Suicide, Fraud and Phillips Consulting: The Story Of West Africa’s Chinese Loan Shark Mafia

One early morning in January 2022, my phone lit up with a familiar caller ID. My good friend Kenneth Bardi was not a regular caller, but we had a great relationship from our time as colleagues on The Other News at Channels Television. Life had taken us on different paths since we last saw each other in 2019, and I was curious to know – what was he up to these days? How was the wife? Any big news? Travel plans? Another baby? A career move?

He didn’t seem to hear any of my excited questions.

“Hello David, I need to talk to you,” he said in the unmistakable heavy voice of a man with something on his mind. “Do you have a few minutes?”

“Uh…OK sure. I’m listening.”

“Have you heard of an app called Sokoloan?”

“Um…yeah I think I’ve seen people talk about it on Twitter. It’s one of those loan app things that send terrible messages to your contacts if you take out a loan and default isn’t it?”

“Yes.”

“Don’t tell me…?”

“Yes. It’s a long story.”

Over the next 5 minutes, I heard a story that hit me like a punch to the kidney. Kenneth you see, is a TV producer and showrunner who has worked with Channels Television, OSMI, Multichoice and many other frontline Nigerian broadcast organisations. His productions credits include The Other News, Star Football Super Fans and OSMI’s 2014 FIFA World Cup broadcast, where he worked on-site in Brazil. By every Nigerian standard, he is a successful middle class professional and not at all who one would expect to be in the introduction of a story like this, but life had happened in unexpected ways.

Shortly after his wife gave birth, complications relating to her delivery led to a hefty hospital bill. Despite the fact that he was busy with 2 concurrent productions for a media organisation that was not hurting for cash, he was being owed over 3 months worth of wages. Hard up and unwilling to put his wife and newborn through another ordeal after what they had already been through, he turned to what seemed like the only readily available option – a short term, high-interest loan from a loan app he found on the Google Play store called Sokoloan.

Like many others before him, he soon came to realise that the seemingly quick and available unsecured loan was not a useful financial instrument, but a trap. Having solved the problem at hand with the initial loan, he found himself taking out another loan shortly after repaying the first one, and then another and so on. This is a cycle that is sickeningly familiar to anyone that has struggled with payday loan debt.

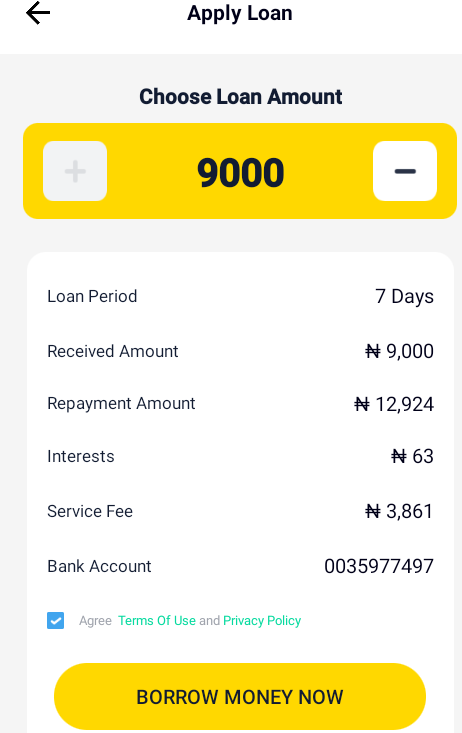

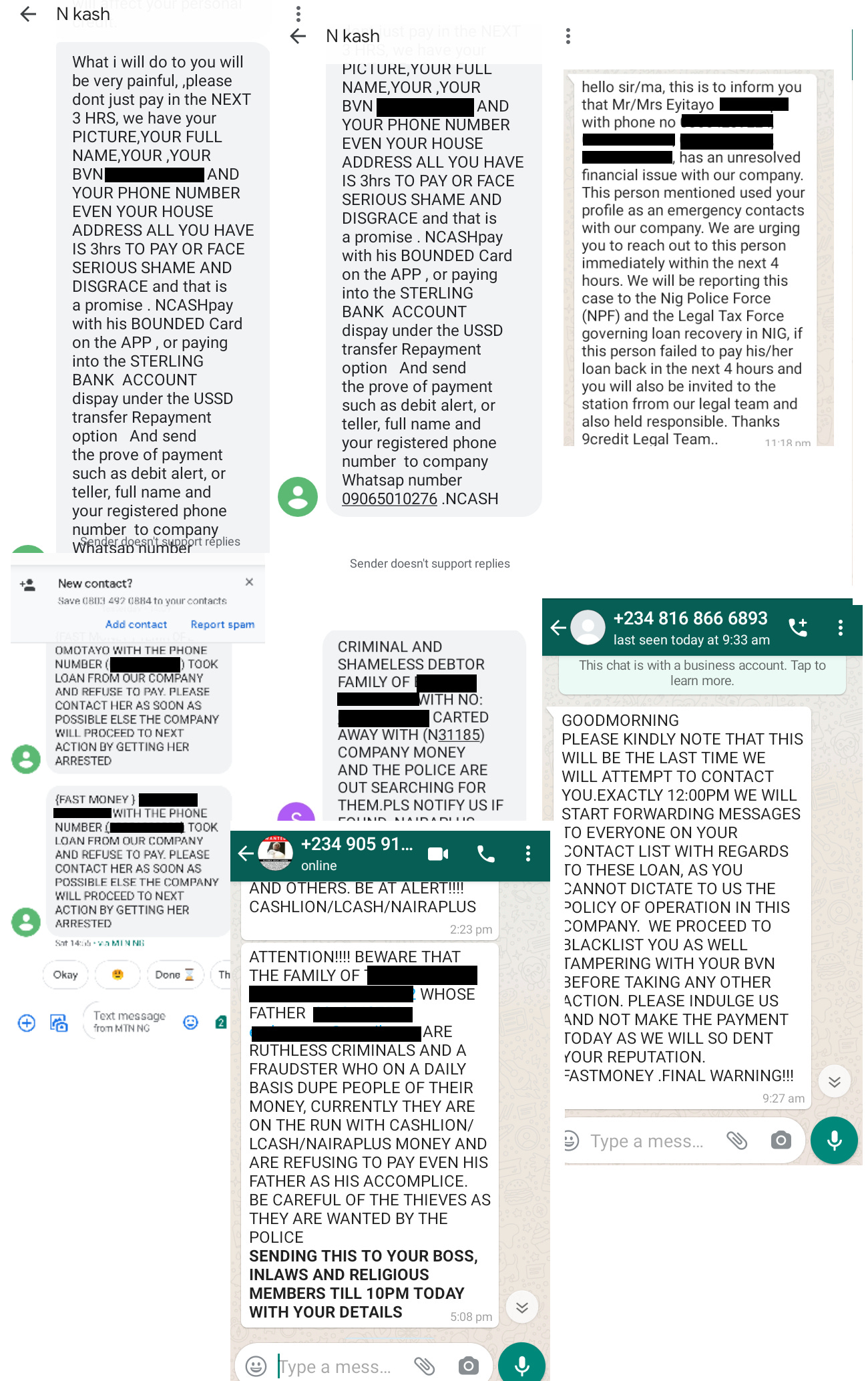

A subsequent N50,000 loan rapidly ballooned into more N120,000 when he missed the payment deadline and had to roll it over. While trying to help out, his wife also got sucked into the same trap and soon the young couple found themselves owing hundreds of thousands of naira to Sokoloan and other loan apps. In August 2021, having missed another Sokoloan payment date, Kenneth’s wife woke up one morning to see her phone flooded with messages from acquaintances, friends and family. Apparently, they had all received a message about her like the one below.

Kenneth’s voice began to break as he recounted what happened next. Unable to come to terms with this scale of humiliation, his wife attempted to kill herself that afternoon. A few weeks later, Sokoloan repeated the trick and she attempted suicide again, this time coming very close to succeeding. Still the messages kept coming for months afterward and he saw his wife fall into a long-term depressive state. Not even the eventual clearing of their loan balance in January was enough to fix the damage that had been done.

“I just want you to help me tell my story,” he said, audibly fighting back the tears.

“I just want you to help me tell my story.”

Chinese Loan Sharks: A Quick Primer

Across South Asia and much of Africa, a perfect storm of weak regulation, growing populations and lack of easy access to consumer credit is fueling the international expansion of a loan shark cartel with origins in China. There are many theories about where exactly this cartel comes from, and whether it can indeed be called a cartel. Some theories link these loan sharks to the Chinese Triads. Others link them to Chinese banks. Some even consider loan sharking to be an inevitable by-product of China’s age-old private lending culture.

The only thing that seems to be agreed on across board is that the Chinese loan sharks currently tearing a trail of tears through large swathes of the Global South have their origins in China’s Hong Kong Special Administrative Region. The city’s flagship daily newspaper, the South China Morning Post regularly covers stories about loan sharks that would raise eyebrows almost anywhere else. In Hong Kong? It’s just Tuesday.

Stories like Kenneth’s have long been widespread in countries like Indonesia, Sri Lanka, the Philippines, India and Bangladesh, but they are now starting to become commonplace across Africa. Driven in part by the promise offered by a financially underserved, credit-hungry population across much of the continent and a state crackdown on loan sharks at home, China’s money lenders have launched a full-pronged assault on the world’s last remaining frontier continent.

According to Chinese government figures, over 41,000 arrests on suspicion of loan sharking have been made since it started a crackdown on the practise in 2019. In a single raid on a loan shark syndicate in the city of Lanzhou where 253 suspects were arrested, the gang was discovered to have over 1,300 illegal loan apps and websites under its control. With these digital platforms, it had issued illegal high-interest loans to over 390,000 people.

While the Chinese government is cracking down on illegal lenders, it is a different story on the African continent. In Nigeria for example, despite central bank regulation expressly forbidding issuance of consumer credit by any unlicensed entity, there continues to be evidence of a vast compliance gap by regulators, banks, payment processors and other stakeholders in the value chain that loan sharks exploit.

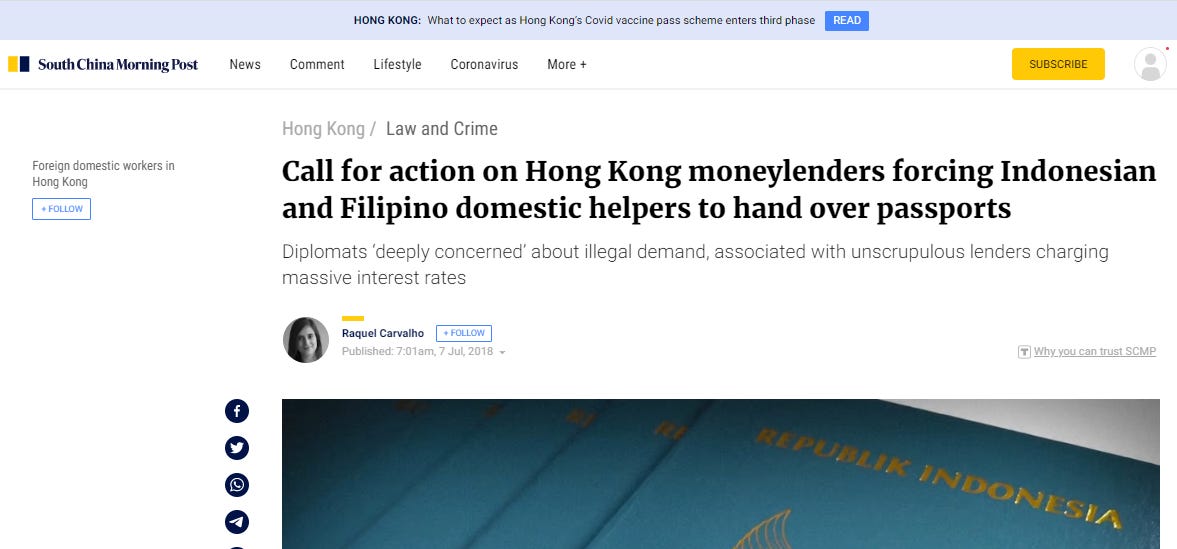

As a small example of this, I used a simple keyword search on Twitter to find evidence of consumers making loan repayments to one of these openly illegal and unlicensed loan sharks via a regulated financial institution. I found this almost instantly:

@SokoLoan Attention, I'm a client with ID number: 8054219120 (Simon Peter Koffi). I made this part loan repayment to soko Lending company with Zenith Bank. Uptil now this payment has not been acknowledged. See attached and resolved it pic.twitter.com/tHmvXgYtKX

— SIMP KOFFI (@koffi890) August 7, 2020

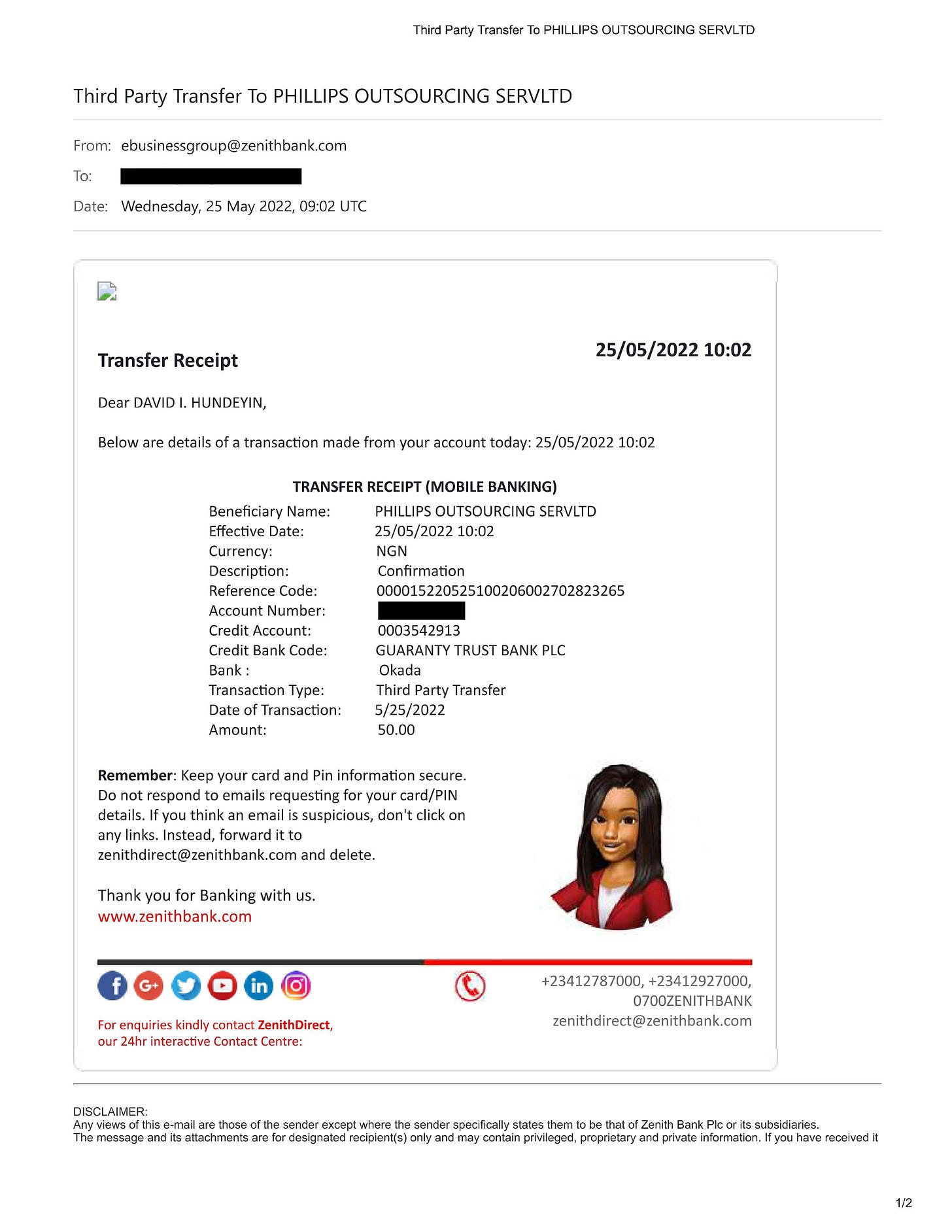

To be sure, I carried out a transaction of my own using the quoted account details to confirm whether this account – registered to a known illegal loan shark for at least 2 years – still exists and is operational. And sure enough:

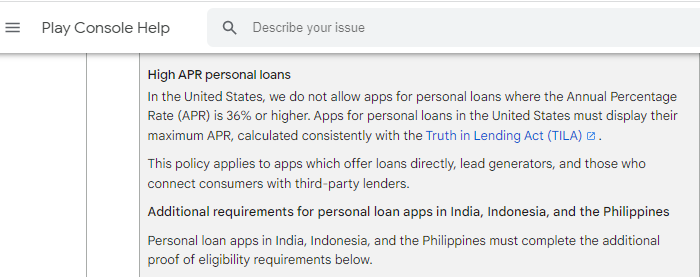

What further worsens the lack of regulatory compliance is that consumer gatekeepers like Google do not apply uniform consumer protection standards to all consumers. According to Google’s Play Store policy, loan apps with annual interest rates above 36 percent are not allowed in the US. India, Indonesia and the Philippines have standalone compliance frameworks, which are a direct response to Chinese loan apps.

Nigeria and the rest of Africa have no such frameworks. This effectively means that to all intents and purposes on the Google Play Store, anything goes in African jurisdictions. Take the following screenshot from an app called Nairaplus, showing its loan interest rate calculator. A 7-day loan on this app has an effective interest rate of 43.6 percent. Its annualised interest rate comes to a staggering 2,273 percent.

Until very recently, this app was still available on the Google Play Store. Just by virtue of being in a weakly regulated geographical jurisdiction, African consumers thus get exposed to predatory loan apps offering loans at 63 times the interest rate allowed in the USA. Even worse, Google Play lists these apps even in African jurisdictions where they are prohibited by law, such as in Lagos State where APR for unsecured consumer credit is legally capped at 48 percent. Why Google allows such apps to be listed at all on the Play Store remains unclear. I put this question to Google’s press team, and at press time there was no response.

Ibrahim and Kehinde: Two Whistleblowers Emerge

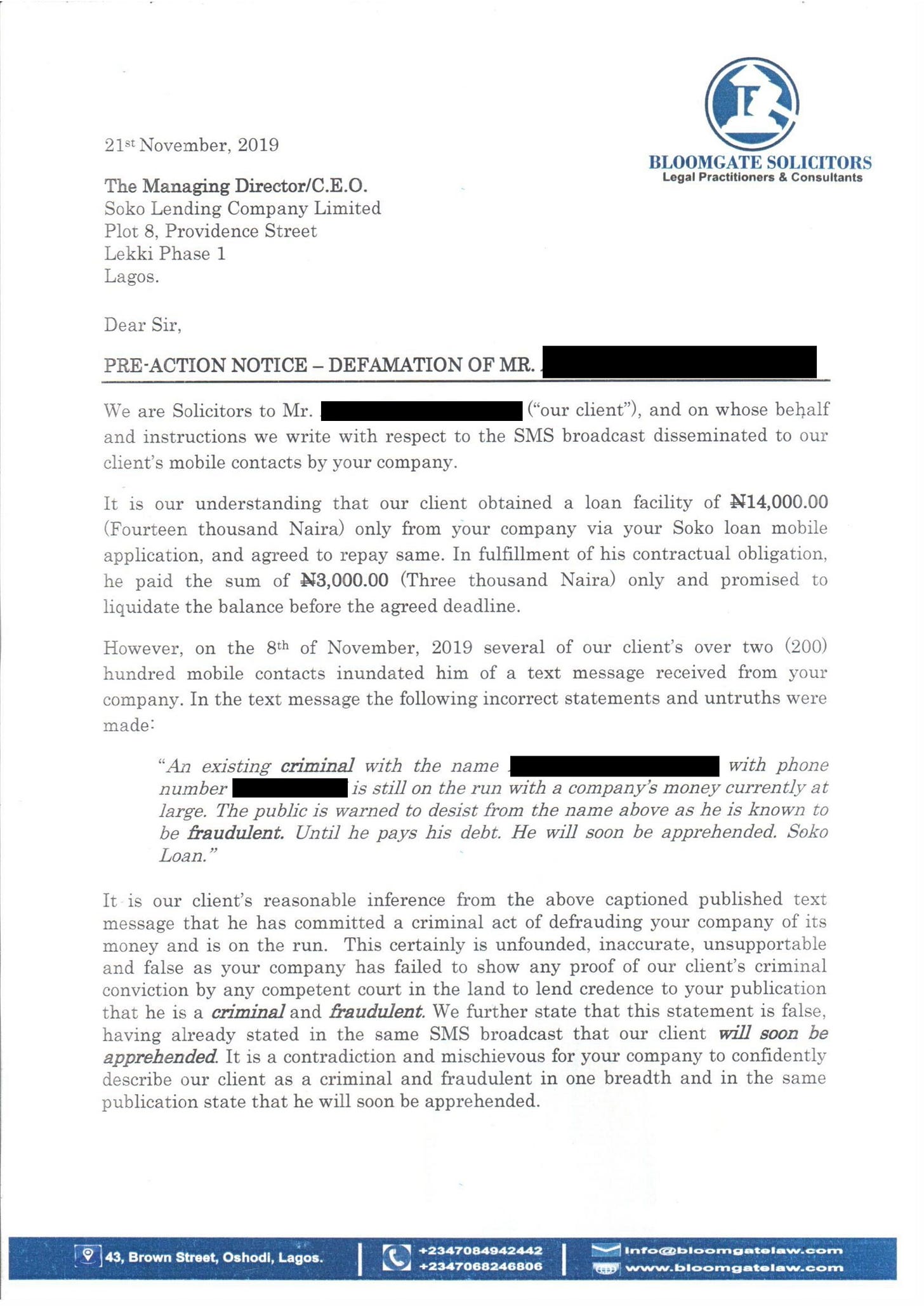

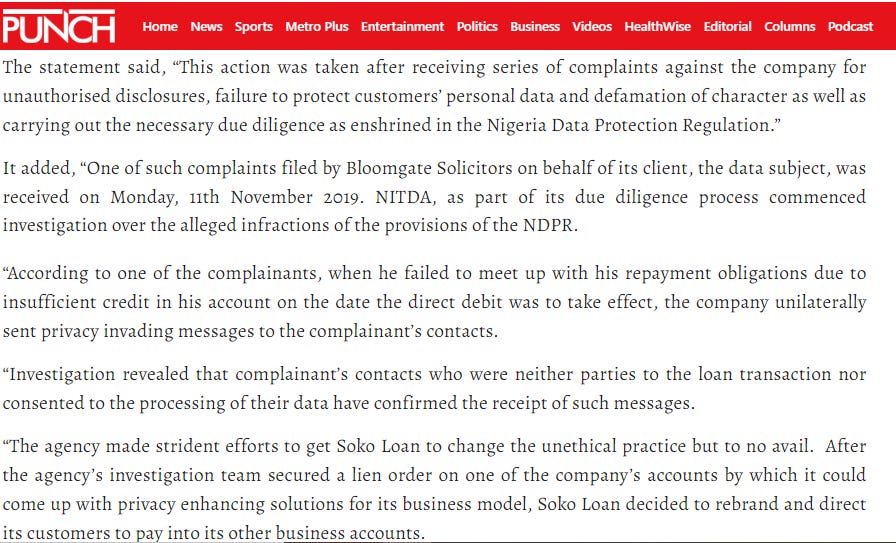

Realising that he was dealing with a ghost entity that somehow had full access to Nigeria’s regulated financial system without being regulated itself, Sesi wrote a petition to the National Information Technology Development Agency (NITDA), detailing Soko Lending Company’s actions as a gross violation of the Nigeria Data Protection Regulation (NDPR) of January 2019.

In August 2021, following nearly 2 years of what it termed “due diligence and investigation,” NITDA announced a record N10M fine against Sokoloan, an amount that is the largest fine ever imposed in Africa for a breach of consumer data privacy. Incredibly, the announcement revealed that Sokoloan carried out a corporate rebrand and changed its payment account details to circumvent a lien imposed on its account by NITDA.

Despite Sesi’s best efforts however, a N10M fine – if it was ever paid – was only ever going to be a tap on the wrist and a drop in the bucket for Sokoloan. Not even a March 2022 raid on the company’s Opebi office by the Federal Competition and Consumer Protection Commission (FCCPC) was enough to stop its operations. Sokoloan simply regrouped and carried on its illegal operations without skipping a beat. Why do we know this? Enter Kehinde [name has been changed], the first of two star whistleblowers in this story.

Despite Sesi’s best efforts however, a N10M fine – if it was ever paid – was only ever going to be a tap on the wrist and a drop in the bucket for Sokoloan. Not even a March 2022 raid on the company’s Opebi office by the Federal Competition and Consumer Protection Commission (FCCPC) was enough to stop its operations. Sokoloan simply regrouped and carried on its illegal operations without skipping a beat. Why do we know this? Enter Kehinde [name has been changed], the first of two star whistleblowers in this story.Using the anonymous contact form on the website displayed on my Twitter bio, he reached out with a juicy proposition:

“I worked full time with Sokoloan. Presently there is no office address as we have been working from home since the raid by the FCCPC. I can give you all the information you need.”

Ibrahim [name has also been changed], the second whistleblower, went straight to the point with his message, which had a clear motivation:

“Good day sir. I’ve been able to gather some information about some of these loan apps especially Sokoloan. My friend in Osun took a loan from them to sort his medical bills and they came at him with full force till he committed suicide.”

Working with these 2 clearly motivated gentlemen, I was able to piece together a basic organogram of this shadowy entity called Soko Lending Company, and figure out not just who the Chinese masquerades are behind it, but also who its local collaborators are and what other illegal loan apps it runs under the same umbrella. The findings went as follows:

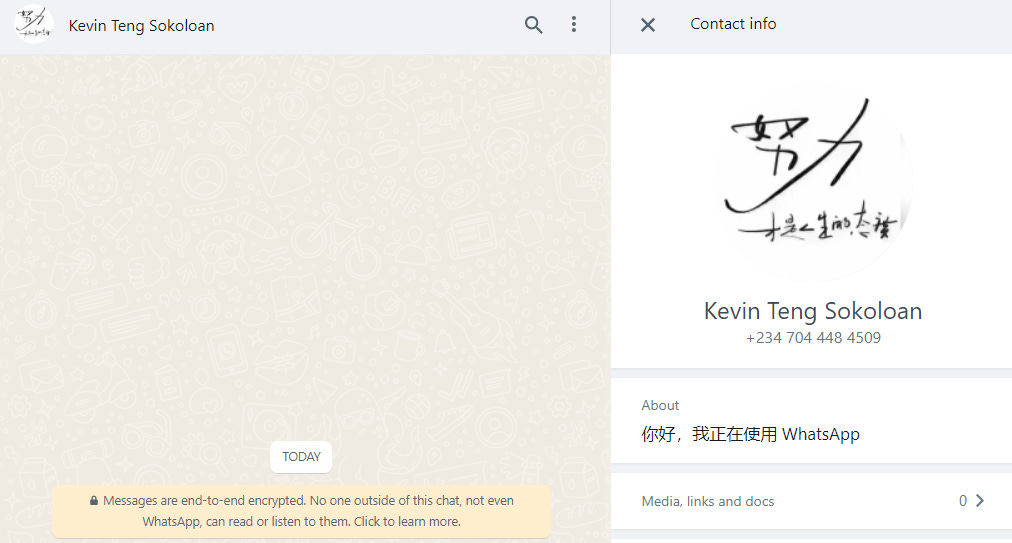

First there is the Chinese CEO, Kevin Teng, who has no known photographs on the internet and appears to have zero web footprint. All he seems to have in the public domain is a WhatsApp profile photo which reads in Cantonese, “Hard work and effort is the right attitude to life.” When read in the context of an illegal loan shark boss whose operation regularly kills people and destroys lives, one might view this as a dark joke in the mold of “Arbeit Macht Frei.” Or that might be reading too much into a few Cantonese characters on a WhatsApp profile photo.

I digress.

There is the company’s General Manager, Nzubechukwu Emmanuel who also appears to be an internet ghost with neither footprint nor photograph. Fortunately the others aren’t so stingy with their online presence.

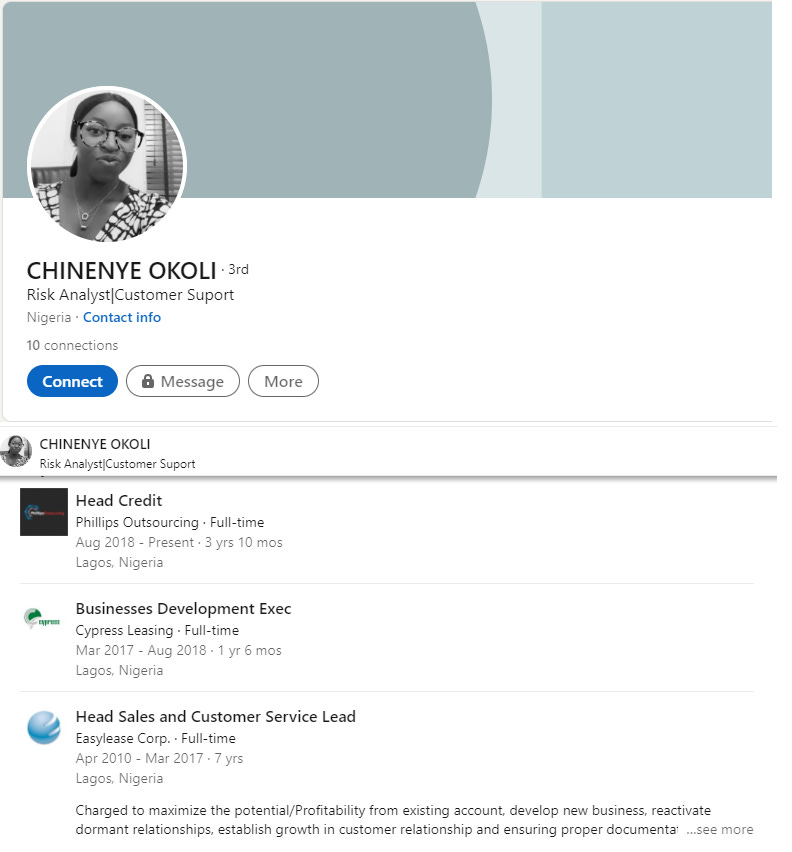

Chinenye Okoli for example, who Kehinde named as Deputy Director in charge of all Soko Lending Company Brands, has a rather interesting LinkedIn page with a surprising corporate entity all over it. More on that later.

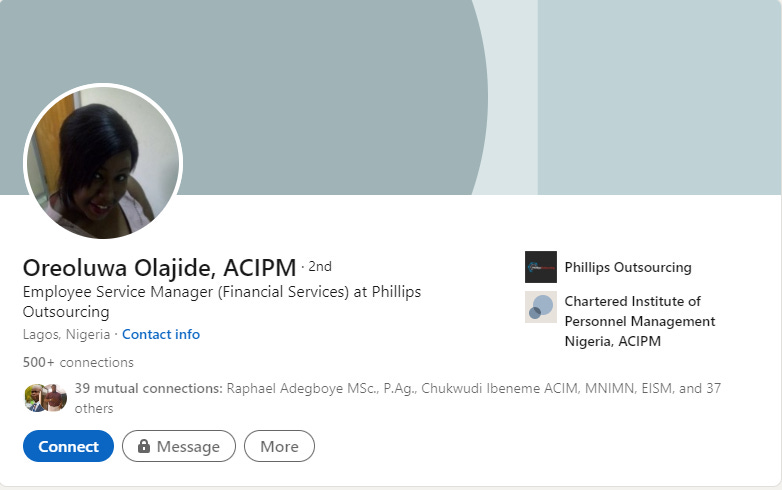

There is also Oreoluwa Olajide, whom both Ibrahim and Kehinde identified as the HR head honcho, responsible for onboarding, offboarding and payroll for all Soko Lending Company brands and their staff. Again more on the corporate entity that keeps showing up on these LinkedIn profiles later.

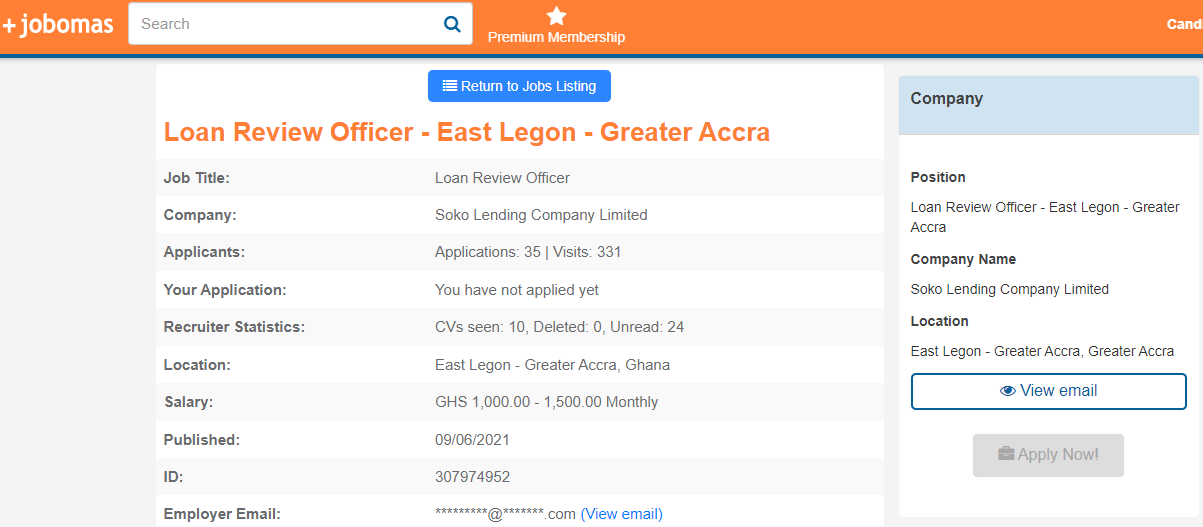

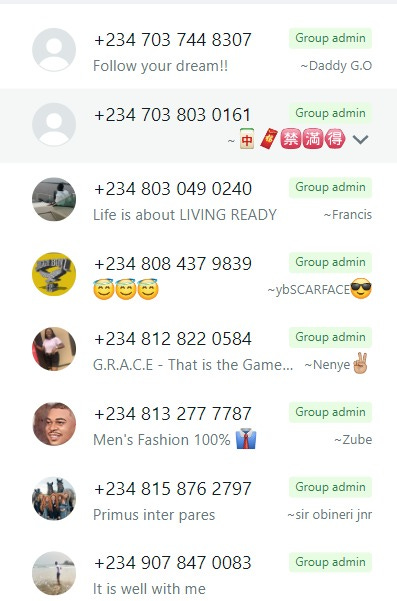

Next up is Isaac Adebisi, who heads a Soko Lending Company sub-brand called Fast Loans, and also doubles as an Acting Manager according to his LinkedIn profile. A certain “Francis” was named by both whistleblowers as the de-facto Head of Operations who recruited most of the current management team. Kehinde informed me that Francis was dispatched to Ghana in 2021 to build the Sokoloan brand there. A little research shows that Soko Lending Company has indeed been recruiting collection agents in Accra, Ghana. It is of course, unregistered in Ghana because regulatory rules in the Sokoloan world, are simply suggestions.

Next, I got my hands on the admin list of a WhatsApp group for Soko Lending Company collection agents. It is in this group, I was informed, that templates and formats for threatening messages and blackmail are brainstormed and shared. If you have ever seen a message from a Soko Lending Company app like one of these below, it likely came out of this group.

The admins in this group, Kehinde said, are directly responsible for authorising and encouraging downlines to send out these messages, especially when the day’s collections targets have not been met. Explaining how this works he said:

“Every agent sends out those defamatory messages to their clients at their own discretion, but the go-ahead is always given by the manager or team lead especially when payment count is low for the day.”

I reached out to every individual and organisation named above for their comment. Unsurprisingly they all declined.

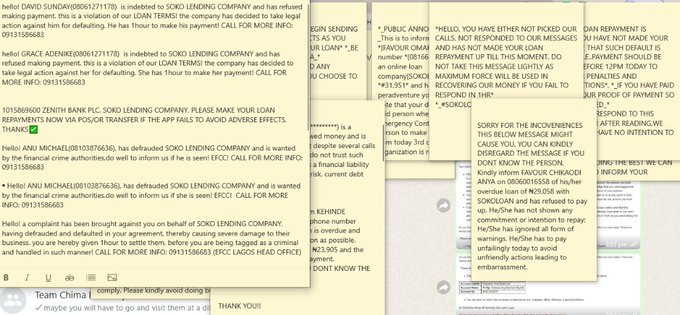

Ibrahim meanwhile, obtained secret internal memos from Sokoloan showing the sheer plethora and variety of blackmail and strong-arm tactics the company employs to force users to pay up. What you can see below is a Sokoloan agent’s computer desktop filled with Sticky Notes. Each of the notes has different types of messages on it, ranging in severity from emotional blackmail to threats to outright lies. This, he was eager to stress, was not a bug but a central feature of how Soko Lending Company operates.

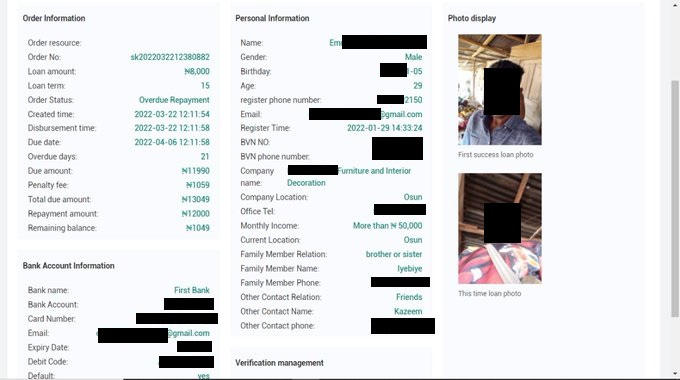

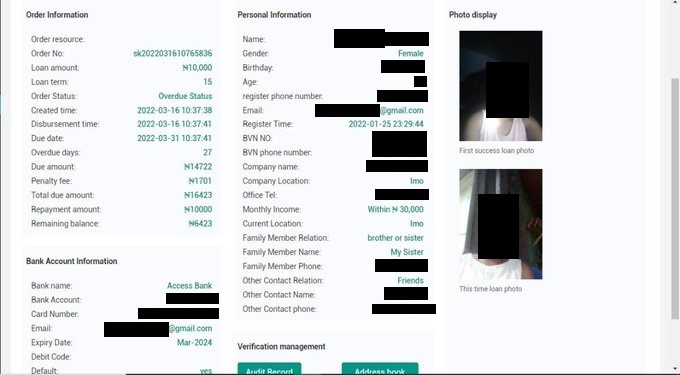

Most disturbingly, he showed me the type of data that Sokoloan keeps on its customers and how said data is stored and used. Customers have their biodata, photographs, BVNs, next of kin details, bank account details, 16-digit card numbers and expiry dates, email addresses and locations stored in plain text format and available to everyone who has access to Soko Lending Company’s backend customer management suite. Which of course, is essentially anyone who has a job at this company.

For reference, I was the one who made the above redactions while preparing this story. Before the voluntary redactions, I was able to clearly read the most private and personal financial details of total strangers and do with them as I please. The implications this raises regarding who has worked at this company before and what they have used this information to do, are nothing short of mind-boggling.

Kehinde also explained that contrary to what Sokoloan and other loan shark apps publicly claim, they have absolutely no power to take any action against defaulters beyond the threatening messages and fabrications. It was also at this point that he mentioned a name that could hold the key to unraveling why Soko Lending Company appears to be so bulletproof despite being in breach of just about every Nigerian financial and data regulation:

“It’s the same information they have on all customers. They fabricate lies just to scare people into submission. They can’t do more than those messages being sent out. If you want to hit Soko Lending Company hard, then start with their outsourcing firm which fronts for them: Phillips Outsourcing Limited.”

Phillips Consulting: The Unlikely Silent Partner

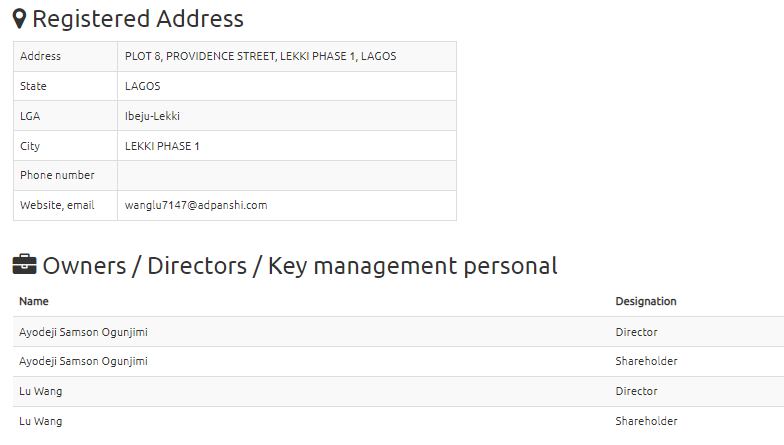

At this point, we will take a step back to examine the corporate structure of Soko Lending Company once again. As mentioned earlier, the details given on its CAC listing are not very useful. The address is false, the directors appear to be ghosts, and even the email address given is a throwaway email address offered by Panshi, a Chinese B2B internet service company, similar to Zoho.

The company has a rudimentary backend as Kehinde showed me, in addition to its completely nonexistent data protection and data minimisation practises. This organisation is a money lender the way a Reliant Robin is a motor car. Which is to say, yes technically, but also no, not really.

How does such a slapdash operation manage to stay one step ahead of Nigerian regulators all the time, with the added bonus of conquering Ghanaian regulators as well? How does an entity this poorly managed somehow run no fewer than 9 illegal loan apps concurrently without folding in on itself?

The answer lies in what Kehinde told me next.

“Oreoluwa is the lady who handles all staff of Soko Lending Company on behalf of Phillips Outsourcing.”

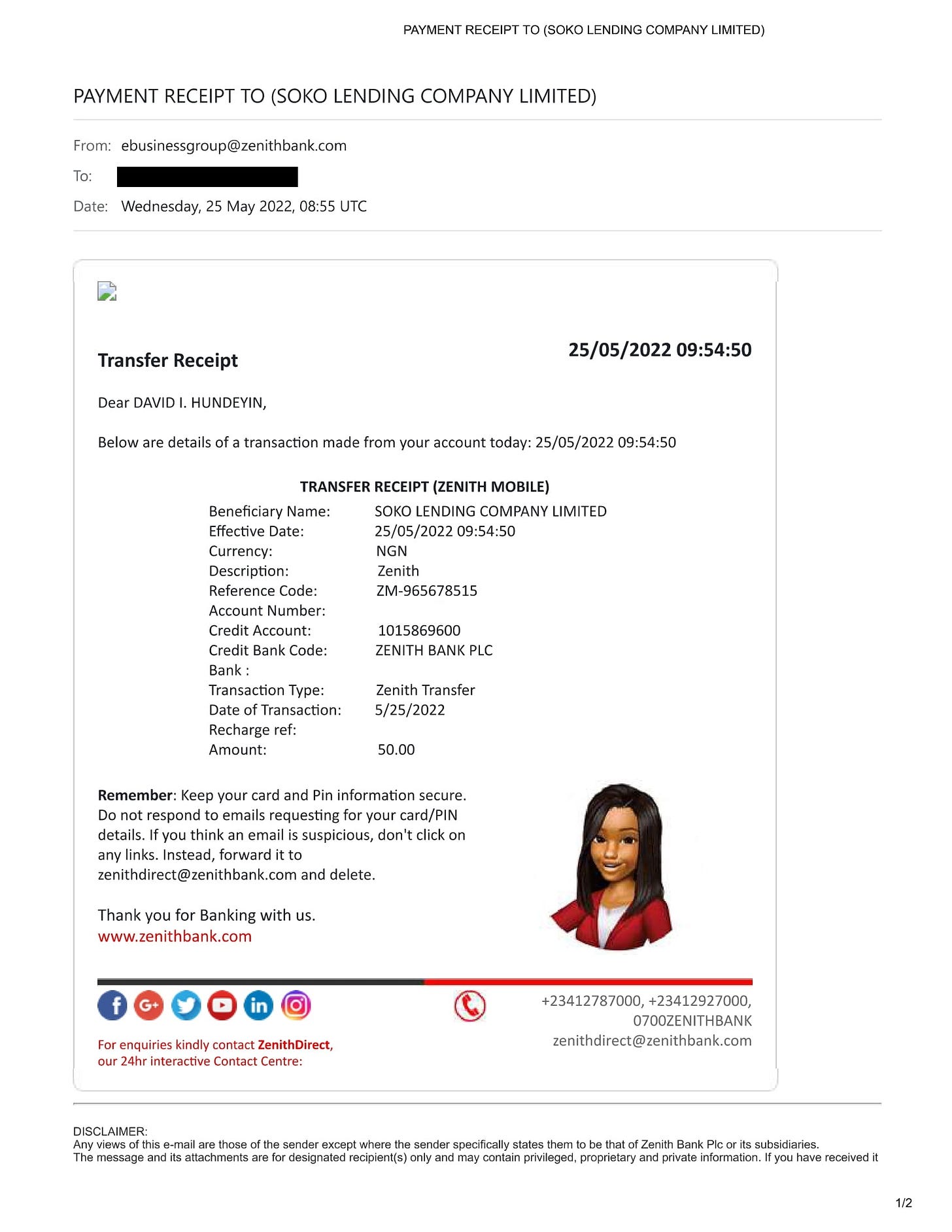

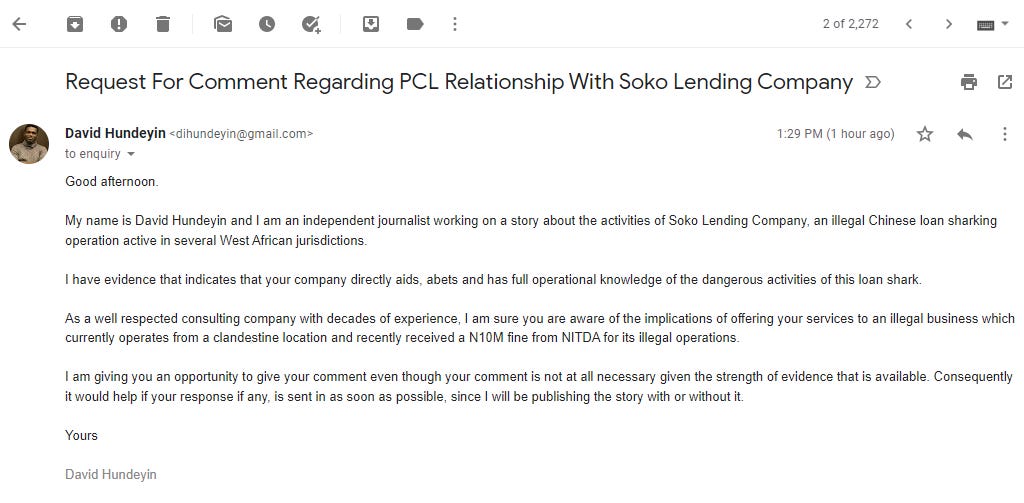

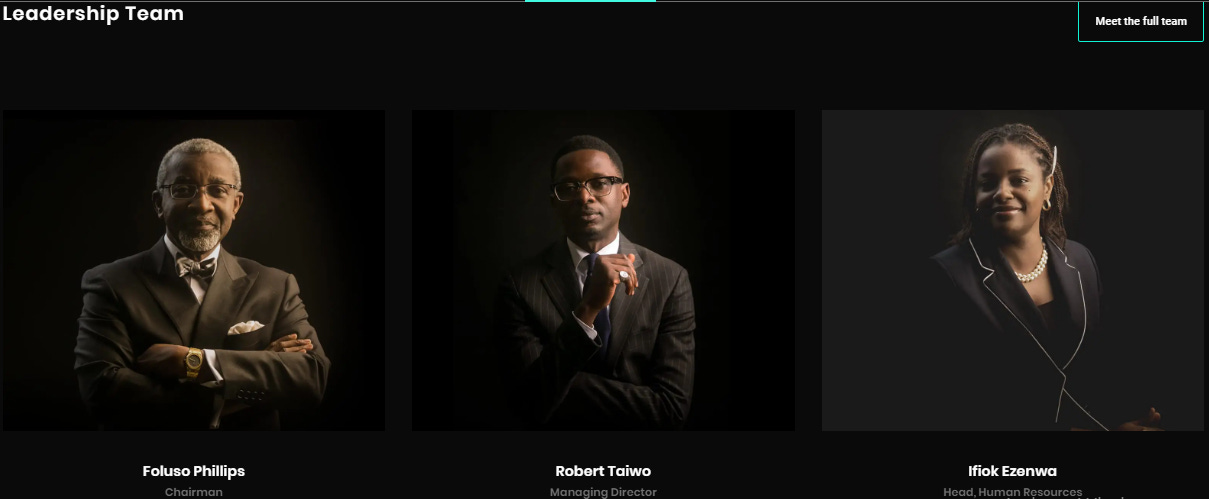

I asked to be sure whether this was a typo, or perhaps there was another company called Phillips Outsourcing that somehow got mixed up in all this. It definitely could not be the Phillips Outsourcing, a well-known subsidiary of Phillips Consulting? You know, the Phillips Consulting Limited? Was he sure of what he was saying?

Yes, he insisted. Phillips Consulting Limited (PCL) literally provides the local muscle for the loan shark operation, while the Chinese bosses provide the capital and the digital infrastructure. What is more, he wasn’t just saying so, he would actually provide documented evidence that Soko Lending Company is in fact, operating through PCL. This evidence would show that not only does PCL handle HR functions for Soko Lending company, it also plays an active part in all of its operations including taking payments from customers and sending our harassing, defamatory messages.

“Show me.”

“OK but first I have to explain something. It’s not allowed, but I sent my personal account to a customer to make payment to. With recent happenings and the way the company treats its staff, more persons will start doing it. I did it before I resigned. Though I am not proud of it, I did it because they delayed our salary and refused to give us proper information about anything for almost 2 weeks while we kept on begging.”

“O…K?”

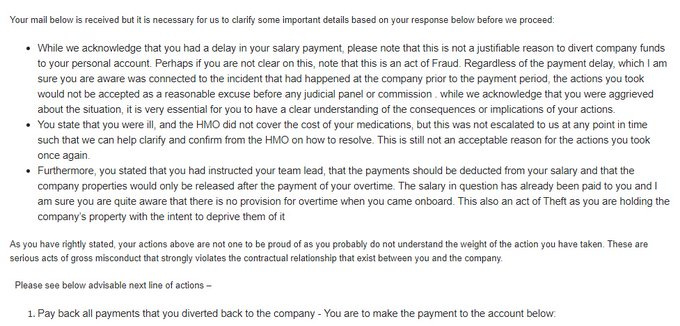

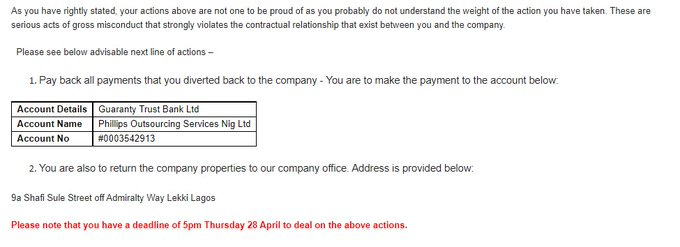

“Now after I did it and I resigned, the HR lady [Oreoluwa] from Phillips Outsourcing sent me an email demanding for me to refund Sokoloan’s money back into Phillips Outsourcing’s account. Here is the mail.”

Here it was.

Prima facie evidence that one of the most revered corporate brands in Nigeria is in bed with a criminal international loan shark syndicate. In this email, funds apparently due to Soko Lending Company were referred to by a Phillips Outsourcing staffer as “company funds.” Worse still, a Phillips Outsourcing company account was provided for the proceeds of a loan shark transaction to be refunded into. And yet I had to make absolutely sure. So I sent a small amount of money to the bank account in the email above and waited for the confirmation receipt. It came.

I emailed Phillips Consulting to see what they had to say for themselves. So far, they have had nothing whatsoever to say.

If they do respond, this story will be updated with the statement.

A few hours before publishing, Ibrahim sent the following message:

“I can confirm that Sokoloan is back operating in Nigeria and one of their new cover addresses is Top Floor, Reals Plaza, Plot 1 Junaid Dosunmu street, CBD, Alausa, Ikeja, Lagos.”

About The Author

5 Comments

Leave a Reply Cancel reply

Related Articles

Fire Destroys 140 Tonnes of Cotton in Western Burkina Faso

A major fire has destroyed more than 140 tonnes of cotton in...

ByWest Africa WeeklyFebruary 25, 2026Côte d’Ivoire Feeds the World’s Chocolate Industry, But When Prices Shift, Cocoa Farmers Are Left With Rotting Harvests and No Income

Côte d’Ivoire produces nearly half of the world’s cocoa, a crop that...

ByWest Africa WeeklyFebruary 18, 2026Atlas Oranto Hit by Licence Loss in Equatorial Guinea, Senegal, Venezuela

Nigerian oil magnate Arthur Eze’s company, Atlas Oranto Petroleum, is facing a...

ByWest Africa WeeklyFebruary 11, 2026Manufacturers record N1.8 trillion in unsold goods

Nigeria’s manufacturing sector is facing a deepening crisis as the value of...

ByWest Africa WeeklyFebruary 9, 2026

I do not even understand how I ended up here, but I assumed this publish used to be great

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

The information is up-to-date and easy to understand.

There is definately a lot to find out about this subject. I like all the points you made