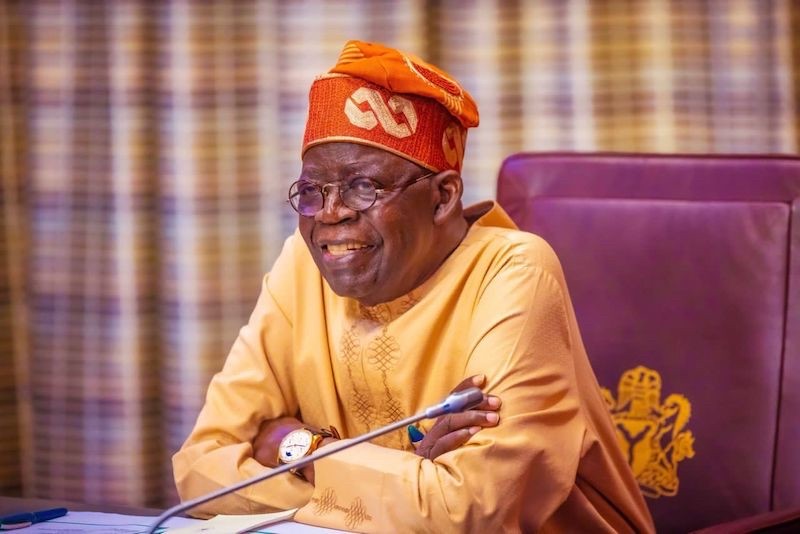

How Tinubu’s Proposed Tax Reform Is Designed To Bleed Nigerians Dry

Nigeria is on the brink of a tax revolution, but for many citizens, it could feel more like a financial siege.

The Nigeria Tax Act, 2025 promises to modernise the country’s revenue system, but behind the rhetoric of reform lies a sweeping expansion of government power and tax burdens that could devastate low- and middle-income Nigerians. From taxing everyday fuel and informal income to expanding VAT and cracking down on small borrowers, the proposed law reads less like a roadmap for development and more like a survival test for millions.

To make matters worse, the Federal Government has so far refused to release the final signed version of the bill, fueling concerns that even more controversial provisions may be hidden from public eyes.

Framed as a modernisation effort, the draft law consolidates decades of outdated tax statutes into a single legal document covering corporate tax, personal income, value-added tax (VAT), capital gains, stamp duties, and more. But beyond its administrative structure, the proposal contains several provisions likely to hit poor Nigerians hardest.

Fuel Surcharge: A Tax on Transport, Power, and Food

The bill proposes a 5% surcharge on all refined fossil fuel products, a move the government claims will encourage the transition to clean energy. However, in a country still heavily reliant on petrol and diesel due to poor electricity infrastructure, this is nothing short of economic punishment.

This surcharge, which excludes kerosene and renewables, will compound the cost of living, driving up prices in transportation, logistics, and food distribution, core sectors for everyday survival.

More Expensive Loans, Less Credit Access

The Act also introduces stamp duties on long-term loans and financial instruments, which could increase the cost of credit. For many low-income families, students, and micro-businesses that rely on such loans for survival or growth, this provision could shut the door on essential financing.

Road Usage Tax: No Direct Charge, But Costs Still Climb

The Nigerian Tax Act, 2025, does not introduce a direct road usage tax or tolls on highways or major roads. There’s no legal basis for governments to charge drivers simply for using the roads.

But don’t relax just yet, costs linked to road use are still rising:

The fuel surcharge means drivers pay more at the pump, pushing up transport and delivery prices.

Ride-hailing and vehicle rental services remain taxable, making daily commutes pricier for many Nigerians.

In short, while there’s no direct toll, transporting yourself or goods around the country just got more expensive.

Bank Charges: New Costs on Every Transaction

The proposed Tax Act introduces expanded stamp duties and taxes on a wide range of financial transactions, effectively turning basic banking into a luxury. Whether it’s transferring money, taking out a loan, or issuing a cheque, ordinary Nigerians are now subject to increased financial friction just for accessing the banking system.

These provisions are especially punishing for people experiencing poverty and unbanked, who often rely on mobile banking, POS agents, or small-scale credit to survive. Under the proposed framework:

Stamp duties now apply to loan agreements, potentially raising interest rates.

Bank drafts, promissory notes, and electronic transfers face new or expanded levies.

Even simple savings or rent-related payments may be caught in the widened tax net.

These hidden costs could push more Nigerians out of the formal banking sector, encouraging cash-based transactions and making financial inclusion harder, the very opposite of what a modern tax system should promote.

VAT Expansion with No Relief for Essentials

While VAT remains at 7.5%, the Act broadens its scope to cover more goods and services, including fixed assets and previously exempt business activities. Given the regressive nature of VAT, where everyone pays the same rate regardless of income, this disproportionately affects people with low incomes.

There is no corresponding expansion of exemptions to basic goods like food staples, school supplies, or basic clothing, raising fears that essential items will now be even less affordable.

Taxing Gifts, Side Hustles, and Informal Earnings

A controversial provision introduces taxation on “accretion to wealth,” including:

Gifts and awards, Grants and donations, Side income from digital work or small trading

In a country where millions depend on informal income, family remittances, or charity to survive, this move is seen as punitive and out of touch.

The Informal and Digital Sector Now in the Crosshairs

Freelancers, remote workers, and online vendors, many of whom turned to digital work as a lifeline, are now included in the taxable base. Without clear protections or incentives, this amounts to squeezing productivity out of Nigeria’s most agile and self-reliant young workers.

Import Price Inflation Through Customs Valuation

The law also formalises customs practices that allow authorities to assign inflated “Free On Board” values to imported goods, leading to higher import duties. This drives up the price of everyday goods like:

Used vehicles, Electronics, Clothing, Medicine and equipment

Poor consumers, who rely on cheaper imported alternatives, will be disproportionately affected.

Stiff Penalties for the Poor and Uninformed

With penalties ranging from ₦100,000 for late filing to millions in fines for tax withholding errors, the law assumes a level of financial and legal sophistication many Nigerians, especially informal traders and rural workers, do not have access to.

Yet there is no clear education plan or free compliance support for small earners, creating a high-risk trap for honest but ill-informed citizens.

No Welfare Cushion, No Social Protection

The most glaring omission in the proposed Tax Act is the absence of any corresponding social safety net.

There are no new unemployment benefits, no healthcare relief, and no subsidies for small farmers or low-income transport workers. The document focuses on extraction, not redistribution.

You can’t tax people into the grave and call it reform. Nigerians pay more and get nothing in return.

Hidden Risks: More Than Meets the Eye

Several less obvious but equally dangerous provisions risk compounding the pain for vulnerable Nigerians:

Centralised Enforcement Powers: The Nigeria Revenue Service (NRS) gains authority to freeze accounts, deduct taxes at source, and access private data without court oversight, potentially enabling abuse and harassment.

Self-Assessment Without Support: Taxpayers must self-declare and pay taxes with little clarity on dispute resolution or taxpayer education, increasing the likelihood of fines for innocent errors.

Education Grants and Scholarships: Ambiguity around whether scholarships and tuition grants are taxable could threaten access to affordable education.

Rental Income Tax Passed to Tenants: Strong enforcement on landlords is likely to push rent costs higher, affecting low-income renters.

Taxing Resale of Personal Items: Used goods sales, an important survival strategy for many, may be classified as taxable gains.

No Simplification for Informal Workers: Mixed personal and business income complicates compliance, risking overtaxation or penalties for Nigeria’s informal sector majority.

Retroactive Taxation Risk: Vague enforcement powers raise the spectre of back taxes for years prior, a potential disaster for informal earners.

IMF’s Support and Caution

The International Monetary Fund (IMF) has expressed conditional support for Nigeria’s tax reforms. While commending efforts to modernise and broaden the tax base, the IMF warns that full revenue gains may take time.

The IMF also highlighted Nigeria’s ongoing fiscal challenges, including a projected deficit of 4.7 per cent of GDP in 2025, urging the government to recalibrate budgets amid falling oil prices and to scale up cash transfers to the poorest.

This cautious stance underscores a critical gap in the current tax proposal: the absence of a social safety net alongside increased tax burdens.

Despite months of debate and the public release of this “final” proposal, the actual signed version of the Nigeria Tax Act 2025 has not been released by the Tinubu administration.

This lack of transparency has raised alarm among many who accuse the government of attempting to hide unpopular details until it’s too late to push back.

While tax reform is necessary, the Nigeria Tax Act 2025, at least as proposed, risks becoming a blueprint for austerity without accountability. With fuel, food, credit, and imports all facing heavier tax burdens, and no meaningful protection for those at the bottom, the Act reflects a governance style that treats citizens as revenue sources, not as people to be served.

Until the signed version is made public, Nigerians are left to wonder what additional burdens may be lurking behind bureaucratic silence and fiscal aggression.

About The Author

%s Comment

Leave a Reply Cancel reply

Related Articles

Ghana Shares Gold Mining Model With Tanzania

Ghana has taken a leading role in shaping Africa’s future approach to...

ByWest Africa WeeklyJanuary 23, 2026West African Proposes Alternative Plan as Burkina Faso Seeks Larger Stake in Kiaka Mine

West African Resources has submitted an alternative proposal to the government of...

ByWest Africa WeeklyNovember 28, 2025Barrick Gold Backs Down as Mali Tightens Control of Its Mining Sector

After more than two years of standoffs, seizures, legal battles and diplomatic...

ByWest Africa WeeklyNovember 26, 2025Surviving Poverty Through Pollution: A Day in the Life of Adamawa Bola Boys

Before leaving Lagos, I was sure that I had left behind memories like...

ByBankole Taiwo JamesNovember 20, 2025

To what length can one be punished for being Nigerian. My major concern is that most youths don’t even know anything about what is going on in the country.