Amid Inflation, CBN Increases Interest Rate To 26.25% For The Third Time In 2024

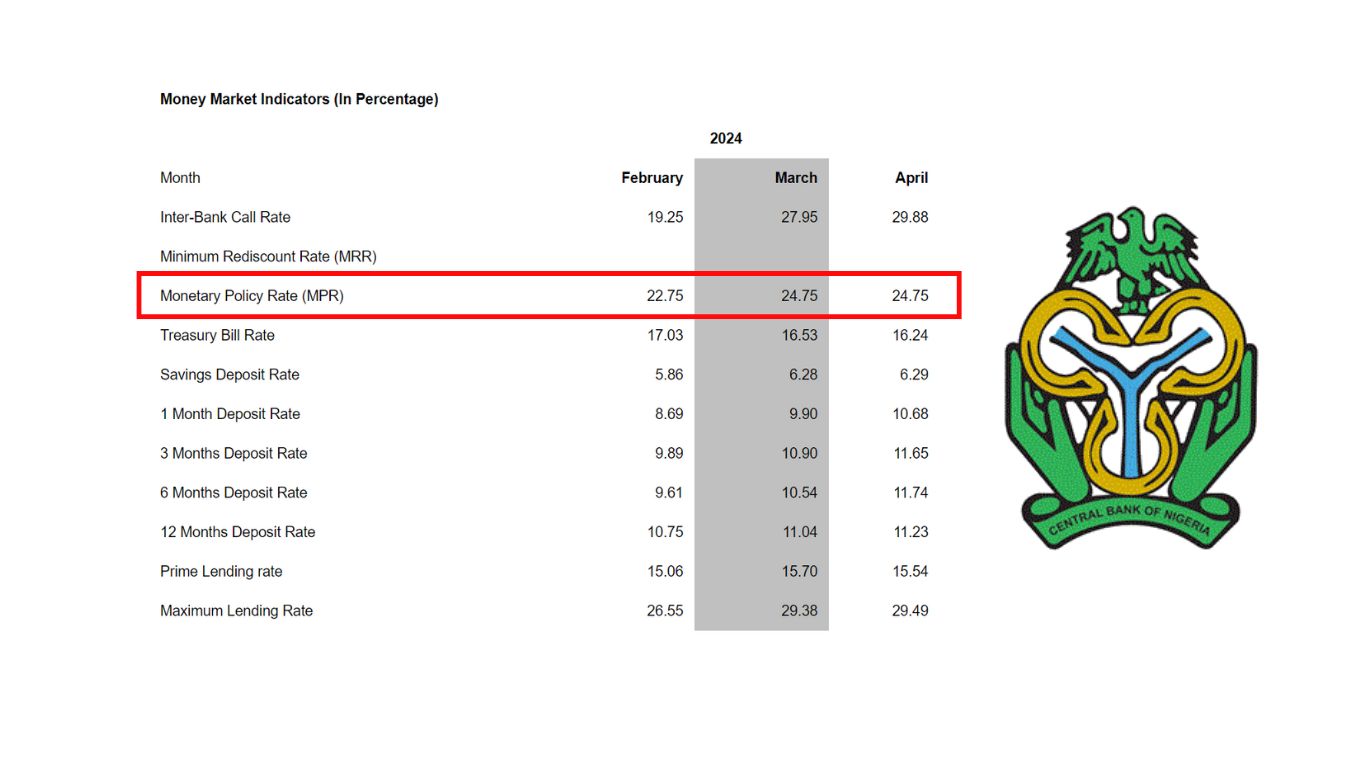

The Central Bank of Nigeria (CBN) has increased its interest rate by 150 basis points (bps) from 24.75 per cent to 26.25 per cent to combat inflation, which is currently at 33.69 per cent.

This was disclosed following a two-day meeting in Abuja, during which the apex banks’ Monetary Policy Committee (MPC) approved increasing the Monetary Policy Rate (MPR) for the third time in 2024.

“The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) held its 295th meeting on the 20th and 21st of May 2024 to review recent economic and financial developments and assess risks to the outlook,” the CBN Governor Yemi Cardoso said on Tuesday.

Also, in an announcement on CBN’s official handle on X (formerly Twitter), the MPC, which Cardoso also Chairs, disclosed its decision to raise the MPR by 150 basis points to 26.25 per cent from 24.75 per cent.

Cardoso also maintained that the Cash Reserve Ratio (CRR) of Deposits Money Banks (DMBS) was retained at 45 per cent, which, according to him, “allowed the MPC to put the Asymmetric Corridor around the MPR at +100 and -300 basis points,” while retaining the liquidity ratio at 30 per cent.

The key focus of the MPC meeting was to achieve price stability by using tools available to rein in inflation,” he expressed.

During the meeting, Cardoso admitted that the cause of inflation in Nigeria is food inflation, which is relatively caused by insecurities that hinder production and means of transportation, among other things.

However, after reviewing the economic and financial status of the country, Cardoso and the MPC decided, with risk assessment, to increase the interest rate from 22.75 in February to 26.75 per cent in May.

About The Author

Mayowa Durosinmi

author

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Mayowa Durosinmi

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Related Articles

Tinubu Deducts N100bn Monthly From Federation Account Without Approval El-Rufai Alleges Says Action Deserves Impeachment

Former Kaduna State Governor Nasir El-Rufai has launched a blistering attack on...

ByWest Africa WeeklyJanuary 26, 2026After Taiwo Oyedele’s Denials, Lagos State Activates ‘Power of Substitution’ Under Tinubu-Altered Tax Law, Allowing Authorities to Redirect Payments Without Court Orders

Lagos State has moved to activate a controversial enforcement provision in the...

ByWest Africa WeeklyJanuary 26, 2026Ivory Coast to Buy Unsold Cocoa to Support Farmers

Ivory Coast has announced a government plan to purchase unsold cocoa stock...

ByWest Africa WeeklyJanuary 23, 2026Ghana Moves to Reclaim Kwame Nkrumah’s Former Residence in Guinea

Ghana has embarked on a diplomatic and cultural initiative to reclaim the...

ByWest Africa WeeklyJanuary 23, 2026