Wale Tinubu’s Oando Records N60.3 Billion Profit-After-Tax, 43% Revenue Increase by End of 2023

Oando Plc reported a profit-after-tax of N60.3 billion for the 2023 financial year, a major turnaround from the N81.2 billion loss it recorded in 2022. This is according to its audited financial statement for the year ending December 31, 2023.

The energy company’s revenue rose by 43 per cent to N2.84 trillion in 2023, up from N1.99 trillion in 2022. However, the cost of sales also increased sharply by 45 per cent to N2.76 trillion. This reportedly consumed 97% of the revenue and limited gross profit growth to N85.02 billion.

Other notable financial results included a 961 per cent rise in operating profit to N218.3 billion. Administrative expenses, however, grew by 218 per cent to N261.35 billion. Net finance costs also rose by 30 per cent, reaching N116.47 billion.

Profit-before-tax for 2023 was N102.97 billion, a 267 per cent increase from the previous year. Income tax expenses grew to N42.7 billion and resulted in a profit-after-tax of N60.3 billion, a 174 per cent improvement year-over-year.

Oando’s performance gained momentum in 2023, President Bola Tinubu’s first year in office. Under the leadership of Wale Tinubu, President Tinubu’s nephew, Oando’s market value rose significantly. It went from N74 billion in 2023 to N1 trillion by September 2024. The share price also increased from six naira on September 1, 2023, to N92, placing Oando among the top 10 most valuable companies on the Nigerian stock exchange.

In August 2024, Oando completed a $783 million acquisition of the Nigerian Agip Oil Company (NAOC) from Italian energy firm Eni. Reports from Peoples Gazette suggested that this deal was tied to Eni’s return to the OPL 245 oil field in partnership with Shell. Oando’s subsidiary, OVH Energy Marketing Limited, also acquired the retail arm of the Nigerian National Petroleum Company (NNPC).

These acquisitions and Oando’s return to profitability in 2023 have raised public concern. Analysts have questioned whether the company’s success is linked to Wale Tinubu’s relationship with the president, particularly given the economic challenges affecting other major businesses. Although Wale Tinubu and Oando have consistently denied any allegations of impropriety, the controversial deals and robust revenue validate claims that the company is enjoying special privileges to dominate the oil and gas sector.

Read More:

- ICYMI: Guyana to Launch $100,000 Cash Grant for All Adult Citizens Following Major Tax Abolishments

- After Public Outcry, Tinubu Orders Release of Minors Detained for #EndBadGovernance Protest

About The Author

Related Articles

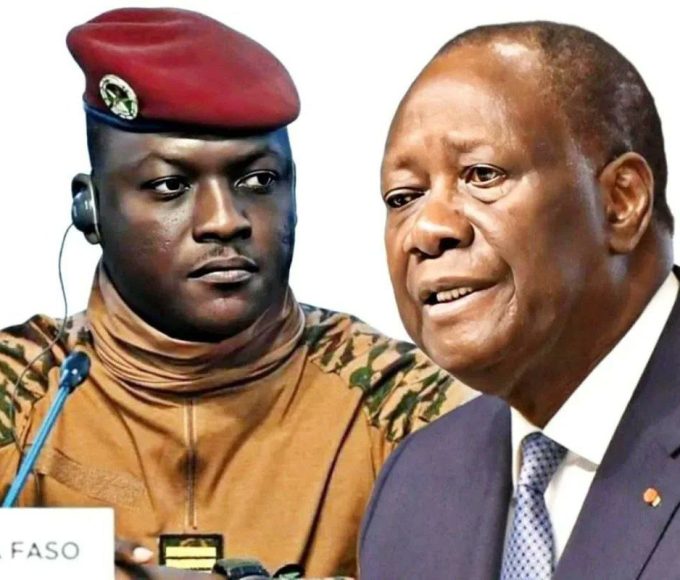

CSS States Considers UEMOA Boycott Over Alleged President Ouattara’s Power Rotation Block

Tensions are rising within the West African Economic and Monetary Union (UEMOA)...

ByOluwasegun SanusiJuly 9, 2025Cedi@60: Bank of Ghana Vows to Keep Currency Stable, Sustain Economic Stability

The Bank of Ghana (BoG) has reaffirmed its commitment to protecting the...

ByConfidence UbaniJuly 9, 2025Malian Court Jails Former Minister Cissoko Over Presidential Jet Scandal; Others Sentenced in Absentia

The Special Assize Court in Bamako has delivered its long-awaited verdict on...

ByOluwasegun SanusiJuly 9, 2025Ghana Sets Up Anti-Gold Smuggling Task Force to Recover Billions in Lost Revenue

Ghana has launched a national task force to combat gold smuggling and...

ByConfidence UbaniJuly 9, 2025

Leave a comment