Unity Bank Fraud: An Unfolding Story Of Nigerian Corporate Malfeasance

Thomas Akoh Etuh is a very rich man.

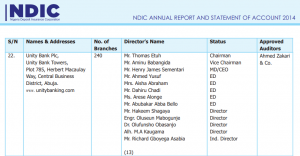

He is the Chairman at Veritas Kapital Assurance Plc and Founder of the TAK group of companies, a multibillion naira conglomerate spanning Agriculture, Logistics, Asset Management, Aviation and Mining. His portfolio includes TAK Continental Limited, TAK Asset Management, TAK Agro, TAK Aviation, Thomasses and Associates Limited (UK) and Cape Cross Salt (PTY) of Namibia). Like many Nigerians of such considerable means, he made the jump from bank customer to bank insider, becoming the pioneer Vice-Chairman of the Unity Bank board of directors in April 2014.

A little under a year later in January 2015, the Central Bank of Nigeria (CBN) approved his appointment as the Chairman of the board.

What happened during the 33 months from his appointment on January 23, 2015, to his retirement on October 4, 2017 would become a case study in regulatory malpractice, absence of compliance, and the sheer, unbridled greed of well-connected insiders in Nigeria’s financial system. Along the way, a previously healthy bank would find itself completely hollowed out after giving out hundreds of billions of naira in Non Performing Loans, reduced to meticulously cooking its books while secretly operating with negative share capital for the better part of a decade. A barely-disguised distress sale to a younger competitor would then be floated as the solution to the bank’s woes, even as its erstwhile chairman would continue to lavish stupendous amounts of money on his personal business interests.

Other people’s money.

Bank Insider Fraud: The Perfect Scam

Former American bank regulator William Black famously wrote a book about the 1980s U.S. Savings and Loans crisis called ‘The Best Way To Rob A Bank Is To Own One.’ In the book, he detailed how the average, run-of-the-mill, successful bank robbery nets an average of $7,500 along with the risk of a bullet to the chest, whereas a moderately competent bank executive could make many multiples of that sum using just 2 basic principles of accounting fraud – Compliance Fraud and issuance of so-called Liars Loans. When the goal is a heist, the idea behind the 2-pronged approach is simple but effective. Compliance Fraud entails lowering internal controls and restrictions that normally limit the bank’s exposure to high risk activity such as subprime lending. Doing this allows the bank to vastly increase its loan portfolio in a short time and thus report incredible levels of growth – at least in the short term. Working hand-in-glove with this is the increased issuance of Liars Loans – loans that are issued with little or no due diligence by the bank, effectively taking the borrower at their word, which a bank is never supposed to do.

According to Black, there are always 3 outcomes whenever this financial formula is put into action. First, the bank experiences incredible growth in the short term, and may be able to report an impressive balance sheet.

Next, Black says, the top ranking executives at the bank become stupendously wealthy.

Finally, the bank itself suffers catastrophic financial ruin that causes its collapse if it is not bailed out or taken over.

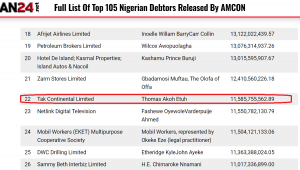

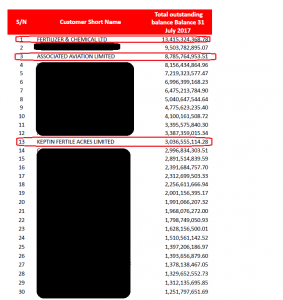

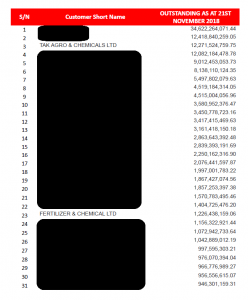

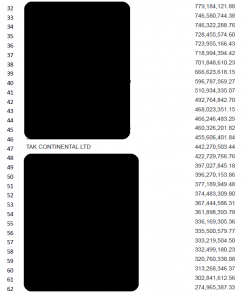

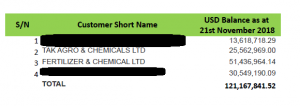

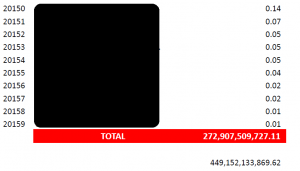

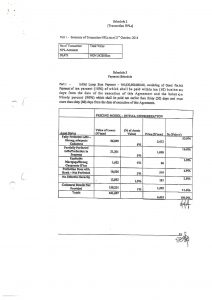

According to sources from within Unity Bank, Thomas Etuh appears to have treated Black’s “formula” as an instruction manual rather than a warning, and the inevitable disastrous outcome is imminent. Etuh, according to these sources, was singlehandedly responsible during his tenure, for inflating the bank’s number of Non Performing Loan (NPL) accounts to over 20,000, coming to a total NPL balance of more than N400 billion by the time he retired. Of this unfathomable number, at least 7 seven companies directly owned by or linked to Etuh alone were responsible for more than N29 billion worth of NPLs that would later be wiped off the books using financial sleight of hand. The following images are excerpts from large data files passed across to West Africa Weekly containing the comprehensive list of NPLs shortly before Etuh’s retirement from the board in 2017.

The companies left unredacted are all companies directly owned by or beneficially linked to Thomas Etuh.

Fertilizer & Chemical Ltd, TAK Agro & Chemicals Ltd, SDEM Erectors Nigeria Limited, North East Gold Comm. Ltd, Keptin Fertile Acres Limited, Yam International (NG) Limited and TAK Continental Ltd are some of the Etuh-linked entities on this list of NPLs, as identified by bank insiders to West Africa Weekly. Entities linked to Etuh alone were responsible for a double digit percentage of all non performing loans on the bank’s books. Recognising that this would become a problem, Etuh’s next move was either evil genius or just plain evil, depending on your perspective. In December 2016, Unity Bank under his leadership struck a sales agreement with a company called Frontier Capital Alternative Assets Limited (FCAAL) to offload its total NPL portfolio – then worth N242 billion – for just N6.43 billion. You can access the full sales agreement here.

FCAAL by the way, is also closely linked to Etuh according to sources at the bank. What this means is that after personally taking nearly N30 billion out of the bank whose board he chaired, in the process inflating its NPL portfolio well past every regulatory limit in Nigerian jurisprudence, Thomas Etuh and his associates at FCAAL would then use a fraction of what he took out of the bank to buy its loan portfolio worth approximately 37.6 times more than what they paid for it. In addition, all collateral used to secure these loans were also taken over by FCAAL in the deal, making it a double loss for Unity Bank and a double gain for Etuh and FCAAL. But he wasn’t done yet. The sales agreement was modified in May 2017 to account for, among other things, the expected value of the NPL portfolio by the end of that year. At the stroke of a pen, the value of the loan portfolio sold to FCAAL went up 44 percent to N436,751,633,476.96 – but the price paid by FCAAL did not change.

Thomas Etuh had successfully masterminded the obliteration of nearly half a trillion naira of wealth from the Nigerian banking system in exchange for the risible sum of N6 billion.

Explaining why this is an especially bad deal, a source who asked not to be named said this:

It is important to point out that the sale of Unity Bank Loans to Frontier was under the pretence that it was helping the NPL of the bank. That is far from the truth because Thomas Etuh, who is responsible for the majority of the NPLs, has created fresh NPLs in the bank. The major reason for the sale was to cover up the huge NPL belonging to Thomas Etuh. Note also that the loans and its collaterals were grossly undervalued with no reasonable revenue generated from the sale (N400bn loans sold for N6bn.) Moreover, the sale eroded the bank’s capital, throwing it deeply into the red. In addition, Frontier Capital has made very little recovery most of which were at ridiculous concessions because it did not pay any reasonable considerations for the loans.

The problem with all this was that regardless of whatever accounting shenanigans could be enacted to hide the fact that Unity Bank was nearly half a trillion naira in the hole due to compliance fraud and Liars Loans, that kind of leakage could not be hidden for long. It was bound to show up on the books eventually and result in the first bank run in Nigeria since the January 2006 collapse of Société Générale Bank of Nigeria. Certainly if the bank were being audited by PwC or KPMG, such gaping holes in the balance sheet could not be hidden for long.

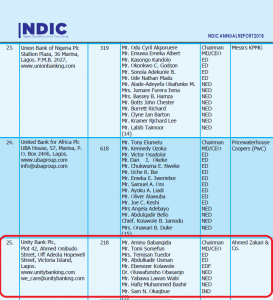

Which perhaps makes it rather interesting that the bank’s long-standing auditor turned out to be a little-known audit firm based in Kano called Ahmed Zakari & Co. The image below is its Lagos office. Feel free to draw your own conclusions, if any.

Explaining the ongoing conspiracy of silence at Unity Bank, a current staff member with knowledge of the matter said:

With this criminal sale of the Bank’s assets, the bank shareholders funds became negative to the tune of about N270 billion. The bank has been operating with huge negative capital for several years.

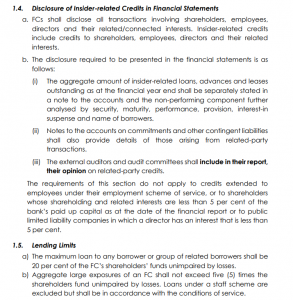

Boardroom And Regulators Unite In Mischief

The Banks and Other Financial Institutions Act (BOFIA) 2020 and the CBN’s Prudential Guidelines contain multiple clauses that criminalise pretty much everything described above. The Prudential Guidelines for example, state that the maximum amount that can be given as a loan to a single borrower or group of related borrowers is 20 percent of the bank’s shareholder funds. Thomas Etuh himself claims that Unity Bank’s shareholders’ funds stood at N31 billion when he took charge, going up to N80 billion by the time he left. Putting aside the whistleblowers’ insistence that Unity Bank has in fact, been running with negative shareholders’ funds since 2016, if we are to use his own dodgy math, his NPL portfolio of N29 billion grossly exceeds the prudential guidelines both in the case of N31 billion SHF (93.5 percent) and N80 billion SHF (36.25 percent).

For some unspecified reason, both the Management and Board of Unity Bank showed complete disregard for these regulations and continued to grant loans to Thomas Etuh in amounts far in excess of the regulatory limits. The CBN meanwhile, appears to have entirely vacated its regulatory position where Unity Bank is concerned. According to staff who were in the know, the bank’s treasurer, Sunny Bakwunye was indicted by a high level committee within the bank for fraudulently diverting N13 billion belonging to the bank.

The recommendation of the committee’s report was that he should be sacked and the N13 billion immediately recovered. For an unknown reason, sources informed West Africa Weekly, this recommendation was never carried out by the Managing Director, and the Treasurer remains not just a free man, but also retains the job to this day.

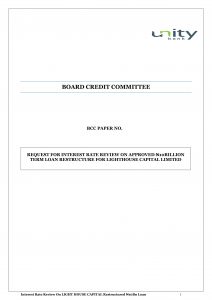

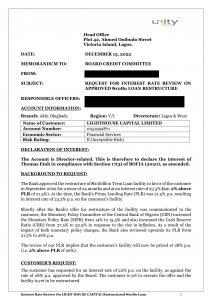

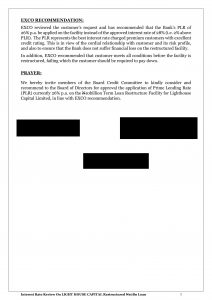

Moreover, the inside word is that as the CBN continues to sit on its hands instead of regulating Unity Bank properly, the risk factor for contagion is growing within the Nigerian financial system due to Thomas Etuh’s insatiable appetite for toxic NPLs. The following memo to the board of the bank signed by the MD and other officials shows that Thomas Etuh has recently been granted new loans totalling N10 billion by the bank he quite literally ate into the red. Once again, the approval for the loan was given with no questions asked.

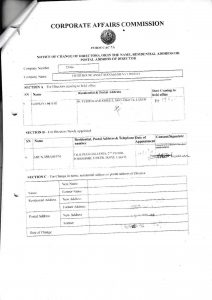

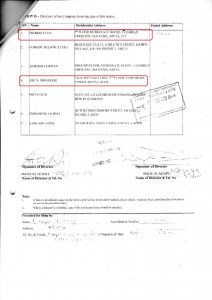

In case you are in any doubt about who is behind “Lighthouse Capital Limited,” the CAC document below should clear that up.

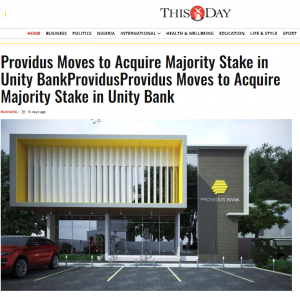

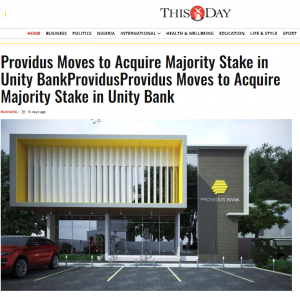

Worst of all, as confirmed by all sources, there is a plan afoot to cover up all these financial atrocities at Unity Bank by going into a merger with Providus Bank. This move is apparently being spearheaded by Thomas Etuh with the support of “allies” at the CBN.

Regulatory Questions That Need Answers

Ahead of any proposed merger involving Unity Bank, the CBN, NDIC and EFCC must carry out investigations to answer the following questions, failing which they might be exposing the Nigerian financial system to potentially catastrophic contagion:

- What is the exact value of insider Non Performing Loans covered up in the sale to Frontier Capital?

- Why was the N13bn fraud by the Treasurer covered up, and why were the recommendations of the committee never implemented?

- Why and how has Unity Bank continued to operate with negative shareholders funds till date?

- What is the role of the auditor in keeping this fraud going?

- What is the true status of the new loans granted to Thomas Etuh by Unity Bank? Have they become NPLs?

- Are there other directors of Unity Bank who are beneficiaries of these loans to Thomas Etuh, which is an incentive for their continued breach of the regulatory limit on insider loans?

Read more: Fraud, Ponzi Schemes and Terror Financing: A Story About Banking In Nigeria

Suicide, Fraud and Phillips Consulting: The Story Of West Africa’s Chinese Loan Shark Mafia

About The Author

18 Comments

Leave a Reply Cancel reply

Related Articles

Asake Sets New Billboard Afrobeats Record as Chart Presence Grows

Asake has further cemented his place as one of Afrobeats’ most dominant...

ByWest Africa WeeklyJanuary 29, 2026Nigerians Lament PayPal’s Return as Old Wounds Resurface

PayPal’s reentry into Nigeria through a partnership with local fintech company Paga...

ByWest Africa WeeklyJanuary 29, 2026Tanzania Eyes Gold Sales as Aid Declines and Infrastructure Needs Grow

Tanzania is weighing plans to sell part of its gold reserves to...

ByWest Africa WeeklyJanuary 29, 2026Mali Tightens Grip on Explosives Supply With New Majority Stake

The Malian government has taken majority ownership of a civil explosives manufacturing...

ByWest Africa WeeklyJanuary 29, 2026

Who audited this bank between 2014 till date?

It say who the auditor is in the article with a photo of the dodgy Lagos office,

Lol. A single audit firm shouldn’t even be allowed to audit for that long. They have 7 years max, unless they’re as big as KPMG and can create an internal Chinese wall between the old audit team and the new one

Worked at providus 2020 – 22 before I left. Worst thing that’ll happen to that promising bank is merging with Unity bank. For a bank as big as Unity using a non known auditor should tell you a lot about what’s going down in that bank. Thank you David for yet another expose into the crime scene called Nigeria.

It has become so shameful that Nigeria is now a Theatre of Atrocities. Majority of the supposedly well meaning Nigerians do not mean well for the nation. This is just a race of self aggrandisement. Shame

This is fraud, in essence the chairman is using depositors money to loan to himself, this is round tripping if I have ever seen one, this is fraud to say the least and the burden of the loans/fraud would be felt by the depositors through bank failure or the government through AMCON loans and bailouts, EVERYBODY INVOLVED IN THIS SHOULD BE ARRESTED, to say the least and the fraudulent companies that took the loans should either be acquired by Unity Bank or whoever purchases them and regulations should be changed as soon as possible to ensure commercial banks with high amount of depositors funds or capital valuation be ALWAYS AUDITED by the Big four accounting firms, to prevent rubbish like this from happening again….

This is fraud, in essence the chairman is using depositors money to loan to himself, this is round tripping if I have ever seen one, this is fraud to say the least and the burden of the loans/fraud would be felt by the depositors through bank failure or the government through AMCON loans and bailouts, EVERYBODY INVOLVED IN THIS SHOULD BE ARRESTED, to say the least and the fraudulent companies that took the loans should either be acquired by Unity Bank or whoever purchases them and regulations should be changed as soon as possible to ensure commercial banks with high amount of depositors funds or capital valuation be ALWAYS AUDITED by the Big four accounting firms, to prevent rubbish like this from happening again….

This is so very interesting…quite illuminating ….

Thank you David for this incredible exposition. This should be shared widely on Social Media, with tags to the various agencies. See what greed can do in lawless society!

What a shame. These are people whom one is expected to looking up to. They turned up to be such a huge disappointment.

When we say all the systems in Nigeria has failed, this is a typical of it. This atrocity didn’t continue without the aid from CBN, and concerned law enforcement agencies, and even now some insiders in the so called unity bank.

Those saddled with the responsibility to fight justice and fairness are themselves deeply stained. So I am just wondering how this heinous act can be handled and unity bank redeemed.

Obviously another sponsored ( political) Article to make a Hardworking Nigerian look bad.

Let’s be smarter than this, was the merger a good idea probably not but the accusations sound very absurd and the author has collected some cool money just to say. Why do Nigerian’s try to bring fellow Nigerian’s down? It’s very sad

So one man did alllllll this passing the board of directors and other protocols? This article is to manipulate and tarnish a hard working man’s effort.

Thanks for your comments as it shows how hallow your intelligence is for not being able to verify a claim before you condemned the speaker it such a waste to have a person like you in a society that is fighting to break out domineering of demon you to be worshiping

I think your response rather sounds sponsored. When the author has made this article readable by dropping data on claims, yet how easy is it for people to praise criminality in this country.

Politics and religion will definitely distroy us.

Why are sounding like a broken bottle, The amount mentioned is it new to you compared to monumental frauds that has happened in Nigeria? If CBN could get as rotten as it has been for decades now what is not possible in Nigeria. Are t mention NNPC here the list is endless.. If this is to tarnish ones image know it that he has the right to sue which he will never do because this might 99% true.

It safe to say that corruption is not limited to the public sector alone. Corporate rascality happens all the time, we’ve seen it in the days of Erastus Akinbola of defunct intercontinental Bank, Oceanic bank and will continue to phester unchecked. With these overwhelming evidence, I won’t be surprised when silence ensued.

Expose them all!

Thank you, DH, for this indepth article on Unity Bank. I have always been curious to understand how a bank with such mediocre appearance continues to operate, if not well connected to the sleazy politicians in leadership. The crime is well described but you know like many such undercurrents including the BAT saga, this rot is only going to get worse until we rid ourselves of a system recycling reprobates in a sham democracy.