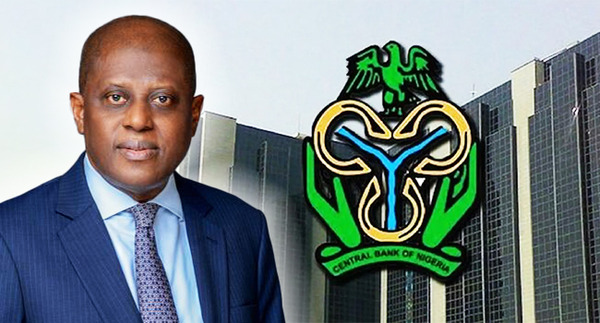

The Nigeria Deposit Insurance Corporation (NDIC) has initiated payments to Heritage Bank depositors with balances exceeding N5 million. This follows the Central Bank of Nigeria’s (CBN) revocation of the bank’s license on June 3, 2024. The revocation was due to the bank’s persistent financial instability and regulatory breaches.

The NDIC, acting as the liquidator, confirmed that payments to depositors began just four days after the bank’s liquidation. This was conveyed via a statement signed by the Director of Communication and Public Affairs, Bashir Nuhu, on Sunday in Abuja.

The disbursements were reportedly made directly through BVN-linked accounts, eliminating depositors needing to visit NDIC offices or complete additional forms. So far, about 82.36 per cent of the total insured deposits have been paid out.

For those with balances exceeding N5 million, classified as uninsured deposits, the NDIC explained that the remaining funds would be disbursed as liquidation dividends upon realising the defunct bank’s assets and recovery of debts.

The NDIC also noted that the remaining 17.64 per cent of insured deposits yet to be mainly paid involve depositors with account issues, such as no debit instructions or missing BVN links. These depositors are urged to come forward for verification to facilitate payment.

It is instructive to state that the remaining 17.64 per cent of the insured deposits yet to be paid were largely depositors whose accounts have post no debits instructions or have no BVN. Others are those with no alternative accounts in other banks or accounts with a KYC limit on the maximum lodgment per day and are yet to come forward for verification, the statement said.

Read More:

- PSquare Splits Again As Peter Okoye Writes Open Letter To Twin Brother Paul

- Just In: WAEC Releases 2024 WASSCE Results

About The Author

Related Articles

Tinubu Follows Gumi’s Lead as Nigeria Signs Turkey Defence Deal, Fueling Speculation Over Who Really Controls the Country’s Security Policy

Nigeria’s diplomatic and security strategy is once again under scrutiny after a...

ByWest Africa WeeklyJanuary 28, 2026Burkina Faso President Ibrahim Traoré Reviews 2025 Achievements, Sets Ambitious Agenda for 2026

Burkina Faso’s President, Ibrahim Traoré, has described 2025 as a year of...

ByWest Africa WeeklyJanuary 28, 2026Mali Says Reports of New Three-State Sahel Currency Are False but Talks Continue on Economic Integration

Mali’s government has rejected claims that it and its neighbours, Burkina Faso...

ByWest Africa WeeklyJanuary 28, 2026CBN Upgrades Opay, Moniepoint, Kuda and Others to National Licences

The Central Bank of Nigeria has upgraded the operating licences of several...

ByWest Africa WeeklyJanuary 28, 2026