the big question.

Why on earth did Ethiopian Airlines even want anything to do with this poisoned chalice called “Nigerian national carrier” in a deal to be overseen by an incompetent no-mark with no significant career in aviation? And why would a well-travelled, widely-respected investor and alumnus of 2 of the world’s Big 4 management consultancies reduce himself to shilling this flaming ball of nonsense on the internet?

What was in it for them?

Well, quite a bit as it turns out. To be more specific, there was everything in it for Ethiopian Airlines – zero material risk and a great opportunity to thoroughly plunder the internal aviation market of Africa’s most populous country with the full knowledge and acquiescence of the “retired pilot”-cum-clown heading its Aviation Ministry. Here’s how we know this:

Shortly after the May 26 “unveiling,” the Airline Operators of Nigeria (AON) put out a statement denouncing Sirika for going ahead with the sham event despite a subsisting court order. The statement contained the following paragraph.

“We discovered a mind-boggling and dangerous agenda to kill all indigenous airline operators and handover a monopoly to Ethiopian Airlines in a dubious and fraudulent way against the economic interest of Nigeria, hence our court action supported by strong material evidence.”

That dear reader, was no exaggeration.

The following images are taken from internal Nigeria Air documents that I got my hands on a few days ago. These documents, which include the airline’s Shareholders Agreement, the Establishment and Operations Agreement and the Management Contract, contain eye-popping clauses that would have quite literally taken every existing Nigerian airline out of the market and gift-wrapped Africa’s 2nd largest internal aviation market to a foreign entity.

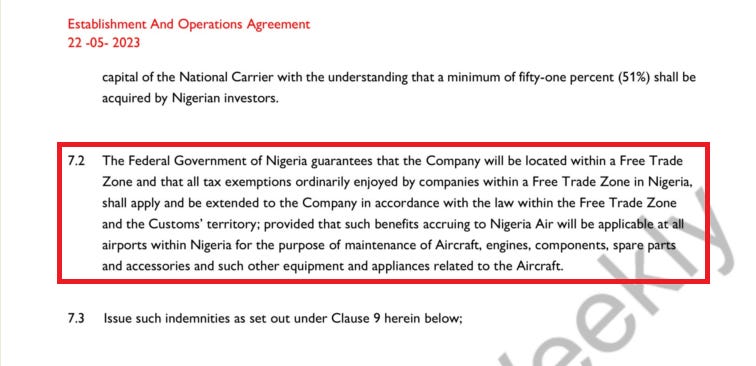

Take this one for example, taken from the Establishment and Operations Agreement. Article 7.2 states that Nigeria Air would be legally registered within a Free Trade Zone for tax purposes, with such exemptions extending to the airline’s activities at all airports in Nigeria. In plain English, what this means is that Nigeria Air alone would be granted perpetual tax-free status among all airlines in Nigeria, and its tax free status would extend to everything and anything it does anywhere in Nigeria.

Just for emphasis, this clause is reiterated later in Article 32.4.

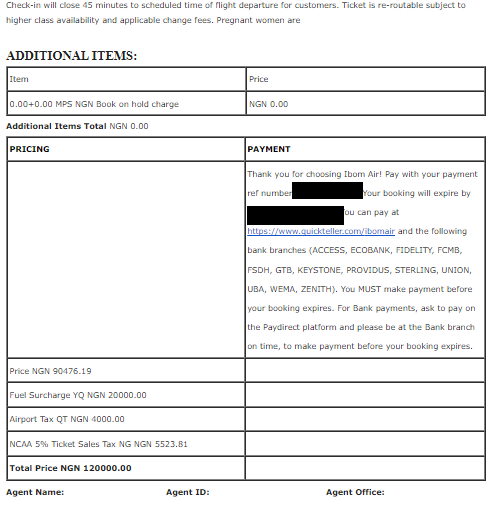

To put the true danger of this in perspective, below is a recent ticket booking for a Lagos – Port Harcourt flight using an existing local carrier. The taxes on this ticket add up to 8 percent of the total price. In a notoriously low-margin industry like aviation, using state power to build a permanent 8 percent price advantage over every other player in the field is as good as stopping the game and carrying the ball home.

Article 7 in the Establishment and Operations Agreement states that Nigeria Air is entitled to advantaged status on all prime routes – domestic and international – at all available frequencies. What that means in English is that the airline must be given preferred status on the most profitable routes and awarded as many slots on those routes as are available. In other words, if Lagos-Abuja is the most profitable route in the country, this airline must be given the right to use its tax advantage from above and ‘compete’ with local operators on that route using the resources of Ethiopian Airlines (a behemoth that made $5bn last year). No one needs to be a genius to work out how that will end.

In the same document, Article 11.8 states that the shareholders of Nigeria Air (i.e Ethiopian Airlines and a few private investors) must be given forex access privileges that are not given to any other airline operating in Nigeria, including behemoths like Emirates and British Airways. Whereas airlines continue to complain about having three-quarters of a billion dollars stuck in Nigeria, this clause would give Ethiopian Airlines free and unconditional access to forex for whatever reason it deems fit. In the event that any shareholder pulls out of the airline, this clause also entitles them to immediate settlement of their investment in USD. Mere mortals in Nigerian aviation may have to negotiate with the CBN to access forex for fuel, wages and maintenance, but Ethiopian Airlines would get whatever it wants from the CBN unconditionally.

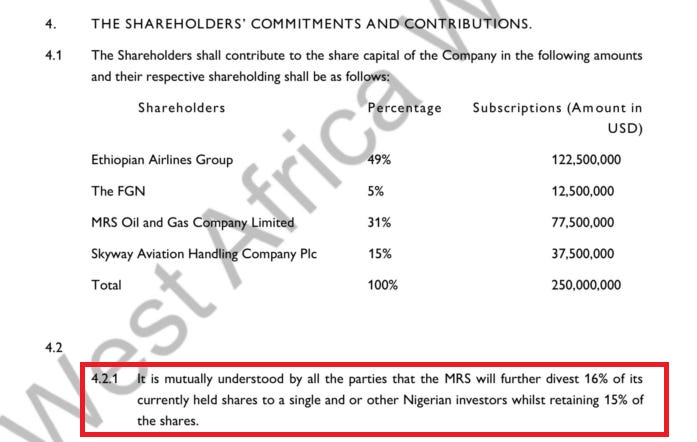

And then there is the shareholding issue. Sirika was famously reluctant to state exactly who the “investors” supposedly are in Nigeria Air. This excerpt from the shareholding agreement below appears to clear that up once and for all. That is, until you carefully read the highlighted portion.

Why is it so important to specify that MRS will subsequently divest just over half of its current shareholding to “a single and/or other Nigerian investors”? Who exactly are the “single and/or other Nigerian investors,” and what makes them so important that even though they are not named, their interests are already baked into the shareholders agreement of a national carrier with a built-in state capture advantage? Could they perhaps, be a Politically Exposed Person?

Say, for example, an Aviation Minister who does not want an entity directly traceable to him to appear on the cap table of a national carrier, whose birth he midwifed with ludicrous built-in anti-competitive advantages that will guarantee an aviation market monopoly in Nigeria? Could it be that an entity on the cap table is holding that person’s shares in trust, to be quietly divested to him at a conveniently unspecified later date when he is out of the public eye and nobody cares anymore?

Sometimes we have more answers than questions.

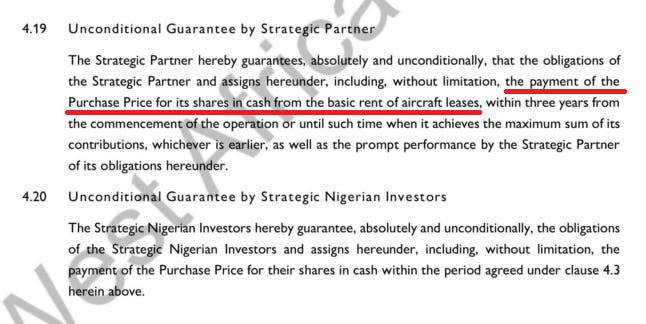

Putting aside issues of state capture and corruption, there is also the simple fact that from a Nigerian point of view, this is a bad deal, while from an Ethiopian point of view, Nigeria and the people governing it must be the biggest mugs on the planet. In Article 4.19 of the Shareholders Agreement below, the Strategic Partner (Ethiopian Airlines) is required to pay for its 49 percent shareholding in Nigeria Air, not through an equity injection or even from its earnings in the venture – but from “basic rent of aircraft leases.”

What that means in plain English is that Ethiopian Airlines will own 49 percent of what is on paper, Africa’s largest internal aviation monopoly, and rather than pay for this privilege or earn it by deducting from its dividends or operating income, it is in fact Nigerians who will indirectly pay for it. It is Nigerian travellers whose airfares will pay for the aircraft leases that will finance the 49 percent shareholding – essentially funding the Ethiopian colonisation of their own aviation space.

On paper the deal remains unsigned, but not for lack of enthusiasm from the Ethiopian side. The “retired pilot” at the Ministry of Aviation, through his incompetence and short sightedness, has effectively allowed a savvy group of actual aviation experts to write themselves the deal of a lifetime at Nigeria’s expense – the sort of lopsided deal that the world has not witnessed since Dutch colonist Peter Minuit bought Manhattan from the Lenape Indian tribe for less than $1,200 in today’s money.

Which finally brings us to the Optimistic Ethiopian-American investor with a big reputation in corporate consulting and private equity investment, who now shills this half-Nigerian-aviation-Thanos, half-punchline-without-an-Air-Operator-Certificate on Twitter. What was in it for him?

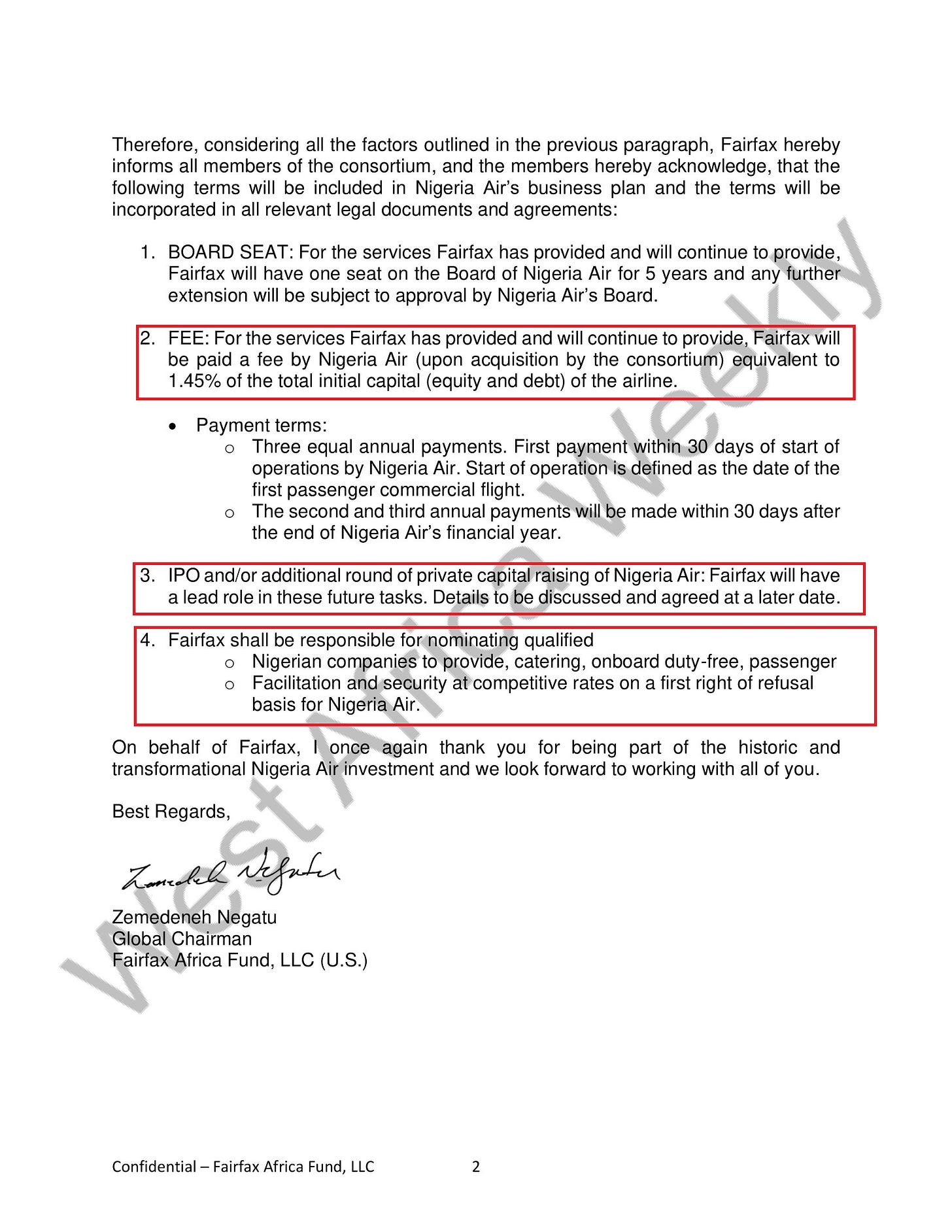

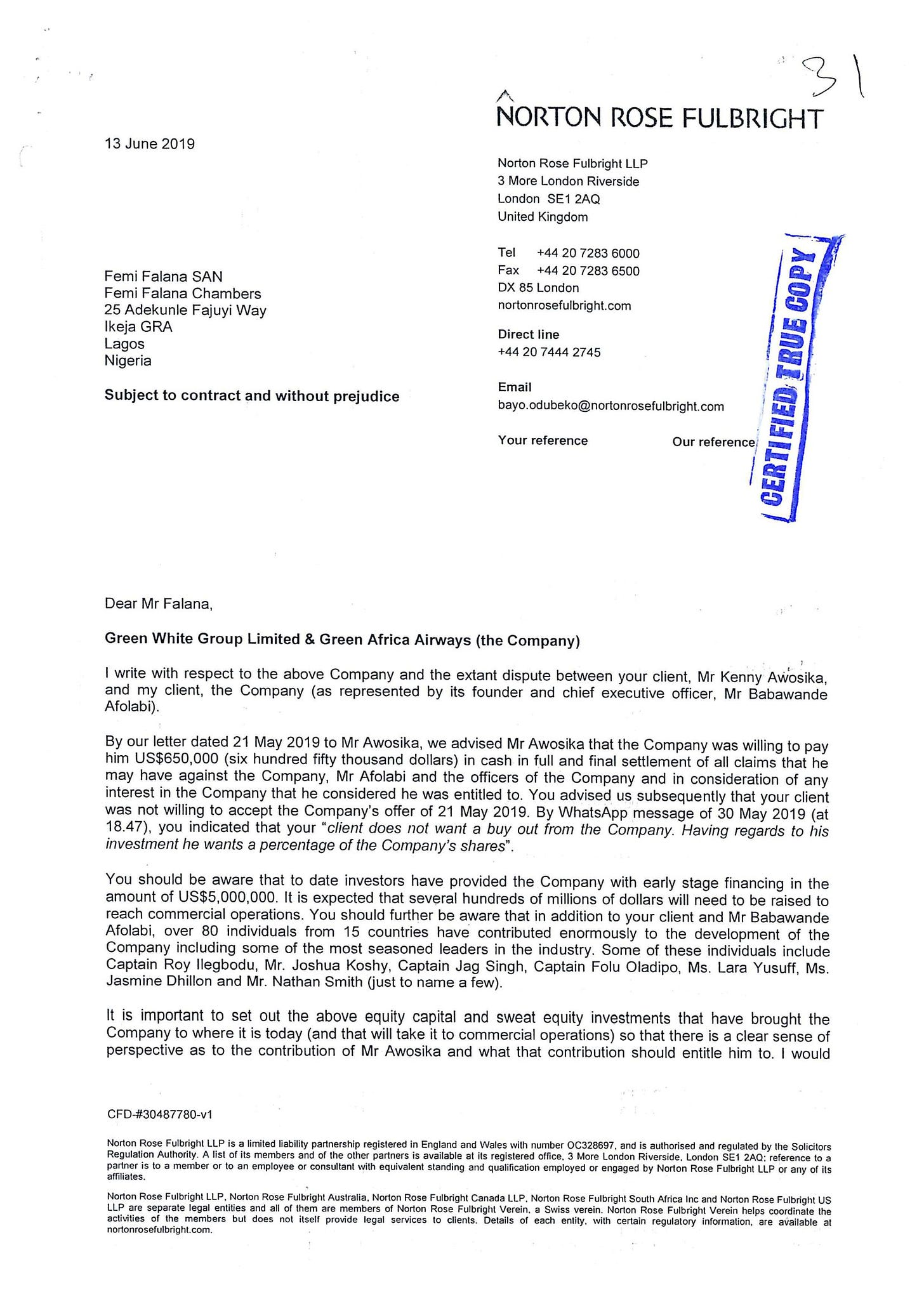

Quite a bit too, as it turns out. The final document I got my hands on shows how much exactly. The investment banking terms offered by Negatu’s Fairfax Africa Fund to the Nigeria Air consortium include some very generous concessions. Here, take a look:

What’s in it for him? Why don’t we use his own numbers to calculate a figure? If this $250m valuation of Nigeria Air that he and Sirika have repeatedly bandied around is accurate, then his proposed fee worth a 1.45 percent share of that figure would come to a nice cash windfall of $3,625,000. To be spread out across 3 annual payments, because he’s nice like that.

Nice work if you can get it.

In addition, Fairfax Partners would also get a guaranteed seat at the table whenever this monopoly airline would have another funding round or an IPO. Maybe it would be a $10 million fee next time? The firm would also get to determine which companies provide services to an airline that was being artificially set up to become Nigeria’s biggest airline from Day 1 via state capture. Why would anyone need first refusal and supplier recommendation rights to a monopoly market operator? Certainly not for potential insider dealing? Or potential insider trading? Or for kickbacks?

Sometimes we have more answers than questions.

As for the alleged helicopter pilot who retired from aviation at 39 to go into politics, promptly failing his way up impressively into the aviation ministry, which he left with the iconic image of airport water cannons saluting a vinyl-wrapped charter flight with foreign registration, he was last seen fighting a new set of battles.

Knowing Nigeria, he will probably become president someday.

Maybe.

Definitely.

Green Africa Airways And The Man Who Stole An Entire Airline

“Like I said, I’ve noticed this “I” statement and trend in you lately which never existed in our relationship for years. Babawande, let me remind you, you did not take the risk alone. We both did.”

This is not a story about an airline. Not primarily anyway.

While an airline is integral to the story, it is the furious legal and social battle surrounding it that has made Green Africa Airways – once touted as the Nigerian answer to Ryanair or Southwest Airlines – take centre stage. This battle has turned childhood friends and business partners into sworn enemies, pitching previously inseparable families against each other in a maelstrom of high-powered lawyers, angry investors, multiple court cases and EFCC petitions, and even (alleged) arson.

Before we get into all that, first, a quick primer about Green Africa Airways and why there was once such a buzz around it.

Green Africa Airways was billed as the low-cost airline that would do for Nigerian aviation what Henry Ford’s mass-produced cars did for American car ownership in the 20th century. Something, something…democratise…something, something…for the common man. You’ve heard it a thousand times before and you get the basic picture: flying is fundamentally expensive, especially in a country whose monthly minimum wage works out at just under $50.

An airline that could figure out how to charge less than its competitors and still remain in business would quickly become the most successful in the Nigerian market, and would possibly help in improving the overall viability of Nigeria’s 21 local and international airports. (Currently, only four of that number have sufficient passenger numbers to pay for their own expenses without government intervention.)

The Green Africa solution was as simple as it was elegant – cut costs wherever possible. Jet aircraft burn more fuel making them more expensive to run in a Nigerian market where sourcing dollars for Jet-A1 is a challenge? Use turboprop aircraft instead. Training and type rating pilots across different aircraft makes and models in the same fleet the way conventional airlines do it is time and capital intensive? Buy a fleet made up exclusively of ATR 72 turboprops so that pilots only need to be rated on that one type, and air crews are more interchangeable.

Even the choice of colour scheme is part of the ruthless cost-cutting since the colour white on aircrafts fades less quickly and requires less pigment than other colours, reducing the repainting frequency and takeoff weight of the aircraft which saves money. Basically, in Nigeria’s extremely price-conscious market, Green Africa would to do aviation what per-second billing did to telecoms in the 2000s.

With that out of the way, our story now begins in 1983 in the sleepy town of Ile-Ife, Osun State. In this town which is recognised by most of West Africa’s Yoruba ethnic group as the ancient cradle of their civilisation, a boy was born to the Afolabi family. According to Yoruba naming customs, it was believed that the boy was the reincarnation of a male ancestor, and so his father Francis gives him the name “Babawande” (“father has returned”).

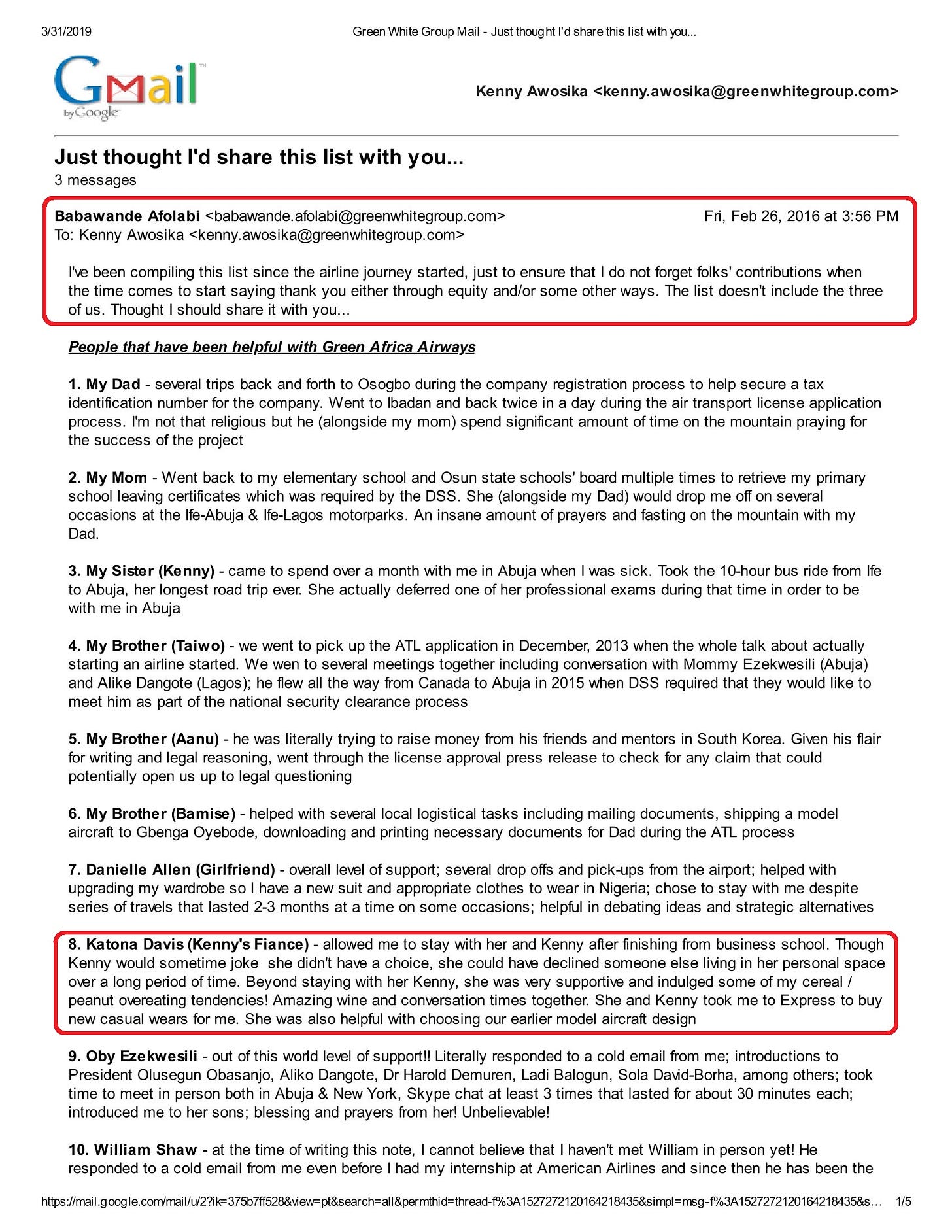

Nearby was the Awosika family, which had maintained a long-standing relationship with the Afolabi family. This family, dotted with successful entrepreneurs and corporate figures including a former First Bank chair inhabited an entirely different space from the Afolabis on the socioeconomic spectrum of Ile-Ife, but that did not stop the 2 families from being close friends.

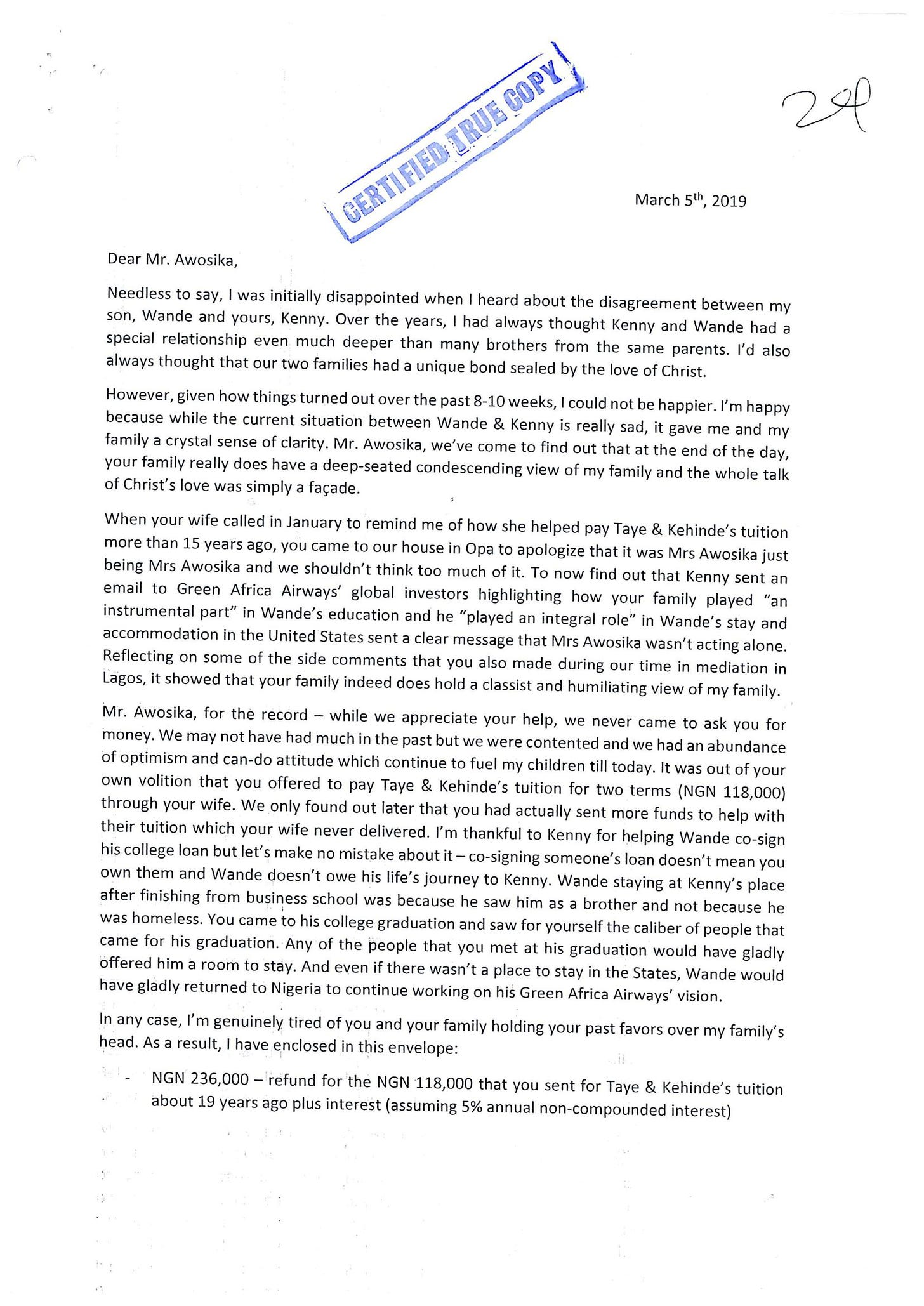

As Babawande grew through his childhood, the Awosikas’ son Kenny became his best friend. Both families became so close that on more than one ocassion, Kenny’s dad Kolawole paid school fees on behalf of Babawande’s younger siblings Taiwo and Kehinde. The idea of repayment was neither discussed nor expected – such was the level of closeness between both families.

As the years went by, Kenny left Nigeria to obtain an education and build a career in the USA, but both friends never lost touch with each other and their relationship remained strong. So strong in fact, that in 2006, after finding his way to Wesleyan University in Connecticut, USA and realising that he was $12,700 short on his tuition, Babawande turned to his best friend for help.

His best friend as always, was all too willing to help. Kenny signed up to be his student loan guarantor – something that needless to say, only a tiny proportion of Americans would willingly do for someone they are not related to. Thus Babawande avoided losing his admission and possibly having to return to Ile-Ife at that crucial juncture in his life.

A few years later, Babawande – let’s call him Wande – actually defaulted on a couple of payments triggering a number of stressful phone calls between Kenny and the loan company, but even that was not enough to shake the friendship that these 2 had nurtured for nearly 30 years. In fact that was just the start of the close personal and business relationship that they would share going forward.

Sometime in September 2013, having long discussed dreams of someday setting up a business together to make an impact in Nigeria, the 2 friends were having a random conversation on Google Hangouts. As you will see below via the conversation transcript, this informal chat is what became the basis for the business entity they would later register together in the state of Maryland.

Both friends excitedly discussed their plans to do something huge in Nigeria, even debating whether to fully involve Kenny’s girlfriend in the business from the start and how she would potentially feel about visiting Nigeria.

Eventually, Babawande and Kenny got down to setting up enterprise email accounts for this business and choosing a name for it. Bear in mind that at this point, the proposed business did not even have a well-defined focus just yet – such was the level of mutual enthusiasm and trust between both men. They eventually settled on the name “Green White Group” in an unsubtle nudge to their dreams of making a huge splash in Nigeria’s business landscape.

Just like that nearly 10 years ago, our 2 friends started on a journey whose culmination at least one of them could not possibly foresee.

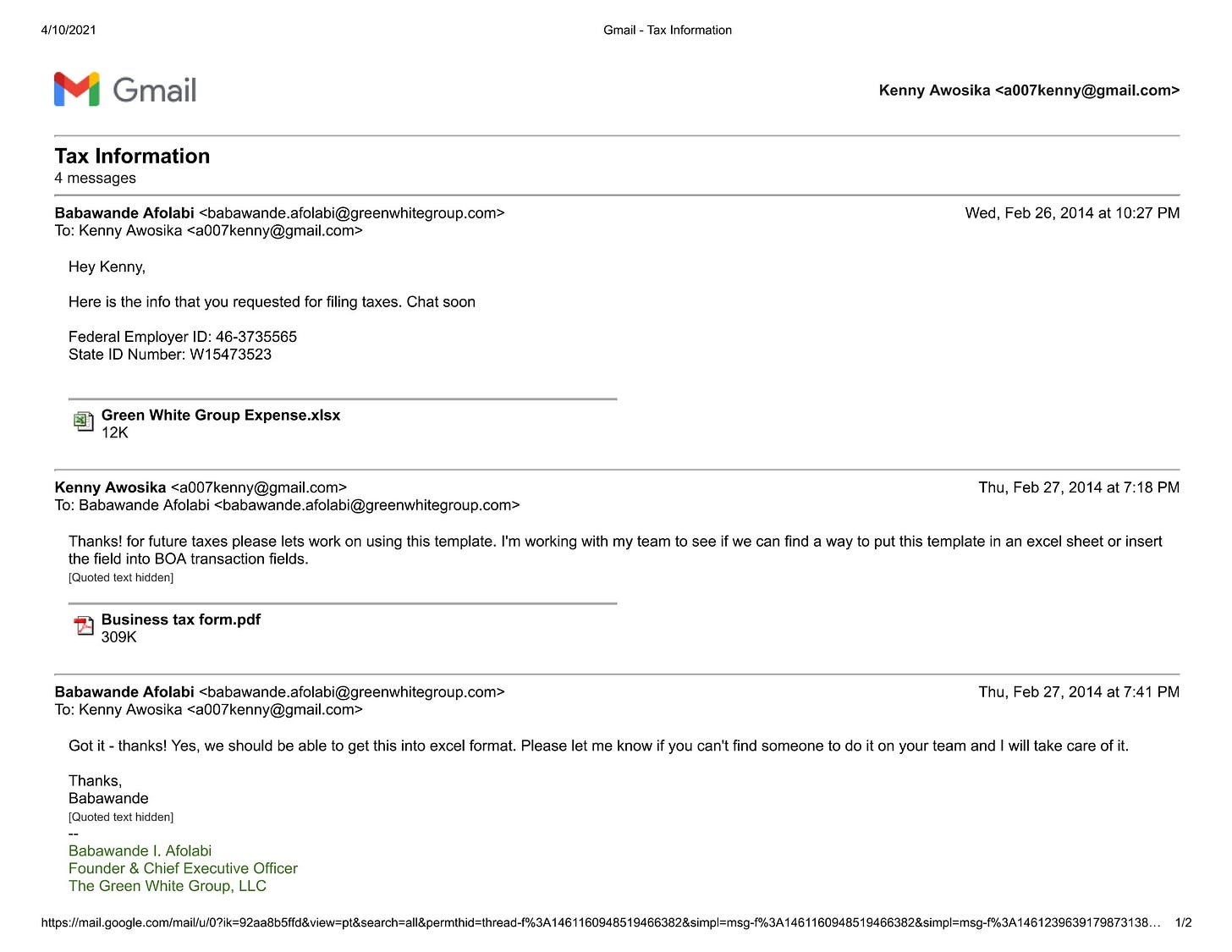

It is at this point that the story started taking a huge left turn for Kenny – not that he knew it at the time. Over the next 2 years, while he busily threw himself into the business of registering, funding and building Green White Group in Maryland, USA, he had no idea that his best friend was planning to perform an epic rug-pull on him in the future. They did everything together, from dealing with IRS tax issues to negotiating a deal to bus a Volvo bus for an intercity transport business in Nigeria.

For the time being, there was no doubt that the business relationship between both men centred around Green White Group, which they co-owned. This is illustrated by the images below taken from the investor pitch deck for GWG’s Nigerian road transport company called MyCityBus.

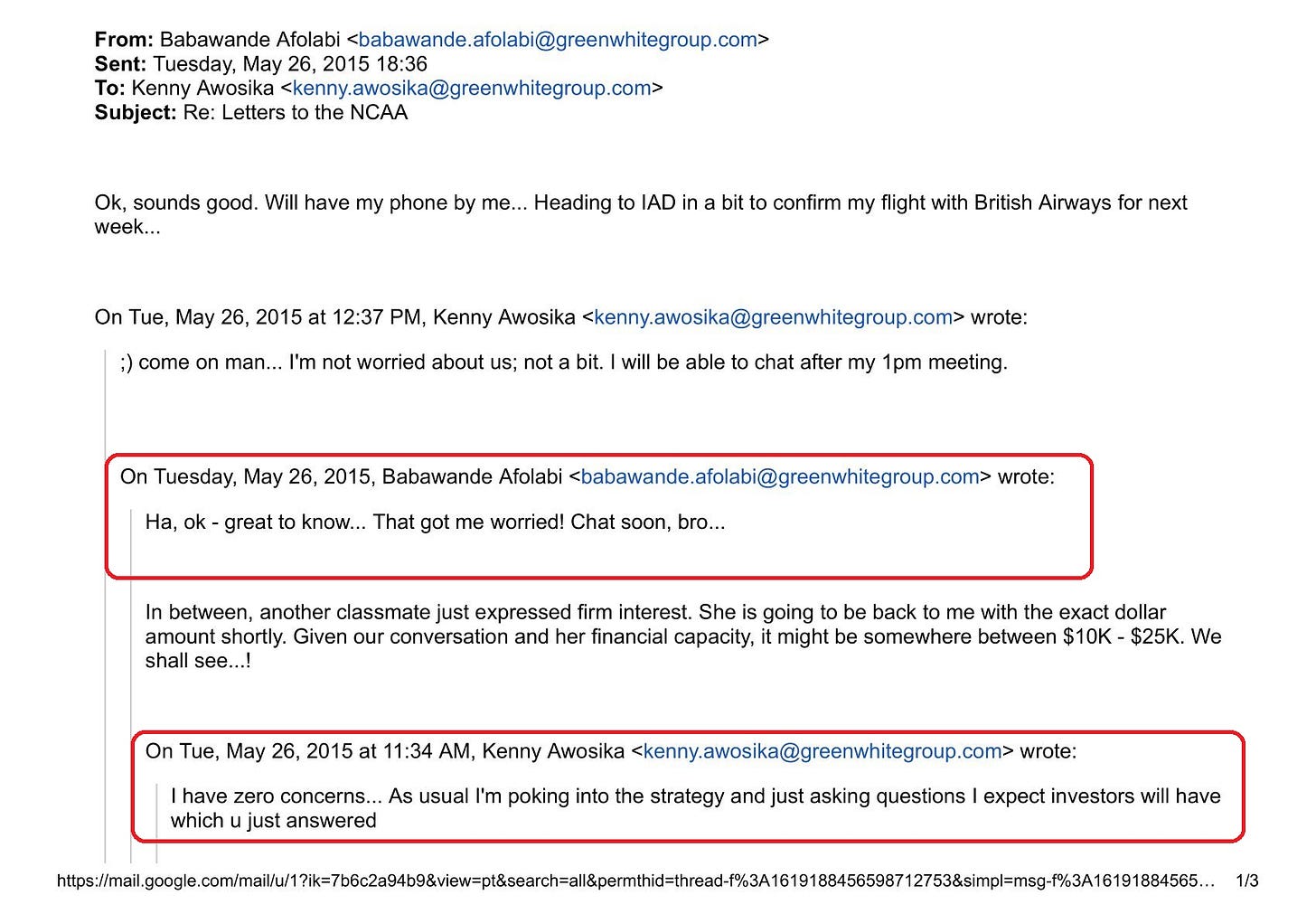

If there is any doubt about the level of involvement and commitment that Wande displayed to the business of running Green White Group, the email conversation below should clear that up decisively. Keep this in mind because it become important later in this story.

Sometime in 2014, Wande came up with an idea to start an airline in Nigeria. A bus transport company was just not ambitious enough for him and he believed they could do more. A low-cost airline following the JetBlue model could potentially unlock hundreds of millions of dollars worth of value and put their names up in lights forever, just the way Wande always envisioned. Kenny, though initially hesitant, began to warm up to the idea.

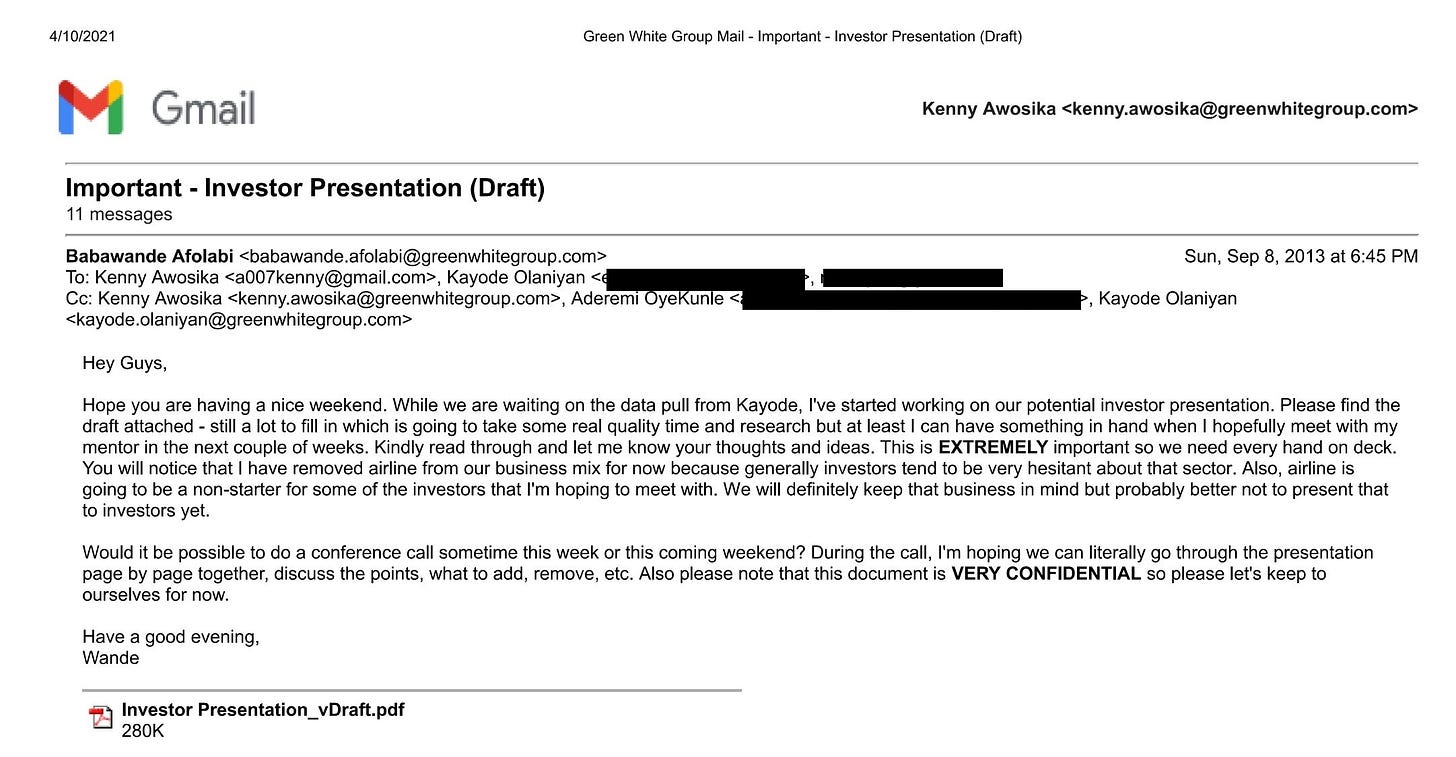

He warmed up to it so much in fact, that he personally handled practically all of the branding and design work that is recognisable today as “Green Africa Airways.” Here, take a look:

The full email exchange is available here. In fact, even the name “Green Africa Airways” also came out of an email exchange between both friends during this period. Kenny also brought the first set of seed investors into what was then known as “Air Africa” before they settled on the name “Green Africa Airways.”

Keep all of this in mind because it is important information.

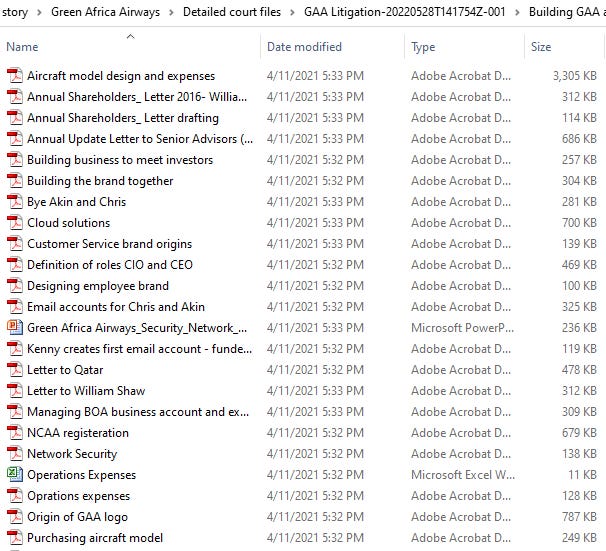

In case you are wondering how on earth I have access to all of this information, the answer is “because it’s in court.” All of these documents technically have been on public record in Lagos State since 2020 as part of a bitter legal dispute that remains unresolved to date. What happened?

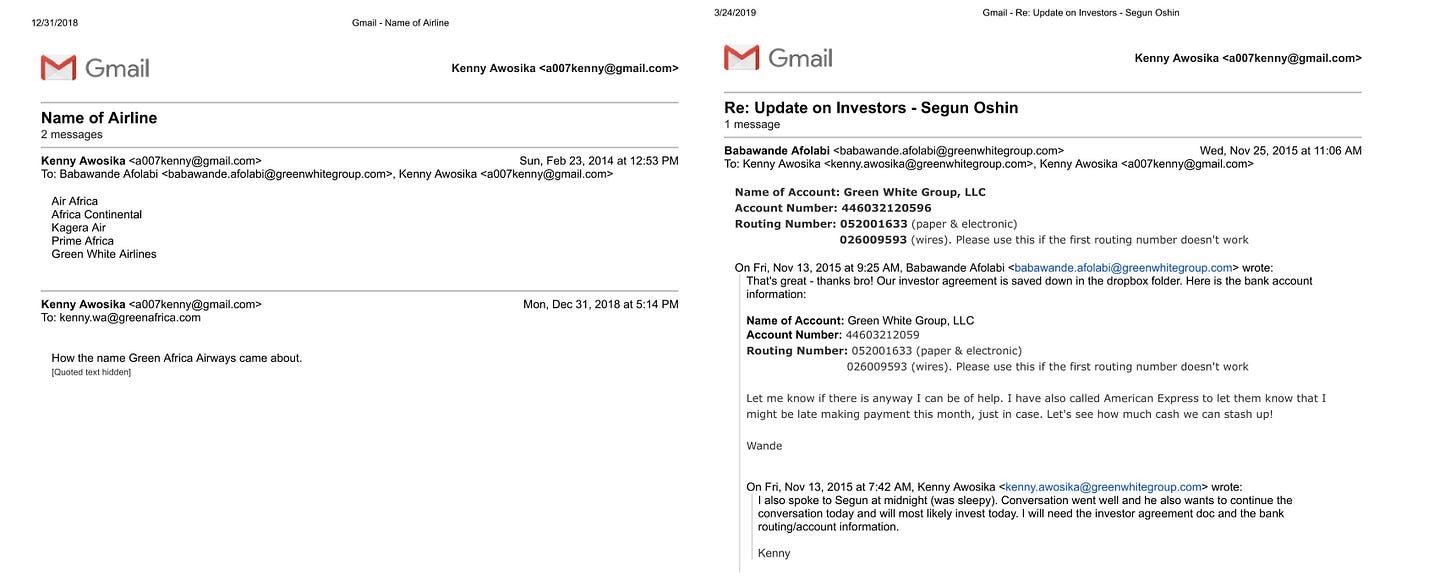

As you can see below, Green Africa Airways – let’s call it GAA – initially pitched to investors as a fully owned subsidiary of Green White Group, which Wande and Kenny co-owned. But something else entirely was happening on the ground in Nigeria. At this time, Kenny was singlehandedly funding GAA’s operations from his personal account in the USA and raising investment from his friends and family in the US, while Wande was in Nigeria pursuing the gruelling NCAA licencing process for GAA.

Kenny first voiced a concern when Wande proposed that instead of writing to the NCAA as “Green White Group”, they should instead write using the letterhead of the Nigerian entity “Green Africa Airways Limited.”

Kenny wanted to know how his interests would be represented since he was a part owner of Green White Group and did not have shareholding in this new Nigerian business entity. By this time, had had spent as much as $20,000 of his own money on the project. Wande assured him that this was only a temporary arrangement to get around NCAA rules against foreign ownership of local airlines. Once they got the licence, he assured his friend, everything would be sorted out!

If you groaned while reading this exchange, that is probably because you instantly recognised the classic signature of a manipulator and a confidence trickster in that conversation: The feigned hurt at what was a perfectly reasonable question; the “don’t worry, just trust me”, which leverages a pre-existing relationship between both parties; the “I can’t believe you think I would do that to you”emotional blackmail; the way the victim immediately backed away from pursuing a satisfactory answer to his valid question; the little pat on his head from the smug conman afterward.

Kenny crucially did not recognise any of this.

This was after all, his childhood friend whom he had known for decades; the man for whom he had stood as a student loan guarantor; the man whose family was tight friends with his own; the man who had squatted in his house after graduating from Stanford Business School. Why on earth would he of all people try to cheat him out of his equity in an airline that they had built together brick by brick off the back of his personal money, from a Google Hangouts chat to a multimillion dollar investment opportunity?

As it turned out, that is exactly what Wande was doing in Nigeria. After using Kenny’s expertise and funding to sort out GAA’s branding and build its IT systems, as well as raise over $73,000 from seed investors – something that catalysed much larger subsequent investments – he was finally ready to cut his childhood friend loose. Now was his time to become the multimillionaire rockstar founder he always wanted to be – without having to share the limelight with Kenny Awosika the rich kid who did not deserve the things that he had.

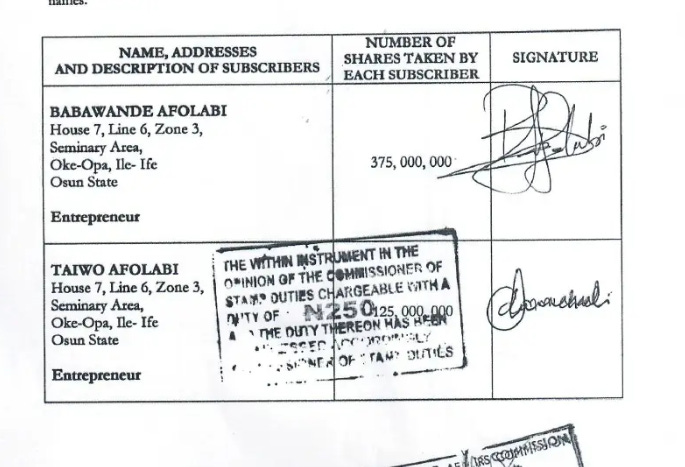

On GAA’s CAC registration documents, Kenny’s name was conspicuously missing. In its place was Wande’s younger brother Taiwo Afolabi (remember him?)

Even worse, Wande attempted to cover his tracks by incorporating 2 new entities in Delaware and London called ‘Green White Group’ without Kenny’s knowledge.

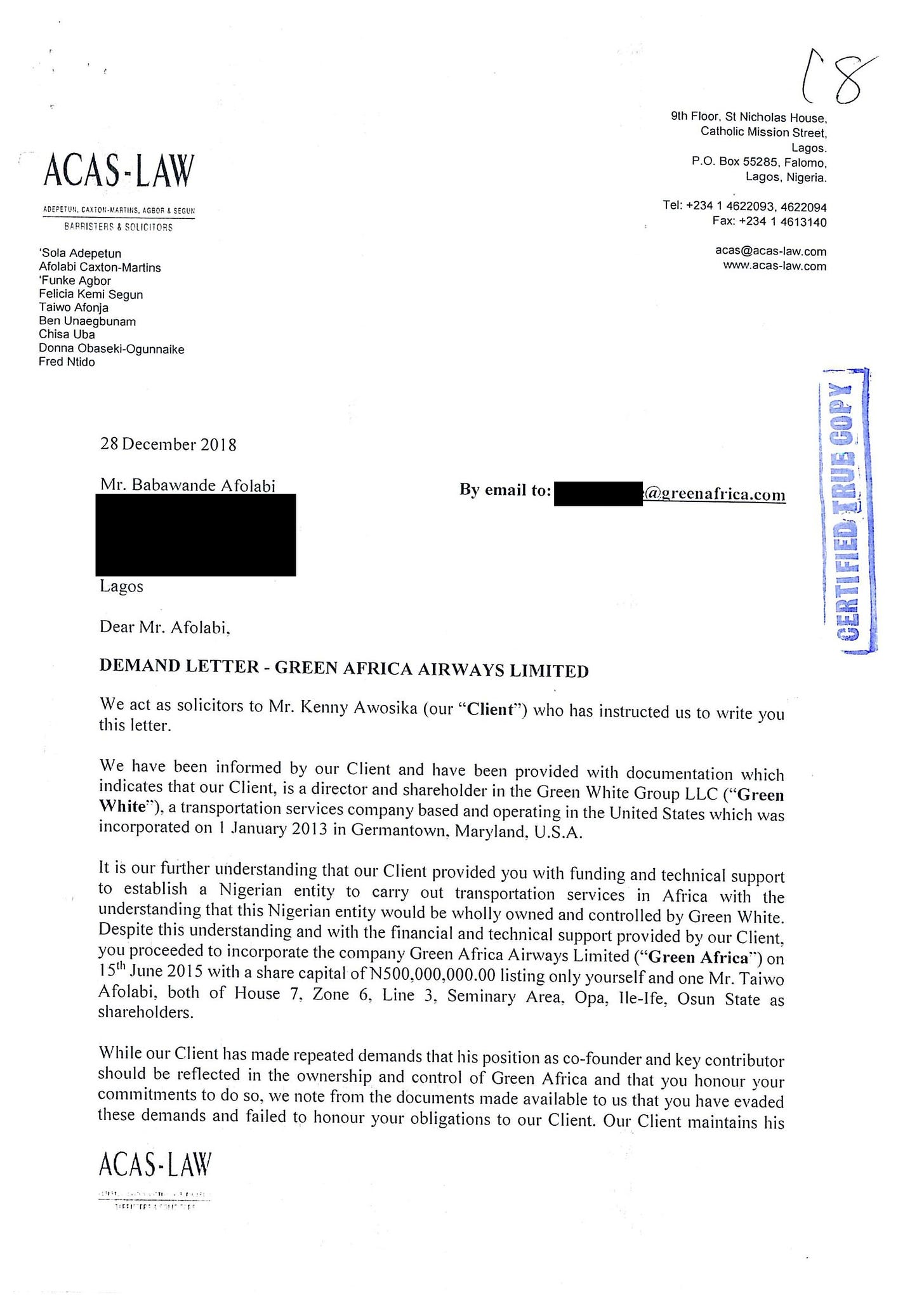

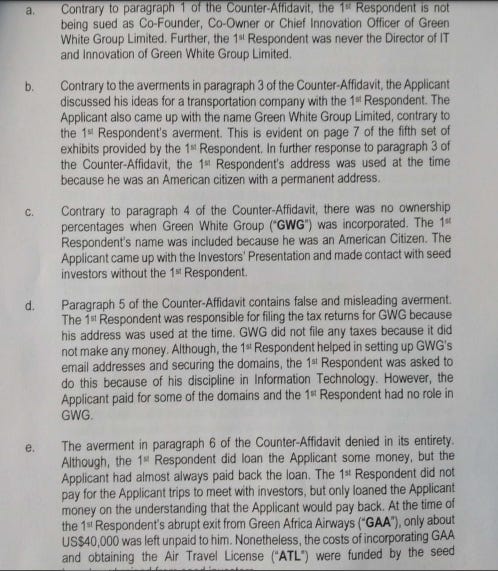

At the point when Kenny discovered this, the alarm bells finally at long last, went off inside his head, and he took legal advise. First came a sternly-worded demand letter to Wande informing him that Kenny expected his shareholding to be reflected on the company’s books immediately.

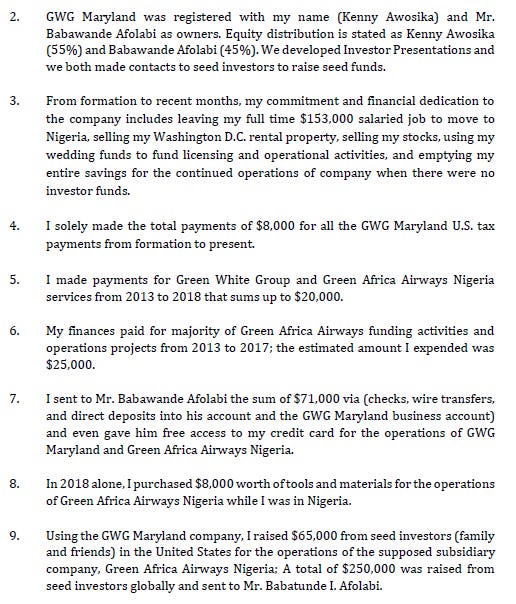

What that had no effect, the next course of action was a petition to Nigeria’s Economic and Financial Crimes Commission (EFCC). Explaining what happened in an excerpt from the subsequent petition, Kenny said:

“While I was making effort to secure investors, I discovered I was duped me by Mr, Babatunde Afolabi by converting all the monies I sent to him to his personal use and with false pretenses, he fraudulently registered Green White Group (GWG) UK and Green White Group (GWG) Delaware without including my name. Babawande Afolabi then linked GWG UK as parent company to Green Africa Airways, Nigeria (now worth $54 Million pre-Series B valuation). It was at this time that I discovered had been scammed by Mr. Babawande Afolabi.”

The extent to which Kenny was used by Wande in setting up GAA can be seen below in an excerpt from the EFCC petition.

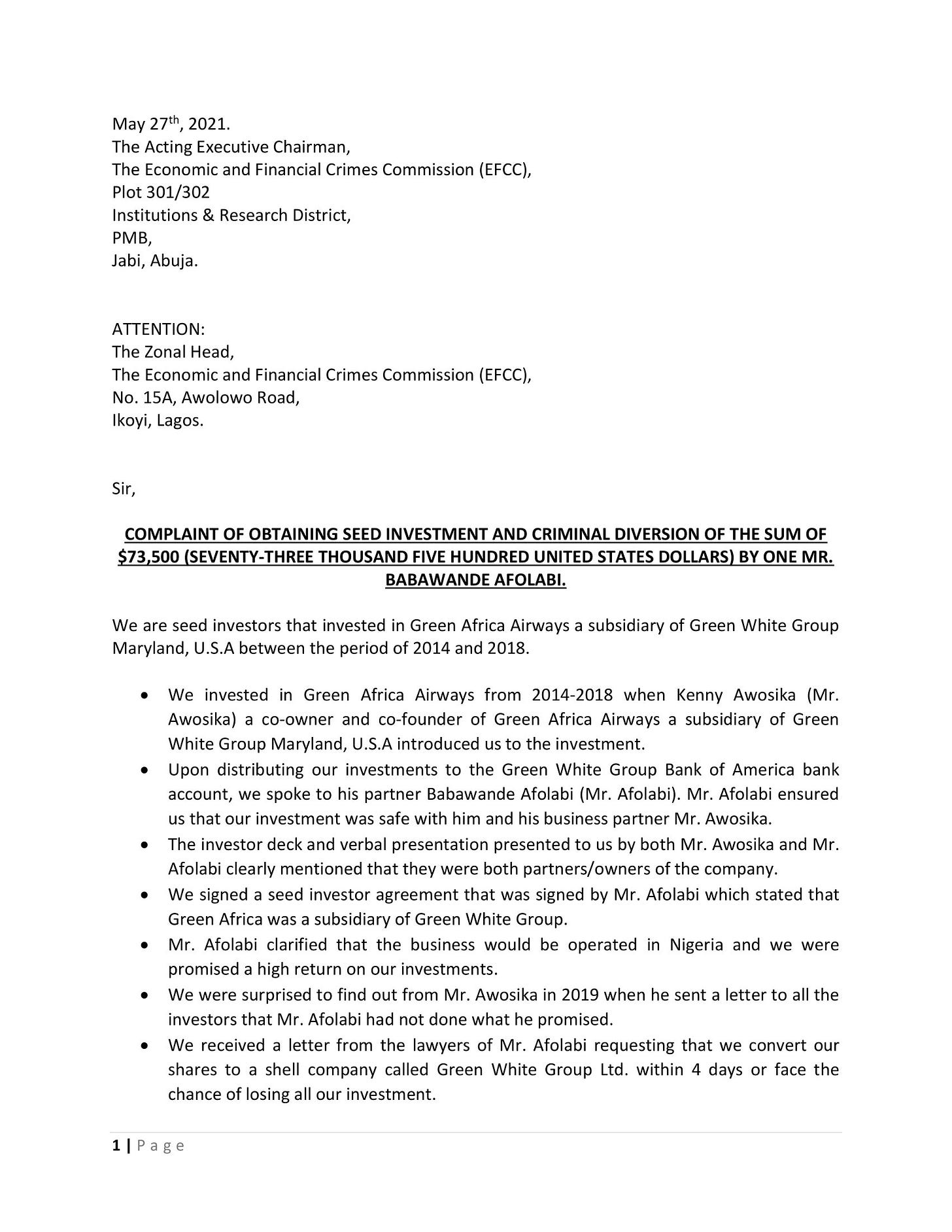

Realising that they had also been scammed by the fraudulent de-linking of GAA from the original Green White Group, a group of seed investors also petitioned the EFCC about Wande’s giant advance fee fraud scheme which had collectively left them $73,500 out of pocket.

Now it gets really dark from here, so feel free to have a stretch and come back later.

Wande’s response to all of this was as silent as it was sociopathic. First, he filed an action at the High Court of Lagos State contending that the EFCC investigation “infringed on his fundamental rights” and that he was a victim of “harassment.” The full document available here is a truly horrifying read. Incredible lie after incredible lie; whopper after whopper.

“Kenny was never the Director of IT and Innovation of Green White Group Limited” (there is a pitch deck in this story that says otherwise); “There were no ownership percentages when Green White Group was incorporated”; “GWG did not file any taxes”; “Kenny’s name was included because he was an American citizen…”

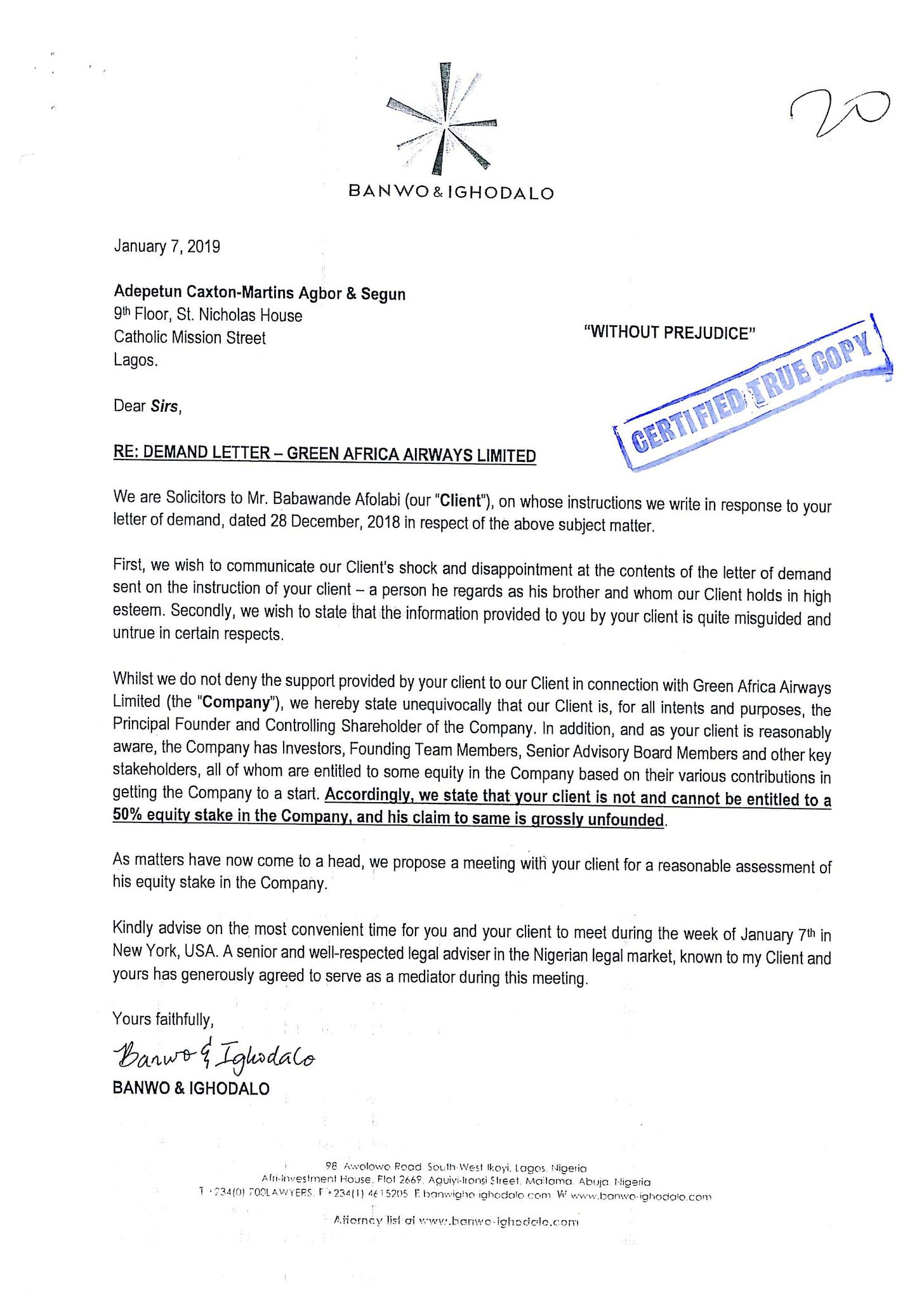

And then came the emotional blackmail from Wande and his legal team. First was a smarmy offer to discuss Kenny’s “unfounded” claim to having 50 percent of Green Africa’s equity and to “assess” how much in their not-at-all-meaningless opinion he should actually have. Refusing this offer to discuss a percentage settlement with the person who stole one’s money and investment would presumably make one “uncooperative.”

Then came actual blackmail in form of a letter from GAA’s newer investors. They wanted Kenny to know that if he did not drop his case against Wande, it would be a “colossal loss of opportunity for everyone including you, millions of people in Nigeria, and Africa.” In the time-honoured fashion of a predator trying to hustle a financially insecure person into signing a poor deal, the letter informed Kenny: “You have a short window of opportunity to determine whether to secure your future and that of your family, or genuinely end up with nothing from this venture.”

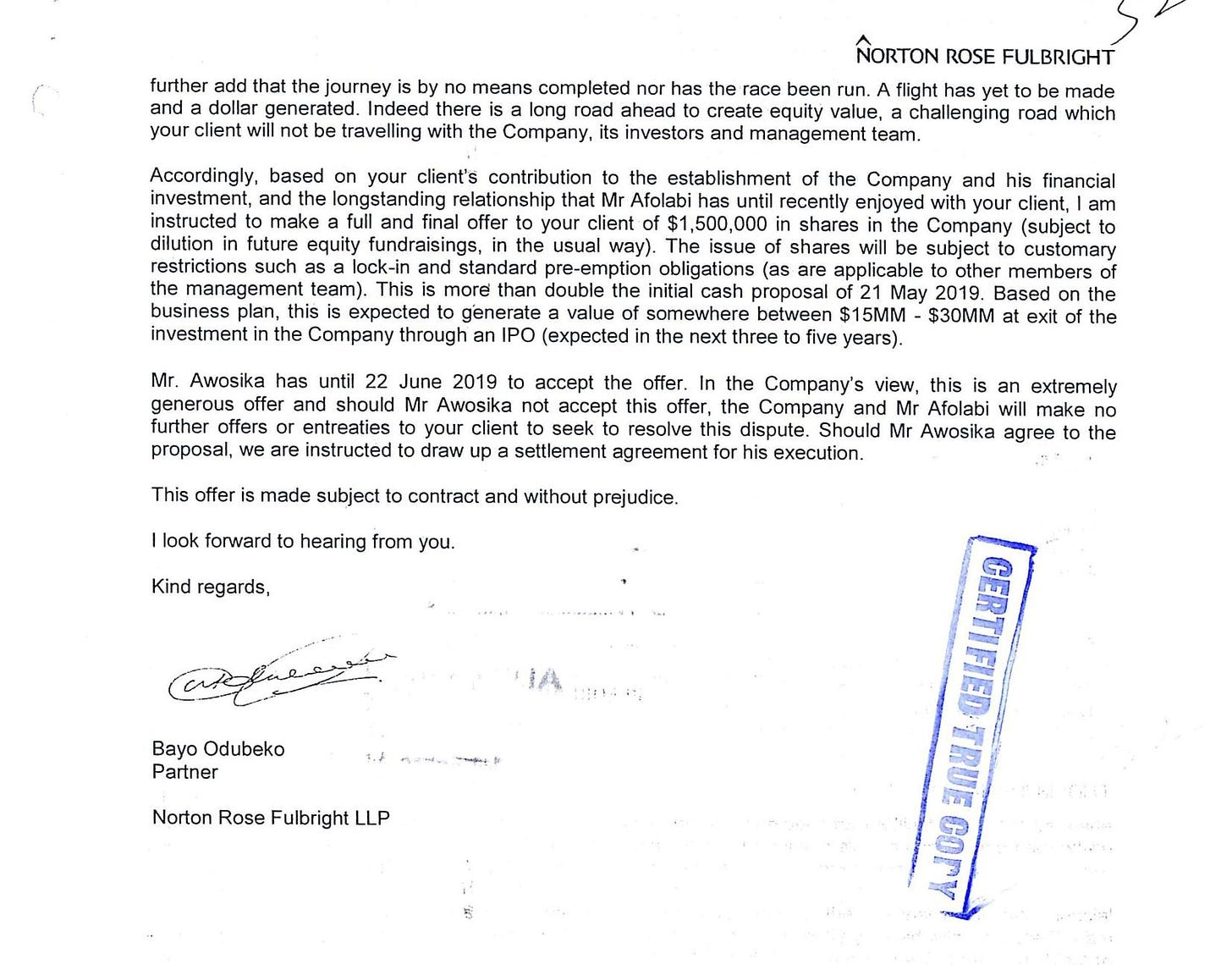

Fortunately or unfortunately, Kenny happens to be an Awosika – and they generally don’t tend to be financially insecure people. So then came a $650,000 offer for him to drop all claims and basically disappear, forever wiped from the history of the airline he very literally set up with his own time, money, resources and connections.

Unsurprisingly he had no interest in this offer either. Wande promptly upped the offer to a “full and final offer” of $1.5m. Presumably, Wande and Green Africa were so generous with investor money that they were happy to offer $650,000 to someone they claimed was just a disgruntled, overentitled former IT consultant, and then more than double the offer 23 days later, completely unprompted. Nothing to read into that at all.

But somehow, it still gets even worse.

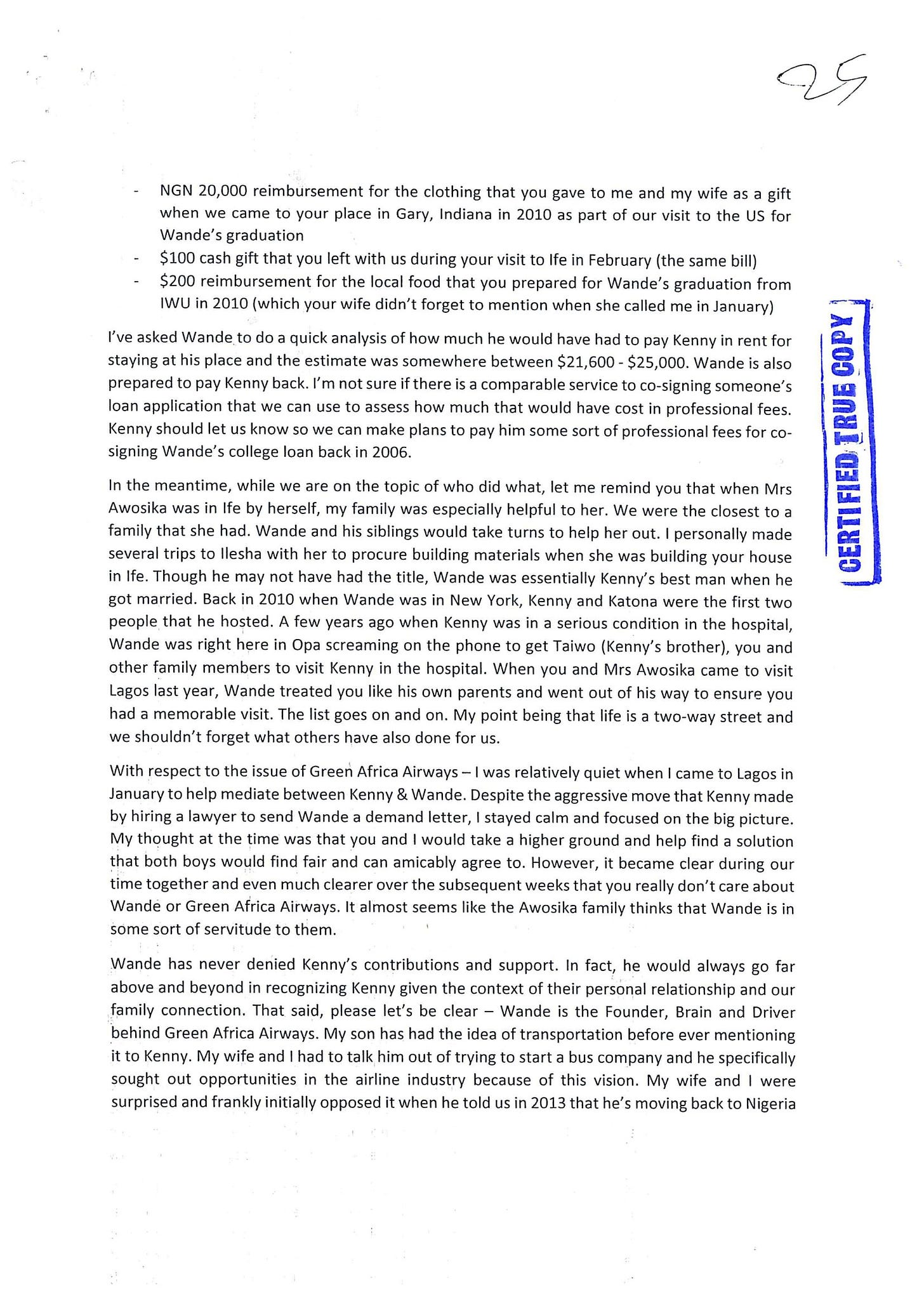

The relationship between the Afolabi and Awosika families had at this point, completely broken down to the point where Wande’s father, Francis Afolabi wrote the following stinker to Kenny’s father, even offering to repay the school fees paid for Taiwo and Kehinde all the way back in the year 2000.

If you’re thinking “Surely this must be the climax of the story,’“ well, no. It’s not.

We’re still getting there.

In his response to Wande’s fundamental rights enforcement motion against the EFCC, Kenny revealed what happened the first time he truly understood his place in Wande’s life, and how his erstwhile bosom friend actually saw him. Describing his and The Applicant (Wande’s) encounter with a High Net Worth investor, he said:

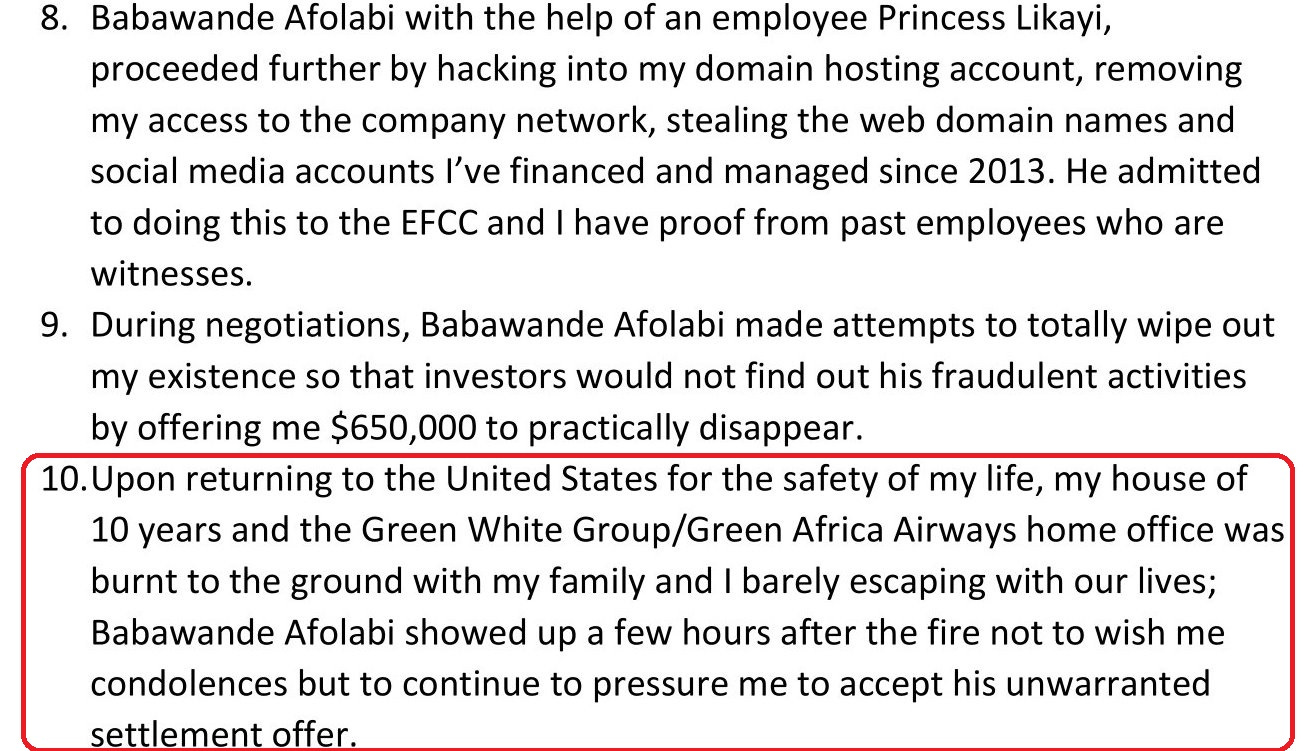

In a subsequent response to Wande’s motion against Kenny and the EFCC at the High Court, Kenny revealed that shortly after he rejected the derisory offers from Wande’s lawyers and returned to the USA due to security concerns, his house at 11305 Appledowre Way, Germantown, MD, 20876 – which was also Green White Group’s registered address for all those years – mysteriously burned down.

I found this to be an incredible claim, so I cross-checked publicly available images of that property with any available social media posts and news stories from 2019 about a fire at that property. And here is what I found, courtesy DCNewsNow.

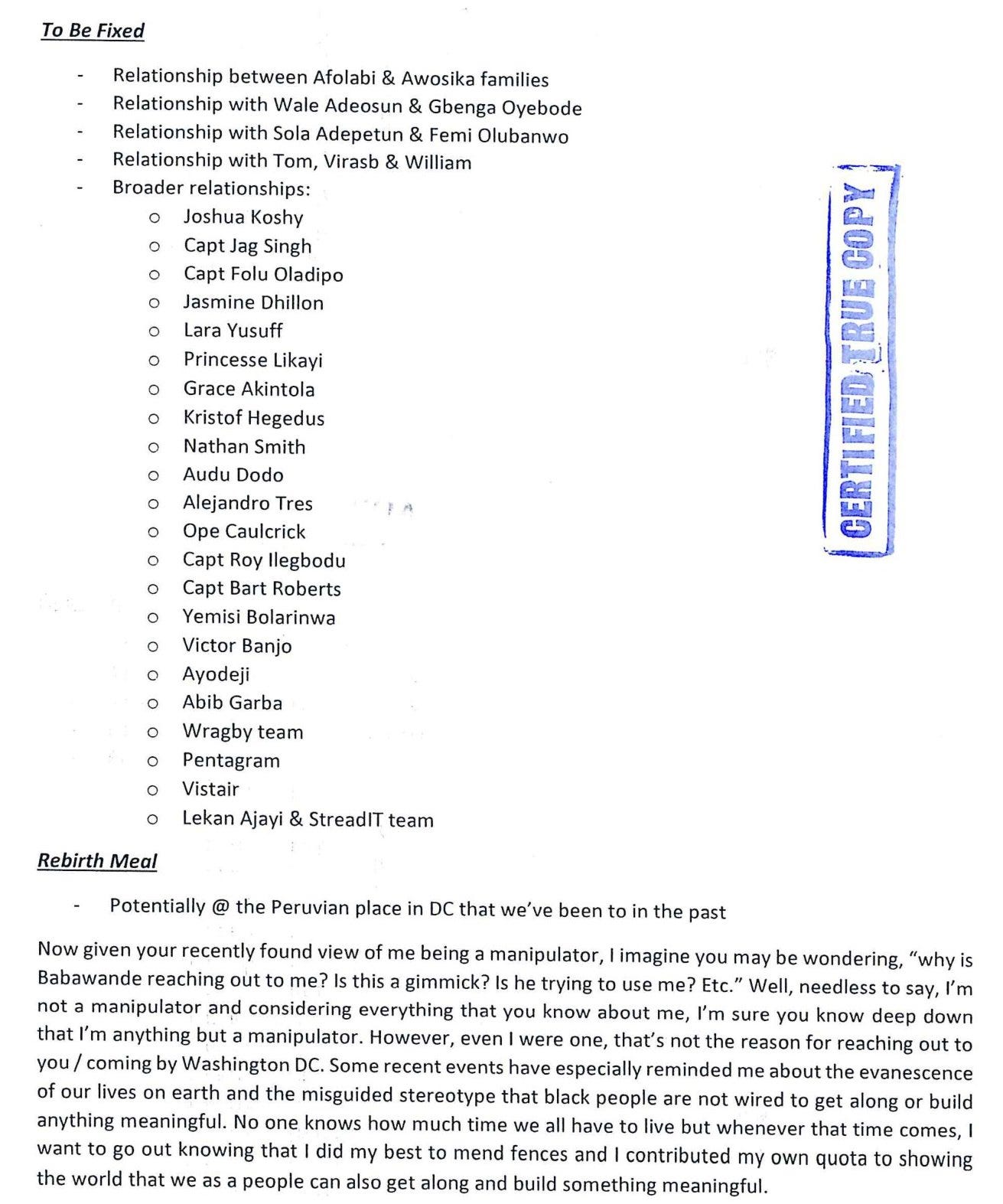

The story is just about over, but I should mention finally that shortly after all of this happened, Wande then sent this personal message to Kenny, requesting a one-on-one “Rebirth Meal” for them to somehow reconcile. This I think, is a good place to end, because the psyche of a sociopath is best expressed in his own words

When I reached out to Wande for his response, this was what he said:

About The Author

Related Articles

Burkina Faso, Mali, and Niger Turn to Russia for Shared Telecom Network

Burkina Faso, Mali, and Niger have announced plans to develop the Sahel’s...

ByWest Africa WeeklyJanuary 23, 2026Ghana Orders Advanced ACH160 Helicopters to Bolster Security Aviation

Ghana has secured an order for a batch of the world’s most...

ByWest Africa WeeklyJanuary 19, 2026AES Confederation Launches Television Network in Push for Media Sovereignty

Meeting in Bamako, the three Heads of State of the Confederation of...

ByWest Africa WeeklyDecember 23, 2025Burkina Faso Grants Broadcast Frequency to AES Radio

Burkina Faso’s Superior Council of Communication has approved the allocation of a...

ByWest Africa WeeklyDecember 19, 2025

Leave a comment