Uganda’s central bank has reduced its key lending rate by 25 basis points to 10 per cent, marking the first cut in a year. The key lending rate, the main interest rate set by a central bank, influences the interest rates banks charge for loans.

According to Reuters, the Bank of Uganda (BoU) cited the recovery of the Ugandan shilling against the U.S. dollar as a key factor in its decision to lower the rate. This decision was made during a Monetary Policy Committee meeting on Wednesday.

The shilling has appreciated over 6 per cent since hitting a record low in late February. This recovery has lessened concerns about persistent inflation. Uganda’s inflation rate, which rose to 4 per cent year-on-year in July, is still below the central bank’s medium-term target of 5 per cent.

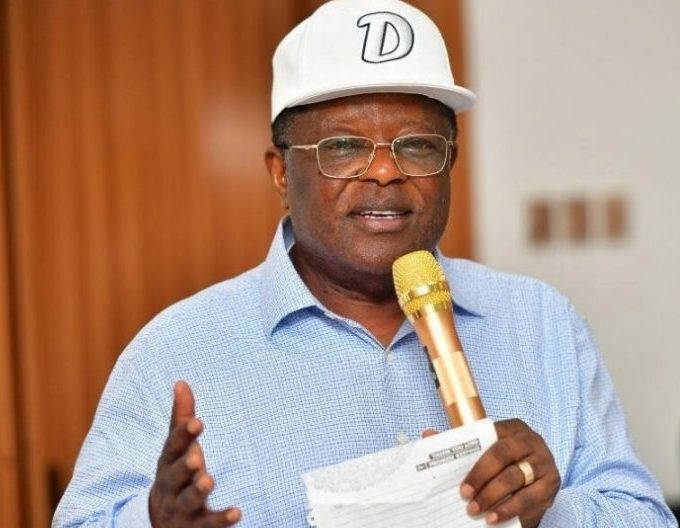

BoU Deputy Governor Michael Atingi-Ego stated,

“The MPC noted that the adverse impact of the past external shocks has abated and there has been some progress in moderating risks of inflation persistence. The inflation projection has been revised slightly downwards relative to the June 2024 forecast … largely due to a lesser depreciated shilling exchange rate”

Atingi-Ego attributed the recent rise in inflation to sectors such as passenger transport, accommodation, and recreation. He expects inflation to rise moderately in the next four months due to seasonal factors but stabilize around the 5 per cent target by the first quarter of 2025. He said the rate cut was appropriate to slightly reduce the degree of monetary policy restrictiveness given the improved inflation outlook and recovery in economic growth.

Economic growth in Uganda has picked up, averaging 6.7 per cent in annual terms in the last two quarters of fiscal year 2023/24 compared to 5.3 per cent growth in the previous two quarters. The central bank’s growth forecast for the 2024/25 budgetary year also remains unchanged at between 6.0 per cent and 6.5 per cent.

Read Also: CBN Increases Interest Rate To 26.75% Despite High Inflation

Breaking: Gas Explosion at Mobil Filling Station Ikeja

Israeli-supplied Tear Gas To Kenyan Security Forces Endangers Kenyans Health – Report

About The Author

Related Articles

Malian Prime Minister Presents 2025 Government Report, Pledges Stability and Reform

Mali’s Prime Minister, Major General Abdoulaye Maïga, has presented the government’s 2025...

ByWest Africa WeeklyMarch 2, 2026AES Ministers Conclude Roadmap Talks in Ouagadougou, Strengthen Security Coordination

Ministers of the Confederation of Sahel States have concluded high level discussions...

ByWest Africa WeeklyMarch 2, 2026Investigation Links Western Funding Networks and NGOs to African Conflict, Terror Financing, and Organised Crime

A transcontinental investigation has exposed an alleged web of Western-funded organisations and...

ByWest Africa WeeklyMarch 2, 2026Tinubu Approves Additional Endless Federal Road Projects While Old Projects Crawl at Snail’s Pace

President Bola Tinubu has approved a fresh round of federal road projects,...

ByWest Africa WeeklyMarch 2, 2026