The Nigerian Senate has approved President Bola Tinubu’s ₦1.77 trillion ($2.2 billion) loan request to partially fund the country’s ₦9.7 trillion budget deficit for the 2024 fiscal year.

The approval came after a voice vote during a session presided over by Deputy Senate President Barau Jibrin, following the presentation of the Senate Committee on Local and Foreign Debts’ report by Senator Wammako Magatarkada (APC, Sokoto North).

The loan forms part of a fresh external borrowing plan to bridge Nigeria’s widening fiscal gap, but it raises concerns over the growing burden of debt servicing on the government.

In August, a report from investment management company Afrinvest predicted that Nigeria’s public debt would rise to ₦130 trillion by December 2024.

This means an increase from ₦121.67 trillion in the first quarter of this year. The “Bank Recapitalisation, Catalyst for a $1tn Economy” report shows growing concerns about the country’s debt-to-GDP ratio.

Also, recent reports from the Central Bank of Nigeria (CBN) reveal that the federal government spent $3.58 billion servicing foreign debts in the first nine months of 2024, a 39.77% increase from the $2.56 billion recorded during the same period in 2023.

The CBN’s statistics highlight a sharp rise in debt servicing costs. In January 2024 alone, a 398.89% surge in payments was recorded, amounting to $560.52 million compared to $112.35 million in January 2023.

Although February saw a slight dip of 1.84%, with payments dropping to $283.22 million from $288.54 million in the previous year, April recorded a significant 131.77% spike, rising to $215.20 million from $92.85 million in 2023.

May 2024 marked the highest monthly payment, with $854.37 million spent on foreign debt servicing—a staggering 286.52% increase from $221.05 million in May 2023.

Read Also: Nigeria Becomes Third-Largest Debtor to World Bank’s IDA, Overtakes India

Rema and Seun Kuti to Shine at Coachella 2025

Conversely, some months recorded declines: June saw a 6.51% drop, and July recorded a 15.48% decrease compared to their respective periods in 2023. However, September 2024 saw an uptick, with payments climbing 17.49% to $515.81 million, up from $439.06 million in September 2023.

These rising debt servicing costs have fueled concerns about Nigeria’s fiscal sustainability despite the increase in inflation and the cost of living.

About The Author

Related Articles

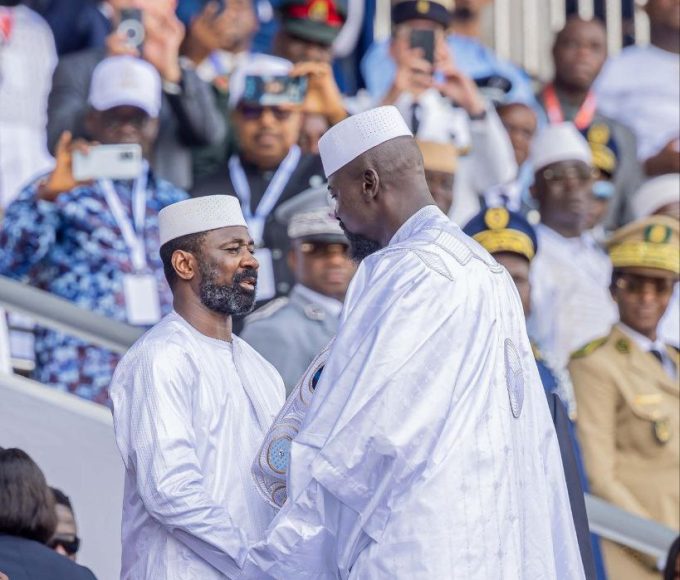

Mali’s Transition Leader Attends Swearing-In of Guinea’s President Mamadi Doumbouya

Mali’s President of the Transition, General Assimi Goïta, represented the country in...

ByWest Africa WeeklyJanuary 19, 2026Malian Army Conducts Successful Surveillance Operation in Mopti Region

The Malian Armed Forces have carried out a successful territorial surveillance operation...

ByWest Africa WeeklyJanuary 19, 2026Nigerian Security Forces Record Major Gains Against Armed Groups

Niger’s Defence and Security Forces have reported significant results following a week...

ByWest Africa WeeklyJanuary 19, 2026Fuel Supply Improves in Bamako as Hundreds of Tankers Arrive

Bamako has recorded a significant improvement in fuel supply following the arrival...

ByWest Africa WeeklyJanuary 19, 2026

Leave a comment