Canadian Mining Company B2Gold Pays Mali $30 Million To Settle Mining Tax Dispute

The Canadian mining company B2Gold has paid the Malian government $30 million (18.3 billion FCFA) to settle a tax dispute related to gold mining operations. B2Gold disclosed this in its third-quarter 2024 results report.

The payment follows an agreement reached in September 2024 after an audit revealed revenue losses of up to 600 billion FCFA ($492-$984 million) for Mali due to mining tax issues.

The settlement was part of ongoing negotiations between the Malian government and mining companies to address shortfalls identified in last year’s audit.

Details from the company’s Q3 indicate the agreement enables B2Gold to continue operating its Fekola mine, Mali’s second-largest gold producer, projected to yield 420,000 ounces in 2024.

It also allows the company to exploit a new deposit, “Fekola Regional,” located 20 km from its leading site. This expansion, expected to commence in 2025, will add an estimated 80,000 to 100,000 ounces of gold annually to the mine’s output.

The Fekola Regional deposit will be governed by Mali’s revised mining code, which took effect in 2023 and increases the government’s stake to 35 per cent, up from 20 per cent under the old code.

The new code, which applies to B2Gold and other major mining companies, including Allied Gold’s Sadiola project and two lithium mines set to begin production soon, is projected to boost Mali’s annual mining revenues to approximately 500 billion FCFA.

Mali’s government, under President Assimi Goita, has made it clear to investors that they must accept the new mining regulations or exit the country. The code aligns with the government’s efforts to reclaim sovereignty over national resources.

Read More:

- Sanwo-Olu Hosts Justice Kekere-Ekun for Dinner Despite NBA President’s Directive

- Canada Tightens International Student Policy, Ends Fast-Track Study Permits for Nigeria and SDS Countries

- Families of Patients Protest Electricity Blackout at UCH Ibadan

About The Author

Related Articles

The AFCON Final in Morocco and the Controversies That Followed

The Africa Cup of Nations final between hosts Morocco and Senegal ended...

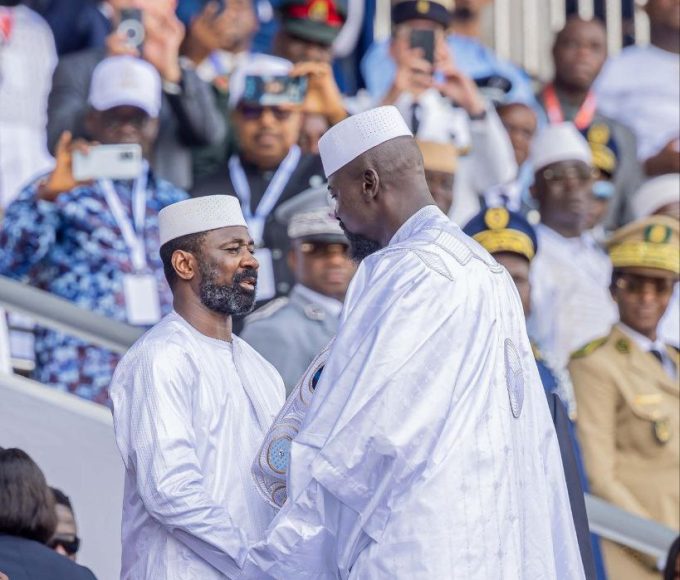

ByWest Africa WeeklyJanuary 20, 2026Mali’s Transition Leader Attends Swearing-In of Guinea’s President Mamadi Doumbouya

Mali’s President of the Transition, General Assimi Goïta, represented the country in...

ByWest Africa WeeklyJanuary 19, 2026Malian Army Conducts Successful Surveillance Operation in Mopti Region

The Malian Armed Forces have carried out a successful territorial surveillance operation...

ByWest Africa WeeklyJanuary 19, 2026Niger’s Security Forces Record Major Gains Against Armed Groups

Niger’s Defence and Security Forces have reported significant results following a week...

ByWest Africa WeeklyJanuary 19, 2026

Leave a comment