Nigerian Fintechs Halt New Account Openings Following Regulatory Directives

Several prominent Nigerian fintech companies, including Kuda Bank, Moniepoint, OPay, and Palmpay, have ceased opening new customer accounts following a directive from the Central Bank of Nigeria (CBN). The move comes two days after the Economic and Financial Crimes Commission (EFCC) blocked 1,146 bank accounts in unauthorised forex dealings.

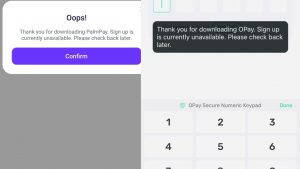

A notice on the website of one leading fintech startup stated,

We’ve temporarily paused new signups on our platform. This means that you’ll be unable to open a new account now. We apologise for any inconvenience this may cause.” As of now, West Africa Weekly has confirmed the inability to open new accounts on the affected fintech apps.

However, customer deposits and banking activities remain unaffected by these measures.

In the past year, fintechs have faced increased scrutiny over their account opening processes. In October 2023, Fidelity Bank blocked transfers to OPay, Palmpay, Kuda, and Moniepoint due to concerns that lax Know Your Customer (KYC) processes led to a rise in fraud incidents. Subsequently, the CBN introduced new KYC rules for all financial institutions, seemingly targeting fintech startups.

The recent directive to halt account openings is believed to be linked to an ongoing audit of the KYC processes of these fintechs, according to an executive at one affected fintech. The pause is described as “temporary.”

On April 26, the CBN and the National Security Agency (NSA) engaged in discussions with representatives of the affected fintechs. It is reported that the CBN expressed concerns about crypto traders exploiting fintech platforms to disrupt the foreign exchange (FX) market. Additionally, the banks’ better relationship with regulators compared to fintechs may have influenced the decision.

An executive at one of the affected fintechs indicated that the directive is connected to the EFCC’s investigation into bank accounts involved in unauthorised FX dealings. However, an analysis reveals that only 10% of the blocked accounts belong to fintechs, with the majority being commercial bank accounts.

While an NSA spokesperson denied any link with the directive to halt new account openings, the CBN did not immediately respond to requests for comment.

In March, the CBN raised concerns about the manipulation of the naira by speculators, leading to measures against cryptocurrency exchange Binance. Two Binance executives have since been charged with tax evasion and money laundering, and peer-to-peer trading restrictions have been imposed.

Additionally, in December, the CBN mandated financial institutions to collect ID cards before opening accounts, contradicting a previous rule to promote financial inclusion. Furthermore, the Nigeria Inter-Bank Settlement System (NIBSS) instructed banks and mobile money operators to delist unlicensed fintechs from directly accepting consumer deposits.

About The Author

Related Articles

Cedi@60: Bank of Ghana Vows to Keep Currency Stable, Sustain Economic Stability

The Bank of Ghana (BoG) has reaffirmed its commitment to protecting the...

ByConfidence UbaniJuly 9, 2025Malian Court Jails Former Minister Cissoko Over Presidential Jet Scandal; Others Sentenced in Absentia

The Special Assize Court in Bamako has delivered its long-awaited verdict on...

ByOluwasegun SanusiJuly 9, 2025Ghana Sets Up Anti-Gold Smuggling Task Force to Recover Billions in Lost Revenue

Ghana has launched a national task force to combat gold smuggling and...

ByConfidence UbaniJuly 9, 2025Nigerians Demand Transparency Over Withheld Signed Tax Laws Under Tinubu Following ₦5 Million Bank Reporting Rule

Weeks after President Bola Tinubu signed four major tax reform bills into...

ByMayowa DurosinmiJuly 9, 2025