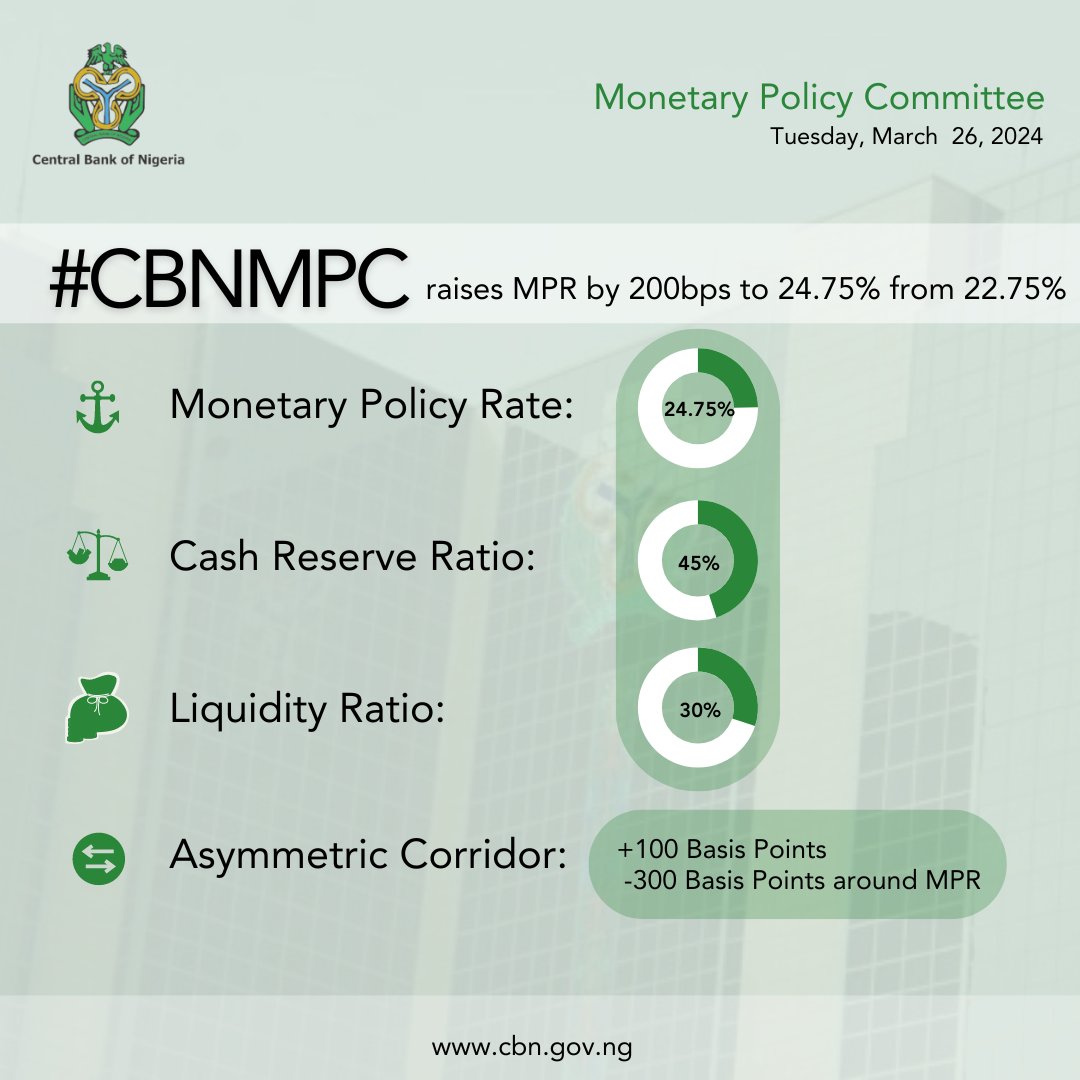

The Central Bank of Nigeria (CBN) has raised its benchmark interest rate, known as the Monetary Policy Rate (MPR), to 4.75%. This marks a 200 basis points surge from the previous rate of 22.75%.

The decision was announced by CBN Governor, Mr. Olayemi Cardoso, following the conclusion of the Monetary Policy Committee (MPC) meeting on Tuesday.

Alongside the MPR adjustment, the CBN retained the Cash Reserve Ratio (CRR) for commercial banks at 45%, while elevating the CRR for merchant banks from 10% to 14%. Additionally, the liquidity ratio for banks remains unchanged at 30%.

The MPC also modified the asymmetric corridor around the MPR from +100/-700 to +100/-300. These measures address prevailing economic challenges, particularly concerning inflationary pressures and exchange rate stability.

The hike in interest rate comes after a series of gradual increases in the MPR over the past year. There was a previous adjustment to 22.75% in February. Mr. Cardoso had highlighted the committee’s concerns regarding persistent inflationary trends and emphasized their commitment to reversing this trajectory. The next MPC meeting is scheduled for May 20th and 21st, 2024.

Read: Bandit Flaunts Ransom Money on Tiktok

About The Author

Related Articles

Niger Government Sanctions Mining Firms, Refuses Oil Permit Renewal

The government of Niger has taken firm action against several mining and...

ByWest Africa WeeklyMarch 9, 2026Burkina Faso Army Recaptures Towns Held by Militants for Seven Years

The armed forces of Burkina Faso say they have regained control of...

ByWest Africa WeeklyMarch 9, 2026Ghana Seeks Stronger Trade and Investment Relations With Nigeria

Ghana is pushing for deeper trade and investment cooperation with Nigeria as...

ByWest Africa WeeklyMarch 9, 2026Peter Obi Donates ₦60 Million to Support Nigerian Universities

Former Anambra State governor and presidential candidate Peter Obi has donated ₦60...

ByWest Africa WeeklyMarch 9, 2026