Oando Says It Recorded N78 Billion Loss in 2022

Oando Plc has released its 2022 Annual reports, consolidated and separate financial statements, revealing a staggering N78.71 billion loss.

According to the company, this result comes seven months after its audited results for the financial period ending December 31, 2021, were released on the Nigerian Exchange Limited.

The 2022 results showed that the group’s net loss for the year stood at N78.71 billion from a profit of N35.82 billion in the preceding year. Despite revenue growth to N1.99 trillion from N804 billion in 2021, the cost of sales and finance cost led to a significant loss.

The directors have decided not to propose a dividend for the year ended December 31 2022.

Oando Plc also recorded a foreign exchange gain of N32.91 billion in 2022.

However, an independent auditor’s report raised concerns about the company’s future, which is growing due to its negative asset position and funding shortfall.

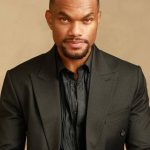

In response to the results, Wale Tinubu, Group Chief Executive of Oando Plc, cited challenges, including pipeline vandalism and increased interest rates, but outlined measures to bolster production and cash flows.

Commenting on the results, he said

“The heightened militancy and pipeline vandalism acts within the Niger Delta region dealt a substantial blow to our upstream operations, resulting in a marked reduction in our crude production volumes due to the protracted shut-ins for repair following each incidence. This was further compounded by a major gas plant fire incident which also necessitated a lengthy downtime.

“Furthermore, a rise in our net interest expense due to increased interest rates on several of our major facilities in line with global rates increases also contributed to our Loss after Tax position.

“In response, we have put in place definitive measures to bolster our production and cash inflows and ensure a speedy return to profitability by collaborating with our partners to institute a comprehensive security framework aimed at permanently curbing persistent pipeline vandalism while concurrently exploring inorganic growth opportunities to increase our reserves and production capabilities. We have also strategically restructured our key facilities to ensure they align with our cash flow dynamics,” he said.

Read: Yahaya Bello used N829m of state funds to pay child’s school fees in advance – EFCC

About The Author

Related Articles

Night Gunfire Near Presidential Palace Sparks Tension in Ouagadougou

Gunshots were heard late on the night of February 28 into March...

ByWest Africa WeeklyMarch 3, 2026Uganda to Start Domestic Gold Purchasing Programme to Boost Reserves

Uganda’s central bank has announced plans to launch a domestic gold buying...

ByWest Africa WeeklyMarch 3, 2026Ghana’s Cedi Expected to End 2026 Around GH¢12.85 to the Dollar

The Ghanaian cedi is projected to hold relatively steady against the United...

ByWest Africa WeeklyMarch 3, 2026Malian Prime Minister Presents 2025 Government Report, Pledges Stability and Reform

Mali’s Prime Minister, Major General Abdoulaye Maïga, has presented the government’s 2025...

ByWest Africa WeeklyMarch 2, 2026