5% Fuel Tax: Tinubu’s Administration Keeps Inventing New Ways to Punish Nigerians

A new fuel surcharge under the 2025 Nigeria Tax Administration Act (NTAA) could push petrol and diesel prices even higher next year, adding to the strain of the 2023 subsidy removal.

Starting January 2026, Nigerians are expected to face another increase in fuel prices following the introduction of a 5 per cent surcharge on petrol, diesel, and other fossil fuels, as stipulated in the newly signed Nigeria Tax Administration Act (NTAA) 2025.

Signed into law by President Bola Tinubu on June 26, 2025, the NTAA forms part of a broader fiscal overhaul that includes the Nigeria Tax Act (NTA), Nigeria Revenue Service Act (NRSA), and Joint Revenue Board Act (JRBA). These laws aim to boost government revenues and promote the transition to cleaner energy sources, but the 5 per cent tax could further inflate already high fuel prices and increase the cost of living.

Currently, Nigerians pay between ₦890 and ₦1,000 per litre of petrol following the fuel subsidy removal in 2023. The new surcharge will be applied on top of existing pump prices, meaning consumers could pay an additional ₦42.50 per litre, according to estimates by Billy Gillis-Harry, President of the Petroleum Products Retail Outlet Owners Association of Nigeria (PETROAN).

Gillis-Harry, quoted by the DailyTrust, described the tax as “sudden” and “costly,” warning that marketers will likely pass the burden directly to consumers. He urged the government to consider instead taxing imported fuel and using the proceeds to support domestic refining, such as at the Dangote Refinery.

The economic impact could be substantial. In 2024, Nigeria consumed approximately 18.75 billion litres of petrol, valued at about ₦15.93 trillion (based on an average of ₦850/litre), according to the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA).

A 5 per cent surcharge on this volume would generate roughly ₦796.5 billion in new revenue, with even more expected from diesel and aviation fuel.

The surcharge will be collected monthly by the Federal Inland Revenue Service (FIRS), which is set to be renamed the Nigeria Revenue Service (NRS). Minister of Finance Wale Edun approved the tax.

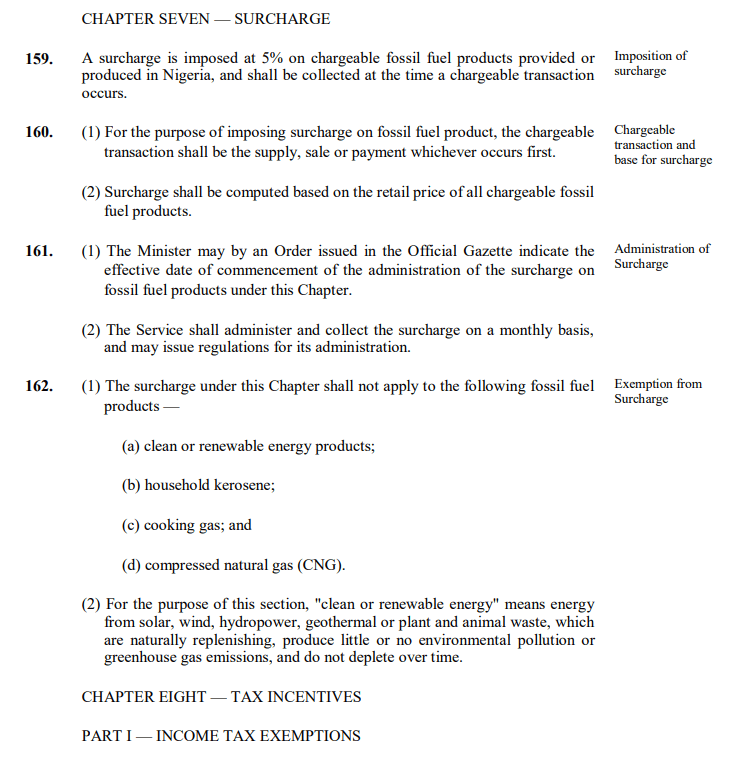

However, several essential fuels and clean energy sources are exempt from the new tax, including:

Cooking gas (LPG), Household kerosene, Compressed Natural Gas (CNG), Solar, wind, and hydropower, Geothermal energy, Biofuels from plant or animal waste.

With inflation already high, many Nigerians fear the tax will drive transportation, food, and electricity costs even higher, exacerbating the economic hardship triggered by earlier reforms.

The 5 per cent fuel tax may also raise questions about the government’s commitment to easing the cost-of-living crisis while promoting clean energy. For many, the measure feels more like a revenue grab than a genuine climate policy.

Read More:

- Ghana’s Minister of Defence, Environment, 6 Others Confirmed Dead In Military Helicopter Crash

- Kano Transport Commissioner Ibrahim Namadi Resigns Following Probe Into Surety Role For Suspected Drug Baron

About The Author

Mayowa Durosinmi

author

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Mayowa Durosinmi

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

%s Comment

Leave a Reply Cancel reply

Related Articles

Tinubu Follows Gumi’s Lead as Nigeria Signs Turkey Defence Deal, Fueling Speculation Over Who Really Controls the Country’s Security Policy

Nigeria’s diplomatic and security strategy is once again under scrutiny after a...

ByWest Africa WeeklyJanuary 28, 2026Burkina Faso President Ibrahim Traoré Reviews 2025 Achievements, Sets Ambitious Agenda for 2026

Burkina Faso’s President, Ibrahim Traoré, has described 2025 as a year of...

ByWest Africa WeeklyJanuary 28, 2026Mali Says Reports of New Three-State Sahel Currency Are False but Talks Continue on Economic Integration

Mali’s government has rejected claims that it and its neighbours, Burkina Faso...

ByWest Africa WeeklyJanuary 28, 2026CBN Upgrades Opay, Moniepoint, Kuda and Others to National Licences

The Central Bank of Nigeria has upgraded the operating licences of several...

ByWest Africa WeeklyJanuary 28, 2026

Tinubu sure knows how to make Nigerians suffer. He deserves a second term.