The Central Bank of Nigeria (CBN) has issued new directives to banks and financial institutions regarding dormant accounts. The CBN will now take over funds in these dormant accounts and reportedly invest them in treasury bills and other securities.

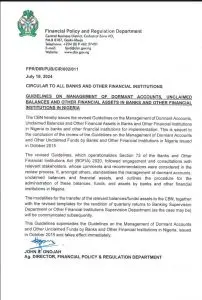

The announcement was made in a circular released on Friday by John S. Onojah, Acting Director of the Financial Policy and Regulation Department. The circular is titled “Guidelines on Management of Dormant Accounts, Unclaimed Balances and Other Financial Assets in Banks and Other Financial Institutions in Nigeria“. The guidelines were initially drafted in April but have now been finalised.

The CBN instructed financial institutions to move funds that have been in dormant accounts for up to 10 years to the Unclaimed Balances Trust Fund (UBTF) Pool Account. The UBTF Pool Account is the designated CBN account for holding unclaimed balances from eligible accounts. The funds will be invested in Nigerian treasury bills and other approved securities. The principal and any interest accrued will be refunded to the beneficiaries within ten working days upon request.

To reclaim funds from dormant accounts, account owners must complete an “Asset Reclaim Form” at any financial institution branch. They must provide proof of account ownership, valid identification, proof of residence, and an affidavit confirming the information. Financial institutions will verify claims within ten working days and forward them to the CBN, which will process the refunds.

Note that dormant accounts are bank accounts that have remained inactive for a specified period, typically at least one year. This inactivity means there have been no deposits, withdrawals, or other transactions initiated by the account holder during that time.

The apex bank has claimed that the new guidelines for such accounts ensure transparency and efficiency in reclaiming funds. According to the directive, information on unclaimed balances will be made available on financial institutions’ websites, the CBN’s website, and through newspaper publications. The interest payable on unclaimed balances will be determined periodically by the CBN, and the CBN will also set the profit and loss ratio for non-interest banks.

This Guidelines supersedes the Guidelines on the Management of Dormant Accounts and Other Unclaimed Funds by Banks and Other Financial Institutions in Nigeria, issued in October 2015 and takes effect immediately, the circular stated.

Read Also: Nigeria’s FCCPC Hits Meta with $220 Million Fine For Data Use Violations

Senator Ndume Declines Appointment as Senate Committee Chairman on Tourism

About The Author

Related Articles

Malian Army Says Dozens of Militants Killed in Airstrikes in Segou Region

Mali’s armed forces say they have killed about twenty suspected militants during...

ByWest Africa WeeklyFebruary 19, 2026Nigeria Approves 33 New Universities While Education Quality and Jobs Remain in Crisis

Nigeria has approved 33 new universities, bringing the total number of sanctioned...

ByWest Africa WeeklyFebruary 19, 2026Gabon Suspends Social Media “Until Further Notice” Amid Rising Unrest

Gabon’s media regulator has announced the suspension of social media platforms nationwide,...

ByWest Africa WeeklyFebruary 18, 2026Niger’s Tiani Visits Algeria in Bid to Strengthen Ties and Revive Key Projects

Abdourahamane Tiani, Niger’s head of state, is on an official visit to...

ByWest Africa WeeklyFebruary 18, 2026