CBN’s Recent Effort to Stabilize Nigeria’s Volatile Exchange Rate: a Policy Overload?

“CBN bans banks and Fintechs from International Money Transfers”

“CBN mulls the conversion of 30bn domiciliary accounts to Naira”

“CBN hikes import duty by 43%…”

“The apex bank added a further 4.4% increase”

“CBN Adopts New CRR Mechanism, Halts Daily Debits for Banks”…

The past few days have seen a lot of policy changes reportedly aimed at saving the Naira from free fall against the United States Dollar. Highlighted above are some of the important headlines involving the Central Bank of Nigeria (CBN) this week.

These developments come in the backdrop of the naira’s biggest fall in the official Nigerian Foreign Exchange Market on Monday, depreciating by 24 percent to close at N1,348 per dollar. In a bid to salvage the threatening economic doom, CBN has seemingly been thrown into a frenzy.

In 24 hours, CBN increased Import Duty twice

The Central Bank of Nigeria (CBN), on Saturday morning, raised import duty rates by 4.4 percent within 24 hours.

The new rate, now at N1,413.62 per dollar, followed a previous increase to N1,356.883. The previous increase, reported on Friday, represented a significant 43 percent hike in the Customs exchange rate. Although the development was met with vehement opposition, the apex bank reviewed the rate yet again.

The sudden upward review and computation of the import duty exchange rate from N952 to N1,413.62 per dollar sparked an uproar among importers and Customs brokers.

CBN and International Money Transfer Operators

The Central Bank of Nigeria (CBN) unveiled new guidelines for International Money Transfer Operators (IMTOs), including a ban on banks and fintechs providing international money transfer services. The apex bank increased the application fee for the IMTO license from N500,000 to N10 million.

In the updated guidelines released on January 31, 2024, the CBN removed the allowable limit of exchange rates quoted by IMTOs, aiming to restructure the foreign exchange market and strengthen the naira. The financial regulator instructed IMTOs to quote exchange rates for naira payouts based on prevailing market rates.

The guidelines set forth a two-phase approval process for IMTOs: approval-in-principal and final approval.

“No person or institution shall operate international money transfer services unless such a person/institution has been duly approved by the CBN,” the document said.

CBN also requires submission of necessary documents to the Director of the Trade and Exchange Department in Abuja. The approval includes an application fee of N10 million, tax clearance, and incorporation documents. Indigenous IMTOs must also provide a Memorandum and Articles of Association indicating the provision of money transfer services.

Additionally, the CBN prohibited banks and fintechs from operating international money transfer services but allowed them to act as agents. Financial Technology Companies, commonly known as Fintechs, are not allowed to obtain approval for IMTO.

The circular outlined permissible activities for IMTOs, restricting transactions to the acceptance of monies for transmission to persons residing in Nigeria.

“The money transfer services shall target individual customers and the transactions shall be on “person to person”, “business to person” and “business to business” transfer basis which may be reviewed by the CBN from time to time,” the guideline reads.

However, IMTOs are not permitted to buy forex from the domestic FX market for settlement. Daily, weekly, and monthly returns must be submitted, with suspicious transactions reported within 24 hours.

IMTO approval is subject to annual renewal at a fee of N10 million or an amount specified by the CBN. Failure to provide the agent bank with a copy of the CBN renewal within the first quarter will result in a cease of transactions with the IMTO.

Possible sanctions for unapproved money transfers include withholding corporate approvals, financial penalties, suspension, and revocation of IMTO approval. Operating without CBN approval is deemed illegal, subjecting individuals or institutions to sanctions or prosecution under the Banks and Other Financial Institutions Act (BOFIA) 2020.

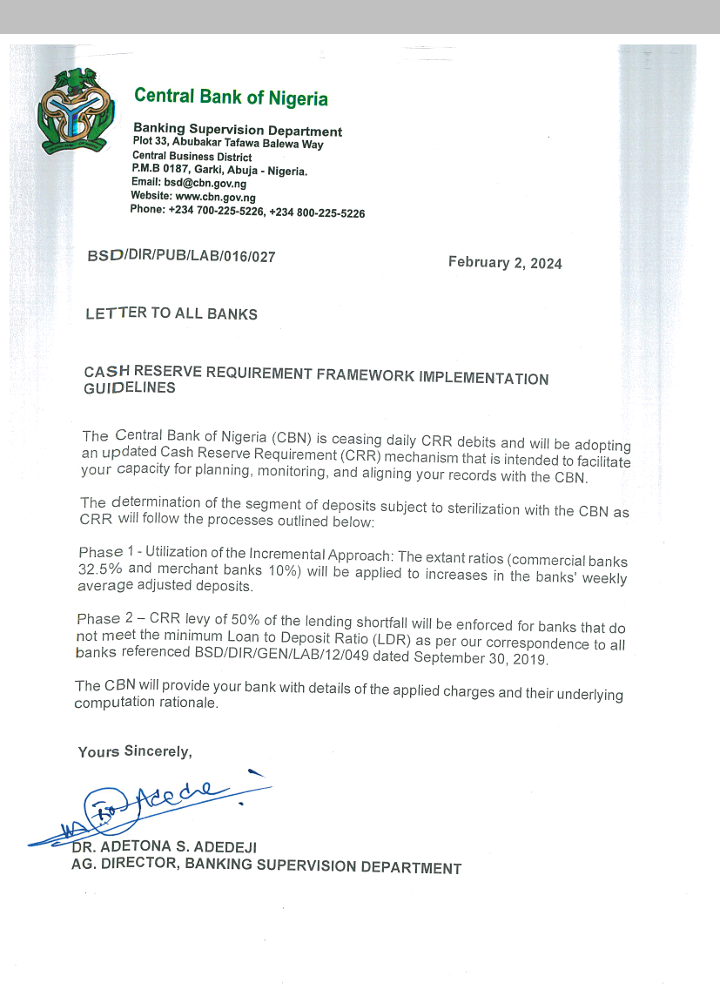

CBN’s New CRR Mechanism

The Central Bank of Nigeria announced a cessation of daily Cash Reserve Requirement (CRR) debits for banks.

In a statement shared on CBN’s official X handle, the bank said it was introducing an updated mechanism aimed at enhancing banks’ planning, monitoring, and alignment with CBN records. Reserve requirements, crucial for meeting liabilities during withdrawals, serve as a tool for the central bank to manage the money supply and influence inflation. This policy was met with mixed reactions, with some commending the CBN governor and others offering criticism.

Cbn and 30bn Domiciliary Accounts

This is perhaps the most trending development involving CBN in recent days. Punch reported that the Nigerian government was considering tampering with domiciliary accounts to stabilize the Naira’s recent decline. The national newspaper was not alone in this speculation, as business analysts and social media users projected similar fears.

Contrary to the claims, however, CBN released a memo debunking the news as fake.

Be the Judge!

The CBN’s recent moves seem to be strategically aimed at strengthening the national currency. The recent IMTO guidelines, for one, could stabilize the forex market by ensuring compliance with anti-money laundering regulations and countering the financing of terrorism.

Some of the recent guidelines, however, come off as frenzied moves. Would strangling importation businesses, for instance, improve the strength of the naira when production in the country is minimal? Is the CBN beating around an overgrown bush or do these policies make for long-term economic stability?

Leave your thoughts.

About The Author

Related Articles

Ghana Seeks Stronger Trade and Investment Relations With Nigeria

Ghana is pushing for deeper trade and investment cooperation with Nigeria as...

ByWest Africa WeeklyMarch 9, 2026ECOWAS Moves Forward With Plan for Single West African Currency

The Economic Community of West African States is continuing discussions aimed at...

ByWest Africa WeeklyMarch 9, 2026Ghana Records Sharp Drop in Inflation, Lowest Since 2021

Ghana’s inflation rate dropped to 3.3 percent in February 2026, marking the...

ByWest Africa WeeklyMarch 5, 2026Uganda to Start Domestic Gold Purchasing Programme to Boost Reserves

Uganda’s central bank has announced plans to launch a domestic gold buying...

ByWest Africa WeeklyMarch 3, 2026

Leave a comment