Former Governor of Ogun State, Olusegun Osoba, has advocated for the taxation of mansion owners in states across the country, specifically mentioning Ogun state and South Eastern States as examples, as a means to bolster internally generated revenue (IGR).

Speaking during an interview on Arise TV, Osoba highlighted the necessity for the state government to explore avenues for revenue generation, especially from affluent property owners.

Osoba emphasized the need for a more proactive approach by the government in collecting tenement rates, citing his own experience as an elite and former governor. He revealed that despite his willingness to pay rates, he often had to inquire about his obligations, indicating a lack of streamlined systems for rate collection.

Drawing a parallel to his experience in London, where he pays council tax for his property, Osoba suggested that similar measures could be implemented in Ogun State and states across the country.

“There are many ways state government can make money, all those of us building mansions. In Southeast mansions, in many parts of the country they should be made to pay ternament rates and everything.

He urged the state governments to consider imposing taxes on mansion owners across the state, pointing out that such measures have been successfully implemented in other regions of Nigeria.

He commended the current administration led by Governor Dapo Abiodun for efforts to computerize the system, envisioning a comprehensive database of landlords to facilitate efficient revenue collection.

Osoba reiterated the potential for the state government to augment its finances significantly by tapping into various avenues, particularly targeting affluent property owners. He urged swift action from the government, emphasizing that taxation on mansion owners could serve as a substantial source of revenue for the state.

Read: Terrorism: BokoHaram Hits Chibok Communities, 11 Dead 1 Abducted

About The Author

Related Articles

The AFCON Final in Morocco and the Controversies That Followed

The Africa Cup of Nations final between hosts Morocco and Senegal ended...

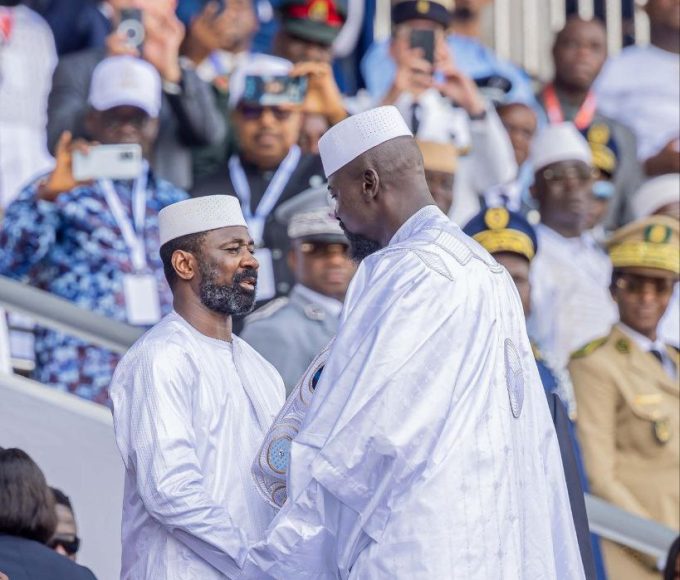

ByWest Africa WeeklyJanuary 20, 2026Mali’s Transition Leader Attends Swearing-In of Guinea’s President Mamadi Doumbouya

Mali’s President of the Transition, General Assimi Goïta, represented the country in...

ByWest Africa WeeklyJanuary 19, 2026Malian Army Conducts Successful Surveillance Operation in Mopti Region

The Malian Armed Forces have carried out a successful territorial surveillance operation...

ByWest Africa WeeklyJanuary 19, 2026Niger’s Security Forces Record Major Gains Against Armed Groups

Niger’s Defence and Security Forces have reported significant results following a week...

ByWest Africa WeeklyJanuary 19, 2026