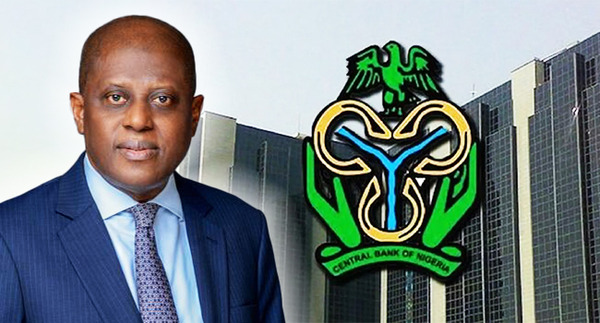

Central Bank of Nigeria (CBN) has issued a new Foreign Exchange (FX) code as guidelines mandating compliance for commercial banks and Bureau De Change operators.

The apex bank disclosed this on Thursday in a 38-page document detailing how the new FX code will help stabilise the naira.

According to CBN, it is a set of principles of good practice in the Nigerian Foreign Exchange Market (NFEM) that aligns with global standard practices while strengthening the country’s financial system.

CBN noted it was created on six critical principles, including ethics, governance, execution, information sharing, risk management and compliance, confirmation and settlement, all of which will take effect on October 14, 2024.

While all Market Participants (licensed Banks and BDCs operators) must submit a self-assessment report on compliance level, they are also required to be in full compliance by December 31, 2024.

Market Participants will be required to submit a quarterly report to the Financial Markets Department (FMD) on the level of compliance with the FX Code within 14 days after the end of every calendar quarter, with the first report due by December 31, 2024,” the guideline reads partly.

Meanwhile, following President Tinubu’s directive to the CBN governor, Yemi Cardoso to float the Naira, it fell from N465 per dollar to N1,657.86.

By floating the Naira, the Nigerian government gave room for demand and supply in the foreign exchange market to determine the value of the Naira, resulting in several measures by CBN to stabilise the naira, including a crackdown on BDC operators and cryptocurrencies, and now, new FX code.

Read Also: Naira Suffers More Depreciation at N1,669/$, After Independence Day Celebration

About The Author

Mayowa Durosinmi

author

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Mayowa Durosinmi

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Related Articles

Tanzania Eyes Gold Sales as Aid Declines and Infrastructure Needs Grow

Tanzania is weighing plans to sell part of its gold reserves to...

ByWest Africa WeeklyJanuary 29, 2026Mali Says Reports of New Three-State Sahel Currency Are False but Talks Continue on Economic Integration

Mali’s government has rejected claims that it and its neighbours, Burkina Faso...

ByWest Africa WeeklyJanuary 28, 2026CBN Upgrades Opay, Moniepoint, Kuda and Others to National Licences

The Central Bank of Nigeria has upgraded the operating licences of several...

ByWest Africa WeeklyJanuary 28, 2026Tinubu Deducts N100bn Monthly From Federation Account Without Approval El-Rufai Alleges Says Action Deserves Impeachment

Former Kaduna State Governor Nasir El-Rufai has launched a blistering attack on...

ByWest Africa WeeklyJanuary 26, 2026

Leave a comment