A Chronicle of Currency Crisis: Naira Vs. Zimbabwe Dollar

Landlocked between the Zambezi and Limpopo Rivers, Zimbabwe lies in the Southern heart of Africa. The country, known for its diverse wildlife and beautiful landscape, is trapped in economic uncertainties, birthed by its depreciating currency.

First Death Knell: Instability of Zimbabwe’s Currency

Zimbabwe currently faces the world’s highest inflation rate as its currency depreciates by over 90%.

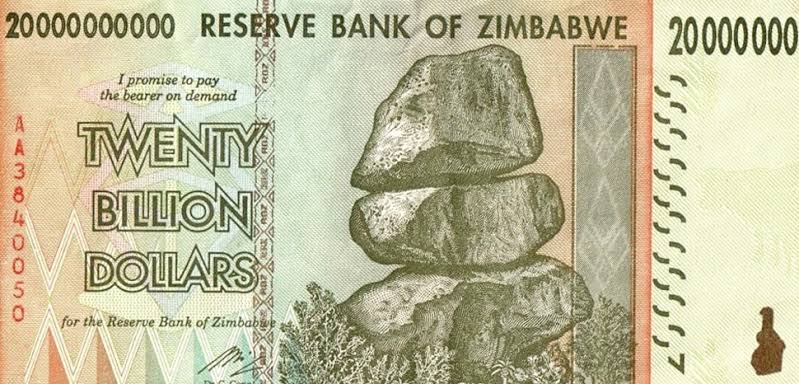

Until the 21st century, the Zimbabwean dollar was a normal currency and functioned as such. Hyperinflation hit the country in the early years of the 21st, sending the value of the currency down the drain. The Zim dollar was demonetized/discontinued in 2015- in place, multiple currencies including the South African rand, Botswana pula, pound sterling, Indian rupee, euro, Japanese yen, Australian dollar, Chinese yuan, and the United States dollar were used.

With hopes of a lasting solution, the Reserve Bank of Zimbabwe introduced a new Zimbabwe dollar (the RTGS Dollar). The sad tale is that even this is dead!

The recent refusal by Zimbabwe’s largest supermarket group to accept the local currency for selected goods, including essentials like water, paints a grim picture of the Zimbabwean dollar’s ‘death’. This was highlighted in an insightful X post shared by Mr. Hopewell Chin’ono, an international journalist.

The Zimbabwean dollar is now DEAD!

Zimbabwe’s biggest supermarket group is no longer accepting the Zimbabwean currency on selected goods including water as seen in the attached pictures.

You see, I and many others predicted that this would happen, but we were labeled Western… pic.twitter.com/DkzV6rsVzu

— Hopewell Chin’ono (@daddyhope) January 8, 2024

According to him, this scenario is a result of a severe decline in the nation’s industrial productivity that leaves it with few operational industries and limited exports. The repercussions of diminished industrial output are substantial

This decline significantly impacts foreign exchange reserves, as reduced productivity leads to lower income from exports. The situation is exacerbated by increased reliance on foreign-produced goods due to inadequate local production. Corruption, theft, incompetence, and a lack of investment further contribute to the struggle to maintain foreign exchange reserves.

The rejection of the local currency by retailers, such as OK Zimbabwe, not only erodes confidence in the RTGS dollar but also triggers devaluation and inflation. How much worse can the 90% devaluation in currency get?

Second Death Knell: A Continuing Struggle

Adding to the woes, CNBC notes that Zimbabwean authorities grapple with a second death knell for their currency. The Zimbabwean dollar has weakened by a third against the US dollar in the official market and by about 40% in the parallel market since January. The Central Bank Governor, Mangudya, attributes this turmoil to increased supply holders rushing to buy US dollars at the end of the year, causing exchange-rate volatility.

Efforts to inject confidence and stabilize the currency are nearly futile. The government is considering new measures, which might be announced at the upcoming central bank meeting. However, the situation remains precarious, raising concerns about the possible demonetization of the Zimbabwean dollar.

THE PROVERBIAL GRASSHOPPER

The parallels with Nigeria are striking. From an economic perspective, can we confidently assert that similar conditions would not lead to the ‘death’ of the Nigerian naira? The reflective example of purchasing power loss in Nigeria over the years prompts a critical examination of the nation’s economic trajectory.

Can Nigeria avoid a fate similar to Zimbabwe’s? While the Nigerian stock market is flourishing, what is obtainable with the nation’s native currency? This alludes to the tale of the proverbial grasshopper who whilst decaying, praised himself for growing robust.

The fall of the naira against the United States Dollars has become rather dramatic. Changing the design of the currency has majorly resulted in cash scarcity and increased suffering for cit is citizens. From 36% on January 1 to almost 50% this week, the nation’s economy is taking a dangerous leap. One that would land it into perilous waters!

To safeguard the currency, prudent economic policies, transparency, and effective governance are imperative.

Read more: PCC staff protest non-implementation of salary structure

About The Author

Related Articles

Cedi@60: Bank of Ghana Vows to Keep Currency Stable, Sustain Economic Stability

The Bank of Ghana (BoG) has reaffirmed its commitment to protecting the...

ByConfidence UbaniJuly 9, 2025Malian Court Jails Former Minister Cissoko Over Presidential Jet Scandal; Others Sentenced in Absentia

The Special Assize Court in Bamako has delivered its long-awaited verdict on...

ByOluwasegun SanusiJuly 9, 2025Ghana Sets Up Anti-Gold Smuggling Task Force to Recover Billions in Lost Revenue

Ghana has launched a national task force to combat gold smuggling and...

ByConfidence UbaniJuly 9, 2025Nigerians Demand Transparency Over Withheld Signed Tax Laws Under Tinubu Following ₦5 Million Bank Reporting Rule

Weeks after President Bola Tinubu signed four major tax reform bills into...

ByMayowa DurosinmiJuly 9, 2025