IMF Predicts Zero Growth Rate for Nigeria, Warns Naira May Depreciate Further by 35% in 2024

The International Monetary Fund (IMF) has predicted a further 35% depreciation of the Nigerian Naira in 2024, owing to the country’s production challenges.

This information was conveyed through the February 2024 Post–Financing Assessment and Staff Report by the IMF, which also forecasts a potential zero growth rate for Nigeria in 2024 and a slow recovery to 2% by 2028.

According to the report, the current monetary policy to curb inflation is inadequate. IMF explains that inflation could peak at 44% before measures are implemented to address the situation.

The absence of local production, coupled with the recent liberalization of commodity imports, is expected to contribute to the depreciation of the exchange rate.

The IMF underscored the impact of adverse climate shocks in 2023 and early 2024. Flooding in some parts of the country has exacerbated weaknesses in agriculture, leading to a decline in output and a surge in food prices.

To counter these challenges, the IMF recommended the development of a comprehensive macroeconomic and growth strategy in collaboration with development partners.

Key components of this strategy include aggressive monetary tightening, fiscal adjustments to restore macroeconomic stability, and the implementation of climate adaptation measures.

The report emphasized that domestic demand has weakened due to three reasons:

- Falling real incomes, potential investment stalling in the oil sector, and declining production.

The IMF’s predictions also point to a fiscal deficit exceeding six percent of GDP in 2024 and 2025, driven partly by increased transfers to address social unrest and a rise in implicit fuel subsidies.

Additionally, it foresees that rising uncertainty would trigger portfolio outflows. That would, in turn, limit Nigeria’s access to Eurobond financing and result in a decline in reserves to $17 billion by 2025.

“With limited external financing options and higher expenditures, there is increasing use of CBN and domestic financing. The authorities implement expenditure measures in 2026, for example, phasing out the implicit fuel subsidy but the debt to GDP ratio still rises by six percentage points above the baseline by 2028.

“The spike in inflation and rise in uncertainty trigger portfolio outflows, and Nigeria is unable to access Eurobond financing. Reserves decline to $17 billion in 2025. Obligations due under the RFI peak at over eight percent of officially reported reserves.

“Nigeria would be able to repay the fund, even in the downside scenario. This assumes that the authorities continue to prioritize external debt service. However, debt service would compete directly with urgent humanitarian needs to tackle rising poverty and food insecurity, which would need to be prioritized.

“Therefore, even assuming the authorities reserve the remaining SDR allocation for RFI repayments, trade-offs could be severe”, the report said.

The uncertainty surrounding Nigeria’s net international reserves level adds further risks, according to the IMF, as would “exogenous shocks that impact external stability, poverty, and food security”.

Read more: Niger State: Reverse all appointments before any dialogue – NLC/TUC tells Gov. Bago

About The Author

%s Comment

Leave a Reply Cancel reply

Related Articles

Ghana’s Prisons to Produce 20% of Sanitary Pads, 30% of Desks and Uniforms for Schools– Interior Minister

The Minister for the Interior, Hon. Muntaka Mubarak, has announced that inmates...

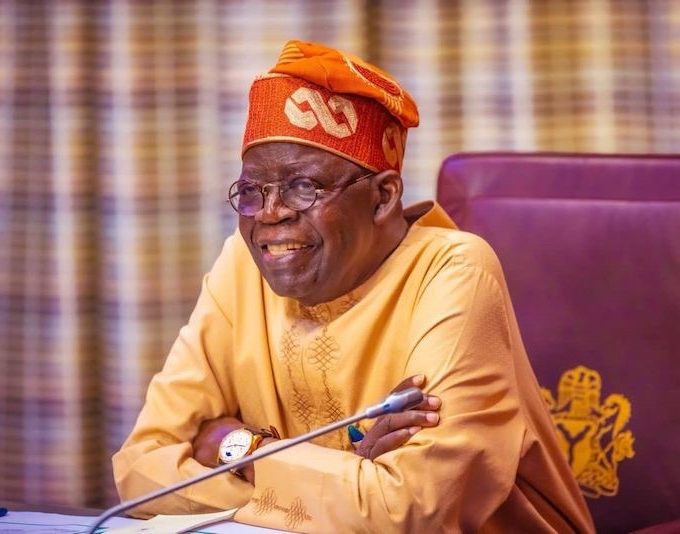

ByOluwasegun SanusiJuly 14, 2025Nigeria: Tinubu’s ‘Renewed Hope’ Agenda Under Scrutiny for Inconsistent Records

President Bola Tinubu’s administration has a bold and expansive plan titled “Renewed...

ByMayowa DurosinmiJuly 14, 2025Cameroon’s 92-Year-Old President, Paul Biya, Declares Bid to Run for Eighth Term in October Election

Cameroon’s President Paul Biya has officially declared his intention to run for...

ByConfidence UbaniJuly 14, 2025U.S. Court Orders FBI, DEA to File Another Joint Status Report by August 7 on Release of Tinubu’s Unredacted Heroin Trafficking Records

The U.S. District Court for the District of Columbia has ordered the...

ByMayowa DurosinmiJuly 14, 2025

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?