Nigeria’s Booming Stock Market: Investor Boon Or Fool’s Gold?

In the eight months since President Bola Tinubu assumed office, Nigeria’s stock market has witnessed remarkable growth. In January 2024, it emerged the world’s best-performing market on paper, beating out Argentina’s stock market.

Bayo Onanuga, the special adviser of Information and Strategy to President Tinubu, highlighted this economic achievement on Saturday.

Bayo Onanuga’s POV

His assertion reads in part: “The Nigerian economy is looking good in some sectors. This is not a harebrained assessment, despite the high inflation and the unstable exchange rate of the Naira.

Those who doubt this don’t need to look far, for a reality check. The economic boom is happening at the Nigerian Exchange, where stockholders are not only recording unprecedented capital gains but are poised to earn equally unprecedented dividends on their investments.”

Onanuga noted the market’s bullish run, which began immediately after Tinubu’s inauguration and his announcement to end the controversial petrol subsidy program. The All Share Index and market capitalization have both seen unprecedented increases, fueled by record profits from Nigerian banks and manufacturers.

According to him, “last Friday alone, 844.4 million units of stocks valued at N15 billion were traded in 15,255 deals”.

This growth, Onanuga argues, is a step towards wider economic prosperity, despite current challenges like the high cost of pharmaceuticals and the need for more foreign exchange inflows. He stated that efforts are underway to stabilize the economy further. This includes potential World Bank funding and foreign investments.

From A Critical Lens

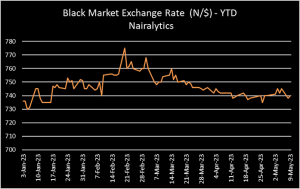

A Harvard Business Review writer, entrepreneur and investor, Ndubisi Ekekwe offers a critical perspective. Referencing Onanuga’s proposition, the professor says in an X post: “The Nigeria stock exchange has been growing on absolute Naira, but on the real value, it is not.

That statement is factual but the irony is that the growth, as noted by Bayo, has made many people poorer and depressed the overall value of the stock market. That is why foreign investors are not coming for that 45% gain because if you made 45% on equity, but lost 50% on currency, with 30% on inflation, you are poorer.”

While Prof. Ekekwe acknowledges the stock market’s growth in Naira terms, he points out the real value depreciation due to currency devaluation and inflation. This situation, he explains, has deterred foreign investors and made many Nigerians poorer, despite nominal gains. He also highlights the concentration of power in the Nigerian stock market, where a few companies dominate, suggesting a rigged economy. While acknowledging opportunities for making money in Nigeria, Ekekwe emphasizes the importance of a stable currency for genuine economic growth.

BOON OR BANE

The contrast between Bayo Onanuga’s optimism and Prof. Ekekwe’s skepticism paints a complex picture of Nigeria’s economy under the current administration.

While the stock market’s growth is undeniable, its real benefits to the average Nigerian and the broader economy are debatable.

As of Monday, the value of the Naira has further depreciated to ₦1350/1$. Onanuga, in his post, remarked that “investors have gained more than N20 trillion since Tinubu came into office”, and that investors are bringing more and more money to the prospering stock market.” This is commendable until the value of Naira in the global economy is brought into the argument. Local investors can leverage the prospering stock market – as long as they do not have to convert their gains to foreign currencies. That catch is rather distressing.

In the backdrop of Nigeria’s depreciating currency, foreign investors are left with little or no choices than to pull out.

To illustrate: In May 23, 2023, the average exchange rate was N762/$1. At that rate, if an investor had invested ₦5M ($6,561) and made a gain of ₦1M by January, 2024. His 6M would be $4,444 today (at the current exchange rate of N1350/$1).

Although he gained a million naira from the prospering Nigerian stock market, the value of his money depreciated by over $1,500 dollars. Lack of foreign investment will, in the long run, further crumble the economy. Bearing that hypothetical scenario in mind, is Nigerian’s stock market growth a boon or bane?

Read more: NNPP Faction Demands Kwankwaso Expulsion, Claims Others Remain Expelled

About The Author

Related Articles

Côte d’Ivoire Feeds the World’s Chocolate Industry, But When Prices Shift, Cocoa Farmers Are Left With Rotting Harvests and No Income

Côte d’Ivoire produces nearly half of the world’s cocoa, a crop that...

ByWest Africa WeeklyFebruary 18, 2026Ghana Set to Become Africa’s Eighth Largest Economy

Ghana is projected to become the eighth-largest economy in Africa by 2026,...

ByWest Africa WeeklyFebruary 16, 2026Mali Extends Barrick Gold License for Another Decade

Mali’s government has renewed the mining license for a major gold operation...

ByWest Africa WeeklyFebruary 16, 2026Senegal Unveils $100m Onshore Oil and Gas Plan After Revoking Idle Licenses

Senegal is moving ahead with a new $100 million onshore oil and...

ByWest Africa WeeklyFebruary 12, 2026