Flutterwave: The African Unicorn Built On Quicksand

On the night of Sunday March 20, 2022, a particular WhatsApp group wouldn’t stop buzzing.

Word had got out that a big story that would shake the Nigerian tech space was coming out the next day. Rumour had it that the story was about Nigeria’s highest valued tech unicorn and that the fellow working on it was a certain enfant terrible of Nigerian journalism. For an unspecified reason, this was very bad news.

Dedicated to Nigerian Tech PR and networking, this WhatsApp group became Ground Zero for the preemptive response to the story, whose very existence was still a rumour. Lawyers were scrambled, friendly journalists were put on notice, social media assets were readied, and a lengthy press release was hurriedly slapped together in response to a story which at that point, consisted of 6 lengthy call transcripts, several unconnected Google Keep notes, a 55MB folder of screenshots and PDF documents, and a rough draft inside my head.

Head Fake: The Story That Never Was

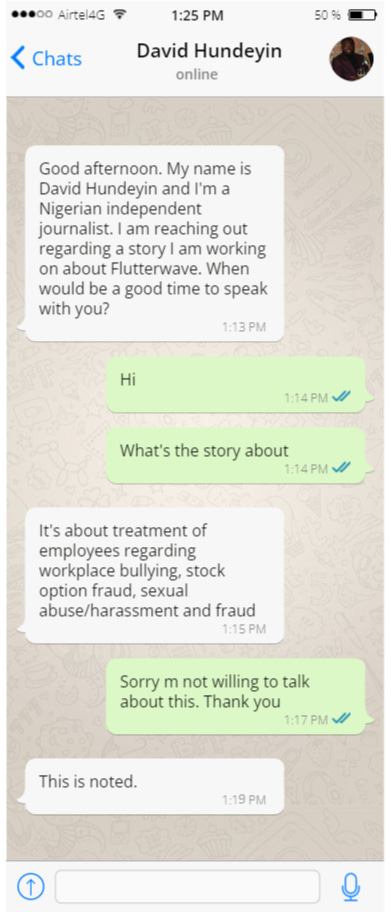

Even though the following days came and went without any sign of the story, Flutterwave’s PR efforts stayed firmly in overdrive throughout this time. First came a flurry of activity in the above-mentioned WhatsApp group when one of the company’s ex employees whom I reached out to for general comment politely said no, only for a screenshot of my conversation with him to start making the rounds a few hours later.

Then came the barrage of calls and messages from everyone connected to Flutterwave with whom I had spent the past 6 months in quiet correspondence while researching the story. They all wanted to know, “Why did I just get a call from Flutterwave? I hope I’m not in trouble. Did you tell them I’m talking to you?” “Trouble?” I silently wondered. “It’s a former workplace, not a religious cult, and you’re all adult professionals, not bullied teenagers – what on earth are you so afraid of?”

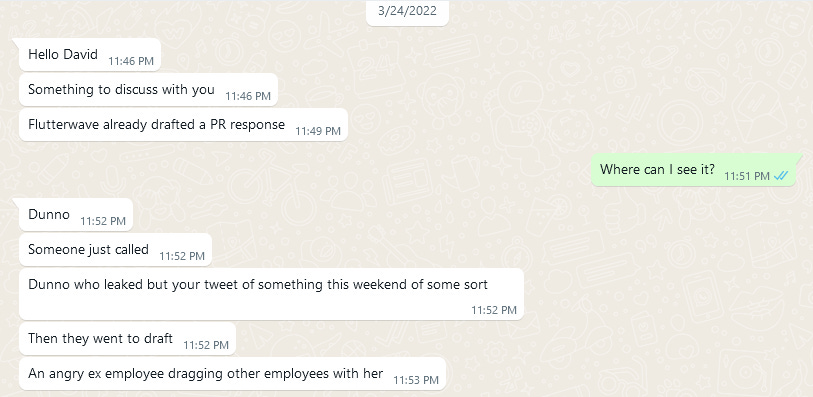

Then came this from my editor, informing me that – story or no story – Flutterwave was going to put out something in response to whatever it thought my story was going to be about. Someone not in the know might have wondered – why is a $3bn unicorn so terrified about a story that doesn’t even exist yet? What does it have to hide?

Unsurprisingly, when the material in question – a fawning 2,300-word PR interview – eventually emerged on April 3, it was an attempt at a direct response to the issues mentioned in the request for comment above, namely employee stock option fraud, sexual harassment and workplace bullying. A little amusingly, it contained a facile attempt to respond to a serious insider trading issue that I briefly teased with an ex employee who had spent our 45 minute conversation referring to Flutterwave as “we.” She incidentally, showed up at the Flutterwave Retreat in Accra, Ghana a few days later.

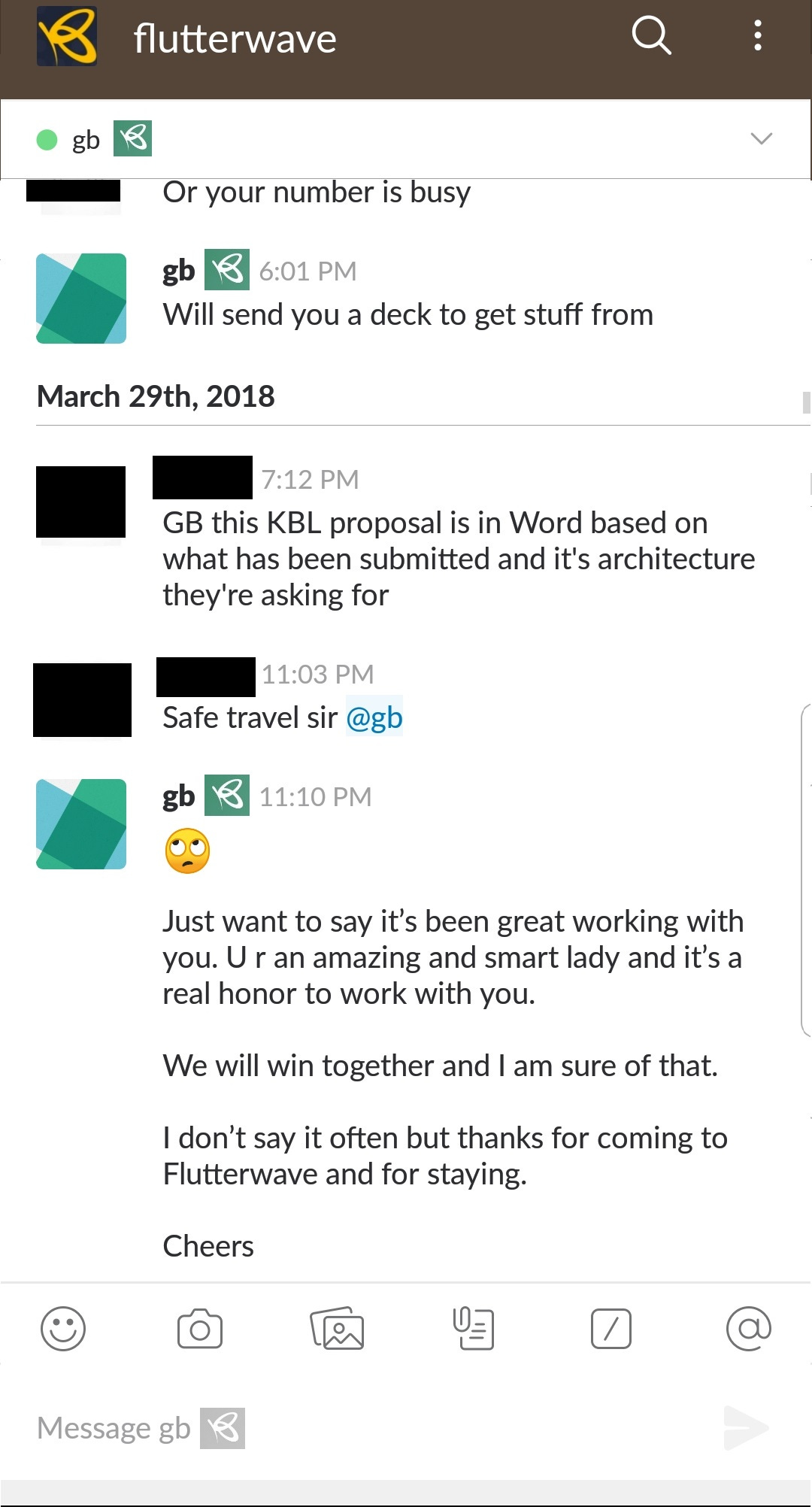

None of this came as a surprise at that point. Since my introduction to the weird internal world of Flutterwave in October 2021, I had witnessed erratic behaviour, sudden panic attacks, group bullying and inexplicable bad faith actions by current and ex staff among each other, competing to get into the good books of a larger-than-life founder who has transcended his birth name, and is now only known by his initials, “GB.”

Thinking of Flutterwave as simply a business that processes electronic payments would be like thinking of the New York Mafia as a group of pizza shop owners – there certainly is that, but there is also so much more going on under the hood. This is precisely why I intentionally leaked word of my story 3 weeks ago in hopes of seeing what else this cage-rattling would uncover. I say “what else” because contrary to what I told most of the 17 current and ex-Flutterwave sources I spoke to, this is not in fact, a story about sexual harassment or workplace bullying. It’s not that those things aren’t present in this story – it’s that the real story makes them seem positively trivial in comparison.

Before we get into that, here is a quick round-up for the benefit of readers who have been living under a rock for the past 3 weeks. After my head fake 3 weeks ago, Flutterwave eventually blinked first and pushed out a lengthy press release attacking 2 former employees suspected of being my sources, including former Flutterwave Head of Implementation, Clara Odero. This turned out to be a mistake. Clara, who runs Credrails these days and does not lack a spine of her own, decided to hit back. A few hours after the Flutterwave press release went out, this happened:

Something has been happening for almost five years I am ready to put a stop to.

I have had my name dragged,maligned and been bullied by a powerful man in tech. It ends today.

— Clara (@WanjikuClara) April 4, 2022

If you’re all caught up, it is now time to dive into a story that is a lot more sinister than you would think. To take us through this weird timeline of events from 2016 to date, I will introduce my 4 principal sources and co-narrators. “Jennifer,” “Ose”, “Sheyi” and “Temi” are the names chosen to shield their identities. Apparently, merely being suspected of speaking out against Il capo di tutti i capi – he of the double consonant initials – could be a red card for any subsequent efforts to work in Nigeria’s small and highly incestuous tech space. Preserving their anonymity is key, so the only detail that will be volunteered is that they are all among the first set of Flutterwave staff, and they all left the company between 2018 and 2021. Here are their stories.

Jennifer: The Consultant Versus The (Lack Of) System

GB somehow convinced Jennifer to take the plunge into a 16 month-old fintech startup. Apparently, GB is blessed with the gift of persuasion, which becomes a recurring theme in the course of this story. Key to Jennifer’s decision to turn down an already-accepted, cushy job offer at one of Nigeria’s largest banks was the once-in-a-lifetime opportunity to join an early stage high growth startup and take advantage of its stock compensation plan. Over and above simply earning a salary, such shares in a sufficiently valuable startup can be financially life-changing. Flutterwave was not coy about it either. The offer was printed in her employment letter, and then in her confirmation letter 7 months later.

She also had no problem with performance on the job, as evidenced by the following documents from her case, which is currently at the National Industrial Court where she is locked in litigation with Flutterwave.

According to court records, Jennifer’s problems at Flutterwave began when – for whatever reason – she fell out of favour with GB despite clearly having no issues with job performance. A list of witnesses in the case summary reveals a list of Flutterwave staff who joined the company around the same time or even later, and some of whom resigned before she did. They all received the stock options promised to them. Jennifer however, did not, despite repeatedly bringing up the subject with GB.

For legal purposes, Jennifer did not agree to be quoted directly in this story, but she did however confirm that former Flutterwave CEO Iyinoluwa Aboyeji signed off on the letter offering her 40,000 shares, which at current market valuation, are worth roughly $2 million. This letter however, vanished into a black hole shortly thereafter, when Iyin was abruptly and unexpectedly fired by GB, leaving him locked out of all company resources including his official email. (More on that later too.)

GB meanwhile, continued to sign off on stock option offers for his preferred office favourites, which created a confusing situation for Jennifer. On the one hand, he continued to praise her work regularly and she consistently met or exceeded her performance targets. On the other hand, only those who kissed the metaphorical ring would get these entitlements that were written in their job offer letters.

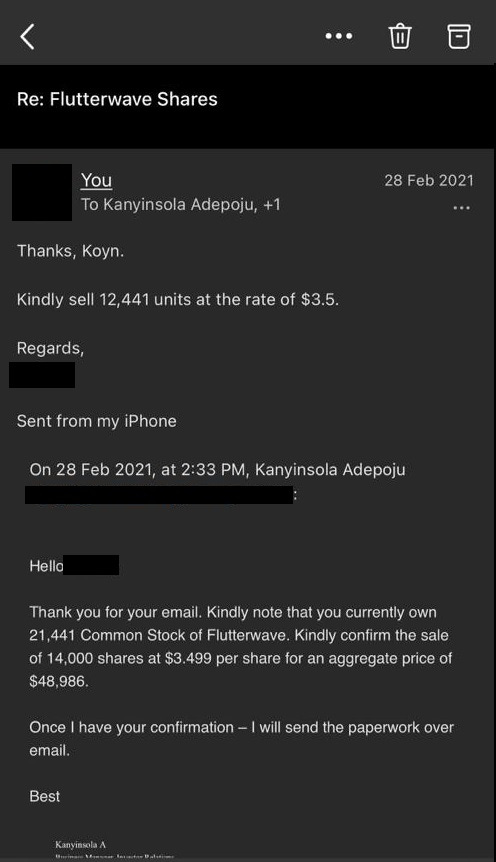

Perhaps more meta was the fact that even those who managed to get their stock packages ended up receiving pitiful offers that were far below market value for their shares. In February 2021 for example, this ex-employee who asked to be completely anonymous was given an offer of $3.50 per share.

The actual market value of Flutterwave shares, as explained in a recent call with a potential Flutterwave investor below, was closer to $20. In other words, GB only permitted this (apparently fortunate) employee to get roughly 17.5 percent of the value of his shareholding. These shares, I was reliably informed, are only permitted to be sold to an investment vehicle controlled by none of other than GB himself at the price he decides. Anywhere else, this would be classified as insider trading. In Nigeria?

It’s Tuesday.

Another source I briefly spoke to claimed that it was after a recent conversation with Iyin about her shares while facing this very issue that the tweet below materialised. Feel free to draw your conclusions.

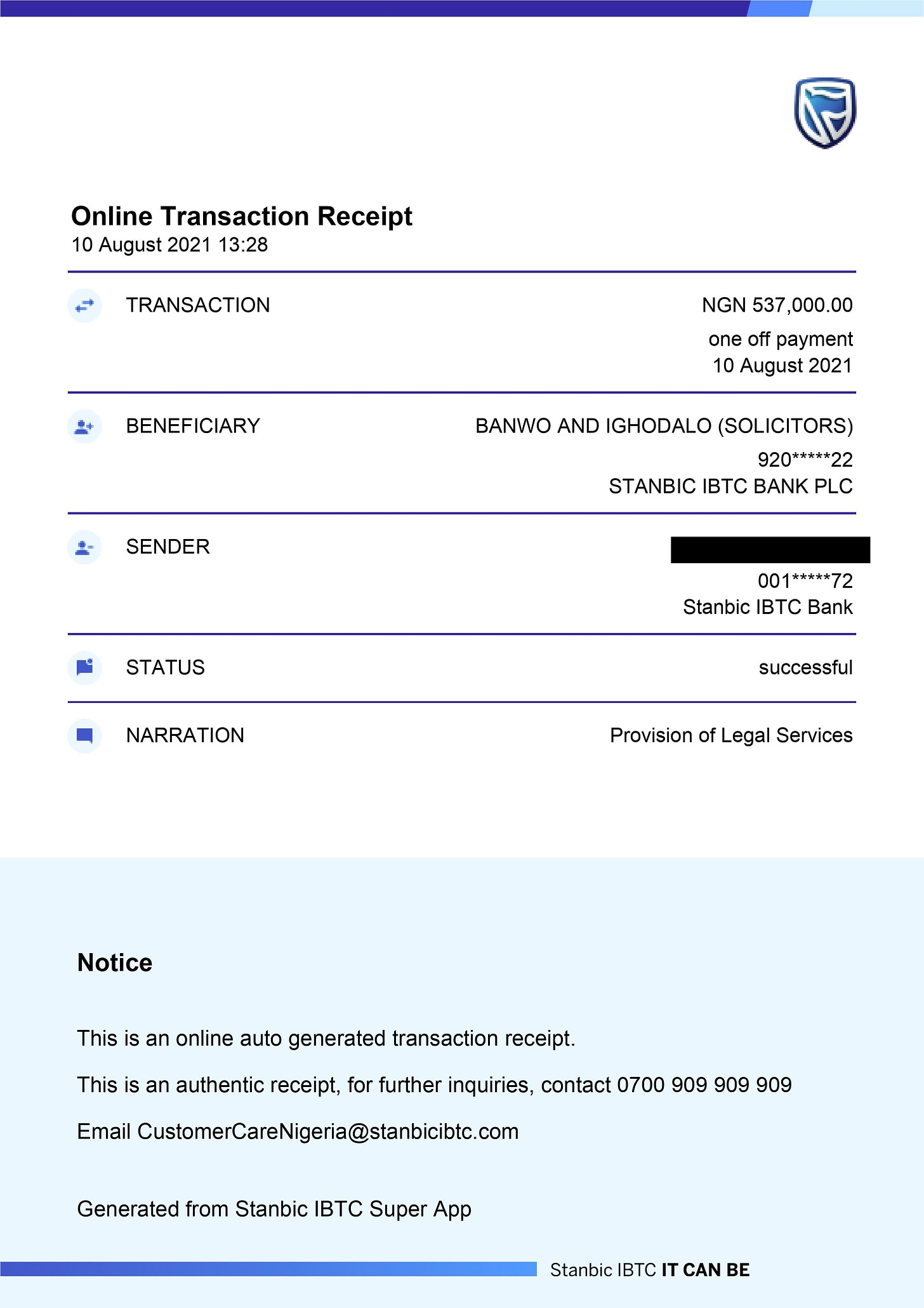

In any case, Jennifer felt strongly enough about the injustice done to her that after leaving Flutterwave in 2021 without any resolution, she decided to go to court. She retained the high-flying law firm Banwo & Ighodalo to work on her case. Payment was made and things seemed to be moving well.

Suddenly and without notice, shortly after presenting a professional opinion stating that Flutterwave was in the wrong and had a case to answer, B&I quietly informed Jennifer that they had been retained by Flutterwave and they would have to drop her case. Apparently whenever Flutterwave wants anything in Nigeria – ethical or not – GB just signs a cheque and makes any problem go away.

In fact as I found out the further I dug into this maze of documents and recordings, the only way for a Flutterwave employee or ex employee to ensure that GB pays them what they are owed is to weaponise a relationship with one of his investors. He only responds to superior power, not threats, pleas or even lawsuits. The fellow below apparently learned that lesson and used it well.

Ose And Temi: Flutterwave OG’s Break The Omerta

Now let’s take a step back 6 years. The year is 2016 and Iyin Aboyeji has just announced what to all intents and purposes is his new venture called Flutterwave, fresh from exiting Andela. Olugbenga Agboola is the CTO and Co-Founder of Flutterwave, having resigned from his job at Access Bank to take this exciting new dive into burgeoning tech space. Or at least that’s what his LinkedIn page says anyway.

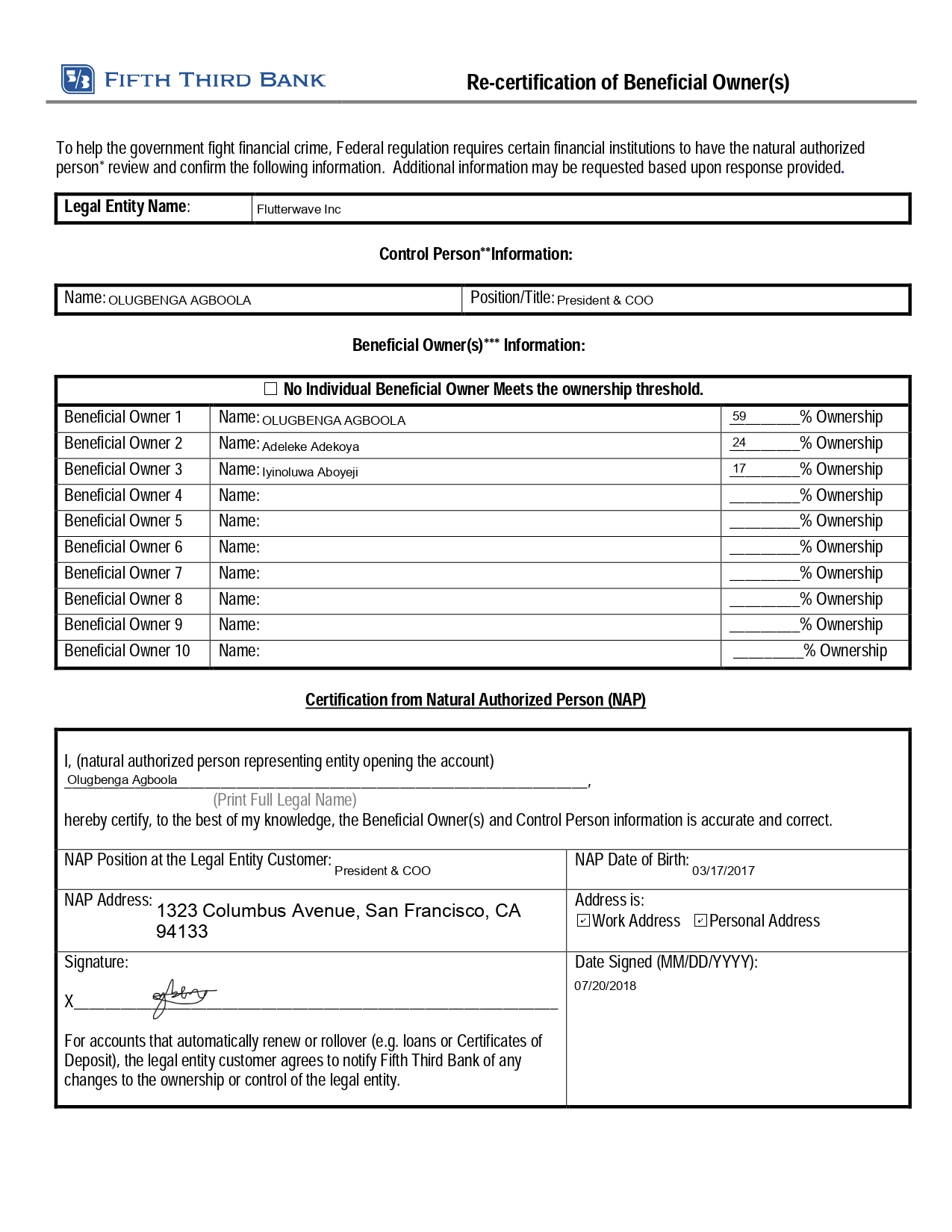

In reality, as I found out to my mounting amazement, Iyin Aboyeji was never anything more than a corporate front for GB who in fact never resigned from his job at Access Bank, and hid the fact of his concurrent involvement in both entities from investors, regulators and even his Access Bank colleagues. I will repeat that for emphasis: Olugbenga Agboola kept his job at Access Bank while building Flutterwave concurrently for at least 2 years while using a young tech figure as the convenient face of his business. Here is evidence.

In case you are thinking that this was some kind of innocent oversight or victimless crime, consider the next set of top secret messages you are about to see. These messages were as incredibly difficult to obtain as they are damning. In the message below, GB reveals to an employee that he will be “acting as Access Bank” in an interaction, effectively representing a bank he works for while using its resources to drive his personal interest at Flutterwave. Or Insider Dealing, as that is otherwise known.

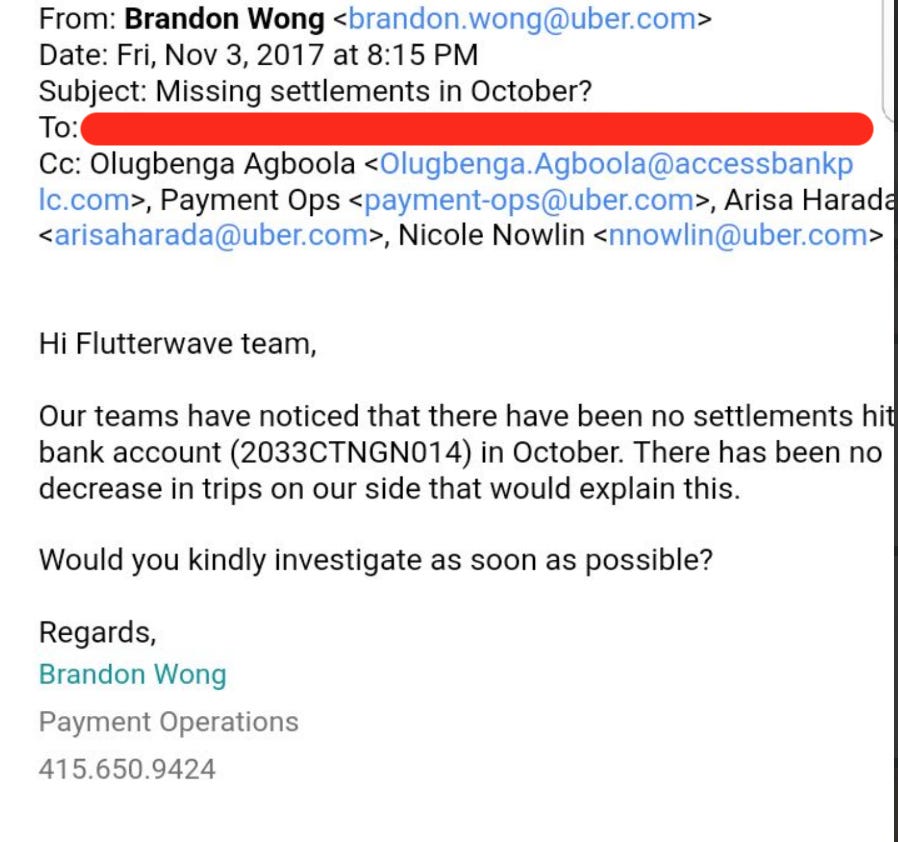

In the message below, GB instructs an employee to advise an external party about the attendance of Flutterwave’s banking partner Access Bank, represented by Adeleke Adekoya at a meeting. The problem is that Adeleke Adeokya at the time also happened to be a Flutterwave co-founder. In other words, for at least 2 years, GB had free reign to use Access Bank assets to benefit Flutterwave without the knowledge of Access Bank or most external Flutterwave stakeholders.

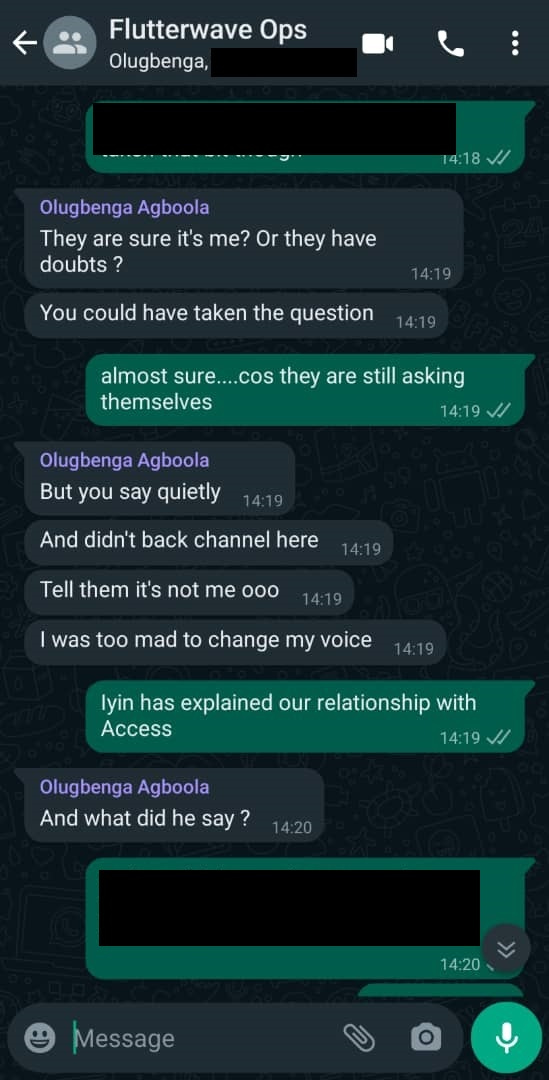

In the messages below, GB is seen enjoying a hearty laugh at the tail end of his time with Access Bank after the bank has found out about his incredibly illegal insider trading arrangement and promptly booted him out. Instead of contrition or humility, he urges employees to approach questions about the illegality with a bold face and throw the onus back to the questioner.

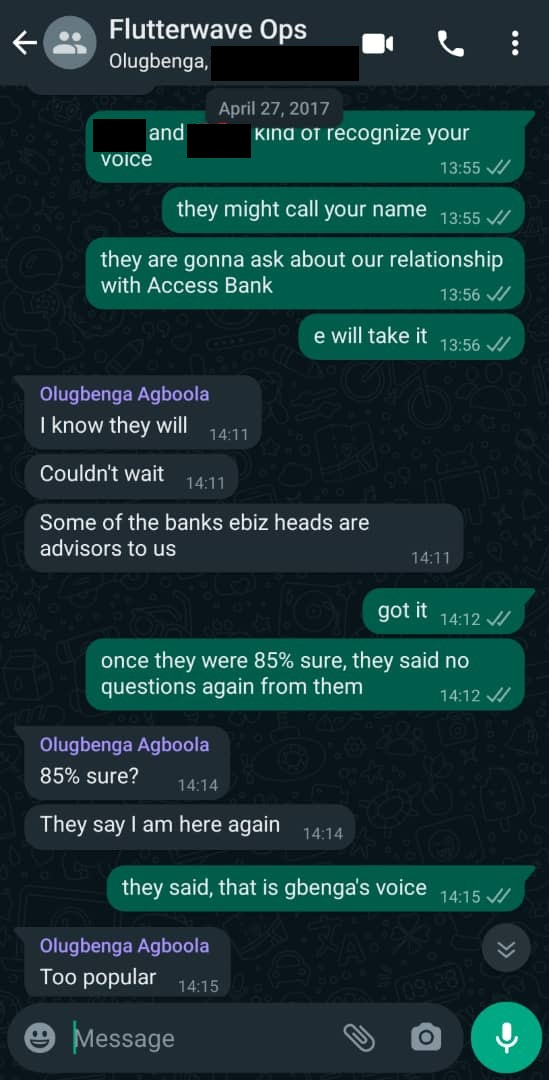

Finally and most significantly, the messages below portray in his true element. Present at a Flutterwave remote meeting while still concealing his involvement in the company from outsiders including Access Bank, he forgets that Iyin is supposed to be answering questions as Flutterwave’s “CEO,” and he jumps in to take charge of the meeting, only realising afterward that he forgot to alter his voice, potentially revealing his true identity as Gbenga Agboola to the other parties on the call. He then instructs an employee to lie that he was not the one whose voice they just heard.

In this message from April 2017, GB remarks that he is being too popularly identified with Flutterwave for his liking. At this point, he is still pretending to be Olugbenga Agboola, Head of Digital Factory & Innovation, Access Bank, while his official Flutterwave email address deliberately does not include a name tag yet.

And just in case there is still any doubt about exactly whose show Flutterwave was all along, the message below from April 2017 shows GB promising that Flutterwave staff including Iyin the CEO will “chop cane” (take a beating), ostensibly for poor performance on a crucial call.

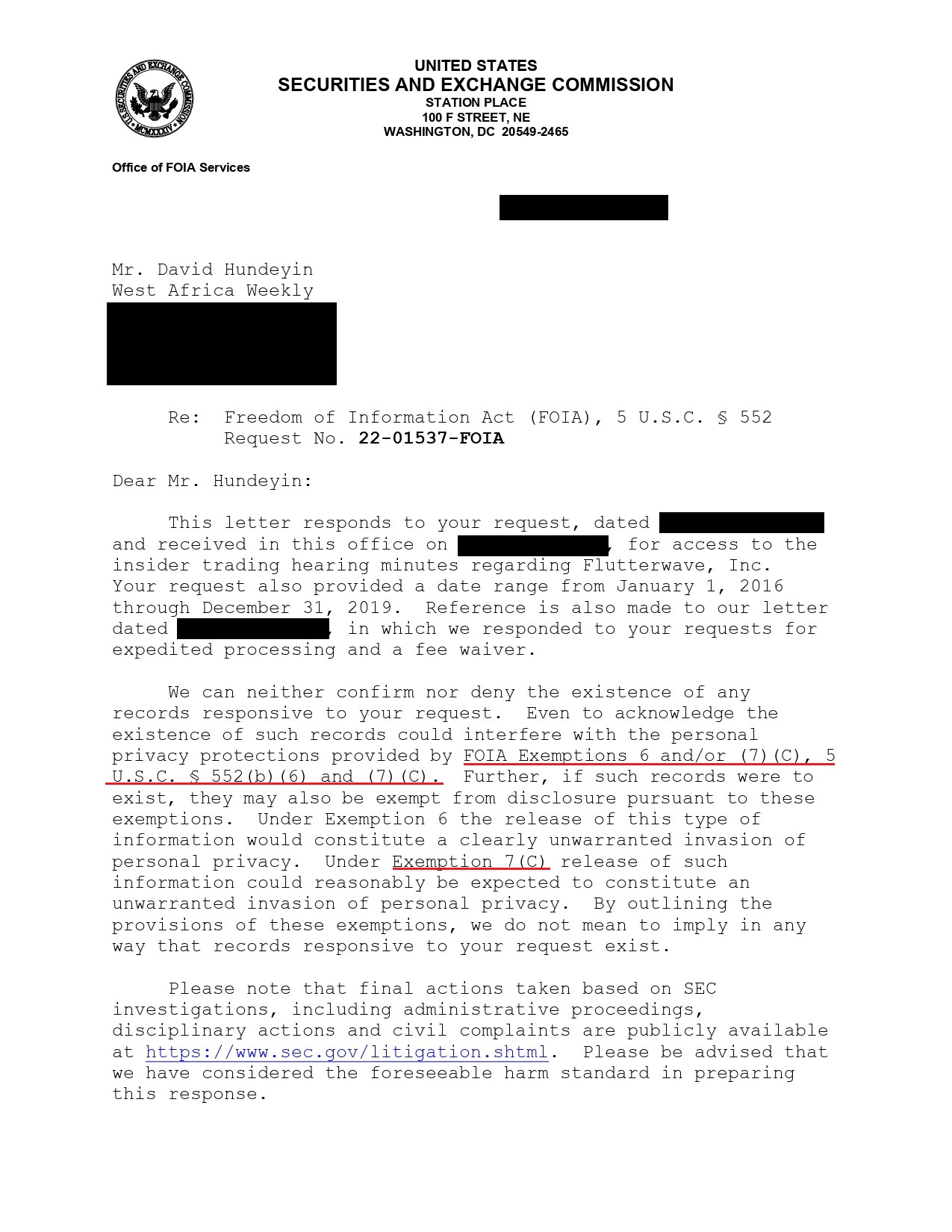

In early 2018, news about this unholy arrangement got to the United States Securities and Exchange Commission (SEC), which has jurisdiction over the Delaware-registered corporation. Under US law, a conviction for insider trading carries a criminal sentence of up to 20 years in prison.

According to several sources, GB, Iyin and – for some reason – Herbert Wigwe flew to the Washington DC for an SEC hearing where they allegedly testified under oath that GB never worked simultaneously at Flutterwave and Access Bank. To confirm whether this actually happened, I submitted an information request to the SEC under the US Freedom Of Information Act (FOIA).

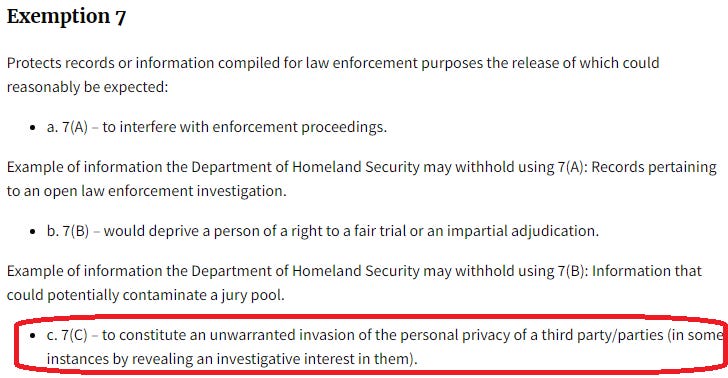

Since exemption 7C was mentioned 3 times in the FOIA request rejection, I looked it up and this was what I found.

Whether this means that the SEC currently has an open investigation on Flutterwave, only the Commission itself can answer. I did however, submit an appeal, so we wait and see.

Remember “Greg Agboola” mentioned briefly at the outset? It turns out that not only does GB have a habit of changing his voice so as to pretend to be other people on conference calls, but he also changes his entire identity when it is convenient to do so. In 2016 for example, at the commencement of business, Adeleke Adekoya was given 37.5 percent of the company, with the remaining 62.5 percent supposed to be divvied up between GB and Iyin. GB then informed Iyin that there was a CTO called “Greg” who would need to be given 10 percent, which would be taken out of Iyin and Leke’s shareholdings.

Which would be fair and unspectacular were it not for the small fact of Greg and GB being in fact, one and the same person.

At this point, I will take a back seat and let the two co-narrators Ose and Temi have a “conversation” which I put together from their lengthy testimony transcripts.

[Ose]: “He is currently trying to shaft investors in addition to everyone else. So the first Angels that they had – he wants to do secondary buyouts, while they want to IPO. And so he will tell them a price that was from several [funding] rounds before like they can’t find the [current price] information themselves. In Nigeria, the reason they had so many chargebacks with Arik was because they were charging cards 3 times. In fact the reason no one has bought Flutterwave is that a majority of their transactions would never pass compliance.”

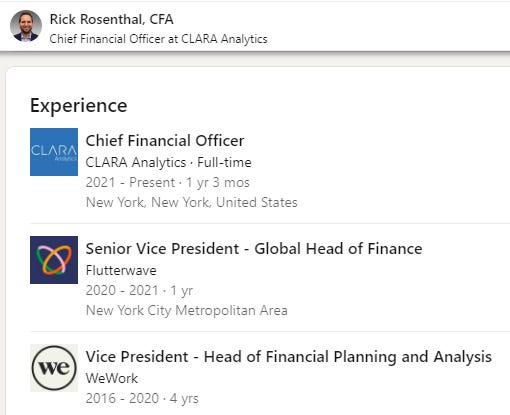

[Temi]: “Someone sent an email detailing all these fraudulent activities to every investor on the cap table, and they are all aware and they talk about it, but they did nothing. After that incident, they put spyware on everyone’s computer. The thing is, if Flutterwave goes down, everyone who is invested takes a hit, and it becomes a problem of who is left holding the bag. Greycroft is the biggest enabler of all of this because they have known this for years, but they keep pushing Flutterwave stock. The company can’t even make it to IPO because when you IPO, you have to show your financials. I don’t know what kind of cooking they’ll have to do with those financials, but the numbers don’t match up. I mean this guy went out and hired the WeWork CFO! I’m not saying there’s anything wrong with that but really? He couldn’t find someone else?”

[Temi]: “You just need to find someone at Access Bank who is willing to talk because when they were audited during the Access-Diamond merger [Q3 2018], they discovered that Flutterwave wasn’t giving them their money. What they discovered was that Flutterwave had been settled, but for some reason, what was supposed to be the bank’s share from these transaction was being settled into Flutterwave’s account and Flutterwave was not remitting it to Access. Why it was even there in the first place is not clear.”

[Temi]: “When Arik had the customer data leak and everyone tried to make it seem like it wasn’t a big deal? We knew. We knew, but GB is the kind of person who likes to kick the can further down the road and deal with it later. The problem with that is it becomes so much bigger later, which is what happened. They didn’t secure the data bucket when they should have. I can confirm that the leak was from Flutterwave. We didn’t secure the information.

Now at least they use AWS. At the very beginning, they were using GB’s aunt’s company as the cloud services provider. Flutterwave is a crime scene from every angle. There is nothing that is 100 percent there. They eat from every corner. GB is also a very insecure man. He doesn’t speak well, he’s not polished and it comes off in how he speaks to people. And now here is a chance for him to be loved finally. So he is doing everything he can to buy the love by getting onto everybody’s cap table, but he’s also doing it to spread his risk because Flutterwave is going down. You can sell investors the IPO dream, but to IPO, you have to put your numbers in order.”

[Ose]: “The thing with how the African tech investment space works is that there’s one white boy who comes in, then the other white boys rush in because of FOMO. There are only a couple of people who do proper due diligence when they come in, such as one of the early Alibaba investors who passed on the most recent Flutterwave funding round. Others just don’t like the man [GB] – they think he’s extremely rash and there’s no substance there. So I’ll speak to investors and they say “He’ll tell us he’s building the Stripe for Africa. Next meeting he’ll tell us he’s building the PayPal for Africa. Next meeting he’s building the Square for Africa. And when you ask him “GB what’s the plan?” he goes “Trust me, I’m going to do it. Just trust me I’m going to make this happen.” ”

I reached out to Mastercard for a statement regarding their constant problem with fraudulent transactions and chargebacks on Flutterwave, as well as the complaints of of insider trading that also dogged Adeleke Adekoya when he subsequently moved on to Mastercard allegedly without declaring his conflict of interest as a Flutterwave co-founder.

The statement from Birgit Deibele, Director of Communications, Mastercard Sub-Saharan Africa read as follows:

Thanks for your note and the opportunity to address your questions. With respect to your first point on chargebacks, while we cannot speak to any individual case, we can share that we hold all our Franchise participants to high standards. If we identify or are alerted to potential violations to our rules, we quickly investigate and take appropriate remedial action with the bank that connects merchants to our network. And, regarding your question about Mr. Adekoya, he is no longer employed by the company and there’s not much more we can share with respect to his tenure. That said, we would note that under Mastercard’s Code of Conduct, Mastercard employees are required to disclose potential conflicts of interest.

Sheyi: Flutterwave’s Susan Fowler Moment?

A few weeks ago, while trying to squeeze out all available information from my noticeably reticent sources, I engaged in a little psychological warfare. First, I tweeted an intentionally vague message designed to trigger the relevant consciences.

Hot Tip: When a journalist reaches out to you for your comment on the antics of an abuser who is known to you, there is no need to go down with them in the name of loyalty.

Either spill the beans or say "No comment."

Don't lie on their behalf. The journalist already knows.

— David Hundeyin (@DavidHundeyin) February 21, 2022

Then writing in my BusinessDay column a few weeks later on March 21, I brought up the story of Susan Fowler, the 25 year-old female developer whose brave and detailed takedown of Uber’s toxic internal environment set a domino sequence of events in action, ultimately leading to the fall of former Uber CEO Travis Kalanick and a tsunami of similar action across the global tech industry.

I hoped at least a few of my tight-lipped female sources might read it and be inspired by the bravery of a woman who was younger than them when she decided to take on the world. One of these female sources was “Sheyi,” who was once a close friend of GB and whom – every other source mentioned in this story stated matter-of-factly – had a sexual relationship with GB. Ose and Temi recall watching Sheyi have tearful public meltdowns in front of the entire office, hurling colourful language at GB without so much as a light censure in return. Sounding noticeably wistful, Temi remarked:

“She was GB’s plaything, and GB has plenty of playthings but hers was the worst. Even after leaving Flutterwave, she is not still free of him because he made sure Flutterwave got a financial interest in the new place she works. Part of the reason some of us are doing this is to try to free our sister from bondage. She can do so much more with her life than this. This is like slavery.”

A couple of days after the BusinessDay column, I reached out to Sheyi for a possible tell-all. Our Zoom conversation lasted for about 15 minutes, and in the conversation, she hinted very strongly that the things I had heard were true. She neither confirmed nor denied having had a sexual relationship with GB, choosing instead to say that the circumstances of her exit from Flutterwave “were very difficult.” People often reach out to her she said, asking whether to accept an offer from Flutterwave, and she has no idea what to tell them or how to explain it.

Despite this veiled admission, Sheyi stated that she was not sure she was “emotionally ready” to tell her story yet, so she would need to sleep on it before giving me an answer. I got my answer the next morning:

Ordinarily, this should have been where the story ended as far as sexual harassment at Flutterwave goes – a dead end. There was apparently too much fear, shame and plausible deniability to get the actual victims of workplace predation to speak out, not least because none of the other presumed victims I spoke to had any notion of sexual propriety on the part of a powerful entity. As far as they were concerned, the fact that it was not rape made it fully consensual, which therefore made it their fault (and possibly their own personal shame) for agreeing to sleep with their boss.

GB himself openly subscribes to this point of view. In 2019, a guerilla Twitter and email campaign against he and CCO Ife Orioke by an anonymous account called “Eko Minaj” resulted in the loss of a potential investor. The anonymous campaigner repeatedly accused him of abusing his position of power by using it to sleep with multiple women at Flutterwave alongside Ife, who happens to be his brother-in-law. I managed to get my hands on a copy of the email thread that went to the investor, causing him to pull the plug on the deal.

Enraged by the loss of investment and loss of face, immediately he convened a Flutterwave town hall to address the allegations of sexual misconduct. The problem is that while the entire campaign was about allegations of sexual and financial misconduct specifically regarding he and Ife Orioke, his rambling town hall speech made generous references to a “right to a personal life,” “right to privacy” and non-invasion of work colleagues into personal space. Nothing about the responsibility of a leader to not take advantage of the less powerful. At a point he exclaimed in the recording below, “Some people are married on paper, but that’s their business!”

The unspoken but clear inference from this town hall was that as long as whatever he did with the opposite sex at Flutterwave was fine as long as it was “consensual.” The town hall address portrayed not an innocent blackmail victim or a contrite person, but an angry and defiant man talking about “fighting back” against the anonymous campaigner.

It is important to point out that this view of what constitutes consent has long been disproved by clinical research. A 2018 study led by Vanessa K. Bohns, Associate Professor of Organizational Behavior, Cornell University revealed that in relationships with an uneven power dynamic such as those between a boss and a subordinate, even simple, polite requests can feel like directives when they come from the person in the position of power. Psychologist Adam Galinsky dubbed this the “Power Amplification Effect,” and Prof. Bohns’s conclusion on the subject reads as follows:

“People in positions of power cannot be trusted to recognize abuses of power they may commit when engaging in a romantic relationship with a subordinate. That ultimately leaves it up to the subordinate to recognize and highlight such abuses if and when they occur.”

One does not of course, need a clinical psychologist to explain why a boss allegedly sleeping with multiple employees is wrong, regardless of however “consensual” such relationships might be. There is for example, the risk of favoritism, which could ultimately lead to poor corporate governance or poor business performance. There is also the obvious risk that everyone finds out, which in itself is guaranteed to create an unpleasant work environment – but of course the head honcho at Flutterwave knows all of this.

As Ose repeatedly stated, the problem always comes down to the fact that this is Nigeria and there are no consequences for bad behaviour. “Who is going to stop you?” she says. Paradoxically, it could well be Sheyi herself who ends up answering that question if and when she decides to speak up.

My final trick was to lay my hands on a secret recording whose existence she was probably unaware of until this moment. In this recording (which I have digitally distorted to conceal her real voice) she promises that one day, given the right push, she will put out a blogpost about her time at Flutterwave and she will “shut the company down.”

Sheyi and most of her co-travelers may not yet be ready to speak up and have their own Susan Fowler moment, but many like “Ose,” “Temi,” “Jennifer” and Clara Odero are currently having theirs. How long is left for what could well be Africa’s most sophisticated fraud operation led by “a Yahoo Boy wearing a suit” as Ose colourfully described him, may just depend on the outcome of this SEC FOIA appeal.

Tick-tock.

Read more: Suicide, Fraud and Phillips Consulting: The Story Of West Africa’s Chinese Loan Shark Mafia

How to Spoof an Entire Career: The Curious Story of Kemi Olunloyo

About The Author

Related Articles

Ghana Shares Gold Mining Model With Tanzania

Ghana has taken a leading role in shaping Africa’s future approach to...

ByWest Africa WeeklyJanuary 23, 2026West African Proposes Alternative Plan as Burkina Faso Seeks Larger Stake in Kiaka Mine

West African Resources has submitted an alternative proposal to the government of...

ByWest Africa WeeklyNovember 28, 2025Barrick Gold Backs Down as Mali Tightens Control of Its Mining Sector

After more than two years of standoffs, seizures, legal battles and diplomatic...

ByWest Africa WeeklyNovember 26, 2025Surviving Poverty Through Pollution: A Day in the Life of Adamawa Bola Boys

Before leaving Lagos, I was sure that I had left behind memories like...

ByBankole Taiwo JamesNovember 20, 2025

Leave a comment