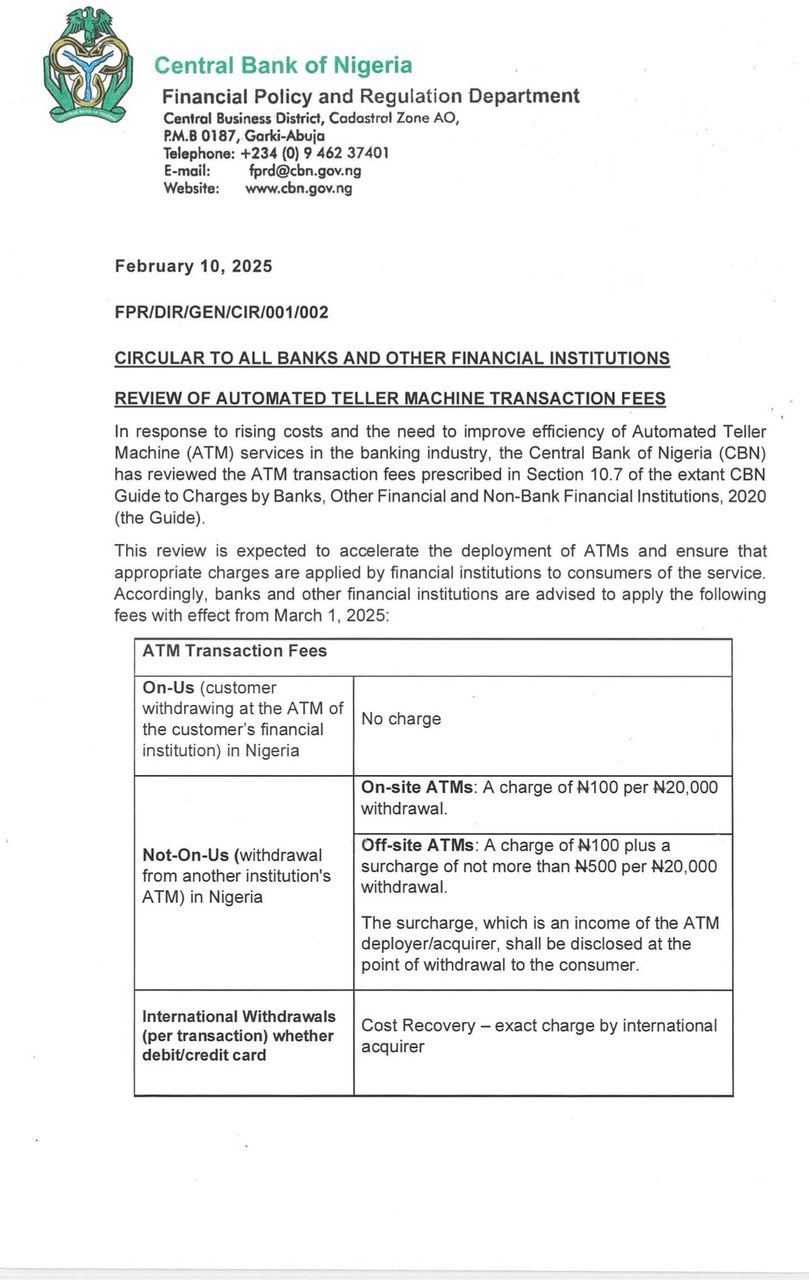

The Central Bank of Nigeria (CBN) has introduced new withdrawal charges for Automated Teller Machines (ATMs), scrapping the three free monthly transactions previously available to customers using other banks’ ATMs. The revised charges will take effect from 1 March 2025.

A circular issued on 10 February 2025 by the Acting Director of the Financial Policy and Regulation Department, John Onojah, directed all banks and financial institutions to implement the new charges. The CBN said the review would encourage banks to deploy more ATMs while ensuring they apply appropriate fees.

- On-site ATMs (machines within bank premises but outside the branch) will now charge N100 per N20,000 withdrawal.

- Off-site ATMs (machines in shopping malls, airports, or standalone cash points) will charge N100 per N20,000 withdrawal, plus a surcharge of up to N500, bringing the total charge to N600 per withdrawal.

- International ATM withdrawals will be charged at the exact rate set by the foreign acquirer.

Withdrawals from a customer’s own bank’s ATMs remain free.

The three free monthly withdrawals allowed for Remote-On-Us (other bank’s customers/Not-On-Us consumers) in Nigeria under Section 10.6.2 of the Guide shall no longer apply, the statement added.

Removing free withdrawals for customers using other banks’ ATMs marks a major shift. Previously, customers could make three free transactions at non-bank ATMs before incurring charges. Now, every withdrawal will attract a fee.

The CBN said the review was necessary due to rising operational costs. It expects the new charges to improve ATM services and encourage financial institutions to expand their networks. However, higher charges may discourage ATM usage. Customers may begin to rely more on mobile banking apps and online transfers.

Read More:

- Public Outcry as MTN Raises Weekly 15GB Data Price from N2,000 to N6,000

- CBN Introduces New ATM Charges, Customers Using Other Banks’ ATMs to Pay N100 Per ₦20,000 Withdrawal

About The Author

Related Articles

Niger Government Sanctions Mining Firms, Refuses Oil Permit Renewal

The government of Niger has taken firm action against several mining and...

ByWest Africa WeeklyMarch 9, 2026Burkina Faso Army Recaptures Towns Held by Militants for Seven Years

The armed forces of Burkina Faso say they have regained control of...

ByWest Africa WeeklyMarch 9, 2026Ghana Seeks Stronger Trade and Investment Relations With Nigeria

Ghana is pushing for deeper trade and investment cooperation with Nigeria as...

ByWest Africa WeeklyMarch 9, 2026Peter Obi Donates ₦60 Million to Support Nigerian Universities

Former Anambra State governor and presidential candidate Peter Obi has donated ₦60...

ByWest Africa WeeklyMarch 9, 2026

Leave a comment