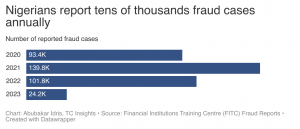

Wema Bank, a Nigerian tier-2 financial institution holding ₦1.8 trillion ($1.6 billion) in consumer deposits, reported ₦685 million ($594,943) in fraud and forgery losses in 2023, shedding light on the pervasive fraud issue within Nigeria’s financial sector.

The losses stemmed from various digital channels and payment collections, including third-party transactions facilitated through the bank’s platform, according to a spokesperson for the bank who spoke to TechCabal. The spokesperson also attributed some of the challenges to Know Your Customer (KYC) and compliance issues.

In response to these concerns, the bank is actively bolstering its fraud monitoring mechanisms and has expanded its digital compliance team. While claiming a significant decline in fraud cases during the first quarter of 2024, this assertion awaits verification as the bank’s Q1 2024 results have yet to be released.

Despite grappling with fraud-related challenges, the bank witnessed substantial growth in 2023, with profits surging from ₦11 billion in 2022 to ₦35 billion, buoyed in part by a ₦13 billion foreign exchange revaluation gain.

In March, the Central Bank of Nigeria (CBN) prohibited banks from utilising FX gains for dividend payouts or operational expenses.

Key highlights from Wema Bank’s financial performance in 2023 include:

- A 71% increase in gross earnings to ₦226 billion from ₦133 billion in 2022.

- A 69% rise in net interest income to ₦91 billion from ₦54 billion in 2022.

- A 44% growth in account maintenance fees to ₦3.9 billion from ₦2.7 billion in 2022.

- A 119% surge in FX transactions to ₦4.1 billion from ₦1.8 billion in 2022.

- A 42% expansion in loans and advances to banks and customers to ₦122 billion from ₦85 billion in 2022.

Additionally, Wema Bank reported notable returns from its loan portfolio, with the value of loans disbursed to customers increasing by 53.6% year-on-year to ₦801.10 billion. Digital income reached ₦745 million, while fees generated from electronic products totalled ₦7.3 billion.

Wema’s digital banking platform, ALAT, also experienced remarkable growth, attracting 2.1 million new users in 2023. However, the total user base remained undisclosed.

Read: NDLEA Destroys Over 300,000kg and 40,042 L of Drugs Seized in Lagos, Ogun

About The Author

Related Articles

Diplomatic Embarrassment Looms Over Tinubu’s Ambassadorial Appointments with Only Two Countries Granting Approval

Some countries may decline to accept several ambassadors recently nominated by the...

ByWest Africa WeeklyMarch 12, 2026Niger Launches Investigation After Attack on Tahoua Air Base

Authorities in Niger say investigations are ongoing following an attack on Air...

ByWest Africa WeeklyMarch 12, 2026Mali Establishes National Observatory to Advance Peace and Reconciliation

The transitional government of Mali has launched a new national body aimed...

ByWest Africa WeeklyMarch 12, 2026Liberia–Guinea Border Tensions Rise After Soldiers Cross Into Disputed Area

Tensions are rising along the border between Liberia and Guinea after reports...

ByWest Africa WeeklyMarch 12, 2026