“Customs is not heeding Form M rate directive”, Netizen Cries out to CBN

The Nigerian Customs Service (NCS) has come under scrutiny for disregarding the Central Bank of Nigeria’s (CBN) directive to base import duty on the ‘Form M’ date exchange rate. This defiance, highlighted by a social media outcry under #ImportDutyWoesNG, has raised alarms about economic stability.

In response to rising concerns, a social media user posted an SOS message, urging the CBN to intervene and prevent irreversible damage to Nigeria’s economy. The failure to implement the CBN’s circular has directly threatened the fair playing field for traders, as expressed in the X post.

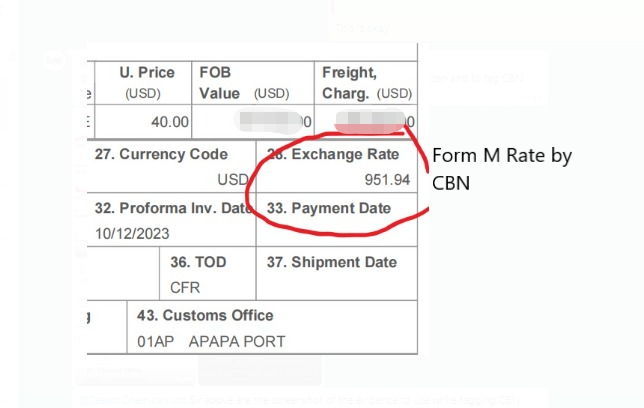

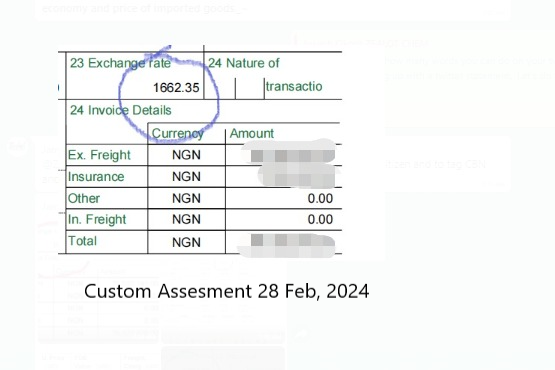

The heart of the issue lies in the revelation that the NCS charges almost twice the Form M closing rate for import duty and clearance of goods, contrary to the recent CBN directive. Interestingly, a document shared by the said X user showed that the exchange rate used by Customs is higher than the official rate.

Reacting, another user called out to the CBN governor, saying:

“Come and see your people! They are yet to implement the CBN exchange rate on imported goods. How can the custom’s exchange rate be higher than the official rate?”

@DrYemiCardoso Come and see your people! They are yet to implement the CBN exchange rate on imported goods. How can the custom’s exchange rate be higher than the official rate? @officialEFCC @cenbank

— 🇬🇧Ariremako🇺🇸 (@Alkaneseries) February 28, 2024

To address this, the CBN issued a directive effective from February 26, 2024, instructing the NCS to use the foreign exchange closing rate on the day ‘Form M’ is submitted for clearing goods and assessing import duties. The aim is to reduce uncertainties, stabilise pricing structures, and curb abnormal increases in the final cost of goods due to unpredictable fluctuations in exchange rates.

CBN’s Director of Trade and Exchange Department, Hassan Mahmud, emphasised the need to curb irregular customs duty rate changes to foster market stability. The recent directive from the CBN followed concerns raised by Labour Party presidential candidate Peter Obi about inconsistent duty charges and arbitrary increases, leading to losses that contribute to an inflationary surge.

Arbitrary increases in customs assessment will only plunge the citizenry deeper into suffering, as the price of goods will further escalate.

About The Author

Related Articles

Zimbabwe Rejects $350m US Health Deal Over Sovereignty Dispute

Zimbabwe has formally withdrawn from negotiations on a proposed $350 million health...

ByWest Africa WeeklyFebruary 25, 2026Niger’s President Outlines Vision for Strategic Partnership with China

Niger’s Head of State, General Abdourahmane Tiani, has articulated a renewed vision...

ByWest Africa WeeklyFebruary 25, 2026Fire Destroys 140 Tonnes of Cotton in Western Burkina Faso

A major fire has destroyed more than 140 tonnes of cotton in...

ByWest Africa WeeklyFebruary 25, 2026Mali’s New Ambassador to Angola Presents Credentials, Pledges Stronger Bilateral Ties

Diplomatic relations between Mali and Angola entered a new phase on February...

ByWest Africa WeeklyFebruary 25, 2026