Naira Hits All-time Low at N1482.57/$ in Official Market

The naira has experienced significant decline, reaching a new all-time low in the official Investor and Exporter window of the foreign exchange market. It closed at N1482.57 per US dollar on Tuesday.

This marks a substantial 9.93% drop from N1348.63/$ on Monday, as reported by FMDQ Securities Exchange.

Stability was observed in the parallel market, where the naira traded at N1,450/$. In the cryptocurrency peer-to-peer market, specifically on Binance’s P2P platform, it traded at N1,499/$.

This steep fall in the official market could be attributed to the technical devaluation of the national currency. FMDQ Securities, responsible for calculating the exchange rate, recently revised its methodology. They issued a market notice stating that the revision was aimed at addressing the recent fluctuations and challenges in the Nigerian Forex market.

The new measures introduced by FMDQ were designed to enhance the accuracy and reliability of the Nigerian Autonomous Foreign Exchange Rate Fixing (NAFEX) and Nigerian Foreign Exchange Market (NAFEM) rates. It involved a rigorous data validation process, including tolerance checks to reflect true market conditions.

Meanwhile, the Central Bank of Nigeria (CBN) has taken action against unethical practices in the financial market. It released a circular to authorised dealers highlighting the issue of inaccurate and misleading information being reported in market transactions. The bank emphasised that such behavior, which creates price distortions, is against ethical standards and will face sanctions.

Despite these measures by the CBN and the Federal Government to stabilise the forex market, the naira continue to depreciate. It is now approaching N1,500/$, a level predicted by Johnson Chukwu, Group Managing Director of Cowry Asset Management Limited.

This decline is expected to lead to increased prices, as noted by Francis Meshioye, President of the Manufacturers Association of Nigeria. Meshioye expressed concern over the impact of the exchange rate on profitability and the subsequent effect on prices, which could lead to reduced purchasing power for consumers.

“It is not possible to remain profitable with this exchange rate. The first challenge is breaking even. It means the prices of things will be higher, and the income is not there for people to buy things as they should buy as things become more expensive”, he said.

Naira’s persistent and dramatic fall against the US Dollar remains a complex challenge to the dwindling Nigerian economy.

About The Author

Related Articles

Ghana’s Prisons to Produce 20% of Sanitary Pads, 30% of Desks and Uniforms for Schools– Interior Minister

The Minister for the Interior, Hon. Muntaka Mubarak, has announced that inmates...

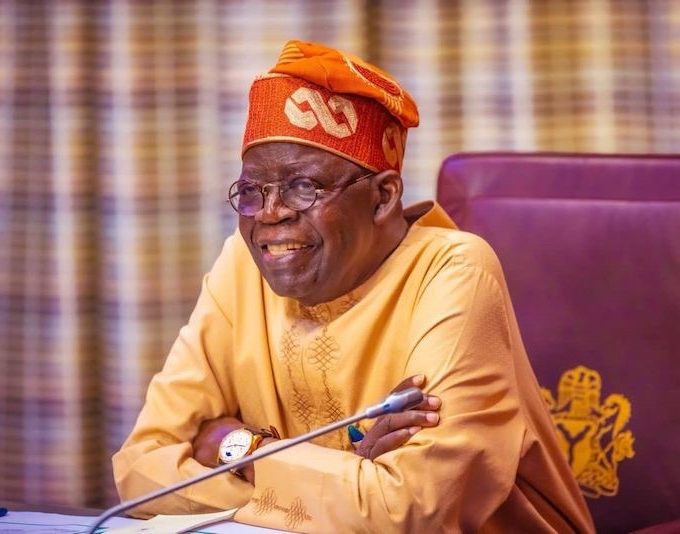

ByOluwasegun SanusiJuly 14, 2025Nigeria: Tinubu’s ‘Renewed Hope’ Agenda Under Scrutiny for Inconsistent Records

President Bola Tinubu’s administration has a bold and expansive plan titled “Renewed...

ByMayowa DurosinmiJuly 14, 2025Cameroon’s 92-Year-Old President, Paul Biya, Declares Bid to Run for Eighth Term in October Election

Cameroon’s President Paul Biya has officially declared his intention to run for...

ByConfidence UbaniJuly 14, 2025U.S. Court Orders FBI, DEA to File Another Joint Status Report by August 7 on Release of Tinubu’s Unredacted Heroin Trafficking Records

The U.S. District Court for the District of Columbia has ordered the...

ByMayowa DurosinmiJuly 14, 2025

Leave a comment