MTN Nigeria Plc has reported a staggering pre-tax loss of N177.8 billion, starkly contrasting the N518.8 billion pre-tax profit recorded the previous year. The adverse financial performance has led to a depletion of shareholders’ funds.

The official exchange rate used was N907.11/$1 as of December 31, 2023. With the current naira to the dollar exchange rate of over N1500, the company’s loss is expected to be wider by the first quarter of 2024.

According to MTN Nigeria’s report, the losses were due to a substantial foreign exchange loss amounting to N740 billion, a significant increase from the N81 billion reported in 2022. This marks the company’s first-ever loss since becoming a quoted company in Nigeria.

In its 2023 financial report published on Friday, the South African telecom giant stated:

“2023 witnessed a very challenging operating environment characterised by rising inflation, currency devaluation, and foreign exchange shortages, complicated by geopolitical disruptions and cash shortages in Q1 arising from a redesign of the naira.

“These factors created severe headwinds for our customers and our business during the year. The inflation rate increased throughout the year, reaching 28.9 percent in December 2023 – the highest reading in 18 years – with an average rate of 24.5 percent.

“This was further exacerbated by higher fuel prices, arising from the removal of the fuel subsidy in May 2023, with the average prices of diesel and petrol up by 66.4 per cent and 257.1 per cent in 2023 to N1,416.8/litre and N600/litre, respectively. In June 2023, the Central Bank of Nigeria (CBN) adopted a more liberal foreign exchange management system and reintroduced the ‘willing buyer, willing seller’ model.

“This has resulted in a 96.7 per cent unfavourable movement in the exchange rate against the US dollar from N461.1/$ in December 2022 to N907.1/$ (Nigerian Autonomous Foreign Exchange Market (NAFEM) rate) in December 2023. This development contributed meaningfully to the upward pressure on the cost of doing business in Nigeria, and for MTN Nigeria in particular, significantly increased the costs for tower leases.”

Despite the challenging financial landscape, MTN Nigeria saw growth in various operational aspects, including a 5.3% increase in total subscribers, reaching 79.7 million, and a 163.2% surge in active mobile money (MoMo PSB) wallets, totalling 5.3 million.

However, the company announced that due to the naira devaluation and its impact on retained earnings, no final dividend payment would be proposed for the year ending December 31, 2023. Back in July 2023, interim dividends of N117.48 billion were approved.

PZ Cussons and Nestle Nigeria also reported huge net losses from the challenging operating environment in 2023, marked by rising inflation, currency devaluation, and foreign exchange shortages.

About The Author

Related Articles

Diplomatic Embarrassment Looms Over Tinubu’s Ambassadorial Appointments with Only Two Countries Granting Approval

Some countries may decline to accept several ambassadors recently nominated by the...

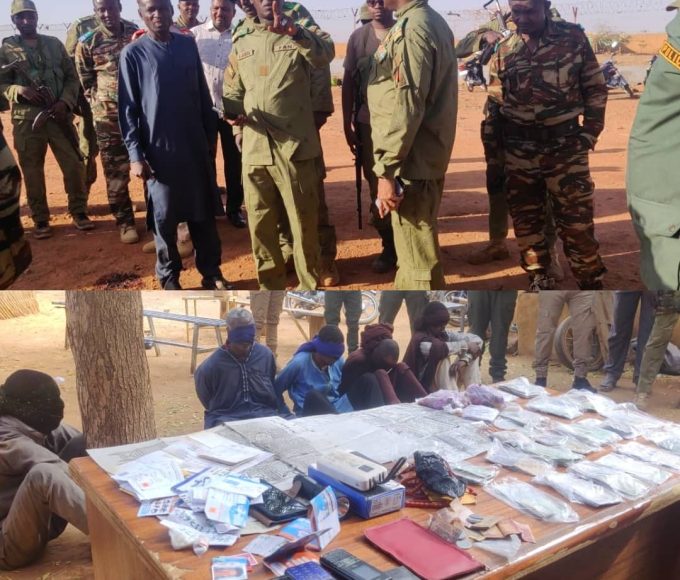

ByWest Africa WeeklyMarch 12, 2026Niger Launches Investigation After Attack on Tahoua Air Base

Authorities in Niger say investigations are ongoing following an attack on Air...

ByWest Africa WeeklyMarch 12, 2026Mali Establishes National Observatory to Advance Peace and Reconciliation

The transitional government of Mali has launched a new national body aimed...

ByWest Africa WeeklyMarch 12, 2026Liberia–Guinea Border Tensions Rise After Soldiers Cross Into Disputed Area

Tensions are rising along the border between Liberia and Guinea after reports...

ByWest Africa WeeklyMarch 12, 2026