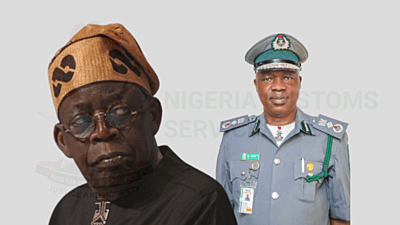

Tinubu’s Revenue Push Is Driving Up Import Prices Through Inflated Customs Valuations

Despite the suspension of the controversial 4 per cent Free-on-Board (FOB) import charge, Nigerian importers continue to face skyrocketing costs at the nation’s ports, driven not by formal tariffs but by what many now describe as systemic overvaluation of goods by the Nigeria Customs Service (NCS).

The real crisis lies in arbitrary customs practices, which have flourished under the Tinubu administration’s aggressive revenue drive.

Under the Bola Tinubu regime, the Nigeria Customs Service has become a major revenue-generating agency, with collections soaring to ₦6.1 trillion in 2024, nearly doubling the ₦3.2 trillion, which is a staggering 90.4 per cent increase in just one year, as recorded in 2023. In the first quarter of 2025 alone, the service reported over ₦1.3 trillion in revenue.

This financial performance is being achieved through questionable means.

The dirty secret? Customs officers are instructed to disregard the actual invoice values of goods and instead impose grossly inflated valuation benchmarks, often with zero transparency or accountability.

These benchmarks, determined internally by Customs, are used to assess import duties, VAT, and other levies, often inflating the actual value of goods by 50 per cent to 200 per cent. Importers say that despite providing complete documentation, including verifiable commercial invoices, customs officials override the declared values using opaque “valuation databases” not accessible to the public.

This practice, introduced initially to combat under-invoicing, has evolved into a blunt revenue-generation tool, with little regard for fairness or international best practices.

According to the World Trade Organisation’s Customs Valuation Agreement, import duties are supposed to be based on the actual transaction value, the price paid or payable for the goods. But Nigerian Customs frequently violates this principle, even when documentation is complete and verifiable.

An imported vehicle invoiced at $10,000 might be revalued at $25,000 or more. A generator worth $3,000? Customs could price it at $7,500, and all import duties, VAT, and levies are calculated on that inflated figure. Importers are left helpless, forced to pay or watch their goods rot.

The impact on the broader economy is severe. The inflated valuations are making it more expensive to import not just finished goods, but also raw materials and machinery critical to local manufacturing.

This is no longer just a port issue; it’s a national economic emergency. Businesses are shutting down. Prices are climbing. And Customs is being weaponised as a fiscal bludgeon.

The Manufacturers Association of Nigeria (MAN) has also raised concerns, stating that non-transparent valuation practices discourage investment and hinder economic competitiveness.

Despite public backlash, the Tinubu regime appears undeterred. In July 2025, the Comptroller-General of Customs, Bashir Adeniyi, announced plans to reintroduce the suspended 4 per cent FOB charge following ongoing “stakeholder engagements.”

This move, alongside inflated valuations, will further compound hardship for importers and consumers alike.

You can’t run an economy on taxes and levies alone. Tinubu’s government is treating revenue like a scoreboard. But the pain is real, and it’s structural.

There is a need for reform and transparency. The federal government needs to:

Enforce compliance with WTO valuation rules

Publish customs valuation benchmarks

Create independent oversight of the Nigeria Customs Service

Stop using customs revenue targets to drive inflationary practices

Without such reforms, the economic fallout could deepen, with inflationary pressure, investor flight, and widespread job losses continuing into 2026.

As things stand, for many in Nigeria’s import-dependent economy, the ports have become less a gateway to commerce and more a choke point of government exploitation.

Read More:

- Ayra Starr, Burna Boy, Tems, Tyla Among African Stars Nominated for 2025 MTV VMAs

- Governance on Hold: Tinubu’s Presidency Remains Stuck in Campaign Mode

About The Author

Related Articles

MultiChoice Pumps GH¢200 Million Into Ghana’s Creative Industry

MultiChoice Ghana has invested more than GH¢200 million into the country’s creative...

ByWest Africa WeeklyMarch 5, 2026FIFA Confirms DR Congo Playoff Spot, Ending Nigeria’s World Cup Dream

Nigeria’s hopes of qualifying for the 2026 FIFA World Cup have come...

ByWest Africa WeeklyMarch 5, 2026Ghanaians to Travel to St Kitts and Nevis Without Visa

Ghanaian citizens will soon be able to travel to the Caribbean nation...

ByWest Africa WeeklyMarch 5, 2026Ghana Records Sharp Drop in Inflation, Lowest Since 2021

Ghana’s inflation rate dropped to 3.3 percent in February 2026, marking the...

ByWest Africa WeeklyMarch 5, 2026

Leave a comment