Hong Kong Emerges as New Hub for African Political Money Laundering Schemes, Western Banks Complicit

A growing body of evidence suggests that Hong Kong, a prominent global financial centre, is being exploited as a hub for African politicians to launder illicit funds, often with the direct or indirect involvement of Western financial institutions and professional service providers. This complex web of financial crime funnels billions out of African nations, raising questions about global financial integrity and the responsibility of the enablers facilitating these schemes.

One of the most prominent cases involves Isabel dos Santos, the daughter of Angola’s former autocratic president, who reportedly amassed a fortune at the expense of the Angolan people. Investigations revealed that dos Santos, her husband, and their intermediaries built a vast business empire of over 400 companies in 41 countries, including at least 94 in secrecy jurisdictions like Hong Kong, Malta, and Mauritius. These companies secured billions in consulting jobs, loans, and public works contracts from the Angolan government.

Critically, “thieving rulers” and their associates are moving ill-got public money to offshore secrecy jurisdictions, often with the help of prominent Western firms. However, brand-name accountants and consultants, such as Boston Consulting Group and PwC, continued to work for dos Santos-linked businesses, receiving significant payments. While some Western banks, like Citigroup and Barclays, eventually abandoned deals linked to dos Santos due to concerns about her status as a “politically exposed person” (PEP), stating money laundering risks, her financial team struggled to find compliant banks.

To further prove this trend, illicit funds from a South African corruption scandal involving President Jacob Zuma and the wealthy Gupta family were allegedly moved via Hong Kong and Dubai. Lord Peter Hain, a Labour peer, claimed that UK banks HSBC and Standard Chartered may have inadvertently been conduits for up to £400 million of these corrupt proceeds, prompting UK financial regulators and the Serious Fraud Office to launch reviews.

Hong Kong’s robust financial infrastructure and perceived regulatory vulnerabilities make it an attractive location for such activities. The city has been identified as a location for shell companies in complex money laundering networks, as seen in a case involving a Venezuelan media executive who laundered over $1 billion, with a Hong Kong shell company, Eaton Global Services, used for primary fund receipt. US lawmakers have explicitly stated that Hong Kong has become a top location for money laundering and sanctions evasion, transitioning from a trusted global financial centre to a critical player in the authoritarian axis of China, Iran, Russia and North Korea.

The Pandemic money laundering report indicated that over 10,000 bank accounts in Hong Kong were used for fraudulent purposes in 2020, laundering 900 million euros of swindled money. Many of these schemes involved fraudulent trading companies registered in Hong Kong by Mainland Chinese, which opened accounts with reputable Hong Kong banks, including HSBC HK, Bank of China HK, HANG SENG HK, Standard Chartered Bank HK, DBS Bank – HK, to transfer funds to offshore destinations like the British Virgin Islands and Cayman Islands.

These accounts exhibited conspicuous patterns, including being set up a few months prior, receiving funds from various European countries within a short period, and then making immediate onward transfers to offshore locations. Despite these clear “red flags,” the Hong Kong Monetary Authority (HKMA) reportedly cannot identify any wrongdoing on the part of the banks concerned, instead attributing the issues to criminal elements.

Moreover, the Panama Papers revealed Hong Kong as Mossack Fonseca’s busiest office, showing its role in facilitating offshore structures. Hong Kong serves as a leading market for offshore havens that offer secrecy, tax shelters, and streamlined international deal-making. The system makes it easy for residents to set up companies in other offshore centres, enabling them to classify holdings as foreign for tax advantages or to circumvent mainland rules.

Traditional money laundering techniques prevalent in Hong Kong include false invoicing for goods and services, using insurance policies and credit cards for illicit cash-outs, and cash smuggling. Secret banks, including secret branches belonging to Western banks, such as Swiss banks, are also reportedly taking deposits quietly in Hong Kong, facilitating the movement of money from Chinese high-net-worth individuals to the West Indies.

The $60 billion Nigerian Rail Project also raises concerns about Western backing through Hong Kong. The project’s financier, China Liancai Petroleum Investment Holdings Ltd, was incorporated in Hong Kong in 2013 and has no proven track record in major infrastructure projects. Its base in Hong Kong means it operates under a legal system rooted in British common law. If it seeks funds from international capital markets, Western institutional investors could become indirectly involved through bond purchases or other instruments. De-Sadel Consortium, a partner in the project, also lists senior Western executives on its board, signalling potential access to Western funding networks.

Hong Kong acknowledges its exposure to money laundering threats, rating its overall money laundering risk as medium-high due to its status as an international finance, trade, and transport hub. The banking sector, in particular, faces a “high” money laundering threat and medium-high vulnerability, with bank accounts being the most common vehicles for illicit funds. Despite efforts by Hong Kong authorities to combat financial crime, including the establishment of a robust AML/CFT regime, structural deficits, complicit banks, and passive authorities contribute to the ongoing problem.

You cannot move billions without a willing banker, lawyer, or consultant. The money may be stolen in Africa, but it is laundered in Hong Kong and legitimised in the West.

Read: Dr. Kingsley Obiora Joins Ranks of Nigeria’s Top Economists with NES Fellowship Honour

Are Tinubu and His Supporters Fueling Ethnic Divisions That Could Push Nigeria Toward Civil War?

About The Author

%s Comment

Leave a Reply Cancel reply

Related Articles

The AFCON Final in Morocco and the Controversies That Followed

The Africa Cup of Nations final between hosts Morocco and Senegal ended...

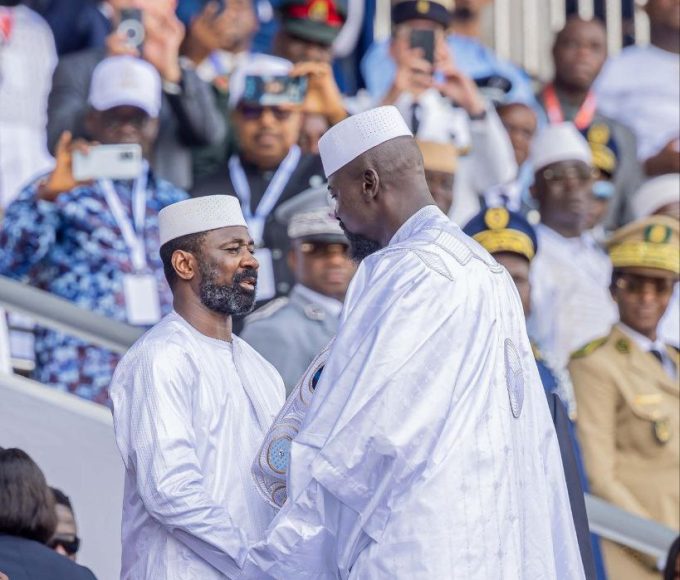

ByWest Africa WeeklyJanuary 20, 2026Mali’s Transition Leader Attends Swearing-In of Guinea’s President Mamadi Doumbouya

Mali’s President of the Transition, General Assimi Goïta, represented the country in...

ByWest Africa WeeklyJanuary 19, 2026Malian Army Conducts Successful Surveillance Operation in Mopti Region

The Malian Armed Forces have carried out a successful territorial surveillance operation...

ByWest Africa WeeklyJanuary 19, 2026Niger’s Security Forces Record Major Gains Against Armed Groups

Niger’s Defence and Security Forces have reported significant results following a week...

ByWest Africa WeeklyJanuary 19, 2026

What’s up to every one, the contents existing at

this site are in fact awesome for people experience, well,

keep up the nice work fellows.