Ecobank, Sendwave, Others Instructed to Pay Customers Money Sent From Abroad in Naira only

Nigerian banks have commenced the implementation of the Central Bank of Nigeria’s (CBN) revised guidelines on international money transfer operations.

These regulations permit banks to convert customers’ remittances from abroad into naira.

As part of the new directives, the CBN has banned dollar and other foreign currency payouts for international transactions received through International Money Transfer Operators (IMTOs).

This measure is said to be aimed at bolstering forex supply and curbing black market trading.

Note that the CBN has restricted the operations of IMTOs to inbound transfers only, and discontinued outbound transfers from Nigeria to other countries.

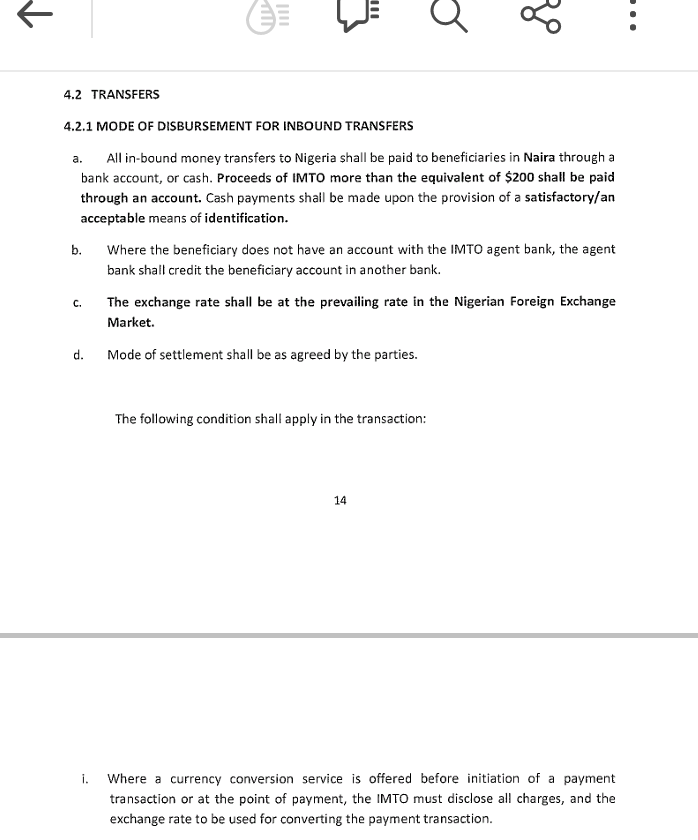

According to the revised guidelines, all inbound money transfers to Nigeria must be paid to beneficiaries in naira, either through a bank account or in cash. Transfers exceeding the equivalent of $200 are mandated to be credited to the recipient’s bank account, with cash payments below $200 requiring satisfactory identification.

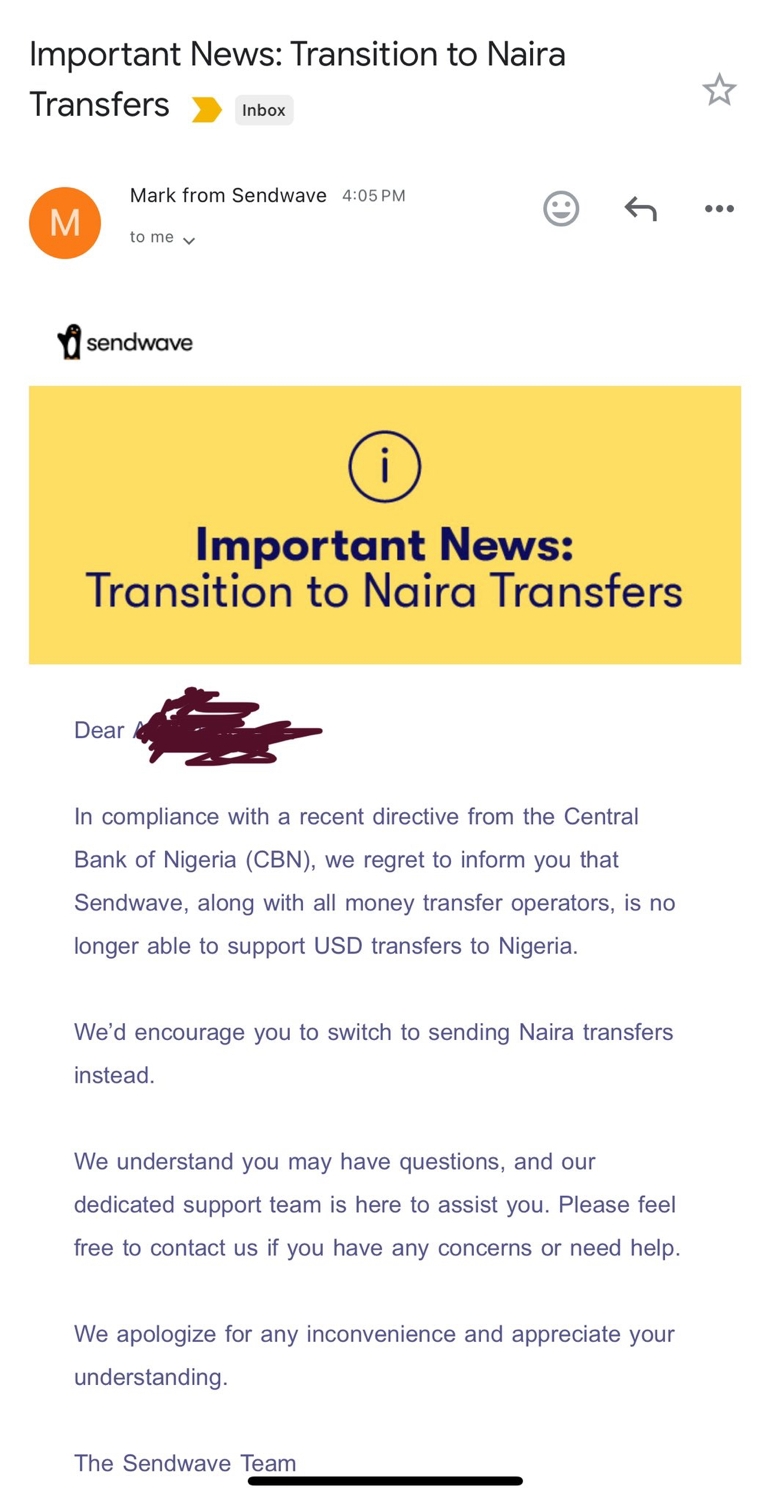

Nigerian banks and financial institutions are now issuing statements to customers explaining the alterations. Like was stated, these changes include payments in naira for all inbound transfers and specific requirements for transactions exceeding $200.

ECOBANK message to customers as seen by West Africa Weekly says:

“Dear Valued Customer,

We would like to bring to your attention recent regulatory changes affecting international money transfers into Nigeria.

“With regards to the Circular issued by the Central Bank of Nigeria (CBN) dated January 31, 2024, all in-bound money transfers to Nigeria will be paid only in Naira through a bank account or in cash at the prevailing rate in the Nigerian Foreign Exchange Market.

“Furthermore, transfers exceeding the equivalent of $200 must be credited to the recipient’s bank account while cash payments for amounts below $200 will require an acceptable means of identification.

The acceptable means of identification is listed as follows: International passport, Driver’s license, National Identity card, INEC Permanent Voters Card (PVC)”

The CBN has also specified that the exchange rate for naira payments will be determined by the prevailing rate in the Nigerian Foreign Exchange Market. This will, undoubtedly, introduce potential challenges due to market fluctuations.

The policy shift, barring dollar payouts for international transactions, may pose challenges for recipients and impact remittance flows. The disparity between official and parallel market rates could affect Nigerians living abroad and their preferences for remittance channels.

About The Author

Related Articles

Malian Army Says Dozens of Militants Killed in Airstrikes in Segou Region

Mali’s armed forces say they have killed about twenty suspected militants during...

ByWest Africa WeeklyFebruary 19, 2026Nigeria Approves 33 New Universities While Education Quality and Jobs Remain in Crisis

Nigeria has approved 33 new universities, bringing the total number of sanctioned...

ByWest Africa WeeklyFebruary 19, 2026Gabon Suspends Social Media “Until Further Notice” Amid Rising Unrest

Gabon’s media regulator has announced the suspension of social media platforms nationwide,...

ByWest Africa WeeklyFebruary 18, 2026Côte d’Ivoire Feeds the World’s Chocolate Industry, But When Prices Shift, Cocoa Farmers Are Left With Rotting Harvests and No Income

Côte d’Ivoire produces nearly half of the world’s cocoa, a crop that...

ByWest Africa WeeklyFebruary 18, 2026

Leave a comment