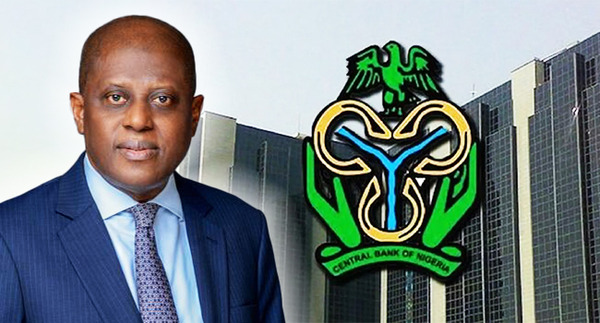

Central Bank of Nigeria issued a letter on April 30, 2024, directing “all non-individuals” on the Agent Banking Authorisation to register with the Corporate Affairs Commission on or before July 7, 2024.

The directive requires Point-of-Sale (PoS) terminals, whether agents, merchants, or individuals, to register with CAC before commencing business.

This was disclosed during a meeting between Fintechs and the Registrar-General/Chief Executive Officer of CAC, Ishaq Hussaini Magaji (SAN), in Abuja on Monday, May 7, 2024.

A meeting of which representatives of Fintechs, including Opay, Momba, PalmpayLTD, Paystack, FairmoneyMFB, Moniepoint, and Teasy Pay, were present at the event and signed a document in agreement to CBN’s directive.

However, Magaji cited in a follow-up post on its official X handle, stating the CBN’s directive is in line with Section 863 of the Companies, Allied Matters Act (CAMA) 2020, and CBN guidelines for Agent Banking, 2013.

In part, a statement from the meeting reads:

The Corporate Affairs Commission and Fintech Companies in Nigeria, better known as PoS operators, have agreed to a two-month timeline for registering their agents, merchants, and individuals with the CAC by legal requirements and the directives of the Central Bank of Nigeria.

Furthermore, “The agreement was reached today during a meeting between Fintechs and the Registrar-General, CAC, Hussaini Ishaq Magaji, in Abuja.”

Meanwhile, with over one million PoS operators in Nigeria, the deadline, starting as of Monday, May 6, gives a two-month deadline for compliance with the CBN directive.

About The Author

Mayowa Durosinmi

author

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Mayowa Durosinmi

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Related Articles

Tinubu Follows Gumi’s Lead as Nigeria Signs Turkey Defence Deal, Fueling Speculation Over Who Really Controls the Country’s Security Policy

Nigeria’s diplomatic and security strategy is once again under scrutiny after a...

ByWest Africa WeeklyJanuary 28, 2026Burkina Faso President Ibrahim Traoré Reviews 2025 Achievements, Sets Ambitious Agenda for 2026

Burkina Faso’s President, Ibrahim Traoré, has described 2025 as a year of...

ByWest Africa WeeklyJanuary 28, 2026Mali Says Reports of New Three-State Sahel Currency Are False but Talks Continue on Economic Integration

Mali’s government has rejected claims that it and its neighbours, Burkina Faso...

ByWest Africa WeeklyJanuary 28, 2026CBN Upgrades Opay, Moniepoint, Kuda and Others to National Licences

The Central Bank of Nigeria has upgraded the operating licences of several...

ByWest Africa WeeklyJanuary 28, 2026