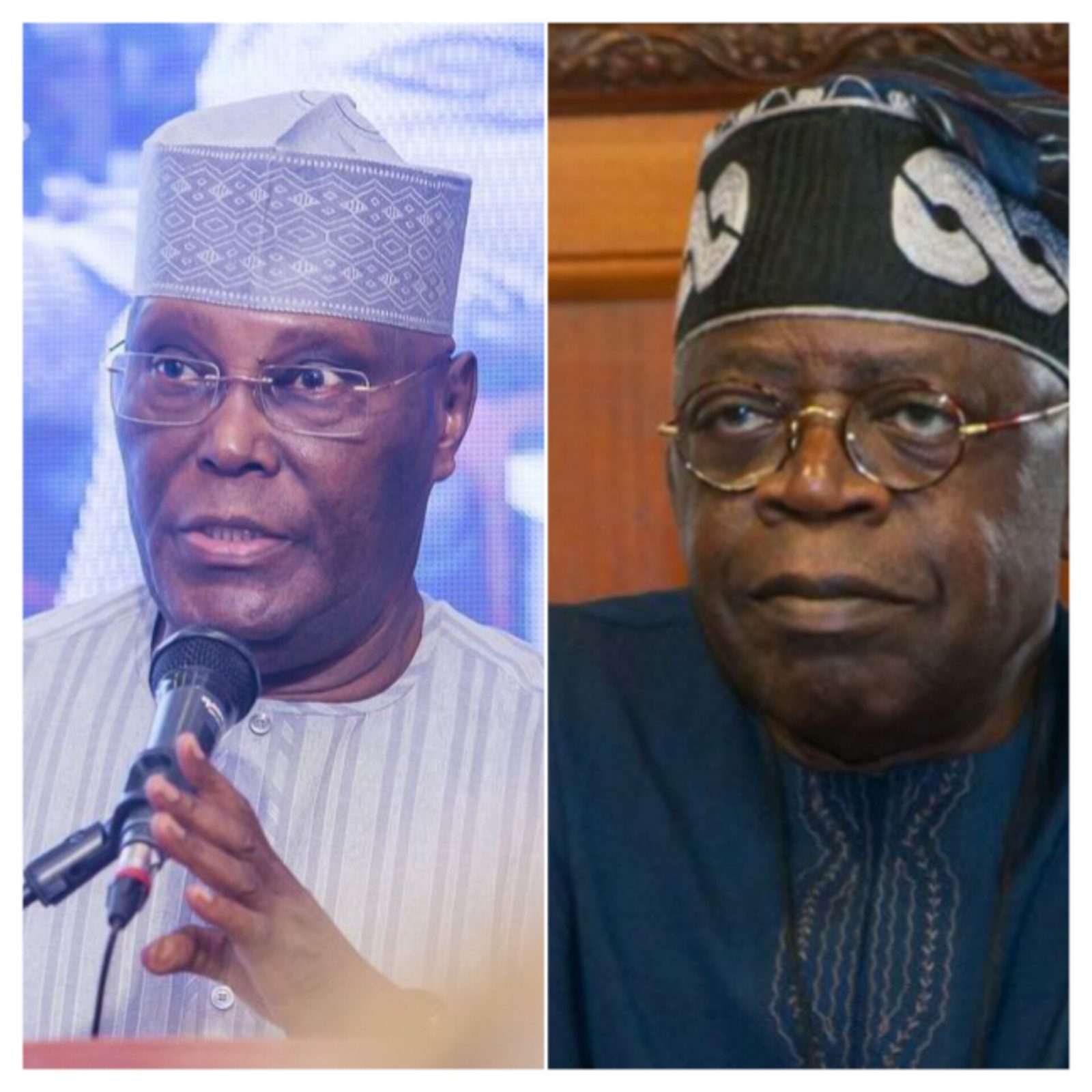

Atiku Abubakar, the 2023 presidential candidate of the People’s Democratic Party (PDP), has criticised Bola Tinubu’s handling of Nigeria’s economic challenges, particularly the foreign exchange crisis.

Owing to the federal government’s policies on foreign exchange, Nigeria currently faces economic challenges that have inflicted hardship on its people.

In a statement released on his X handle on Sunday, Atiku, responding to a meeting organised by Tinubu to address the economic downturn, claimed that Tinubu failed to present concrete policy steps to resolve the country’s currency fluctuation and poverty crises. He asserted that during the meeting, instead of addressing the pressing issues at hand, Tinubu opted to deflect criticism and buy more time for his administration’s strategies. He said:

“At a meeting called at his instance on Thursday to address the Foreign Exchange crisis and the problem of economic downturn, among others, Bola Tinubu failed, yet again, to showcase any concrete policy steps that his administration is taking to contain the crises of currency fluctuation and poverty that face the country.

“Rather, he told the country and experts who have been offering ideas on how to resolve the crisis that he and his team should not be distracted and allowed time to continue cooking their cocktail that has brought untold hardship to the people of Nigeria.”

Stating his disagreement with Tinubu’s request that his administration not be distracted but allow more time, Atiku noted that the wrong policies of the Tinubu administration continue to inflict severe hardship and distress on the economy. “And the rest of us cannot keep quiet when, clearly, the government has demonstrated sufficient poverty of ideas to redeem the situation.”

Drawing from the proposed solutions outlined in his policy document titled “My Covenant With Nigerians,” Atiku offered several policy prescriptions he perceived would rescue the country from its current economic situation.

He proffered reforming the foreign exchange market, as he emphasised the need to eliminate multiple exchange rate windows, which “only served to enrich opportunists, rent-seekers, middlemen, arbitrageurs, and fraudsters.”

Also, he advocated against adopting a fixed exchange rate system, arguing that it contradicts the principles of an open, private sector-friendly economy. Instead, he proposed a managed-floating system to ensure stability while allowing for controlled fluctuations in the currency value.

In his words:

“A fixed exchange rate system would be out of the question. First, it would not be in line with our philosophy of running an open, private sector-friendly economy. Secondly, operating a successful fixed-exchange rate system would require sufficient FX reserves to defend the domestic currency at all times. But as is well known, Nigeria’s major challenge is the persistent FX illiquidity occasioned by limited foreign exchange inflows to the country. Without sufficient FX reserves, confidence in the Nigerian economy will remain low, and Naira will remain under pressure. The economy will have no firepower to support its currency. Besides, a fixed-exchange rate system is akin to running a subsidy regime.”

“On the other hand, given Nigeria’s underlying economic conditions, adopting a floating exchange rate system would be an overkill. We would have encouraged the Central Bank of Nigeria to adopt a gradualist approach to FX management. A managed-floating system would have been a preferred option. In simple terms, in such a system, the Naira may fluctuate daily, but the CBN will step in to control and stabilize its value. Such control will be exercised judiciously and responsibly, especially to curve speculative activities.”

Critiquing Tinubu’s administration for hastily formulating new foreign exchange management policies without proper planning or consultation, the former VP stated that the government underestimated the potential negative consequences of its actions.

He said, “I firmly believe that if and when the Government is ready to open itself to sound counsels, as well as control internal bleedings occasioned by corruption and poorly negotiated foreign loans, the Nigerian economy would begin to find a footing again.”

Read more: Top 10 Most Expensive States In Nigeria Due to Inflation

About The Author

Related Articles

CSS States Considers UEMOA Boycott Over Alleged President Ouattara’s Power Rotation Block

Tensions are rising within the West African Economic and Monetary Union (UEMOA)...

ByOluwasegun SanusiJuly 9, 2025Cedi@60: Bank of Ghana Vows to Keep Currency Stable, Sustain Economic Stability

The Bank of Ghana (BoG) has reaffirmed its commitment to protecting the...

ByConfidence UbaniJuly 9, 2025Malian Court Jails Former Minister Cissoko Over Presidential Jet Scandal; Others Sentenced in Absentia

The Special Assize Court in Bamako has delivered its long-awaited verdict on...

ByOluwasegun SanusiJuly 9, 2025Ghana Sets Up Anti-Gold Smuggling Task Force to Recover Billions in Lost Revenue

Ghana has launched a national task force to combat gold smuggling and...

ByConfidence UbaniJuly 9, 2025