Binance, the world’s largest cryptocurrency trading platform, on Tuesday, restricted Nigerians from freely engaging in dollar-naira trade on its peer-to-peer (P2P) platform due to alleged pressure from President Bola Tinubu’s administration.

The trading platform had temporarily paused its P2P operations, and restricted traders from posting new offers above a certain price. This arbitrary move was allegedly commanded by the Nigerian government who, on the same day, formed an alliance aimed at combating forex speculation.

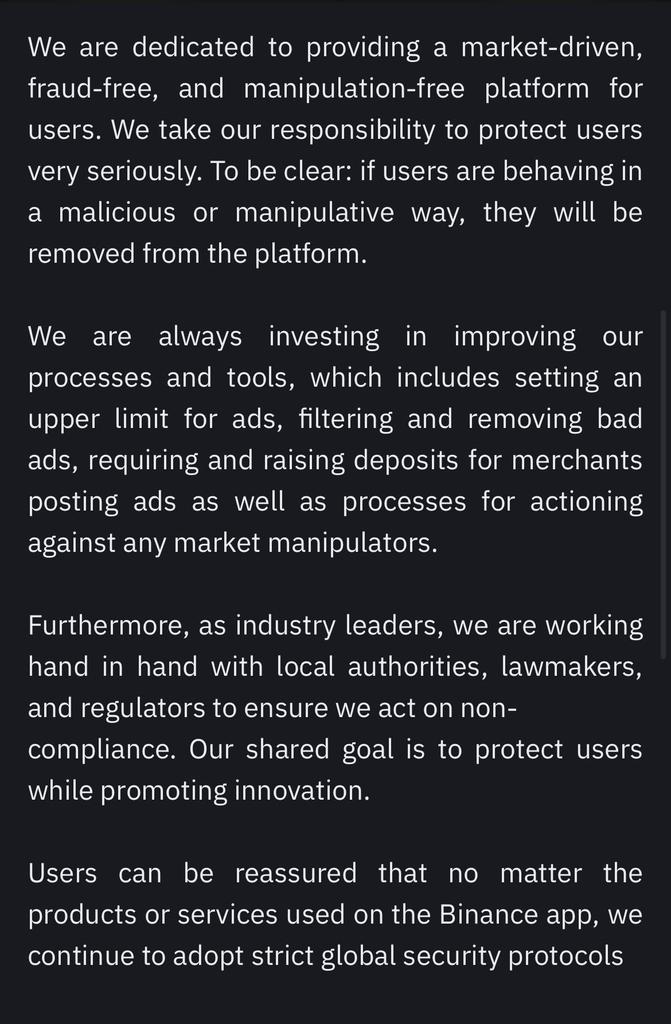

Binance, in an announcement about its “commitment to P2P users in Nigeria” on Tuesday, warned that “users behaving in a manipulative way will be removed from the platform.”

“As industry leaders, we are working hand in hand with local authorities, lawmakers, and regulators to ensure we act on non-compliance”, the statement read in part.

The crypto exchange platform further stated that it is

“setting an upper limit for ads, filtering and removing bad ads, requiring and raising deposits for merchants posting ads as well as processes for actioning against any market manipulators.”

Ideally, Binance’s P2P platform facilitates direct buying and selling of cryptocurrencies for fiat currency among users and is a free market. This implies that prices are determined by market forces like supply and demand. In a desperate move to resuscitate the naira from its free fall, the Nigerian government allegedly pressured Binance to censor a supposedly free market.

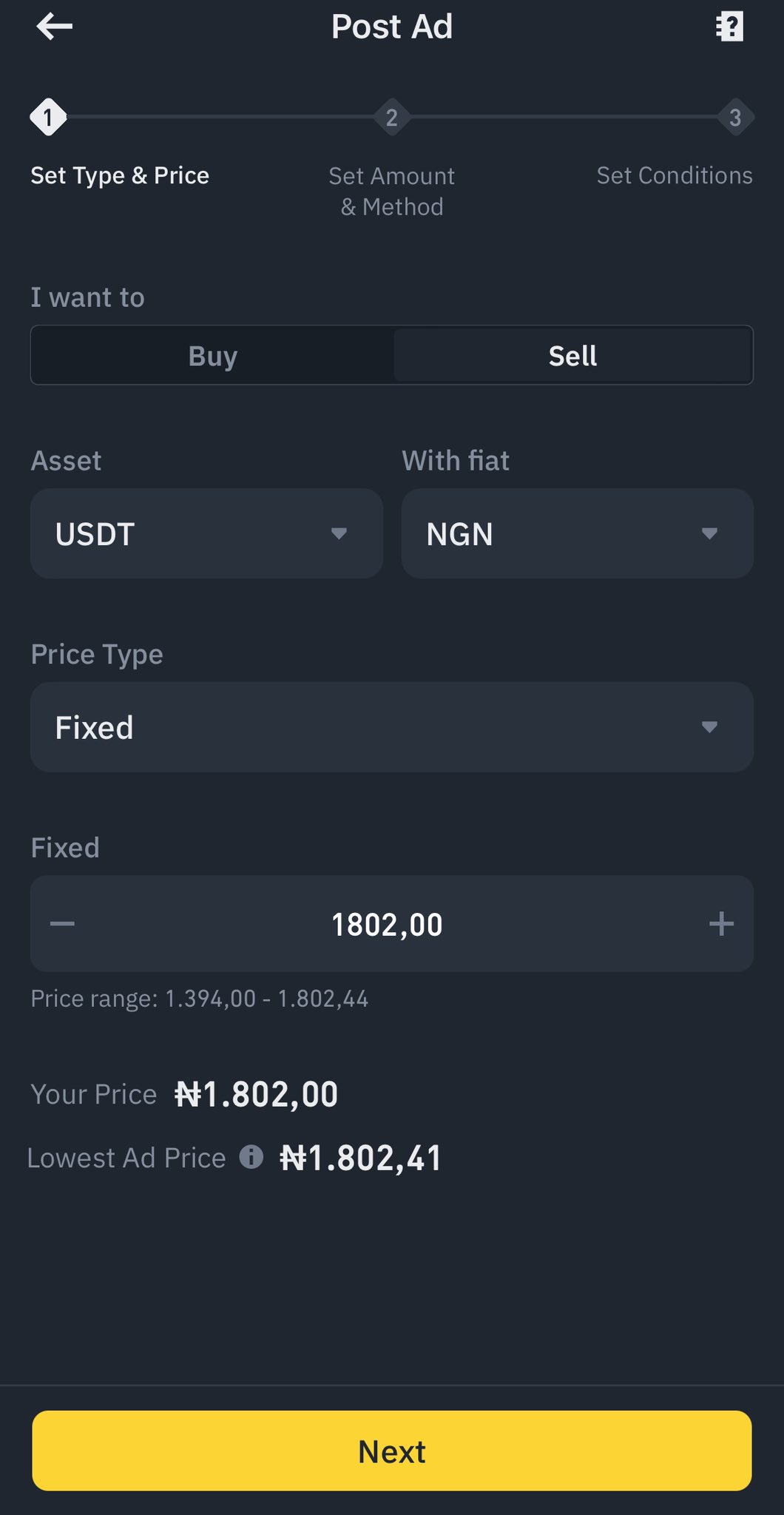

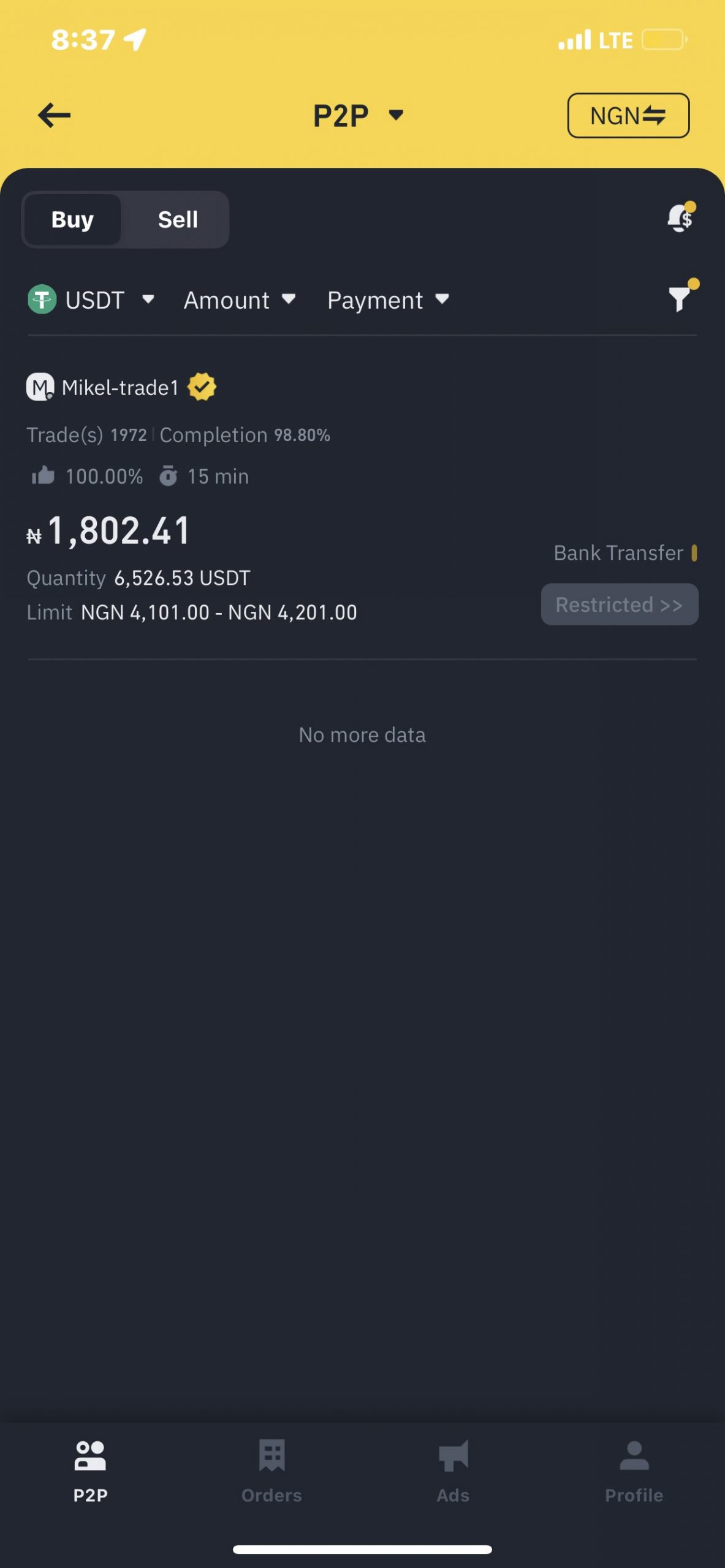

The platform placed a price cap on Tether (USDT) tokens within its peer-to-peer (P2P) platform. This restricted the selling price of USDT to 1,802 naira per unit. Users reported that Binance disabled the sell option, capped the buy option, and restricted the purchase of certain cryptocurrencies for Nigerian users.

Heated Reactions on Social Media

These recent measures evoked criticism among Nigerian Binance users, with many expressing dissatisfaction on social media. Users argued that these restrictions are counterproductive and may lead them to migrate to other platforms for dollar-naira trading.

An X user, MikaelBernard, one of the first to raise awareness on the development, said:

“The CBN, in conjunction with the NSA, EFCC, and other govt parastatals allegedly ordered Binance to set a cap on traders selling USDT.

“You can no longer sell your OWN tokens for above 1802/$. This is why nobody has been able to buy tokens today. I don’t know what they aim to achieve, but traders are now on telegram, selling at 1850/$ and above.

“If this is how they plan to save the naira, I’m sorry but it’s going to fail woefully. Binance was only a medium. If you block Binance, people will find new ways. This whole policy is absolutely ridiculous. Naira is going to zero.”

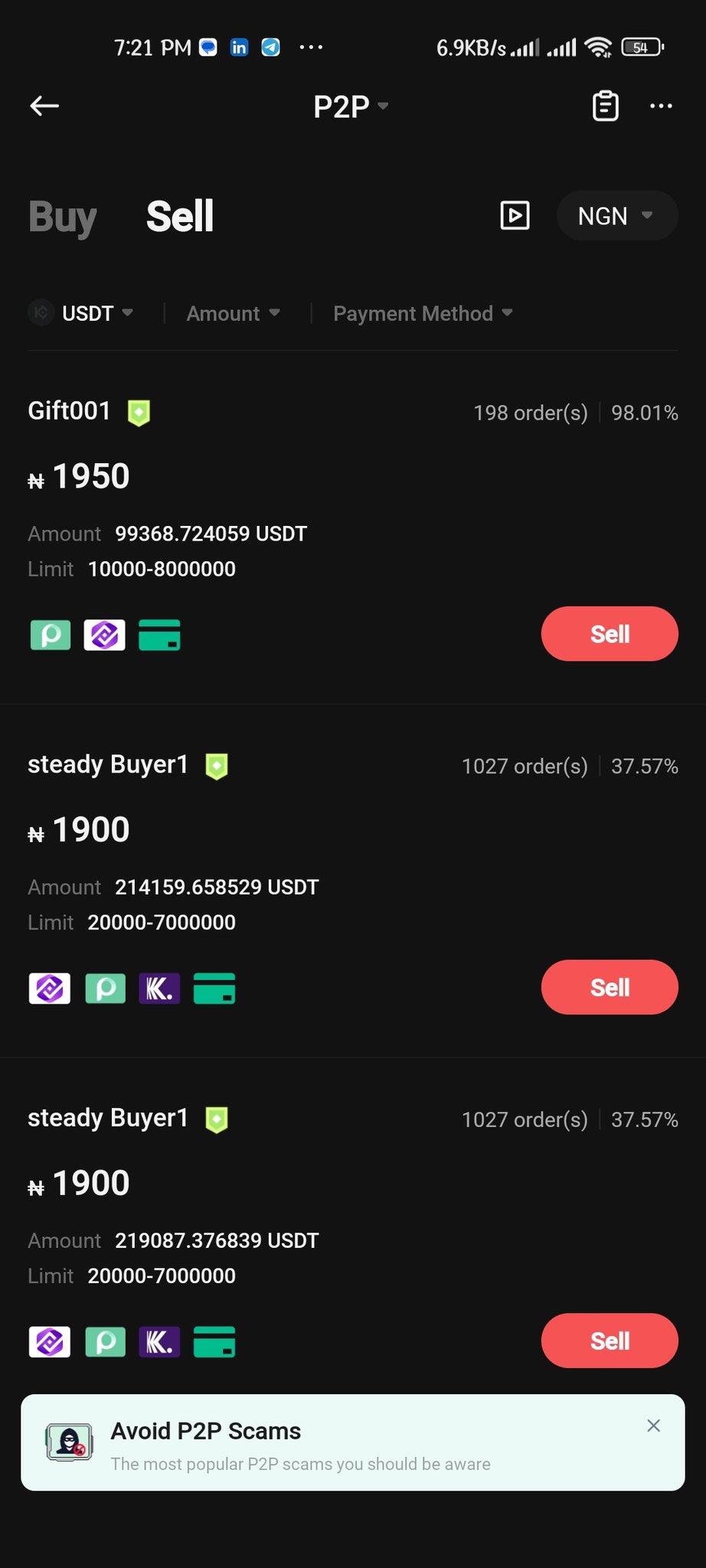

Netizens noted that in trying to control exchange rates by manipulating P2P transactions, the Nigerian government may need to act smarter than manipulating Binance. There are numerous other exchange platforms like Kucoin, Bybit, OKX, Bitget, and others, that have experienced an influx of new users in the past couple of hours.

Aftermath of Binance’s USDT Cap

The government’s alleged collaboration with Binance has only worsened the Nigerian FX situation by creating an artificial scarcity which, in turn, drove the naira close to ₦2000/USD in some exchange platforms on Tuesday.

In tersely worded sentences, many Nigerians expressed their loss of confidence in the naira, the Tinubu-led administration, and Binance.

Binance’s arbitrary collaboration with the Nigerian government may have set the platform up for doom. Nigeria is a significant player in the cryptocurrency market, with over half of its adult population engaging in monthly cryptocurrency trading, according to an earlier report by Binance.

Recent restrictions on domiciliary accounts and International Money Transfer Operations (IMTO) in Nigeria could have also significantly increased the number of Nigerians using exchange platforms to save their money or receive funds from abroad. Recall that West Africa Weekly reported that the Nigerian government banned banks and Fintechs from outbound transfers and instructed that inbound transfers be carried out in naira only.

Desperate Times and Desperate Measures

The Nigerian government’s move to unify forex windows in mid-2023 led to a substantial decline in the naira against the US dollar, doubling from approximately 700 naira/$1 to a historic high of over 1,600 naira/$1.

In July 2023, the Nigerian Securities and Exchange Commission (SEC) cautioned local investors against using Binance, citing the platform’s lack of a license to operate in the country and declaring its operations as illegal.

In August, the Association of Bureaux de Change Operators of Nigeria (ABCON) urged the government to ban Binance. The association cited concerns about Binance becoming a focal point for investors and exporters, putting pressure on the Naira- when in reality, peer-to-peer trading works. Recall also that, in 2021, President Muhammad Buhari placed a ban on cryptocurrency trading which was later lifted in December 2023 under the current administration.

The crypto ban merely increased the Nigerian crypto clientele and did nothing to strengthen the naira which is now on a dramatic decline, officially hitting a new low of ₦1800/USD on Monday.

Operation Attack Speculators

To combat forex speculation and stabilise the Nigerian economy, the Economic Financial Crimes Commission (EFCC) raided perceived currency speculators at a popular Abuja Bureau De Change hub on Monday. Locals report that the EFCC officials shot in the air to instil fear.

The following day, the National Security Adviser, Nuhu Ribadu, directed law enforcement agencies to take firm measures against anyone engaged in foreign exchange market speculation.

In a related development, the Office of the National Security Adviser (ONSA) and the Central Bank of Nigeria (CBN) formed an alliance to combat forex speculation and tackle the issues affecting the country’s economic stability.

The partnership also involved coordination with key law enforcement agencies such as the Nigeria Police Force, the Economic and Financial Crimes Commission (EFCC), the Nigeria Customs Service, and the Nigeria Financial Intelligence Unit.

Zakari Mijinyawa, Head of Strategic Communication at the ONSA, highlighted that the activities of speculators — operating both domestically and internationally through different means — have played a significant role in the naira’s depreciation, exacerbating inflation and leading to economic instability in Nigeria.

Might the loathsome restriction on Nigerian Binance users, indeed, be connected to the ONSA/CBN alliance then?

About The Author

Related Articles

Malian Army Says Dozens of Militants Killed in Airstrikes in Segou Region

Mali’s armed forces say they have killed about twenty suspected militants during...

ByWest Africa WeeklyFebruary 19, 2026Nigeria Approves 33 New Universities While Education Quality and Jobs Remain in Crisis

Nigeria has approved 33 new universities, bringing the total number of sanctioned...

ByWest Africa WeeklyFebruary 19, 2026Gabon Suspends Social Media “Until Further Notice” Amid Rising Unrest

Gabon’s media regulator has announced the suspension of social media platforms nationwide,...

ByWest Africa WeeklyFebruary 18, 2026Côte d’Ivoire Feeds the World’s Chocolate Industry, But When Prices Shift, Cocoa Farmers Are Left With Rotting Harvests and No Income

Côte d’Ivoire produces nearly half of the world’s cocoa, a crop that...

ByWest Africa WeeklyFebruary 18, 2026

Leave a comment