The UK’s inflation rate fell to 2.3% in April, the lowest level in almost three years, driven primarily by declining gas and electricity prices. This decrease strengthens the case for the Bank of England to consider cutting interest rates later this year.

As earlier reported, the International Monetary Fund (IMF) has suggested a significant reduction to 3.5% by the end of 2025.

According to the Office for National Statistics, consumer prices in the UK rose 2.3% in April compared to a year earlier, down from 3.2% in March. This marks the lowest inflation rate since July 2021 and brings it closer to the Bank of England’s 2% target.

The sharp drop in inflation was mainly due to a decrease in the cap on household energy bills set by a government regulator. BBC reports that energy prices were 27% lower in April than last year, with gas prices down by 38%. Additionally, food inflation eased to 2.9% from 4%, contributing to the overall decline. However, prices for mobile phone bills and rents continued to rise.

Some food items, such as milk, butter, poultry, and fish, were cheaper in April than last year, thanks to falling fertiliser prices and more arduous supermarket negotiations on own-brand items. Conversely, prices for olive oil, cocoa, and crisps increased due to poor harvests and high demand.

The Bank of England, which recently raised interest rates to 5.25%—the highest level in 16 years—to combat inflation, hinted that it could cut rates as early as this summer if the downward trend in inflation continues. The Bank’s interest rates influence borrowing costs for mortgages and loans, as well as returns for savers.

Despite the overall decline in inflation, the cost of services remained high at 5.9%. The recent price decrease for goods ranging from food to household appliances by 0.8% in April provided some relief. Still, the cost of living remains a concern for many households and businesses.

Overall, the Bank of England expects inflation to continue falling and come close to its target soon. However, there is a need for a cautious approach before making any rate cuts.

About The Author

Related Articles

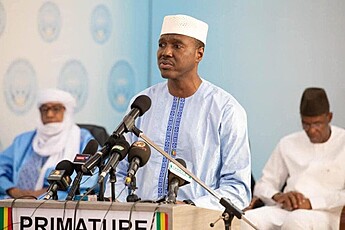

Mali Raises $56M from Telecom Taxes, Channels Bulk Toward Power Supply Upgrades

The Government of Mali has announced that a total of 34 billion...

ByOluwasegun SanusiJuly 18, 2025Ghana’s Foreign Minister Debunks “Igbo Kingdom in Ghana” Claim, Calls for Pan-African Solidarity

Ghana’s Minister for Foreign Affairs, Sam Ablakwa has officially debunked viral claims...

ByOluwasegun SanusiJuly 18, 2025Burundi’s President Ndayishimiye Appointed as African Union Special Envoy for Sahel Region

The Chairman of the African Union (AU), H.E. João Lourenço, has appointed...

ByOluwasegun SanusiJuly 18, 2025Burkina Faso’s August 4 Stadium Reopens After Major Renovation and CAF Reaccreditation

After four years of absence from the international football scene, Burkina Faso...

ByOluwasegun SanusiJuly 17, 2025