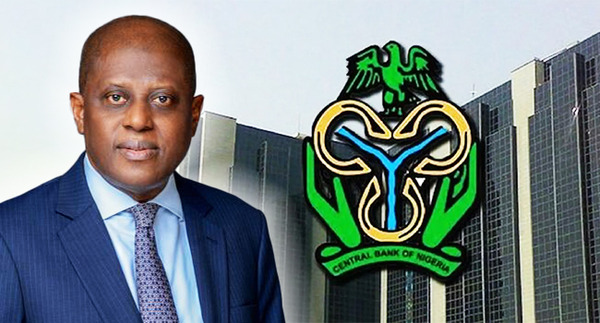

The Central Bank of Nigeria has upgraded the operating licences of several leading fintech firms and microfinance banks, granting them national status and formally authorising them to operate nationwide.

Among the institutions affected are Opay, Moniepoint Microfinance Bank, Kuda Bank, PalmPay and Paga. The upgrade reflects the reality that these platforms already serve millions of customers nationwide through digital channels and agent networks, far beyond the limits of their former regional or specialised licences.

The CBN said the move is part of efforts to align regulation with the rapid expansion of digital financial services in Nigeria. Fintech companies have become central to everyday banking activities, including payments, transfers, bill payments and access to savings and credit, particularly for small businesses and individuals outside the traditional banking system.

With the new national licences, the affected institutions are now required to meet stricter regulatory standards, including higher capital requirements and the establishment of physical offices in key locations across the country. The central bank says this will improve consumer protection, strengthen supervision and ensure better customer support.

READ MORE: Arthur Eze Loses Senegal Offshore Oil Block as Government Reclaims Licence

Officials stressed that the upgrades were not automatic and that only institutions that met compliance, governance and risk management requirements were approved. The CBN also reiterated its commitment to enforcing know-your-customer and anti-money laundering rules across the sector.

Industry observers say the decision marks a significant moment for Nigeria’s financial system, effectively recognising fintech firms as core players rather than peripheral disruptors. It also signals tighter oversight at a time when digital banking is growing rapidly amid economic pressure and declining trust in traditional institutions.

For customers, the licence upgrades are expected to bring greater stability, accountability, and expanded services as fintech firms scale their operations under more precise national regulation.

About The Author

Related Articles

Burkina Faso President Ibrahim Traoré Reviews 2025 Achievements, Sets Ambitious Agenda for 2026

Burkina Faso’s President, Ibrahim Traoré, has described 2025 as a year of...

ByWest Africa WeeklyJanuary 28, 2026Mali Says Reports of New Three-State Sahel Currency Are False but Talks Continue on Economic Integration

Mali’s government has rejected claims that it and its neighbours, Burkina Faso...

ByWest Africa WeeklyJanuary 28, 2026Arthur Eze Loses Senegal Offshore Oil Block as Government Reclaims Licence

Senegal has revoked an offshore oil exploration licence held by a company...

ByWest Africa WeeklyJanuary 28, 2026Tinubu Deducts N100bn Monthly From Federation Account Without Approval El-Rufai Alleges Says Action Deserves Impeachment

Former Kaduna State Governor Nasir El-Rufai has launched a blistering attack on...

ByWest Africa WeeklyJanuary 26, 2026

Leave a comment