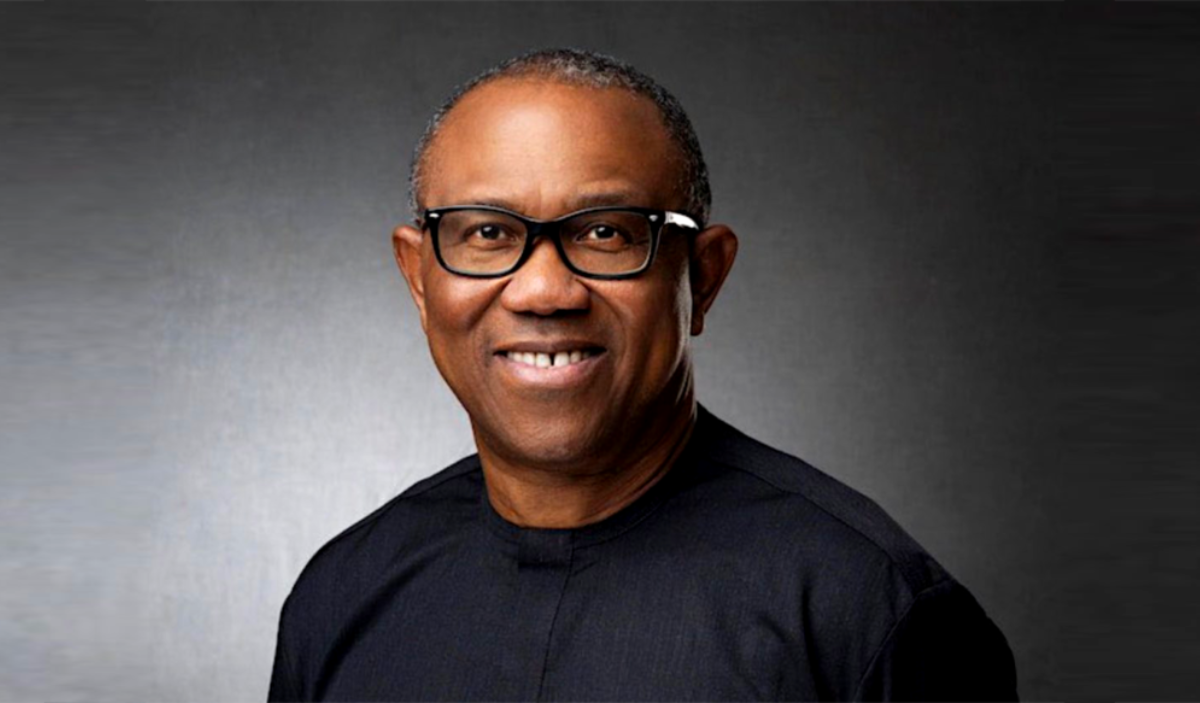

The vintage Onitsha-based trader and Opposition Leader, Peter Obi has expressed crucial opinionated criticism over the recent decision of the Central Bank of Nigeria on its increased Monetary Policy Rate, MPR, to 22.5% and Cash Reserve Ratio of 45%.

On his official X handle, Obi posited that insecurity and tightening liquidity in the financial system do not improve productivity, that is, food production, which is the primary cause of inflation in Nigeria.

Earlier, West Africa Weekly reported the recent move by Nigeria’s Central Bank Governor, Yemi Cardoso, on the directives to increase the nation’s MPR to 22.5% with a CRR of 45%, a move Obi faulted to worsen the economic situation in Nigerian households further.

Obi however expressed that a 30% increased interest rate on manufacturing sectors, which mostly rely on bank loans and credit facilities will make it difficult to repay, which has the potential to cause increased unemployment.

Tightening liquidity in the financial system does not improve productivity, i.e. food production, which is the major cause of inflation in Nigeria, he stated.

Moreover, in his submission, he stated that the most critical way to manage Nigeria’s high rate of inflation and decline in production is for the government to address the issue of insecurity in the country, which will allow for increased food and crude oil production, and an overall increase in production, which will make products, especially food, cheaper.”

Read more: Most kidnap incidents are not real – Nigerian Police

About The Author

Mayowa Durosinmi

author

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Mayowa Durosinmi

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Related Articles

Zimbabwe Rejects $350m US Health Deal Over Sovereignty Dispute

Zimbabwe has formally withdrawn from negotiations on a proposed $350 million health...

ByWest Africa WeeklyFebruary 25, 2026Niger’s President Outlines Vision for Strategic Partnership with China

Niger’s Head of State, General Abdourahmane Tiani, has articulated a renewed vision...

ByWest Africa WeeklyFebruary 25, 2026Fire Destroys 140 Tonnes of Cotton in Western Burkina Faso

A major fire has destroyed more than 140 tonnes of cotton in...

ByWest Africa WeeklyFebruary 25, 2026Mali’s New Ambassador to Angola Presents Credentials, Pledges Stronger Bilateral Ties

Diplomatic relations between Mali and Angola entered a new phase on February...

ByWest Africa WeeklyFebruary 25, 2026