The Central Bank of Nigeria (CBN) has released comprehensive guidelines outlining the operations of bank accounts for Virtual Assets Service Providers (VASPs).

This announcement, made on the official X page, marks a notable shift from previous directives restricting financial institutions from engaging with cryptocurrency service providers.

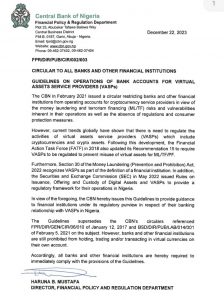

The CBN’s decision, detailed in a circular issued by Haruna B. Mustafa, Director of the Financial Policy and Regulation Department, noted that it is in response to the evolving global trends necessitating regulation in virtual assets and cryptocurrencies.

While acknowledging the inherent risks of money laundering and terrorism financing associated with these operations, the CBN now emphasizes the need to regulate VASPs to prevent the misuse of virtual assets for unlawful activities.

The Financial Action Task Force (FATF) updated its Recommendation 15 in 2018, highlighting the imperative to regulate VASPs to counter potential financial risks.

Furthermore, Nigeria’s Money Laundering (Prevention and Prohibition) Act of 2022 recognizes VASPs as part of the definition of a financial institution. This move aligns with the Securities and Exchange Commission’s (SEC) issuance of rules in May 2022, establishing a regulatory framework for digital assets and VASPs within the country.

The newly released guidelines supersede previous circulars issued by the CBN on January 12, 2017, and February 5, 2021, on the subject matter.

However, the directive maintains the prohibition on banks and other financial institutions from directly holding, trading, or transacting in virtual currencies for their accounts.

By the guidelines, all banks and financial institutions are obligated to comply with the provisions outlined promptly.

Read: Osoba – “Tinubu Will Sign Executive Order To Stop Cash Hoarding”

About The Author

Related Articles

US Security Narrative Shifts from Terrorism to Mining in Nigeria

A new bill introduced in the United States Congress is drawing attention...

ByWest Africa WeeklyFebruary 12, 2026Galatasaray Ready to Sell Osimhen if Barcelona Meet €80m Valuation

Victor Osimhen could be on the move again as Spanish giants Barcelona...

ByWest Africa WeeklyFebruary 12, 2026Senegal Unveils $100m Onshore Oil and Gas Plan After Revoking Idle Licenses

Senegal is moving ahead with a new $100 million onshore oil and...

ByWest Africa WeeklyFebruary 12, 2026Ghana’s Cocoa Crown Under Threat as Nigeria, Ecuador and Indonesia Close In

Ghana’s position in the global cocoa industry is facing mounting pressure as...

ByWest Africa WeeklyFebruary 12, 2026