The Central Bank of Nigeria (CBN) has granted Approval-in-Principle (AIP) to 14 new International Money Transfer Operators (IMTOs) as part of a strategy to double foreign-currency remittance flows through formal channels. CBN’s Acting Director of Corporate Communications, Mrs Hakama Sidi Ali, disclosed this in Abuja on Wednesday.

The initiative aims to increase the sustained supply of foreign exchange (FX) in the official market by fostering greater competition and innovation among IMTOs. This will reduce the cost of remittance transactions and boost financial inclusion.

Sidi Ali announced the approval, stating, “This will spur liquidity in Nigeria’s Autonomous Foreign Exchange Market (NAFEX), augmenting price discovery to enable a market-driven fair value for the naira.”

According to her, the CBN sees boosting formal remittance flows as a strategy to stabilise Nigeria’s exchange rate, which has been shaken by external factors like changes in foreign investment and oil exports.

Recall that in January 2024, the CBN issued a circular removing the previous cap on exchange rates quoted by IMTOs and revised operational guidelines, which included increasing the application fee for an IMTO license from N500,000 in 2014 to N10 million. A collaborative task force was also established to work towards doubling remittance inflows, reporting directly to CBN Governor Yemi Cardoso.

About the task force, Cardoso said: “We’ve set ourselves a target to double remittance flows into Nigeria within a year, a goal I firmly believe is within reach.”

“We are wasting no time driving progress to remove any bottlenecks hindering flows through formal channels permanently. We have a determined pathway and a sequenced approach to tackling all challenges ahead, working hand in hand with key stakeholders in the remittance industry.”

According to him, the task force will meet regularly to implement strategies and monitor their impact on remittance inflows.

Read: Diaspora Remittances to Nigeria Drop by 6.28% in Q1 2024

About The Author

Related Articles

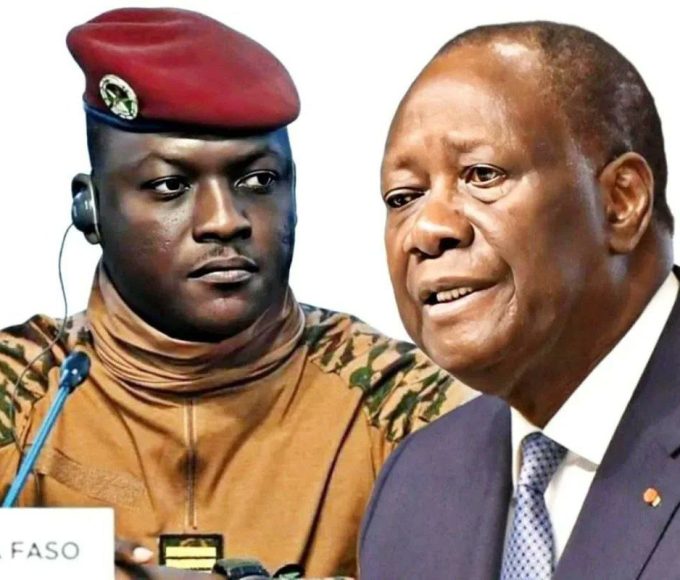

CSS States Considers UEMOA Boycott Over Alleged President Ouattara’s Power Rotation Block

Tensions are rising within the West African Economic and Monetary Union (UEMOA)...

ByOluwasegun SanusiJuly 9, 2025Cedi@60: Bank of Ghana Vows to Keep Currency Stable, Sustain Economic Stability

The Bank of Ghana (BoG) has reaffirmed its commitment to protecting the...

ByConfidence UbaniJuly 9, 2025Malian Court Jails Former Minister Cissoko Over Presidential Jet Scandal; Others Sentenced in Absentia

The Special Assize Court in Bamako has delivered its long-awaited verdict on...

ByOluwasegun SanusiJuly 9, 2025Ghana Sets Up Anti-Gold Smuggling Task Force to Recover Billions in Lost Revenue

Ghana has launched a national task force to combat gold smuggling and...

ByConfidence UbaniJuly 9, 2025