CBN Raises Import Duty as Naira Hits New Low Against The Dollar

The Nigerian Naira (NGN) further depreciated against the US Dollar on Monday, reaching a new low of 1,515 Naira to a dollar in the parallel market. This marks a 2.97 per cent decline compared to Friday’s exchange rate of 1,470 Naira per dollar.

Nigeria’s external reserves, however, increased marginally by 0.4 per cent, reaching a four-week high of $32.4 billion as of May 8, 2024.

Recall that the Central Bank of Nigeria (CBN) recently resumed dollar sales to Bureau De Change (BDC) operators to intervene in the retail forex market. However, delays in dollar disbursement from the CBN have led to complaints from BDC operators, with some requesting refunds for Naira payments.

In response to the naira’s depreciation, the CBN has raised the exchange rate for calculating import duty at the nation’s seaports to 1,457.014 nairas per dollar, representing a 3% increase from the previous rate. Importers are now required to pay higher import duties, which affects cargo clearing processes and thus worsens the hardship experienced by the citizenry.

Analysts anticipate continued naira depreciation unless the CBN intervenes. Jonathan Nicole, former president of the Shippers Association of Lagos State, criticised the frequent tweaking of import duty rates, stating that such instability undermines investor confidence.

As the naira struggles against the dollar, stakeholders call for more stable forex policies to support economic growth and investment in Nigeria.

About The Author

Related Articles

The AFCON Final in Morocco and the Controversies That Followed

The Africa Cup of Nations final between hosts Morocco and Senegal ended...

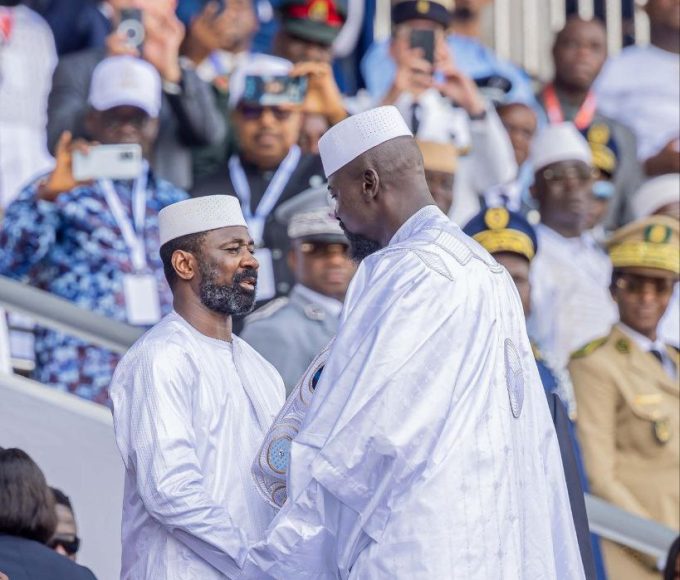

ByWest Africa WeeklyJanuary 20, 2026Mali’s Transition Leader Attends Swearing-In of Guinea’s President Mamadi Doumbouya

Mali’s President of the Transition, General Assimi Goïta, represented the country in...

ByWest Africa WeeklyJanuary 19, 2026Malian Army Conducts Successful Surveillance Operation in Mopti Region

The Malian Armed Forces have carried out a successful territorial surveillance operation...

ByWest Africa WeeklyJanuary 19, 2026Niger’s Security Forces Record Major Gains Against Armed Groups

Niger’s Defence and Security Forces have reported significant results following a week...

ByWest Africa WeeklyJanuary 19, 2026