VNV Global Slashes Value of Wasoko Holding by 48% Amidst Planned Merger with MaxAB

Swedish investment firm VNV Global, known for supporting startups in various sectors including mobility, health, and marketplaces, has reduced the value of its holding in African B2B e-commerce startup Wasoko by 48%, according to its 2023 annual report.

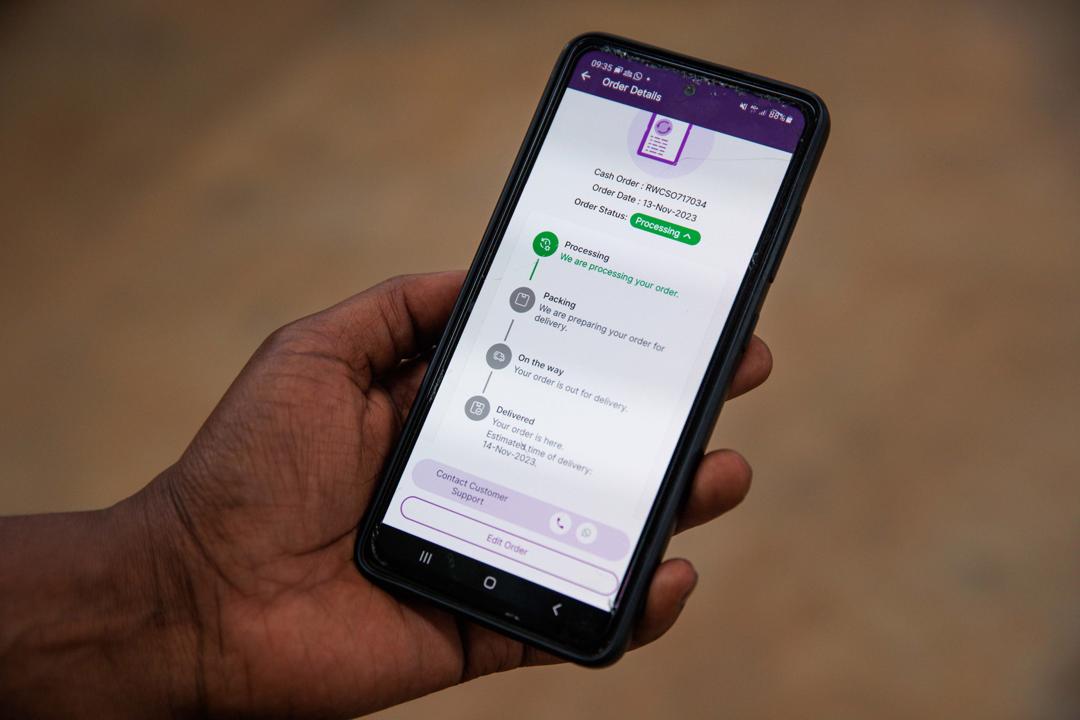

In the report, VNV set Wasoko’s fair value at approximately $260 million as of December 2023, coinciding with Wasoko’s announcement of its planned merger with Egyptian counterpart MaxAB. This valuation is based on VNV’s 4.2% stake in the startup, valued at $10.9 million.

This markdown is not the first for Wasoko by VNV. In Q4 2022, Wasoko was valued at $501 million, shortly after closing a $125 million Series B investment round led by Tiger Global and Avenir, valuing the company at $625 million. However, complications arose as Wasoko disclosed to TechCrunch in December 2023 that it only received $113 million of the total funding raised in that round. VNV Global had invested $20 million in that funding round.

VNV Global bases its fair value estimate on a valuation model utilizing trading multiples of public peers rather than historical funding rounds.

Wasoko expressed pride in having VNV Global as a major investor and clarified that VNV has not reduced its shareholding in Wasoko. The company remains supportive, including through the merger with MaxAB. Wasoko emphasized that it is not involved in VNV’s internal reporting but views VNV’s continued holdings as indicative of expected long-term value growth.

VNV Global’s report preceded the MaxAB merger announcement. The investment firm, formerly known as Vostok New Ventures, has divested from Russian startups and plans to retain its stake in Wasoko post-merger. The firm’s spokesperson highlighted their long-term investment approach and expressed confidence in the combined company’s potential for substantial growth in the years ahead.

Read: Son of Guinea-Bissau Ex-president Jailed in U.S for Heroine Trafficking Conspiracy

About The Author

Related Articles

Ghana Seeks Stronger Trade and Investment Relations With Nigeria

Ghana is pushing for deeper trade and investment cooperation with Nigeria as...

ByWest Africa WeeklyMarch 9, 2026Ghana and Malawi Strengthen Digital Cooperation at Global Tech Summit

Ghana and Malawi have agreed to strengthen cooperation in digital technology development...

ByWest Africa WeeklyMarch 9, 2026ECOWAS Moves Forward With Plan for Single West African Currency

The Economic Community of West African States is continuing discussions aimed at...

ByWest Africa WeeklyMarch 9, 2026Ghana Records Sharp Drop in Inflation, Lowest Since 2021

Ghana’s inflation rate dropped to 3.3 percent in February 2026, marking the...

ByWest Africa WeeklyMarch 5, 2026