In April, Nigerian banks faced significant challenges as major banking stocks experienced losses month-to-date. This downturn aligned with the first month-to-date decline in the NGX All Share Index of the year, with a 6% loss in April alone.

The most impacted were the FUGAZ banks—First Bank, UBA, GTCO, Access Bank, and Zenith—although Zenith remained the only one to maintain its position in the SWOOT (Stocks Worth Over One Trillion Naira) index.

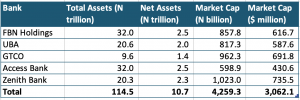

As of December 2023, Nigeria’s largest banks had a total net asset value of N9.7 trillion but only a combined market capitalisation of N4.2 trillion ($ billion), translating to a price-to-book ratio of 0.43, or 43%, indicating significant undervaluation by investors compared to their book values.

Challenger banks like Opay and Kuda Bank are valued above $1 billion despite their minor operational scales.

According to the Nairametrics SWOOT Index, FBN Holdings, UBA, GTCO, and Access Bank each fell below the trillion naira market cap as of April, a level they last exceeded in January.

For instance, Access Bank, Nigeria’s largest bank by assets, saw its market cap fall to about N598.9 billion by the end of April despite having over N32 trillion in total assets and N2.5 trillion in net assets.

Similarly, UBA, with total assets and net assets of N20.6 trillion and N2 trillion, respectively, saw its market cap drop from over N1 trillion in January to N817.3 billion at April’s end.

FBN Holdings, Nigeria’s oldest bank, peaked just above N1 trillion in early April but fell to N857.8 billion by April 30th, 2024.

GTCO also experienced a dip; valued above N1 trillion as recently as April 26th, it ended the month with a market capitalisation of N962.3 billion.

Zenith Bank, however, remained in the SWOOT, though it risks dropping below if the sell-offs continue into May 2024, with total and net assets of N20.3 trillion and N2.3 trillion, respectively.

Several factors contribute to these low valuations relative to net assets despite consistent dividend payouts. Some analysts attribute it to the high liquidity of bank stocks. In contrast, others point to a general disinterest in the Nigerian stock market, suggesting that intrinsic stock values are seldom reached.

A more recent factor is the banking recapitalisation announcement by the apex bank, which requires banks to raise over N4 trillion in new capital. This has likely prompted a sell-off, as lower share prices benefit bank shareholders when the capital increase is through a rights issue.

Read: Eleme Fire: East-West Road rehabilitation not the cause of accident – Minister of Works

About The Author

Related Articles

Niger Government Sanctions Mining Firms, Refuses Oil Permit Renewal

The government of Niger has taken firm action against several mining and...

ByWest Africa WeeklyMarch 9, 2026Burkina Faso Army Recaptures Towns Held by Militants for Seven Years

The armed forces of Burkina Faso say they have regained control of...

ByWest Africa WeeklyMarch 9, 2026Ghana Seeks Stronger Trade and Investment Relations With Nigeria

Ghana is pushing for deeper trade and investment cooperation with Nigeria as...

ByWest Africa WeeklyMarch 9, 2026Peter Obi Donates ₦60 Million to Support Nigerian Universities

Former Anambra State governor and presidential candidate Peter Obi has donated ₦60...

ByWest Africa WeeklyMarch 9, 2026