Access Bank Allegedly Loses Over N75M Of Customers Money To ‘Network Glitch’

On May 26, Uchechukwu Innocent, an Onitsha-based businessman, received a total inflow of $49,718 in his Access Bank domiciliary accounts through Access Bank Ghana, but Access Bank Nigeria held the funds.

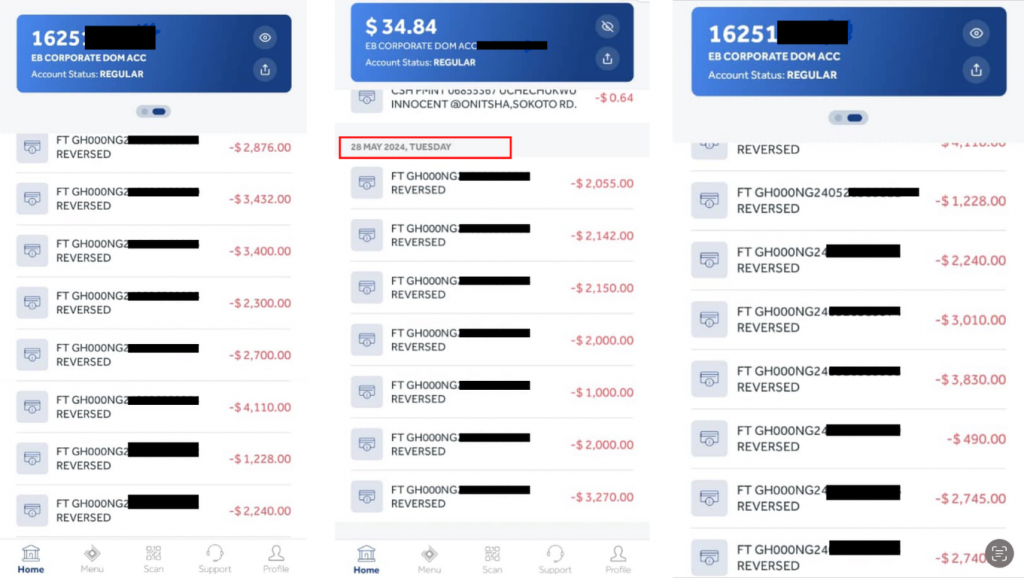

Innocent told WAW that he had received an inflow of $14,617 and $35,101 from Access Bank Ghana into two U.S. domiciliary accounts in Access Bank Nigeria, with account numbers 162519**18 and 162519**89.

He said the transaction history only showed “Reversed” to a reference number with GH description.

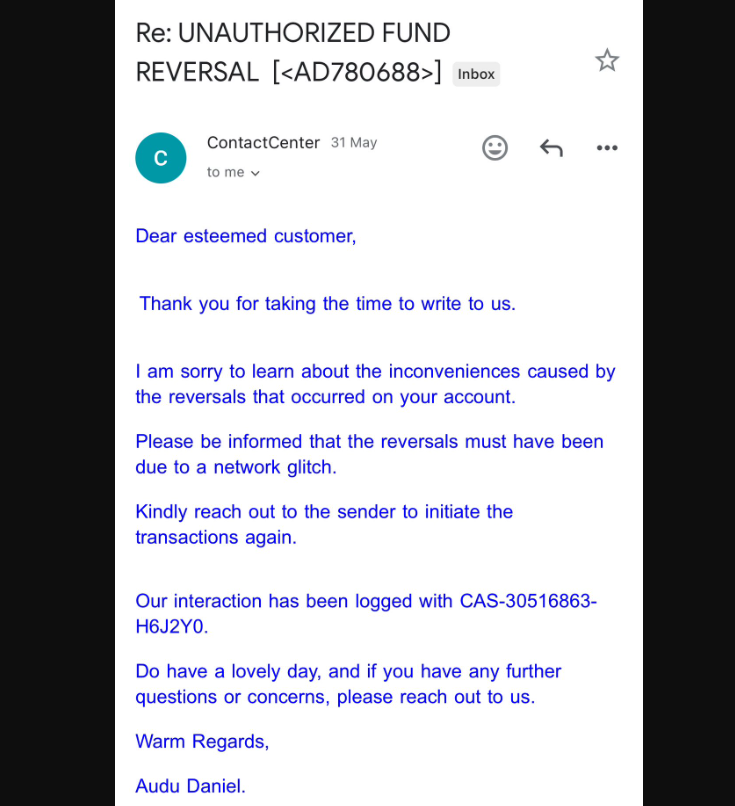

On that exact 28th being Tuesday, I wrote a mail to Access Bank Lagos Branch in Victoria Island of an unauthorised deduction of funds from my accounts,” he said.

In the letter of complaint to the bank, Innocent expressed his disappointment despite trusting the financial institution. He subsequently requested an “immediate reversal” of the funds totalling $49,718, which, when converted, was equivalent to over N75 million as of May.

In response to him, Access Bank wrote that the reversals must have been due to a network glitch and requested that he contact the sender to initiate the transaction again.

As requested by the bank, Innocent contacted the sender, who confirmed that he was yet to receive a reversal of the funds he had sent.

When WAW sent an email to Access Bank Nigeria to confirm the status of the transactions on Monday, June 3rd, Access Bank responded by saying:

We are working on your request, and one of our representatives will contact you within 24 hours.”

Meanwhile, Innocent reached out to Access Bank on its Instagram handle, but there was no response.

My goods are already back in Nigeria, and demurrage is accumulating. The funds trapped in your bank are meant to be sent to my Chinese manufacturers in China,” Innoncent’s message on Instagram read.

However, over the past few days, Access Bank has also told other U.S. domiciliary account holders who were affected just as Innocent to consider the issue a “network glitch.”

Most of their complaints have been left hanging, with others taking to social media to call the attention of the Central Bank of Nigeria to their plights.

About The Author

Mayowa Durosinmi

author

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Mayowa Durosinmi

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Related Articles

Cedi@60: Bank of Ghana Vows to Keep Currency Stable, Sustain Economic Stability

The Bank of Ghana (BoG) has reaffirmed its commitment to protecting the...

ByConfidence UbaniJuly 9, 2025Malian Court Jails Former Minister Cissoko Over Presidential Jet Scandal; Others Sentenced in Absentia

The Special Assize Court in Bamako has delivered its long-awaited verdict on...

ByOluwasegun SanusiJuly 9, 2025Ghana Sets Up Anti-Gold Smuggling Task Force to Recover Billions in Lost Revenue

Ghana has launched a national task force to combat gold smuggling and...

ByConfidence UbaniJuly 9, 2025Nigerians Demand Transparency Over Withheld Signed Tax Laws Under Tinubu Following ₦5 Million Bank Reporting Rule

Weeks after President Bola Tinubu signed four major tax reform bills into...

ByMayowa DurosinmiJuly 9, 2025