Ghana and MultiChoice Face Off As Pay-TV Dispute Enters Crucial Phase

Ghana’s stand-off with MultiChoice Ghana over DStv subscription prices has moved from public posturing into formal regulatory action. In early August, Communications Minister Samuel Nartey George issued a firm deadline for a 30% fee cut by August 7, 2025, warning that…

I have directed the NCA to act swiftly. If by August 7 DStv has not complied, their broadcasting licence will be suspended, and accusing the company of cheating Ghanaians for years.

MultiChoice called the demand “not tenable,” warning that such a steep discount could jeopardise service quality and lead to job losses. Their counterproposal, to freeze prices and halt revenue remittances, was dismissed as inadequate. The NCA issued a formal suspension notice, granting MultiChoice 30 days (until September 6) to respond or risk further action.

The dispute has tapped into frustrations over unequal pricing. The premium DStv package is priced at around US$83 in Ghana, compared to US$29 in Nigeria, despite Ghana’s cedi gaining over 40% in value this year.

READ MORE: Ghana Slashes Domestic Airfares Amid Cedi Gains, While Nigeria Faces Soaring Flight Costs

While Canal+ has not pulled out of Ghana, the dust-up has heightened scrutiny on the media giant pressing toward full control of MultiChoice. The recent conditional approval of Canal+’s takeover by South Africa’s Competition Tribunal adds complexity, underscoring how regulators increasingly treat pay-TV as a consumer utility.

For Ghanaian viewers, the stakes are high. A suspension could block access to major sporting events, news, and entertainment. Consumer advocacy groups have welcomed the government’s push for affordability, while industry watchers warn that aggressive regulation could deter future investment. With Parliament also signalling its interest, stakeholders call for a balanced dialogue on legal clarity.

With the August 7 deadline behind us, the focus shifts to MultiChoice’s response and whether the NCA will escalate or reverse course. The outcome in Ghana could become a defining moment for pay-TV policy across the continent, balancing fair pricing with the need for sustainable media services.

About The Author

41 Comments

Leave a Reply Cancel reply

Related Articles

The AFCON Final in Morocco and the Controversies That Followed

The Africa Cup of Nations final between hosts Morocco and Senegal ended...

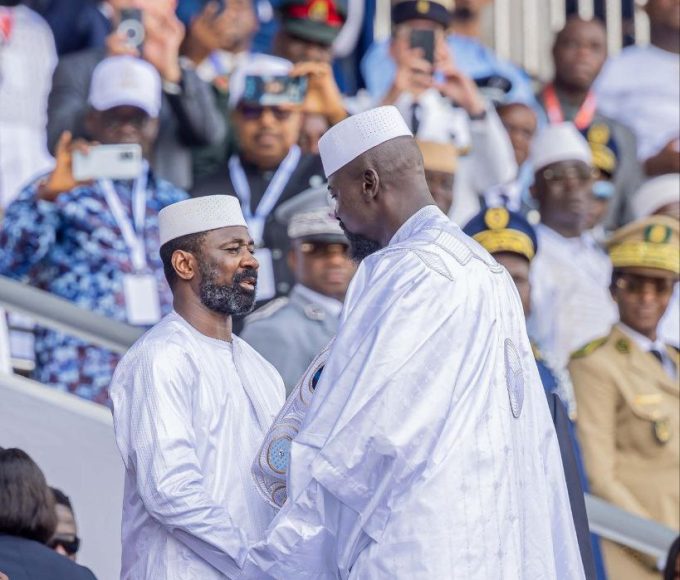

ByWest Africa WeeklyJanuary 20, 2026Mali’s Transition Leader Attends Swearing-In of Guinea’s President Mamadi Doumbouya

Mali’s President of the Transition, General Assimi Goïta, represented the country in...

ByWest Africa WeeklyJanuary 19, 2026Malian Army Conducts Successful Surveillance Operation in Mopti Region

The Malian Armed Forces have carried out a successful territorial surveillance operation...

ByWest Africa WeeklyJanuary 19, 2026Niger’s Security Forces Record Major Gains Against Armed Groups

Niger’s Defence and Security Forces have reported significant results following a week...

ByWest Africa WeeklyJanuary 19, 2026

Na lie. What content did Multichoice provide. Their service over the decades have always been airing old movies repetitively at cut-throat subscription costs. They have cheated and looted from the people. Why will their full bouquet cost $69 in Ghana but only $19 in Nigeria? What accounts for the price difference? It’s lame and stupid for anyone to argue with strength of local currency because we only pay the equivalence in dollar terms.

Your propaganda won’t wash. Please hurry up and pack out, Multichoice mad Canal+. You are unreasonable cheats

Hey come on get your facts right, multichoice is not officially out of Ghana, they have been handed a 30 day ultimatum to respond to the government’s demand or have their license revoked. Canal+ is still operating.

I support your statement, they should pack-up and leave Ghana, if only they are not ready to comply with the demand Ghana government requested as equivalent payment, as Multi-TV charges Nigeria $19, Ghana also pay the same $19 not $68 . God punish Multi-TV for cheating Ghanaians for quite a long time.

Multichannel price in $ so it’s just fair that if the cedi has appreciated against the $, they equally respond to it. There must be fair trade practice.

It’s time to improve the services of our local GTV to avoid exploitation by these foreign communication networks. We are ready to pay for good services from GTV or any local network.

Master, go and learn something about economy of scale and u will understand will they charge lesser in Nigeria than in Ghana.

Go away u don’t like the fact that they’re been asked to reduce their prices.. Aden moy3 nkwasiafuor saaa. … The government is trying hard to help u yet your stupidity won’t give chance sia

There are other countries that have the similar number if users and similar population like Ghana but have lower prices as compared to Ghana.

How much were you paid by the two operators to write this article? Very laughable skewed writeup that does not reflect the general feeling of Ghanaians of them. Their content outdated and the subscription packages sky high.

At least add a disclaimer: “This is a sponsored article”

Hahaha, very true. Awful write up, misleading headline

When did this happen? In Hhana here there is no news like that. Multichoice has been given 1 month to respond to the regulatory charges. They have not communicated their withdrawal to anyone yet.

Check your licensing fees. Ghana fees might be too high. What about the cost of operating in Ghana? These costs were not arbitrarily fixed! The more subscribers the merrier the costs of subscriptions! The amount you spend in transmission to 10 persons is the same amount you spend in transmission to 100 persons! So, the larger the population, the lower the subscription rate.

What about the countries that the population is far less than Ghana

Your argument would have held true if we didn’t know of the pricing in Angola and Liberia. At 37million population, Angola has a bouquet price of $25, compared to Nigeria. So the argument about numbers doesn’t hold. You can also review the subscriber numbers, Nigeria has an estimated 2million, both Angola and Ghana have 400k subscribers.

Do they use entirely different equipments for the transmission to different countries?

Stupid headline.

So reduce the price and get more subscribers

Bro, as simple as that

Is the value of the dollar different in respective African countries??

They cannot blackmail us with substandard programs and repeat of old shows. Losing access to sports programs is not the end of our world. I think the 30 day notice is weak. Send thrm packing.

It’s a shame that MultiChoice have taken advantage of their monopoly to over milk Ghanaians. What’s the point of Ghana paying over and above what Nigerians pay when the denominator is dollar. This multi national companies hovering around are just interested in killing people’s pocket in the country they operate and repatriation the Revenue to their home countries but not entertaining and educating. Afterall all they do is repetition of old contents

This rubbish caused by Ghanaians because when the prices is down the Ghanaian people look it to be fake and when it high it is original in the eyes of Ghanaian people while their hearts are hot when paying for it. It will be very hard for DSTV to reduce their subscriptions package in Ghana.

1. The amount of unseen fees (bribe) that went under table before the establishment of their network in Ghana is very high.

2. The Ghanaians, Honourable is fighting for will come back to fight against him. Because those cartels who part take from the money that passed tbrough under the the table are there watching how thing will play out.

3. If Ghanaians want the reductions of DSTV to come to life then they most speak with one voice and stand by their decision if not nothing will change.

The population factor.

Why are so many Ghanaians subscribing to the Nigerian DStv feed? The answer boils down to cost. Although precise subscriber figures aren’t publicly disclosed, anecdotal reports suggest the trend is widespread. In Ghana, a DStv Premium subscription runs about USD 83 per month. Even after stripping out roughly 30 percent in taxes—bringing the effective price down to around USD 60—we are still paying more than double the USD 29 charged in Nigeria. In reality, Ghanaian viewers are effectively subsidizing loss-leading prices in other markets by shouldering the higher fees here. The significant shift of Ghanaian viewers to the Nigerian DStv feed—a trend that threatens the long-term health of DStv Ghana. By narrowing the price gap on the bouquet packages to align more closely with neighboring markets, Multichoice Ghana can recapture those subscribers, bolster customer loyalty and ensure a sustainable future for DStv Ghana.

I think is high time Multichoice takes Ghanaians serious in terms of business. What is good for the goose is good for the gander. You can’t operate in an unfairly system like this. All we ask of is subscription fee cuts. Over the years, when the dollar goes high Multichoice will obviously increase their fees and now that the dollar rate has come down, you must reduce your fees as well. Period!!

Mine expired just yesterday 10/8/2025. I won’t re- new my subscription. I’ve seen that they’re cheating us, I’ll subscribe the Nigerian one for cheaper price.

I differ from the earlier assertion that the high charges are as result of market size. How about other countries that are less populated than Ghana? We are being exploited with any justifiable cause. Let’s support the minister on this. We can’t be intimidated by expatriates in our own land.

We are talking about pay TV for sports here not health insurance. I live overseas with higher income than most people in Ghana but will not spend half of that amount monthly on sports. Those, including Sam George, who subscribe to DSTV obvious have free money to throw away. Why don’t you allow them. Only a stupid minister would war out of this.

Their prices are too much , let’s us devoid of politics , MTN Ghana was asked to increase their data bundle nd lower cost , yes they did it regardless of tax , so why is ghana multi choice resisting , are they the main owners. They should stop dat tin and decrease the price , u always show old movies , and old animations, nothing new apart from sports.

I don’t know why Ghana government has keeping quet all this while Multichoice has cheated Ghanaians for over decades repeating movies, showing old movies everyday and increasing subscription every three months look this people doesn’t respect Ghanaians if they can’t comply, then they should leave why always foreigners come and choose to do what they like in our own land it doesn’t happen anywhere Ghana leaders pls pls think about your people because this don’t happen anywhere.

This blog post is ill researched and fake news and should be treated so. Multi choice refusal to reduce their subscription prices by 30% cause the regulator body in Ghana after several warning to issue the company 30 days mandate of their reason of refusal or face withdrawal of their license. This article is devoid of truth and full of lies, should be treated as fake news.

You can go to hell dstv

Make them lef, they think they can just down treat us cus we don’t speak up

Thanks to Communication Minister, God bless you .

Please speak for Ghanians ,we LOVE YOU

This are the people we want Lead us in GHANA

There are instances where I refuse to renew my subscription in Ghana, when DStv Ghana called me I told them they have increased their prices and I cannot afford. What they told me was that the government is taking taxes on my subscription that is why they keep increasing their prices. Assuming that is true that could explain the differences in Ghana and Nigeria

What I don’t understand is the excessive Nigerian influence in our broadcasting. We are in Ghana and still paying a higher subscription fee every month, but I don’t see what benefits we gain from it. Many Nigerians are reaping the rewards, while it feels as though Ghana is missing out.

I understand that Nigeria has laws protecting their broadcasting industry, which restricts the amount of foreign content shown. DStv complies with these laws, and if they don’t, the Nigerian authorities ensure they do. I believe Ghana should adopt similar measures to protect our broadcasting industry so that we can reap the benefits as well.

We shouldn’t allow them to dictate terms in our country when it isn’t benefiting us. Look at how the entertainment industry in Ghana is struggling, and DStv is not doing enough to support and promote our industry in the same way it does in Nigeria.No Ghana should not allow kraa

The cut throat subscription of DSTV is becoming increasingly alarmed which something must be done to sustain their operations in Ghana. Iam happy with the steps taken by the NCA to salvage this off Ghanaians. Better Multi Choice reduce their subscription or pack of for reasonable investor takes over, period.

you came into power on the hot wings on ANTI LGBT, now you’re fighting TV broadcasting.. pathetic.

channel your energy into what you promised and if you want to add TV, then eliminate those stations who keep showing “spiritual money and money scam broadcastings”

That’s a senseless talk right there, because he talked against certain actions in the past it detains him from addressing other issues? All this man wants is to better our living and you’re here talking nonsense

I support your statement, they should pack-up and leave Ghana, if only they are not ready to comply with the demand Ghana government requested as equivalent payment, as Multi-TV charges Nigeria $19, Ghana also pay the same $19 not $68 . God punish Multi-TV for cheating Ghanaians for quite a long time.

Why are we even wasting our time on these multichoice cheats? There are great sport broadcasting companies like sky sports,bein and other equally great top broadcasters who can offer even better than whatever multichoice is offering. I trust this government to dialogue with such companies to take over and operate in Ghana in place of these cheats of a company. They cannot continue with that old movies nonsense and keep cheating Ghanaians. DSTV must comply or leave our country. I’m irritated by their level of arrogance. Who do they think they are?

Thanks to Communication Minister, God bless you .

Please speak for Ghanians ,we LOVE YOU

This are the people we want Lead us in GHANA