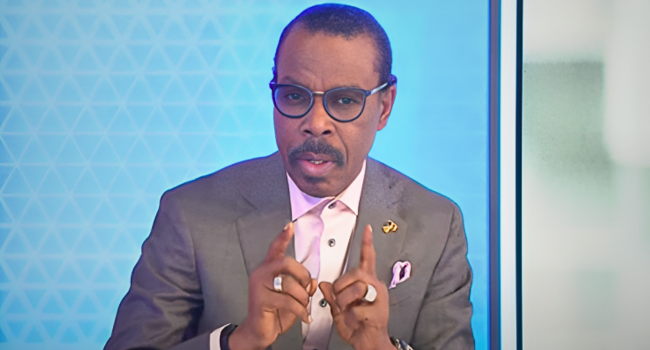

Speaking on the ongoing crackdown on Bureau de Change (BDC) operators by law enforcement agencies in a bid to stabilize the falling Naira, a prominent economist, Bismarck Rewane, has labelled the approach as counterproductive while speaking on Channels Television’s Business Morning show this morning.

Since the Federal Government decided to unify the forex rate in June 2023, the Nigerian Naira has experienced a rapid decline, plummeting from N700/$1 to over N1500/$1.

In response, authorities have escalated efforts to rein in the currency’s free fall, resorting to raids on BDC operators as part of their strategy.

Addressing the issue, Rewane criticized the tactics employed, stating, “This doesn’t happen in other countries, raiding markets and all. You are only making it more difficult because there is what we call an illicit premium in a currency. You leave them to do what they want; a speculator can make money, and a speculator definitely will lose money,” he noted.

Expressing scepticism towards the effectiveness of the current approach, Rewane advocated for a more hands-off strategy, emphasising the importance of allowing the market to settle naturally.

He asserted that intervention through an increased supply of dollars would be more effective in stabilizing the forex market.

“Let the market settle, and when you have enough supply, intervene. If the central bank wakes up today and says we are going to intervene with $500m, all the bureau de change will run into the bush because nobody will patronize them,” Rewane remarked.

Rewane questioned the rationale behind the raids on BDC operators, questioning the alleged offences they had committed. He challenged assertions of involvement in naira racketeering and note mutilation, arguing that such actions do not address the root causes of the forex crisis.

“What is the offence that they have committed in the first place? I heard something like naira racketeering, mutilation of notes, and all that. Is that the problem? And I heard the BDC man saying that we will ensure that the rate will come down, were they the ones that ensured the rate went up in the first place?” Rewane queried.

In conclusion, Rewane underscored the fundamental principles of supply and demand in currency markets, stressing that sustained intervention to increase supply would ultimately lead to the appreciation of the Naira. He urged policymakers to reconsider their approach and focus on strategies aimed at addressing underlying economic imbalances rather than targeting BDC operators.

Read more: Nigerian Police Force to Lift Ban on Tinted Glass Permits With Stringent Measures

About The Author

Related Articles

Bola Tinubu Administration Accused of Enabling Terrorism as NSA Nuhu Ribadu Pushes Terrorist Reintegration with Western-Funded Ex-Fighter Programs

The administration of President Bola Tinubu is running the country on autopilot...

ByWest Africa WeeklyMarch 1, 2026Zimbabwe Rejects $350m US Health Deal Over Sovereignty Dispute

Zimbabwe has formally withdrawn from negotiations on a proposed $350 million health...

ByWest Africa WeeklyFebruary 25, 2026Niger’s President Outlines Vision for Strategic Partnership with China

Niger’s Head of State, General Abdourahmane Tiani, has articulated a renewed vision...

ByWest Africa WeeklyFebruary 25, 2026Fire Destroys 140 Tonnes of Cotton in Western Burkina Faso

A major fire has destroyed more than 140 tonnes of cotton in...

ByWest Africa WeeklyFebruary 25, 2026