Niger defaults up to half billion in debt payment

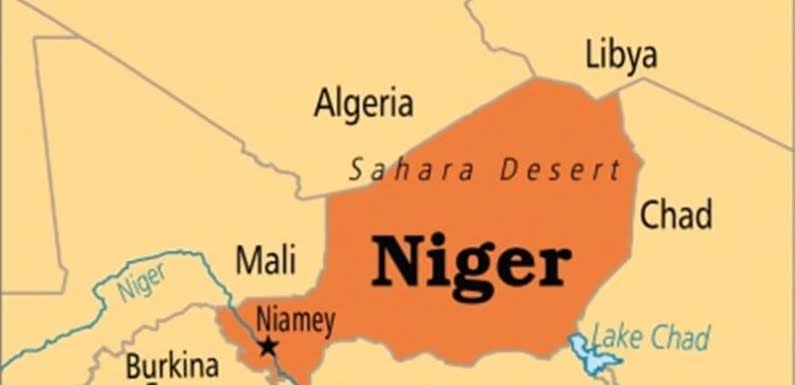

It has been reported that the Republic of Niger is facing escalating debt defaults, with the country falling behind on payments totaling $519 million since the military coup in July.

The West African debt management agency, UMOA-Titres, reported a recent default of 13.4 billion CFA francs ($22 million). The amount brings the total default to about $519 million and emphasizes the ongoing economic challenges in Niger, exacerbated by regional sanctions.

The missed repayment, due on February 16, triggered concerns as Niger has previously missed payments in August, November, and January. According to UMOA-Titres, the defaults are connected to sanctions imposed by the Economic Community of West African States (ECOWAS) and the West African Economic and Monetary Union (UEMOA).

The debt management agency issued a statement affirming their vigilant monitoring of the situation in collaboration with relevant institutions.

Recall that sanctions were initially enforced in 2023 following the coup that ousted President Mohamed Bazoum. The July 30 coup prompted ECOWAS and UEMOA to suspend Niger from regional financial markets. The repercussions were severe, including the freezing of external bank assets, suspension of financial transactions with West African countries, and the cancellation of a planned 30 billion CFA franc ($51 million) bond issuance by the Central Bank of West African States (BCEAO).

International aid, a significant portion of Niger’s annual budget, was halted, leaving the country grappling with economic hardship. Neighboring nations closed their borders, electricity supply was disrupted, and over 70 percent of power sourced from Nigeria was severed, as West Africa Weekly earlier reported.

Despite stringent sanctions, the government consolidated its power and announced its departure from ECOWAS alongside Mali and Burkina Faso. In further retaliation, the government of the Republic of Niger placed a ban on all commercial and international flights coming from or going to Nigeria. The three Junta nations are now reportedly contemplating discontinuing the use of the CFA currency. It is unclear, at the moment, how Niger intends to tackle its debt crisis.

Read more: Burna Boy Thrills Fans at Spill Gate Festival

About The Author

Related Articles

Asake Sets New Billboard Afrobeats Record as Chart Presence Grows

Asake has further cemented his place as one of Afrobeats’ most dominant...

ByWest Africa WeeklyJanuary 29, 2026Nigerians Lament PayPal’s Return as Old Wounds Resurface

PayPal’s reentry into Nigeria through a partnership with local fintech company Paga...

ByWest Africa WeeklyJanuary 29, 2026Tanzania Eyes Gold Sales as Aid Declines and Infrastructure Needs Grow

Tanzania is weighing plans to sell part of its gold reserves to...

ByWest Africa WeeklyJanuary 29, 2026Mali Tightens Grip on Explosives Supply With New Majority Stake

The Malian government has taken majority ownership of a civil explosives manufacturing...

ByWest Africa WeeklyJanuary 29, 2026

Leave a comment