According to Taiwo Oyedele, the chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Nigeria may easily earn N10 trillion a year by managing its non-oil assets well.

This results from the Presidential tax panel demanding the sale of floppy assets in the state.

At a stakeholders’ event held in Lagos on Thursday night, Oyedele gave a speech at the Harvard Business School Association of Nigeria. He emphasized the necessity of better asset management and the possible advantages of liquidating underperforming assets to create cash and promote economic expansion.

Tinubu is mostly known for his tax collection as Lagos State governor. However, the decision to sell underperforming assets is a move to sell non-oil assets since crude oil remains the government’s major source of revenue. Nonetheless, non-oil asset sales are inextricably a tax reform policy, though yet to be made a new regulation. At its adoption, it aims to bolster economic growth and the burden of tax regulation on businesses in Nigeria.

During the speech, Oyedele highlighted the need for improved asset management and the potential benefits of selling underperforming assets to generate liquidity and stimulate economic growth.

He said, “Imagine that you become more efficient with an N100tn asset alone. Even if you get a return of 10 percent yearly, that’s easily N10tn. If you cannot manage the asset well, then sell it and get liquidity in.”

Speaking of liquidity, the problem with economic improvement surrounds maintenance policies. Accumulating non-oil assets into liquidity requires adequate policies that efficiently utilise incomes generated by selling off underperforming assets.

Read: FIRS Begins Digital Enrollment of Traders To Widen Tax Net

About The Author

Mayowa Durosinmi

author

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Mayowa Durosinmi

M. Durosinmi is a West Africa Weekly investigative reporter covering Politics, Human Rights, Health, and Security in West Africa and the Sahel Region

Related Articles

Trump’s Greenland Threat Forces Europe to Taste the Logic of Western Colonial Power

It rarely begins with soldiers. More often, it begins with a sentence,...

ByWest Africa WeeklyJanuary 21, 2026The AFCON Final in Morocco and the Controversies That Followed

The Africa Cup of Nations final between hosts Morocco and Senegal ended...

ByWest Africa WeeklyJanuary 20, 2026Tinubu Government Claims Intelligence Cooperation With the US, Yet New York Times Publishes Conflicting Story Following $9 Million US Lobbying Effort

When the New York Times published its investigation suggesting that claims from...

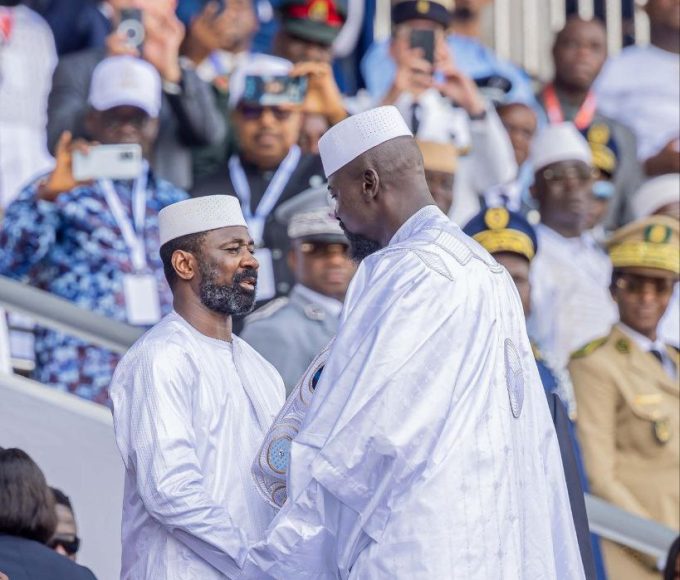

ByWest Africa WeeklyJanuary 19, 2026Mali’s Transition Leader Attends Swearing-In of Guinea’s President Mamadi Doumbouya

Mali’s President of the Transition, General Assimi Goïta, represented the country in...

ByWest Africa WeeklyJanuary 19, 2026